An efficient payroll process is key in ensuring your construction business runs smoothly. There are a number of software tools out there to help you save time and money by calculating costs, paying employees, managing job costs, and filing necessary taxes and reports. For companies specializing in construction, each project widely varies in size, type, and cost. An efficient accounting service is necessary to keep track of job-specific data and to calculate the costs of each unique job. There are a number of construction payroll software tools out there, but which one is the best for you? We’ve detailed 8 of the best and most popular construction accounting solutions so you can find the right fit for you.

Top 8 Best Construction Payroll Software Tools

- Payroll4Construction – best for construction specific reporting

- ADP Run – best for companies of any size

- eBacon – best for construction-specific reporting

- Gusto – best for small companies

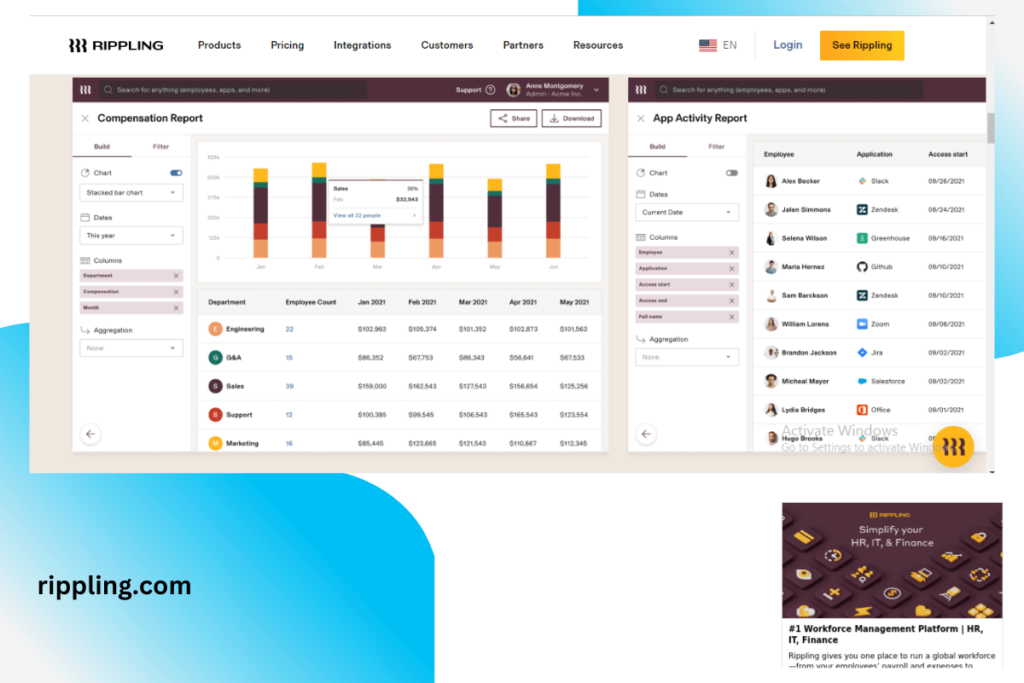

- Rippling – best for HR and payroll

- Paylocity – best for midsize to large companies

- Viventium – best for user customization

- Intuit Quickbooks – best for easy set-up

1. Payroll4Construction – best hands-off option

PRICING:

Contact Payroll4Construction for pricing

Payroll4Construction is designed and tailored specifically for companies that deal in construction. Payroll4Construction claims that you just submit the timecards, and they take care of everything else. It sounds too good to be true, but seriously. Users simply submit payroll data and Payroll4Construction handles your payroll, paying employees through check or direct deposit. Payroll4Construction even handles tax information like W-2s and gives you construction-specific reports every payroll. You can even pay contractors, as well as salary and hourly employees in the same tool.

KEY FEATURES:

- Mobile app

- Construction reports

- Tax filing

REASONS TO BUY:

- An easy no-fuss solution, let Payroll4Construction take care of your accounting needs for you

REASONS TO AVOID:

- Mobile app costs extra

- Lacks customizable interface

2. ADP Run – best for companies of any size

PRICING:

Plans start at $59/ mo + $4 per employee

Run by ADP is a great payroll and accounting service for anyone, especially those in construction because it offers unique features that not all payroll software ofter, like union-specific and construction specific reports and filing. Run also offers a full-service HR suite that can help you get setup with onboarding, and help you manage worker’s comp and background checks, just to name a few. ADP Run is a great help with taxes, offering help with state and federal tax filing.

KEY FEATURES:

- Mobile app

- Full-service HR tools

- Construction-specific reports

REASONS TO BUY:

- Easy to use, end-to-end payroll and accounting service

REASONS TO AVOID:

- Not for large enterprises

- Add-ons can get expensive

3. eBacon – best for construction-specific reporting

PRICING:

Call for pricing

eBacon is the ultimate construction payroll reporting software. eBacon offers simple ways to track hours spent working, and even bill different rates in the same day. eBacon is one of the few payroll companies that is designed specifically for construction, not a standard payroll service with add-on construction features. This means eBacon really knows the ins-and-outs of what is needed to keep your construction company running smoothly. They offer features like certified payroll, compliance reports, and fringe benefit management, among a host of others.

KEY FEATURES:

- Certified payroll

- Construction-specific reporting

- Keep track of multiple pay-rates in a single day

REASONS TO BUY:

- Construction-specific tool that makes payroll, accounting, and taxes simple

REASONS TO AVOID:

- Limited HR services

4. Gusto – best for small companies

PRICING:

Plans start at $39/ mo + $6 per employee (Contractor-only option at just $6/ mo per employee)

Gusto is one of the most affordable payroll options on the market, making it an attractive option for anyone. Simply manage payroll for employees with W-2s and 1099s, or choose their affordable contractor-only option. Gusto is great for smaller construction companies because it allows you to create job codes, track projects, and manage costs, all in one platform. However, Gusto is not suitable for larger companies who do a lot of government or union work because it lacks the tailored features for construction.

KEY FEATURES:

- Next-day direct deposit

- Mobile app

- Employee advances through Gusto Wallet

REASONS TO BUY:

- Easy to use tool that manages construction-specific taxes at state and federal levels

REASONS TO AVOID:

- No certified payroll

- No construction-specific reports

5. Rippling – best for HR and payroll

PRICING:

Call for detailed quote, plans start at $16/ mo (per employee – for payroll and HR modules)

Rippling is not a construction-specific payroll tool, but it would be hard to tell. Rippling offers onboarding and a full-service payroll that works in all 50 states, great for companies with multi state operations. Pay contractors and file W-2s and 1099s alike. There are a ton of reports included in the system, and the opportunity to create your own custom reports, so you never miss out on anything. Rippling lets the user create job codes for any work or union needs and offers international payroll.

KEY FEATURES:

- Third-party integration

- State and federal tax filing

- HR services

REASONS TO BUY:

- An HR and Payroll service that streamlines and keeps everything necessary at your fingertips

REASONS TO AVOID:

- Have to buy payroll module separately

6. Paylocity – best for midsize to large companies

PRICING:

Contact Paylocity for pricing

Through Paylocity you can file and pay federal and state taxes, create customized reports, access multi-state payroll, and basic HR functions. Paylocity makes it easy to pay contractors, hourly, and salary employees through one easy-to use interface. Paylocity offers some construction-specific reporting, but does offer the ability to create your own reports, so tracking should be a breeze. The HR tools include onboarding, PTO tracking, and worker’s comp management.

KEY FEATURES:

- Mobile app with geofencing

- Unlimited pay runs

REASONS TO BUY:

- Simple to use tool to manage payroll, HR, and construction-specific reporting

REASONS TO AVOID:

- Pricing is complex, need to purchase each module separately

7. Viventium – best for user customization

PRICING:

Call for tailored quote

Viventium is an all-in-one solution that offers next-level customization. Viventium is the only option on this list that keeps users up to date on compliance laws through notifications and email alerts. Viventium offers specified payroll and HR services based on industry, including skilled labor. Using their construction tailored tools, you can create custom job codes, track OSHA training, and offer multiple pay rates in a single day. While the HR features are add-ons, you can track worker’s comp, PTO, and so much more in one convenient location.

KEY FEATURES:

- Full-service payroll

- Tax filing at state, local, and federal levels

- Mobile app

REASONS TO BUY:

- Highly customizable, straightforward tool for all construction accounting needs

REASONS TO AVOID:

- HR features are a la carte and can add up

8. Intuit Quickbooks – best for easy set-up

PRICING:

Plans start at $35/ mo + $4 per employee

Quickbooks is not a construction-specific tool by any means, but they do offer a lot of tools handy for construction companies. Since it is a dedicated accounting software first, Quickbooks exceeds all payroll expectations, including unlimited and automatic pay runs, ability to work with W-2s and 1099s, and even same day direct deposit. Quickbooks can integrate with construction apps and offers some construction-specific reporting.

KEY FEATURES:

- Same or next-day direct deposit

- Robust list of HR features, like healthcare in all 50 states

- Third-party integration

REASONS TO BUY:

- Stay on top of all accounting and payroll needs, while also managing HR functions

REASONS TO AVOID:

- Construction-specific reporting limited

References and Links:

https://www.payroll4construction.com/

https://www.payroll4construction.com/request-a-quote/

https://www.payroll4construction.com/payroll-services/how-we-help-you/

https://www.adp.com/what-we-offer/products/run-powered-by-adp.aspx

https://www.adp.com/what-we-offer/payroll/payroll-for-1-49-employees/payroll-packages.aspx

https://www.ebacon.com/become-one-with-ebacon/

https://www.ebacon.com/time-saver/

https://gusto.com/product/pricing

https://www.rippling.com/payroll

https://www.rippling.com/pricing

https://www.paylocity.com/our-products/payroll/

https://www.viventium.com/industries-skilled-labor/

https://www.viventium.com/payroll/

https://quickbooks.intuit.com/payroll/

https://quickbooks.intuit.com/accounting/