RELATED: Tools for Medical Practice Accounting | Apps for Attorney Accounting | Organizing Software for Receipts

Companies and individuals alike depend on the accounting software to stay abreast of their financial transactions. It’s easier and a little less prone to error than conventional methods. This can save some time through functions such as automation and will provide the operator with a space to preserve essential papers and records which can be accessed at any time without any difficulty.

Managing a company requires constant financial monitoring. Using accounting software helps the business owner with activities such as preparing to submit taxes and monitoring revenue and spending. Choosing the right accounting software is critical since it may be costly and time-consuming. Before you buy accounting software, you’ll need to figure out your company’s requirements.

The following information can help you understand many possibilities available to you and aid you in making an informed decision.

Upfront Conclusion

The best accounting software for CPA firms right now is Bonsai and FreshBooks.

Top 9 Best Accounting Software

- Bonsai – Best For Tracking The Financial Health Of CPA Firms

- FreshBooks – best for small to midsize businesses (SMBs) and freelancers.

- QuickBooks Online – Best for inventory management and tracking profit or loss.

- Oracle NetSuite – Best for startups to small and medium-size organizations

- Wave – Best for small businesses

- FinancialForce – Best for sharing customer records and common workflows across departments

- Sage 50cloud Accounting – Best for Budgeting and Inventory management

- Xero – Best for small businesses or startups with no accountants

- GoDaddy Bookkeeping – Best for beginning freelancers and small business owners.

1. Bonsai – Best For Tracking The Financial Health Of CPA Firms

PRICING: The starting price of Bonsai is $17 per month for an annual Starter plan which is charged as a one-time payment every year.

Many CPA firms use accounting software to improve their productivity and ensure their workers have time to focus on other important tasks. Bonsai is one of the best platforms that you can use for maintaining the health of your CPA firm.

The software will track your profits and record them every year. It will also keep you updated on all your losses. You will also receive a summary and comparison of profits and losses through a detailed report and graph. So you can easily maintain your financial position in the market by developing strategies based on Bonsai’s analysis.

Saving your CPA firm from legal trouble will also be easy with the well-developed tax assistant. You can get your books in order before the annual payment period to maintain compliance.

Key Features:

- Track your billable hours to send accurate receipts to clients

- Understand your profit and losses to use tactics that will improve the income of your CPA firm

- Receive reminders for tax payments on your dashboard

- Navigate your finances easily with the business reporting feature of Bonsai

- Sync different credit cards to your account to track your money with ease

Reasons To Buy:

- It is best for beginners and advanced users

- Three plans are offered to meet your business size and needs

- You can also enjoy accountant access on the most expensive package

- Signing contracts with clients is a breeze with reliable templates

Reasons To Avoid:

- The expense tracker requires some improvements

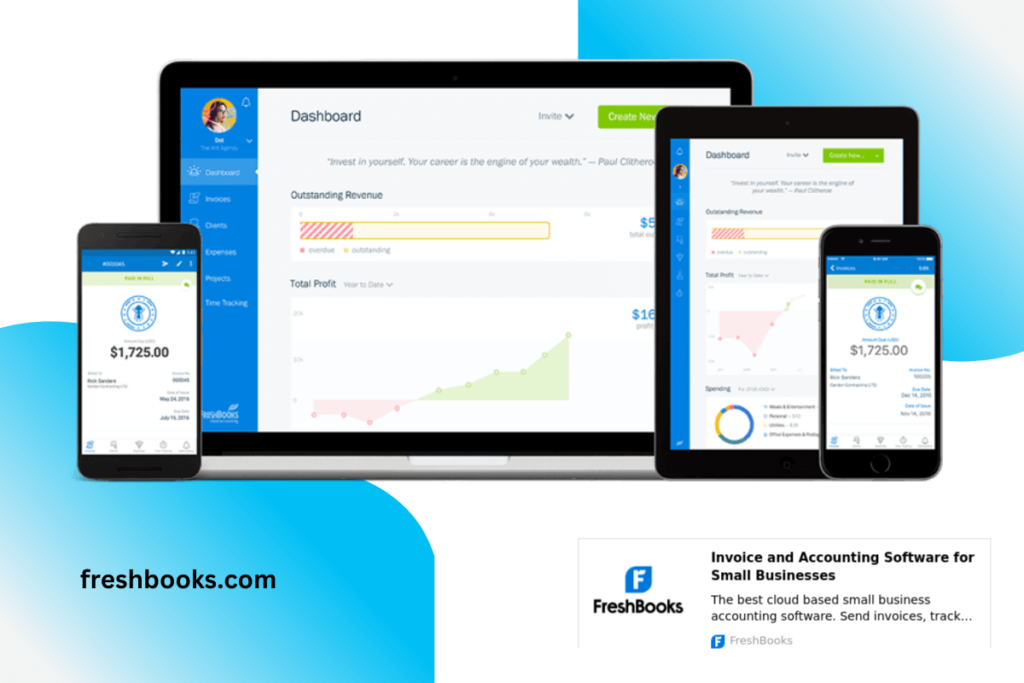

2. FreshBooks – best for small to midsize businesses (SMBs) and freelancers

Pricing: It has a 30-day free trial, its lite plan costs $15 monthly, plus the program costs $25 monthly, while the premium plan costs $50 monthly.

FreshBooks is the best for small companies, billable time is tracked, and payments are collected online using this system. Customers may expect a simple and efficient invoicing procedure from the vendor’s solution.

Key features:

- Document Templates

- Email Invitations & Reminders

- Email Management

- Expense Claims

- Feedback Management

- Hourly Billing

- Mobile Alerts

- Performance Metrics

Reasons to Buy

- It has an excellent Customer care

- It’s simple to use.

- It constantly improves its functionality.

- It is cost-effective.

Reasons to Avoid

- Only budgeting at the project level is permitted.

- The majority of plans only allow for a single user to utilize them.

- No native payroll or accounts payable functionality.

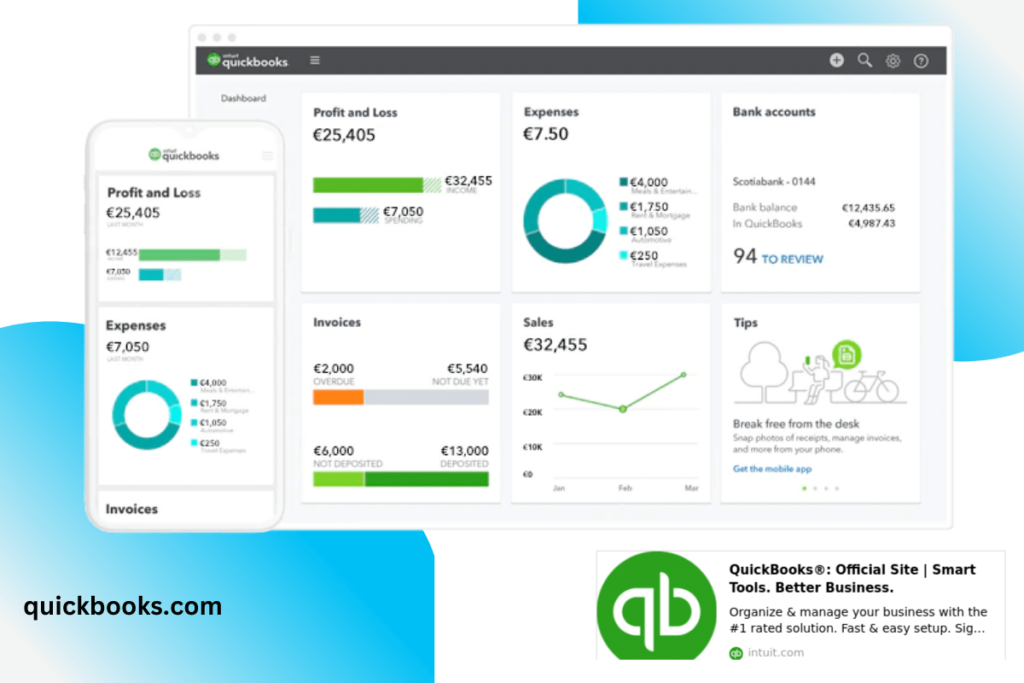

3. Quickbooks Online – Best for inventory management and tracking profit or loss.

Pricing: It has a 30-day monthly trial and four various price ranges; the start plan costs $25, the essential plan costs $50, the plus plan costs $80, and the advanced plan costs $180.

Accounting software like QuickBooks Online lets users download and reconcile transactions, making it easier for firms to keep track of employee timesheets and bank transfers. Quickbooks Online is software that manages all parts of a business’s financial transactions and reporting. A few of the software’s numerous uses include bookkeeping, payroll administration, billing and collection, bank reconciliation, cost tracking, financial reporting, and tax planning.

Key Features include:

- Accrual Accounting

- Ad hoc Reporting

- Address Validation

- Asset Accounting

- Asset Tracking

- Attendance Management

- Automatic Backup

- Billable Items Tracking

- Call Monitoring

Reasons to Buy

- The apps run on iOS or Android.

- It gives room for customization.

- The interface is easy to use.

- A variety of pricing levels

- Reconciliation is a simple procedure.

Reasons to Avoid

- Cost increases when new features are added

- Data cannot be transferred from Online to Desktop.

- The number of people who can utilize this service is relatively small.

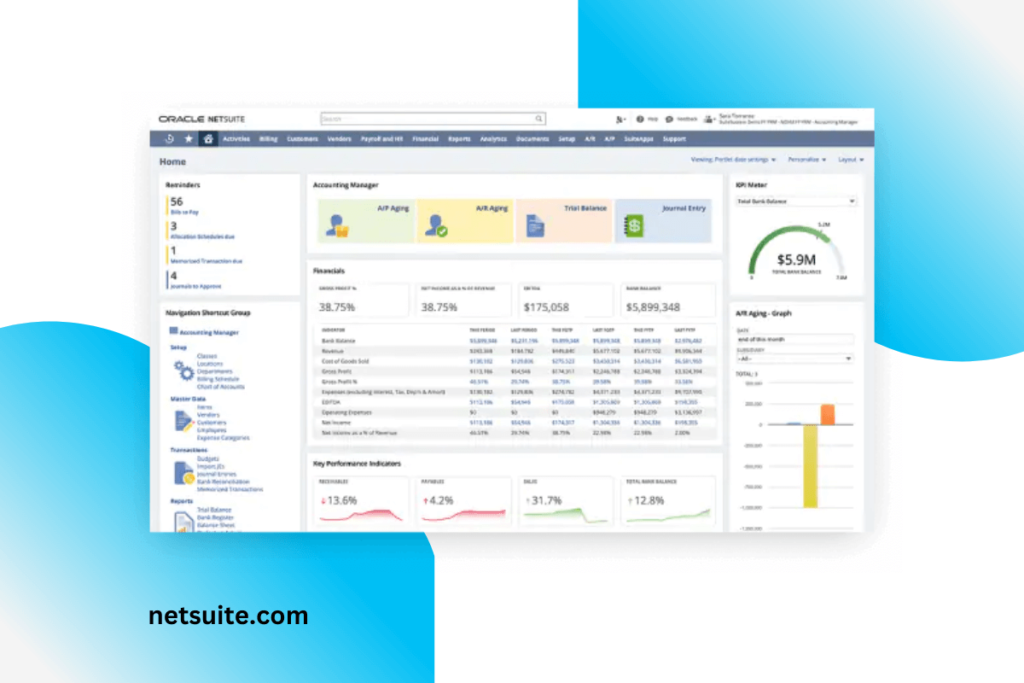

4. Oracle NetSuite – Best for startups to small and medium-size organizations

Pricing: It has no free version or trial and costs $499 monthly.

NetSuite is a cloud solution that delivers a comprehensive financial performance and cash flow picture. NetSuite is an all-in-one solution if your organization has inventory or if you’re a manufacturer or require buying skills. The efficient supply chain and order management systems assist company owners in saving money and increasing profits. “

Key features:

- 1099 Preparation

- 3PL ManagementManagement

- Fraud Detection

- Fund Accounting

- Gantt/Timeline View

- General Ledger

- HR Management

- Idea Management

- Import/Export Management

- Income & Balance Sheet

Reasons to Buy

- ERP system is potent

- Completely scalable

- Processes are automated and configurable

- Management of fixed assets

- Platform is integrated

Reasons to Avoid

- Only a cloud-based version is available.

- It is pretty expensive.

- It is not easy to learn.

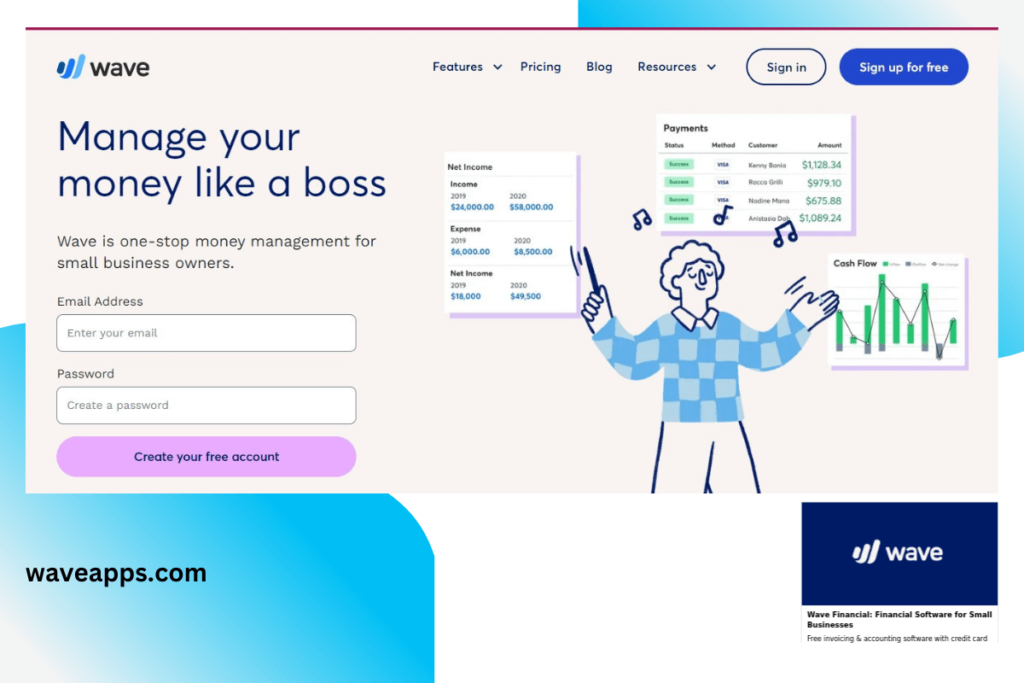

5. Wave – Best for small businesses

Pricing: It is free.

The goal of Wave Accounting is to make accounting more efficient for enterprises. Businesses can handle all bank account and credit card information in real-time using Wave’s bank reconciliation solutions, improving efficiency and accuracy in accounting. Besides sales tax, balance sheet, cash flow, profit/loss, and many more metrics, companies may create various reports. Services like Invoicing, billing, payment tracking, payroll administration, financial management, credit card processing, and receipt scanning are just some of the services offered.

Key Features:

- Tax Support

- Invoicing

- Estimates

- Client Portal

- Contact Management

- Expense Tracking

- Bank Reconciliation

Reasons to Buy

- It is easy to use and free

- There are a lot of features

- Well-designed templates for invoices.

- Help from accountants is available.

Reasons to Avoid

- It has a few smartphone applications available.

- It is not suitable for big organizations.

- It has poor customer service.

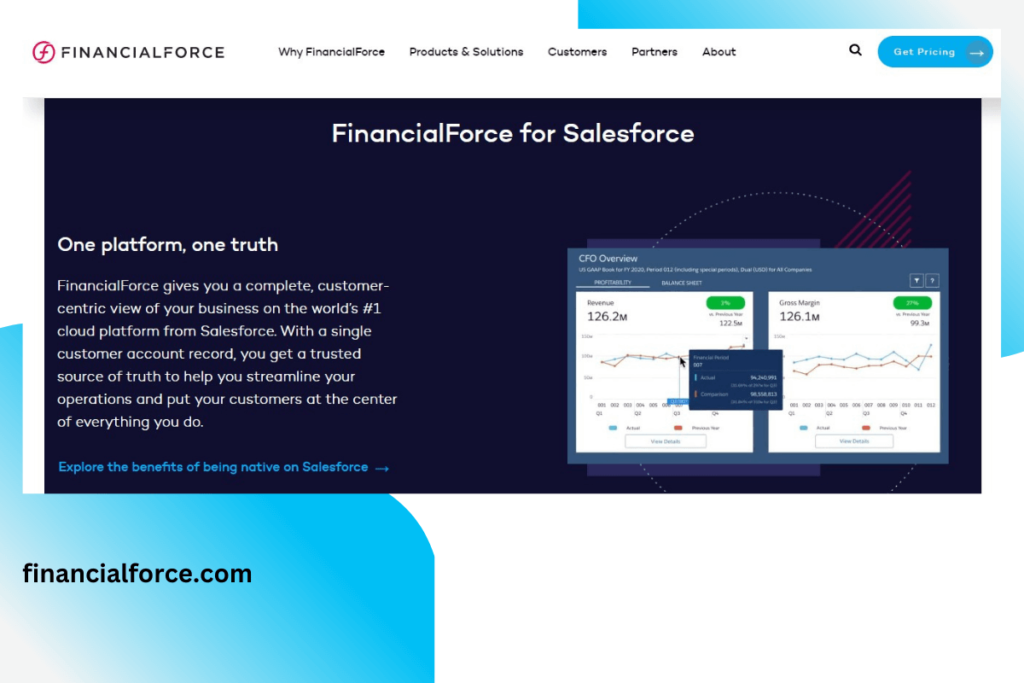

6. FinancialForce – Best for sharing customer records and common workflows across departments

Pricing: It doesn’t have a free plan, and the team has to be contacted to know the price.

FinancialForce is a cloud-based financial management solution designed for sales and service-oriented businesses. It has various built-in applications, including general ledger (GL), accounts payable/receivable (AR/AP), billing, revenue recognition, spend ManagementManagement, inventory management, fixed asset management, and financial reporting/analytics.

Key features

- Billable Hours

- Purchase Orders

- Check Printing

- Credit Card Processing

- Invoices

- Recurring Billing

- Sales Reports

- Balance Sheet

- Cash Flow Statement

- Custom Dashboard Reports

Reasons to Buy:

- It was integrated with the Salesforce server.

- Easy to customize.

- It has a robust inventory management functionality.

- It has excellent customer service.

Reasons to Avoid

- It is easy to make errors, and training is essential.

- Initial setup is time-consuming and difficult.

- It is challenging to learn.

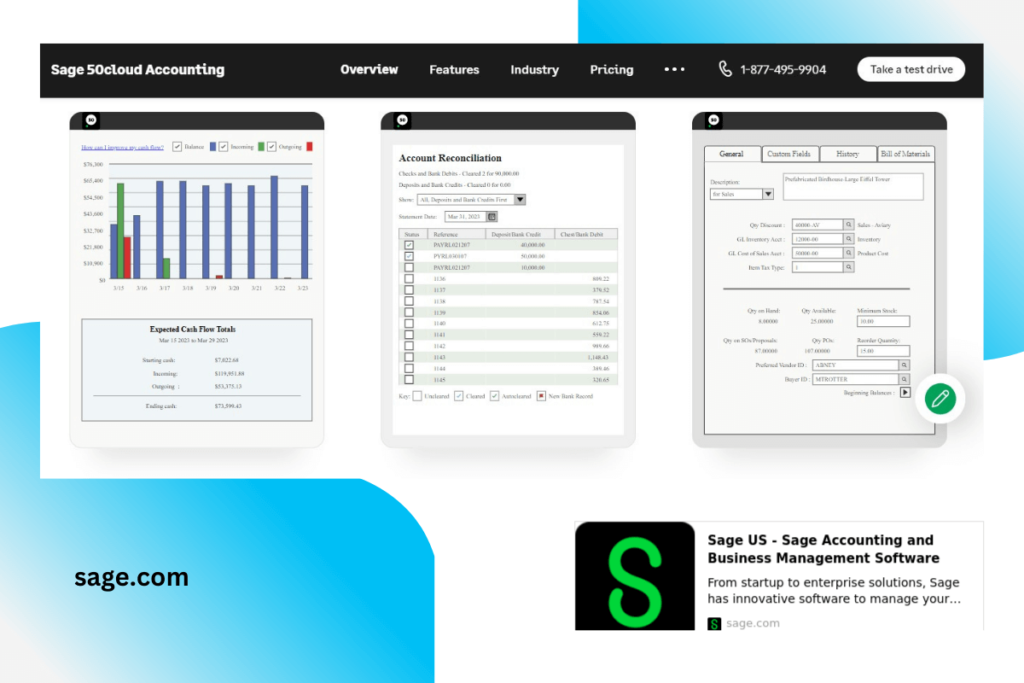

7. Sage 50cloud Accounting – Best for Budgeting and Inventory management

Pricing: It has three pricing levels; the one user plan costs $340 annually, the five-user plan costs $510 annually, and the program that allows up to 40 users costs $842 annually.

Sage 50c provides excellent accounting standards, the most flexibility and mobility of any accounting software, and the most inexpensive subscription options for your organization.

Key features:

- Customer management

- Sales tracking

- Invoicing and payment acceptance

- Integration with Microsoft Office 365

- Solid reporting

- Automated bank feeds and bank reconciliation

- Purchase orders

- Phone support

Reasons to Buy

- It has powerful accounting functionalities

- It has a high capacity for effective reporting

- It has the ability to S\supports many businesses

- Small enterprises may benefit from this adaptable solution.

- It has a simple implementation procedure.

Reasons to Avoid

- It is difficult to learn

- Inconsistent calculation of tax code formulae

- Integrating additional software might be difficult.

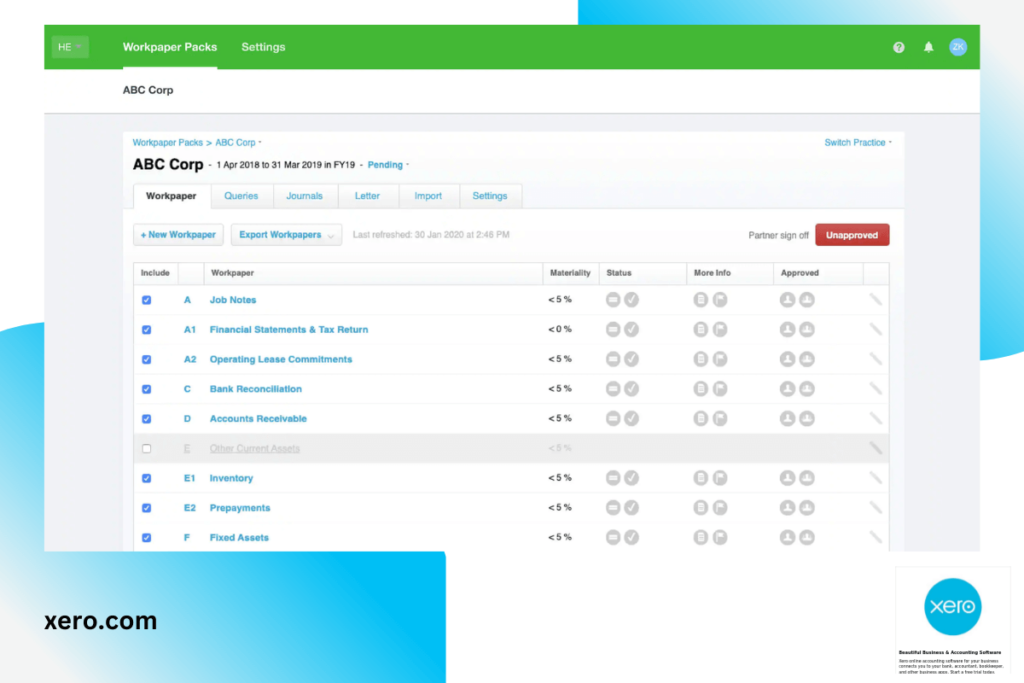

8. Xero – Best for small businesses or startups with no accountants.

Pricing: It has a 30-day trial; the yearly plan costs $12 monthly, the growth plan costs $34 monthly, and the established plan costs $65 monthly.

Xero is a cloud-based accounting tool for small businesses and personal financial management. It includes invoicing with quotes, bank reconciliation, purchase order and cost management, and tax administration, in addition to the standard general ledger and double-entry accounting features.

Key features include:

- Xero Dashboard

- Sales Overview

- Xero Invoicing

- Quotes

- Client Portal

- Contact Management

- Expense Tracking

Reasons to Buy

- Every plan includes an unlimited number of users.

- All plans include inventory management.

- It automates the bill and receipt capture process.

Reasons to Avoid

- There is no live telephone assistance.

- With the entry-level plan, there are limits on bills and invoices.

9. GoDaddy Bookkeeping – best for beginning freelancers or small business owners

Pricing: It has a paid plan that costs $4.99 monthly, the essential plan costs $9.99 monthly, and the premium plan costs $14.99 monthly.

GoDaddy Bookkeeping is an accounting system software that is great for online retailers since it automates and simplifies bookkeeping. You can make professional invoices, simplify tax deductions, and keep track of sales using GoDaddy Bookkeeping.

Key Features

- Mobile access

- 256-bit data encryption security

- Invoicing

- Profit and Loss report

- Pre-populated Schedule

- Data import

- Data import from bank and credit cards

Reasons to Buy

- It is not expensive

- It can be used by freelancers and contractors

- It can be integrated with an online selling platform.

Reasons to Avoid

- There is no double-entry bookkeeping.

- There is no free trial

- There is no payroll integration.

Frequently Asked Questions

Why is accounting software necessary for small businesses?

Accounting software is a wise investment for a small firm. Attempting to track your business’s accounts by taking notes is inefficient and exposes you to accounting blunders. Additionally, if your firm plans to develop at all, you will be pleased you started with software rather than having to play catch-up later. Further, the software may assist you in complying with tax rules. Additionally, the software may assist you in maintaining control over your business’s finances rather than delegating that responsibility to another individual.

Should I use free accounting software or premium accounting software?

This is entirely dependent on your requirements. Occasionally, free software does not come with a lot of help. Therefore it’s critical to evaluate your abilities in this case. Additionally, free choices may have limits.

Can accounting software assist you with tax preparation?

Yes, accounting software may assist you in preparing your taxes. As you are probably aware, accounting software may assist you in generating company reports depending on your revenue and costs. It may also assist you in managing your taxes, depending on the plan you choose.