Upfront Conclusion

The best accounting software for insurance agencies right now is FreshBooks and Zoho Books.

Accounting for financial firms such as those in the insurance industry is exceptional from what is seen in most businesses. This means that insurance firms need access to a unique set of accounting software to run their businesses and manage fiduciary funds correctly.

There are many good accounting software for businesses out there, but not all of them are the best fit for insurance firms: Some of them are so complex that without having a high degree knowledge of accounting and bookkeeping, you will experience great difficulty in using and navigating through them.

As an insurance agency, you need software that is easy to use and has excellent features to accurately and efficiently deal with your agency’s billings and transactions. In addition, when selecting an accounting software for your insurance agency, you have to consider features for fiduciary fund management, payroll management, etc.

Hence, we have compiled this list of the best accounting software for insurance agencies to facilitate your decision-making process.

The Top 8 Best Accounting Software for Insurance Agencies

Having researched and compared the features, pricing plans, add-onand s, among other characteristics of the best accounting software for insurance firms, these are the 6 top best options.

| Brand | Starting price | Best for |

|---|---|---|

| 1. FreshBooks | $15/month | Overall |

| 2. Zoho Books | $15/organization | Agencies on a budget |

| 3. Patriot Accounting | $20 – $30/month | Many useful features |

| 4. Netsuite ERP | $499/month | All-In-One Solution |

| 5. Striven | $49 – $99/month | Scalability |

| 6. Tally prime | $630 $1890 | Easy-to-use |

| 7. Zar money | $15/month | Integrations |

| 8. Horizon | $150 | Small insurance agencies |

1. FreshBooks – Best Overall Accounting Software for Insurance Agencies

In the realm of accounting software, FreshBooks stands supreme when it comes to invoicing. With FreshBooks, you can customize invoice payment terms, add invoice due dates, and even instantly get updated once an invoice has been viewed and paid by your customers. FreshBooks also lets you set up recurring invoices for set amounts on a set schedule. The best part is that FreshBooks has many other amazing features that make it an excellent choice for meeting the accounting needs of insurance agencies.

Pricing

FreshBooks pricing plans include:

- Lite: $15/month

- Plus: $25/month

- Premium: $50/month

- Custom plan: Available on request.

It also offers a 30-day free trial. We recommend the Premium plan because it supports an unlimited number of billable clients and contains all the essential features needed for your insurance agency’s accounting needs.

Features

- With just one click, you can generate your insurance agency’s financial statements, such as general ledger and other reports.

- FreshBooks offers robust and customizable invoice and invoicing features.

- FreshBooks offers excellent automations such as automated payment reminders to your customers, tracking project hours, and more.

- FreshBooks offers great customizability that lets you customize things like invoices, proposal templates, and estimates.

- FreshBooks offers an e-payment feature that lets your customers pay their insurance premiums through various online payment channels.

- FreshBooks offers excellent customer support through phone, emails, and live chat.

Why Do We Recommend FreshBooks As One Of The Best Accounting Software For Insurance Agencies?

We recommend FreshBooks because apart from being a cloud-based software with powerful invoicing features, it is also very easy to use and doesn’t require any prior accounting experience. The best part is that, unlike most accounting software, FreshBooks offers a mobile application for Android and iOS.

2. Zoho Books – Best Budget Accounting Software For Insurance Agencies

Zoho Books offers many fantastic features needed for an Insurance agency’s accounting needs at a relatively low price; hence, you enjoy great value at little to no cost with Zoho Books. Zoho Books is cloud-based, so you need not worry about installations as you’d a traditional accounting software.

Moreover, you need not be an accountant nor have an accounting background to use Zoho Books because Zoho Books’ intuitive user interface makes it easy to use, and the Zoho Books partners and help desk are always there to assist you.

Pricing

Zoho Books pricing plans include:

- Free: For businesses with less than $50,000 annual revenue.

- Standard: $15/month.

- Professional: $40/month.

- Premium: $60/month.

It also offers 14 days free trial. We recommend the Premium plan because it contains additional features like custom domain, custom buttons, and multi-transaction number series.

Features

- You can automatically import and reconcile your Bank feeds with your Zoho Books records with Zoho Books.

- Zoho Books offers a client portal which lets your customers view and pay their invoices.

- Zoho Books offers automated workflows, and you can schedule recurring payments and transactions.

- You can easily track and manage your inventory, receivables, and payables.

- You can create and manage subaccounts and schedule payments email reminders.

- You can connect a payment processor to your account to receive payments from your clients through gateways such as PayPal, Stripe, Braintree, and Square.

Why Do We Recommend Zoho Books As One Of The Best Accounting Software For Insurance Agencies?

We recommend Zoho Books because it gives you great value for your money, and you can even get free forever access if your insurance agency has an annual turnover of less than $50,000. Zoho Books offers excellent customer support, security, ease of use, customizability, and integrations.

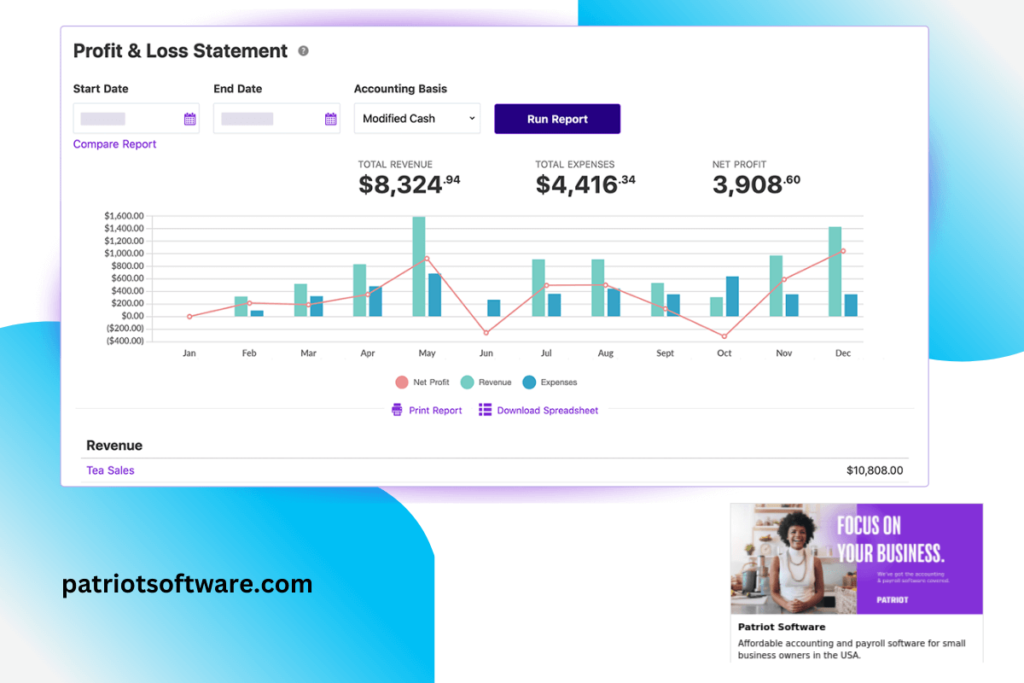

3. Patriot Accounting

Patriot Accounting has been in existence for over 30 years, and it has earned a reputation for being an ideal solution for handling accounting tasks. It’s an excellent software option for insurance agencies that are looking for basic features like tracking unpaid bills and issuing invoices.

The basic Patriot Accounting plan is loaded with many useful features. The process of creating an account is quite straightforward, and the dashboard gives you the ability to manage users, generate invoices, accept payments, and pay bills. However, the Premium Accounting package includes a few capabilities that are not often included with basic software. This includes the capacity to print vendor checks and provide credit notes.

Pricing

Patriot offers 30-day free trial. Patriot Basic Accounting costs $20 per month (unlimited use) Patriot Premium Accounting costs $30 per month (unlimited use).

Features

- Approval Process Control

- Recurring/Subscription Billing

- Tax Management

- Invoice Processing

- Customizable Invoices

- Online Payments

Why Do We Recommend Patriot Accounting As One Of The Best Accounting Software For Insurance Agencies?

Patriot Accounting software is created with a complete set of functionalities and ease of use without the need for intensive training. It is hosted on secure servers and secure data centers for continuous usage and access.

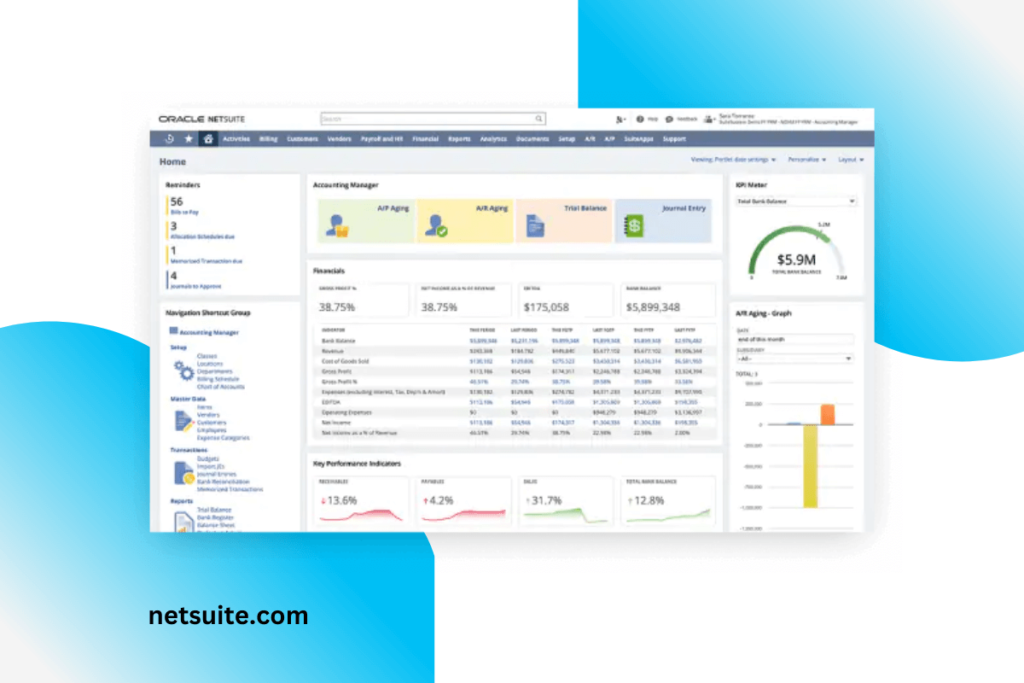

4. Netsuite ERP – The All-In-One Accounting Software for Insurance Agencies

Netsuite Erp is one of the best enterprise resource planning software that had accounting for insurance agencies embedded in their products. From our research, it has earned its place on the list of the top 3 best accounting software for insurance agencies for its offer combination of accounting solutions that includes payroll management, CRM, etc., to give you the best accounting software experience.

Pricing

Netsuite ERP pricing products start from $499 per month, but you have to call for a price quote that varies based on the features you want.

You can also schedule a product demo.

Features

- Netsuite also offers you many management solutions such as revenue accounting, fixed assets accounting, accounts payable and receivable, etc.

- It includes payroll tracking and recording.

- Tracks your income, expenses, and payments.

- It offers you an easy-to-use and customizable dashboard.

- Facilitates and simplifies your business and accounting reporting.

- It also helps you keep track of time and projects.

- Daily reconciliation with your bank account against your transactions made.

- It is also good for Fiduciary funds tracking and monitoring depreciation.

Why Do We Recommend Netsuite as the Best Accounting Software for Insurance Agencies?

Netsuite ERP suite of products is a good option for insurance agencies ‘ accounting. We recommend it to you because of the host of amazing features it offers to insurance agencies that perfectly fit the type of accounting solution you need as an insurance firm. Netsuite is an all-in-one accounting software option for you – you will certainly love having all these features for your firm with just one software.

>>MORE: Is Otto Insurance Legit & Safe? | Why is Travel Insurance Important? | Are Insurance Companies Open On Weekends | What Is An Insurance Guarantor?

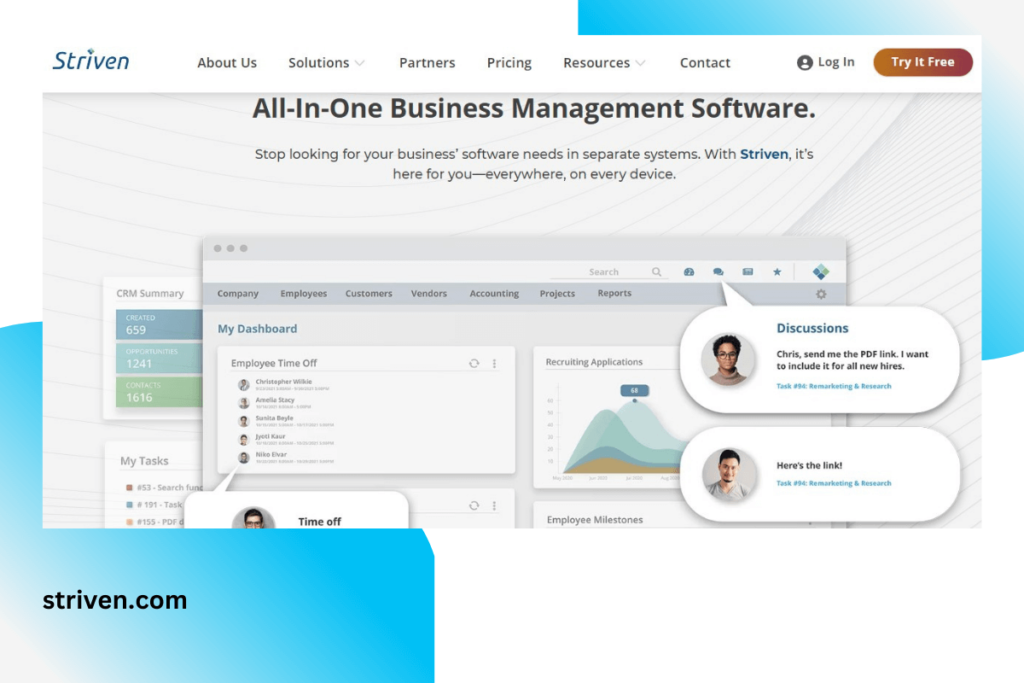

5. Striven – Best Accounting Software for Insurance Agency’s Scalability

This is the rubber-up to Netsuite ERP in our research on the best accounting software for insurance agencies. It is a cloud-based software that is suited for insurance agencies. Its features are developed to give your business solutions such as ERP, CRM, inventory management, project management, human resources, etc.

It also promises to give you a 360 view of how your insurance agencies are performing.

Pricing

Striven pricing plans include;

- Striven plan-1: $49 per month /user.

- STRIVEN PLAN-2: $99 per month/user.

We strongly recommend that second plan as its features are good for you as an insurance agency. It also offers you 30 days free trial and 60 days money-guarantee

Features

- It gives you access to a highly customizable dashboard

- Striven offers high-level Integration with Google, Microsoft, etc.

- You can have access to Striven at any time and place it both on desktops, PCs, and mobile devices.

- You can easily create custom management and accounting reports for understanding the health of your business.

- From the hassle of billing and invoicing for your agency.

- Good for your fiduciary fund accounting and payroll management.

- Striven is excellent at AP / AR and GL and Bank Reconciliation of your transactions.

Why Do We Recommend Striven as One of the Best Accounting Software for Insurance Agencies?

One major reason we recommend Striven and that because of the unlimited scalability it offers to insurance agencies. Its pricing system is structured to help your insurance agency grow. The pricing system allows you to add more clients and users as you grow.

6. Tallyprime – Top Easy-to-use Accounting Software for Insurance Agencies

This is another enterprise resource planning accounting software that has made its way into our list. Launched in 1989, with its roots in India, this accounting software has offered simplicity to insurance agencies management companies. Tallyprime is an excellent choice when it comes to handling Inventory Management, Payroll Management, Manufacturing processes, Budgets and Scenarios, and Audit for insurance agencies.

Pricing

Tally prime pricing plans are;

- The silver plan: $630 /single user

- The Gold plan: $ 1890/multi-user.

You can also schedule a demo. We recommend that you go for the Gold plan as it best fits insuranc3 and it is also a good value for your money.

Features

- Tallyprimes automatically generates bills and keeps a record of them.

- It gives you the option to view business reports in various ways, which keeps you open to new and better ideas.

- It offers a simple navigable interface.

- When there are many clients, Tallyprime makes your multitasking easier.

- It also facilitates easy and faster online payments.

- Tallyprime lets you keep track of income, expenses, and payments.

- It is also nice for multiple client management and facilitates the recurring payments of premiums for insurance agencies.

Why Do We Recommend Tallyprime as One of the Best Accounting Software for Insurance Agencies?

Tallyprime is developed to provide insurance agencies with simple, easy-to-use accounting software. It is easy for both professional, non-IT, non-tech savvy, and amateur accountants. Hence, we recommend it for this reason as all the employees of your insurance agency will find it simple and will be very comfortable using it.

>>MORE: What Is UMR Insurance? | Do I Need Life Insurance If I’m Single? | Why Is Title Insurance Important? | How Does Orthodontic Insurance Work

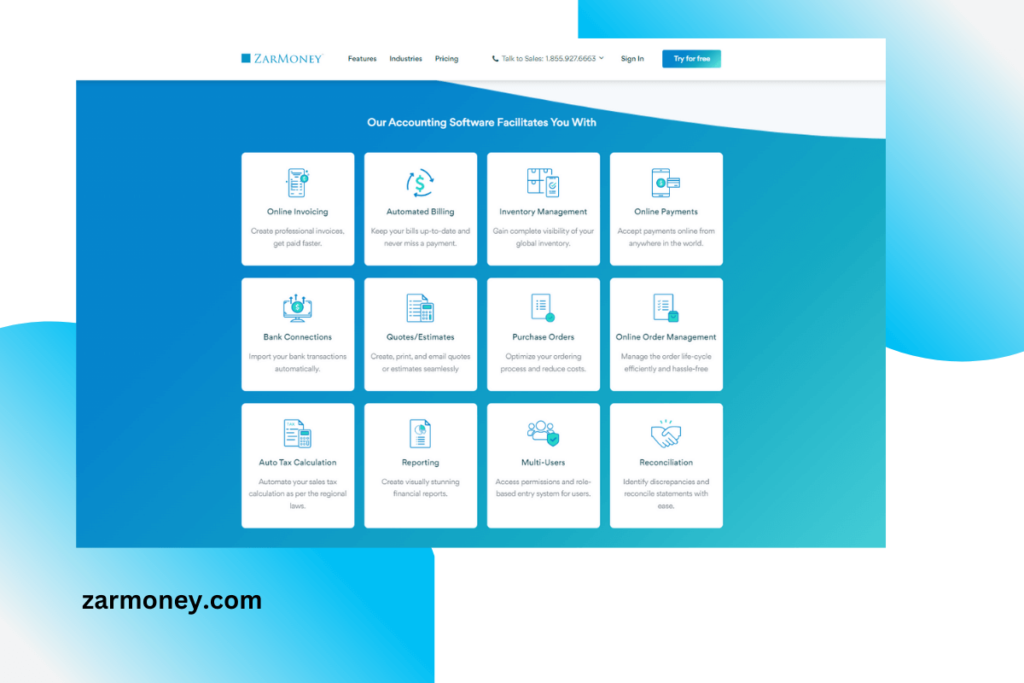

7. Zarmoney – Ideal for the Best Integrations for Insurance Agencies

Just like Sage Intacct, Zarmoney is cloud-based accounting software. Zarmoney is a comprehensive business accounting software developed for many businesses and different sizes, but it is a good choice for insurance agencies. It has earned its place in this list of the best accounting software for insurance agencies for its customizable features and integration it offers.

Pricing

Its pricing starts at $15 per month/1 user.

It also offers two weeks of a free trial, and you can schedule a demo.

Features

- It simplifies recurring payments such as premiums that might be coming in from your clients.

- For your payments, you can upload and attach receipts and invoices.

- You can also track expenses, such as bill payments, incomes, and time.

- You can create custom rules to simplify your accounting process more

- It connects and syncs with over 9600 banking institutions in the US and Canada.

- Zarmoney enables automatic tax calculation and filing, and you can also reconcile with your bank with one click.

Why Do We Recommend Zarmoney as One of the Best Accounting Software for Insurance Agencies?

There are so many reasons why Zarmoney is perfect for your insurance agency, but the main reason why we do recommend it is that if the host has integrations and customizable features it offers. You can even customize your accounting rules to match your processes and make them simpler for you. Isn’t that nice?

Zarmoney also lets you Integrate with Stripe, Authorize.net, Zapier, etc.

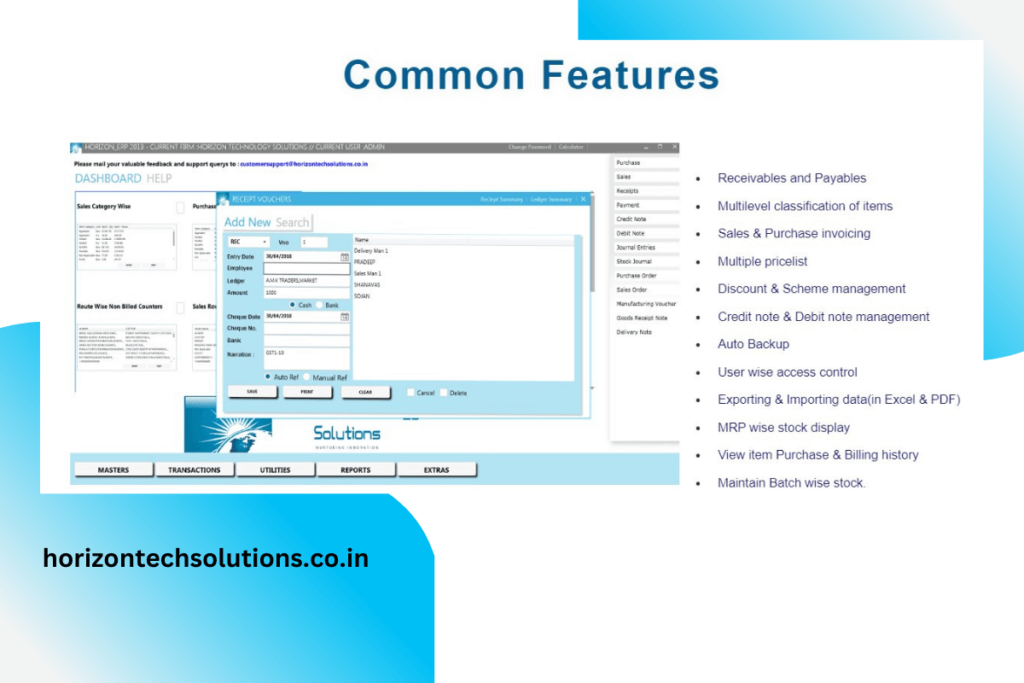

8. Horizon – Best Accounting Software for Small Insurance Agencies

Horizon is an Enterprise resource planning software that offers an easy-to-use and user-friendly interface and business accounting solutions for small businesses. Its cloud-based features are excellent for management and accounting, which your insurance agency needs.

Are you looking for the best accounting software for your new or small insurance agencies? Horizon is the best option for you. As one of the best accounting software for insurance agencies, it is best for smaller insurance agencies.

Pricing

Horizon’s pricing starts at a one-time payment of $150 per user. However, you have to give a call to receive a price quote based on the features you want for your insurance agency.

It also offers a free trial.

Features

- Horizon is very simple and easy to use.

- It allows easy invoice customization.

- Provides bank reconciliation against all your transactions.

- Facilitates inventory, expenses, and income tracking.

- It gives multi- entity tracking in case your insurance agency has multiple locations.

- Gives you easy reporting and customizable reports.

- It saves time as it gives you fast reporting.

- It is also great for the recurring payments of premiums associated with insurance agencies.

Why Do We Recommend Horizon as One of the Best Accounting Software for Insurance Agencies?

Though Horizon offers some range of features compatible with insurance firms, it was built mainly to enable small businesses to thrive. Since then, many smaller insurance agencies have been found as their best option. Its easy-to-use interface and simplicity make it a good option for the growth and scalability of small insurance firms.

We, therefore, recommend it as the best option for small insurance agencies.

Last Tip On Accounting Software For Insurance Agencies

Choosing the right Accounting software for insurance agencies has never been easy, especially for the distinct and special needs accounting agencies need. We have taken this opportunity to make it hassle-free for you, and in this post, we have listed out the best accounting software for insurance agencies for you.

Starting from the Nextsuite – the overall best accounting software to Striven, Tallyprime, Sage Intacct, Zarmoney, and Horizon, we explain their features, pricing plans and recommend the best plan for you. When it comes to management and accounting solutions, this accounting software handles premiums, payments, and payroll for insurance agencies.

As a last tip, we recommend that you choose the right option for your agency based on its needs, budget, etc. However, if you are looking to replace the accounting software, you are using it due to overgrowing it as your clients increase in number and your agency grows. In that case, we suggest that you make sure that the accounting software you select would have a scalability feature that is more adaptable to growth.

Read More

- Insurance Companies To Work For

- What Is Commercial Insurance?

- Insurance Risk Management Software

- Best CRMs For Life Insurance Agents

RELATED: Cloud Accounting Tools Best For Small Companies | Top Rental Property Accounting Tools | Accounting Textile Company Software