RELATED: Alternative Tools For Freshbook | Best Architecture Accounting Tools | Accounting Real Estate Company Software

When it comes to operating a gas station, there are many moving parts. From managing inventory and prices to dealing with customers and employees, there’s a lot to keep track of. And one of the most important aspects of any business is accounting.

Having accurate and up-to-date financial records is essential for making informed decisions, tracking progress, and ensuring compliance with regulations. And one of the best ways to keep all this in check is using accounting software, but which software is actually going to help your business and save you time and money, and which may cause you more problems than its worth?

In this guide, we’re giving you the lowdown when it comes to the best of the best.

Upfront Conclusion

The best accounting software for gas stations right now isFreshBooks. and Zoho Books

Top 6 Accounting Software for Gas Stations

| Brand | Starting price | Best for |

|---|---|---|

| 1. Freshbooks | $4.50/month | Streamlining everything |

| 2. Zoho Books | $15 per organization, per month | Most Affordable |

| 3. Patriot Accounting | $20 – $30/month | Complete experience |

| 4. Wave Accounting | Free | Small businesses |

| 5. Kashoo | $20/month | Basic experience |

| 6. AccountEdge | £300/year | Reliable service |

| 7. Tipalti | $149/month | Most reputable bookkeeping |

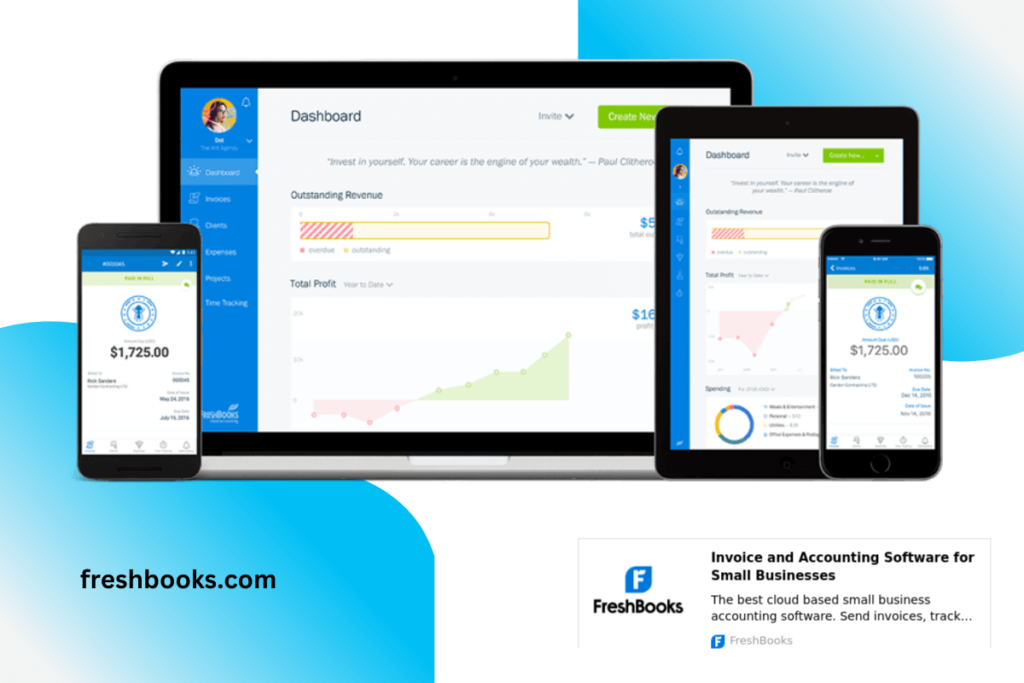

1. Freshbooks – Best Accounting Software for streamlining everything

Pricing: $4.50 per month

If QuickBooks isn’t for you, then you can be sure FreshBooks is the next choice you want to consider. Clocking in at 305,000 worldwide customers, this is one of the most highly reputable and highly rated apps among customers, and it comes with so many features you can be sure it can do what you want.

This user-friendly option is easy to pick up and use and comes with all those essential features like inventory management, sales tracking, payroll services for managing your staff, time tracking tools, and a simple interface.

Key Features:

- Easy inventory tracking

- Easy reporting and analytical insight processing

- Quickly add your receipts and sales manually or through integrated software or hardware

Reasons to buy:

- No setup fee to get you started

- Uses bank-level security to keep your data safe

- Offers world-class support when you need it

Reasons to avoid:

- Consulting features are a premium extra

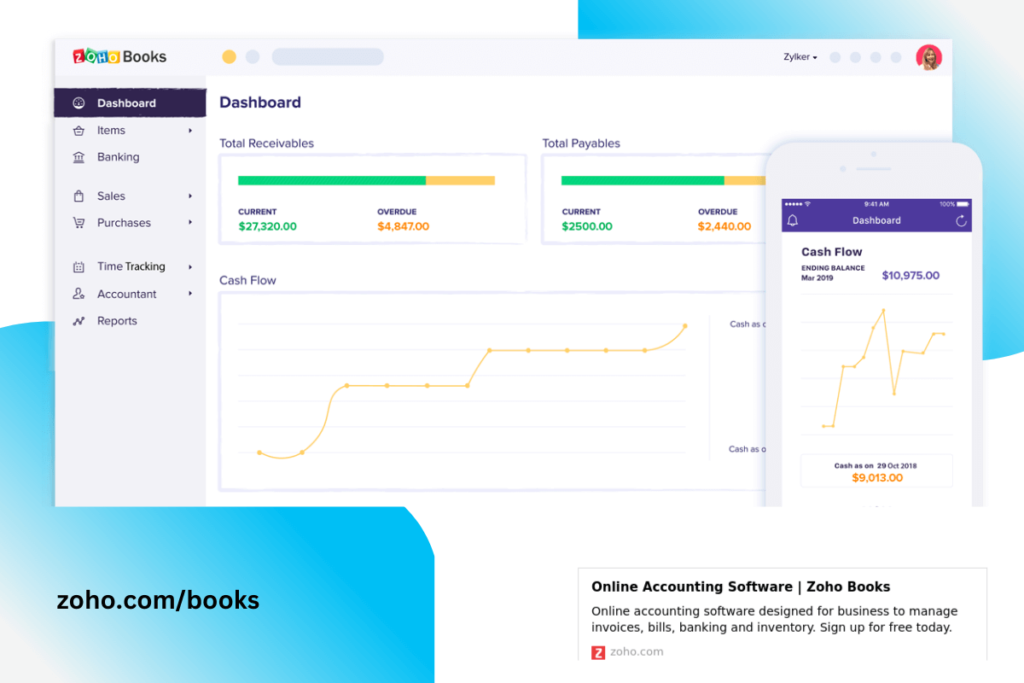

2. Zoho Books – Best Accounting Software For Affordability

Pricing: $15 per month (Free plan available)

Zoho Books is a very reputable and reliable cloud-based accounting software for small, medium, and large-scale businesses. It has many features and capabilities that make it an excellent choice for Gas Stations to meet their accounting needs.

Zoho Books lets you import and reconcile your bank records, track and manage expenses, and create custom invoices for your customers. The best part is that you get to enjoy these features at very affordable prices, and sometimes, even at no cost, depending on the annual revenue of your Gas Station.

Key Features:

- Inventory management feature for your gas station

- Time-tracking and estimates.

- Reporting feature to create, organize, and manage custom reports.

- Expense-tracking feature to track and manage expenses, payables, and receivables.

Reasons to buy:

- No set-up fee required

- Excellent customer support

- Intuitive user interface than doesn’t require a prior accounting background.

- Excellent automations and flexibility.

Reasons to avoid:

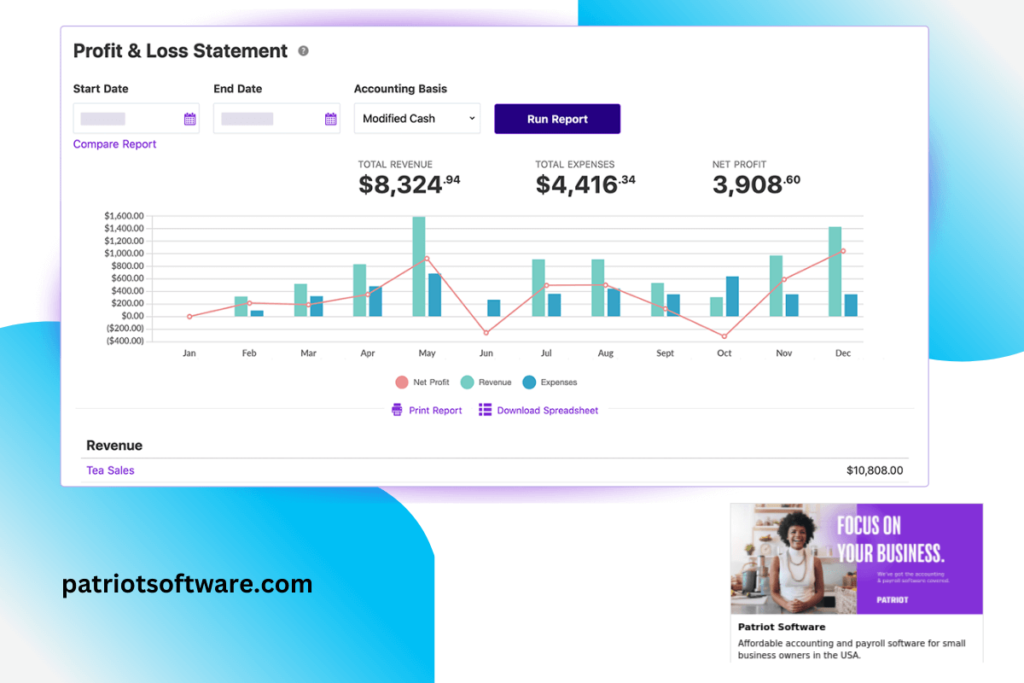

3. Patriot Accounting – Best for Small Businesses On a Budget

Pricing: $20-$30/month

Patriot Accounting is an online software created to automate the computation of employee salaries and tax deductions. It is perfect for gas stations searching for a cost-effective solution.

Patriot’s software’s user-friendliness and ease of setup is one of its greatest characteristics, with assistance available at every step of the process for new users. The Patriot website also contains a series of free lessons on various topics that you can examine while considering whether to join up. Patriot offers a 30-day free trial where you can test its capabilities.

Key features:

- Unlimited pay runs

- Contractor payments

- An employee portal

- Free access to expert support

Reasons to buy:

- Transparent costs

- Comprehensive resources

- Affordable

- Ease of use

Reasons to avoid:

- Additional fees

- No benefits administration

- No customizable reports

>>MORE: Accounting Software For Textile Industry | Enterprise Resource Management Software | HR Management Software | Enterprise Network Monitoring Software

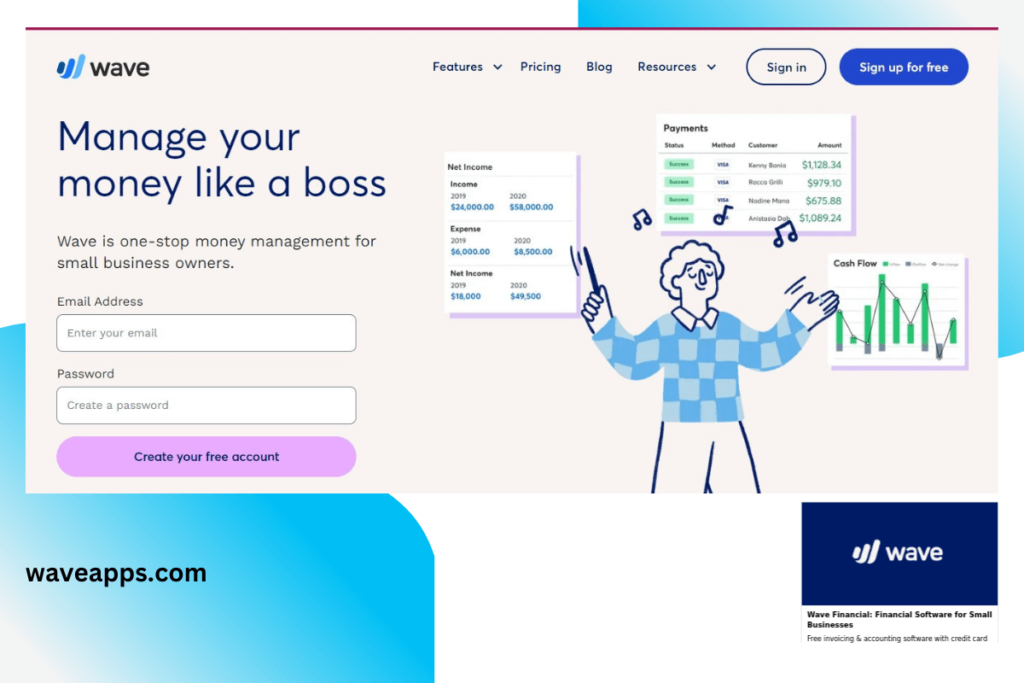

4. Wave Accounting – Best Accounting Software for Small Businesses

Pricing: Free, with premium option 1.4% +20p of each transaction

If you’re looking to get started with organised bookkeeping, look no further than Wave. Wave is a free, cloud-based service that is exclusively designed with small businesses in mind, and while it aims to keep things simple, it’s packed full of powerful features to ensure you have the best experience.

There’s everything, from invoicing and expense management, receipt scanning and inventory management, and all data displayed visually to help you understand the condition of your business in an instant. If you want easy account management, this is it.

Key Features:

- Full 256-bit encryption to keep your data secure

- Accountant-friendly software if you need to export all your data quickly

- Work out tax in an instant using the built-in automated processes

Reasons to buy:

- No setup fee

- All data and insights are available through the dedicated mobile app

- Generating detailed and insightful reports is easy

Reasons to avoid:

- Payment speeds for some services can be slow

- Some software updates can drastically change certain formats of app

5. Kashoo – Best Accounting Software for a Basic Experience

Pricing: $20 per month (free plan available)

Accounting can be overwhelming if you’re new to it (even if you’ve been doing it a long time), and sometimes you’re just going to want something nice and simple that allows you to focus your attention on running your business as efficiently as possible, rather than faffing around with your books.

This is where Kashoo comes into play. While it’s not the most popular accounting software globally, it’s simple and effective and gets the job done without the bells and whistles. You’ll find invoice tools, payment accepting features to help you make money, all income and expense tracking as standard, sales and tax calculations, reporting, and all certified and secure.

Key Features:

- Track and estimate all taxes you need to pay

- Full income and expense tracking

- Accept payments from all major providers and services

- Allow multiple users to manage your accounts

Reasons to buy:

- The premium tier allows for payroll functions and project management

- Customisable payment tiers to match your business needs

Reasons to avoid:

- Very basic features compared with other services

- Not very scalable

- UX can be a bit hard to navigate at times

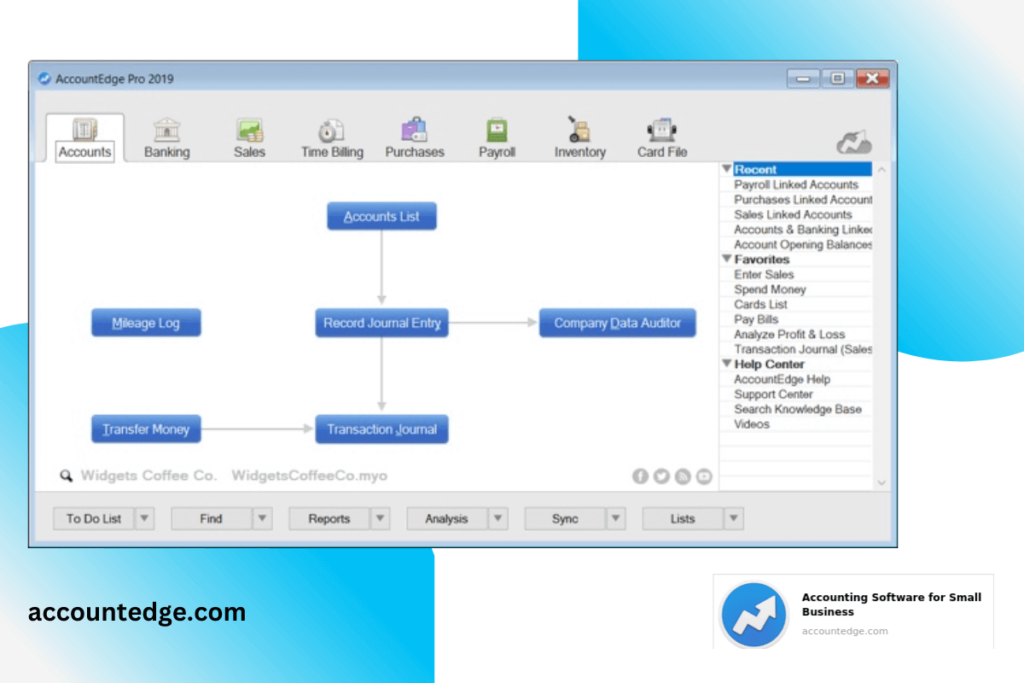

6. AccountEdge – Best Accounting Software for a Reliable Service on Mac

Pricing: £300 per year (+VAT)

If you’re using an Apple Mac operating system to manage your business, then why not get an entirely optimised accounting software that’s built for your system. AccountEdge comes with a range of features to make your life easy in a straightforward way but doesn’t compromise on features.

The software was launched back in 1996, meaning it’s been around for over 22 years, which speaks for itself. This is a trusted, award-winning accounting platform for running your payroll, tracking and billing your inventory, managing partner contracts, and so much more.

Key Features:

- Full bank management tools to handle all payments and account processes

- Create orders for stock and handle bills from within the app

- Full payroll features as standard

- Time tracking included

Reasons to buy:

- Bank reconciliation

- All features you need to handle your taxes

- Compliance with all regulations

Reasons to avoid:

- Only available on Mac computers

7. Tipalti – Best Accounting Service for the Most Reputable Bookkeeping

Pricing: $149 per month

If you’re running a big business, a franchise, network, or series of businesses, and you need accounting software that can handle a ton of data (mostly complex data), then Tipalti is the service for you. Used by some of the biggest names in the business and winner of over a dozen awards, this platform won’t let you down.

And as one of the most top-rated accounting software in the world, you know this software works for you. From full account and balance management, full tax and regulation compliance, ultra-fast payment processing, inventory purchase management, and more, once you choose Tipalti, you won’t go back.

Key Features:

- Integrate with literally any ERP, accounting system, or performance marketing platform

- Drastically reduce payment processing errors with automated processes

- Connect and process payments in any country

Reasons to buy:

- On average, optimises your business’s workload by 80% at all stages

- On average, help your business make 25% more from payment reconciliation reports

- Entirely automated processes that save you so much time

Reasons to avoid:

- Requires a setup fee to get started

- Not suitable for small businesses

>>MORE: Treasury Management Software | Accounting Software For Woodworkers | Accounting Software For Photographers | HR & Payroll Software

Frequently Asked Questions

What do I look for in accounting software for gas stations?

The best accounting software for gas stations will vary depending on the size and needs of your business, but in general, you’ll want to look for features like income and expense tracking, invoicing and billing, tax compliance, and reporting.

It’s these kinds of features that will help you keep on top of your finances, make sure you’re paying the right amount of tax, and help you run your business more efficiently and effectively.

How do I choose which one is right for me?

The best way to choose the right accounting software for your gas station is to take a look at the features that are important to you and see which ones fit your business needs the most.

For example, if you’re looking for software that can help you with tax compliance, then Tipalti would be a good choice. However, if you’re looking for something that’s more geared towards small businesses, then AccountEdge might be a better option.

It really depends on your specific needs, so take a look at the features of each software and make a decision based on that.

What’s the difference between accounting software and bookkeeping software?

The main difference between accounting software and bookkeeping software is that accounting software is designed to help you with your overall financial management, while bookkeeping software is more focused on helping you keep track of your transactions.

Both are important for running a business, but if you’re looking for something specific to help you with your finances, then accounting software is what you need.

How long does it take to get the benefits of accounting software?

The benefits of accounting software are usually seen pretty quickly, as soon as you start using it to manage your finances.

You’ll be able to track your income and expenses, make sure you’re paying the right amount of tax, and generally get a better overview of your financial situation.

In some cases, it might take a little longer to see the benefits, depending on how complicated your financial situation is. However, in general, you should start seeing the benefits pretty quickly.

What does it mean for accounting software to be compliant?

When a piece of software is compliant, it means that it meets all the necessary requirements to be used for accounting purposes.

This includes things like being able to generate financial reports, complying with tax regulations, and having the necessary security features to protect your data. Of course, what the regulations are will depend on which country you’re operating in.

Not all accounting software is compliant, so it’s important to check before you buy.