Upfront Conclusion

The best free small business accounting software right now is FreshBooks and Zoho Books.

Being a small business owner is no walk in the park. While there are some upsides to owning your own business, small business owners are often under more pressure to make sure their business succeeds. That’s why small business owners need all the help they can get. Small businesses and their workers can benefit from streamlining busy work by using accounting software, especially in preparation for tax season.

Get rid of your pen and paper and manage your books using accounting software to save time and increase accuracy. To help your small business run seamlessly, we’ve compiled a list of the top 11 best free accounting software for small businesses available on the market right now.

Top 11 Best Free Accounting Software for Small Business

- FreshBooks – Best for Ease of Use

- Zoho Books – Best for small businesses looking to scale

- Sage – Best for multiple features

- Bonsai – Best For Freelancers And Medium Businesses

- Wave – Best overall

- Sunrise – Best for bookkeeping solutions

- GnuCash – Best for sole proprietors

- Akaunting – Best one-stop free accounting solution

- ZipBooks – Best for easy invoicing

- CloudBooks – Best for freelancers

- NCH Express Accounts – Best for small businesses with less than 5 employees

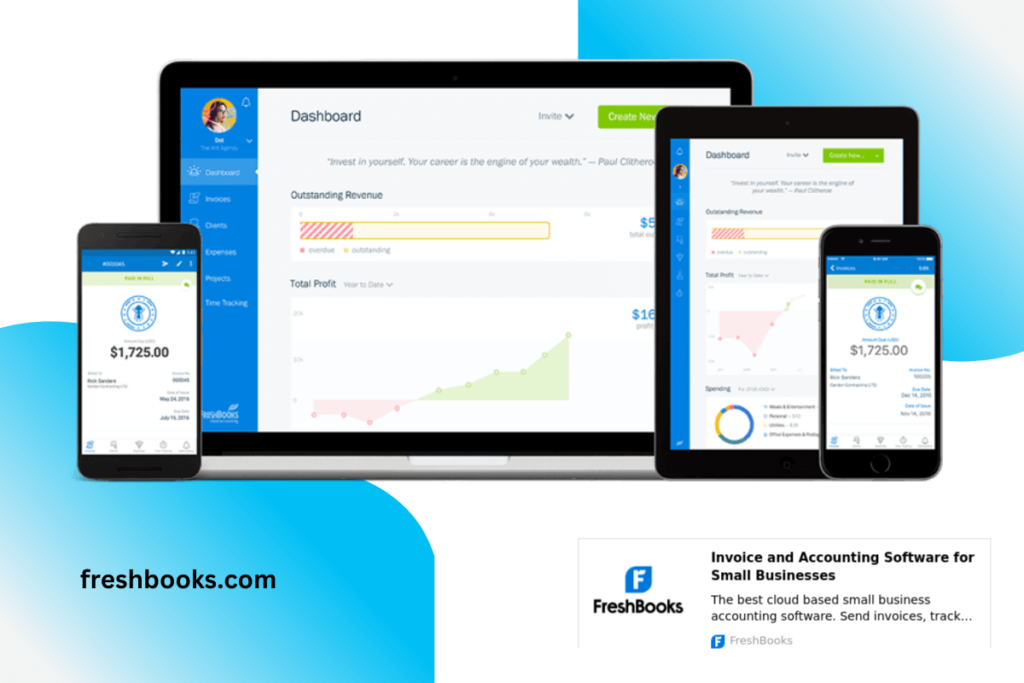

1. FreshBooks – Best for Ease of Use

Pricing: Plans start at $15/month after a free 30-day risk-free trial

Invoicing is the most important accounting requirement for most service-based firms. In comparison to other accounting software, FreshBooks provides greater customization options for invoicing. Its main role is to transmit, receive, print, and pay invoices, but it can also handle the fundamental bookkeeping requirements of a company. This accounting software enables service-based firms to issue proposals, track time on tasks, and accept payments.

Designed for business owners rather than accountants, FreshBooks allows your distribution company to manage large amounts of cash flow with ease. Create invoices, track expenses, generate expense reports, and easily compile financial data for taxes using a clean and easy-to-navigate interface that simplifies the billing process.

| Pros | Cons |

| Easy to use | User Limit |

| Allow multiple users | No Multi-Currency Support |

| User friendly interface | – |

| Unique and valuable features | – |

| Estimates and adequate reports | – |

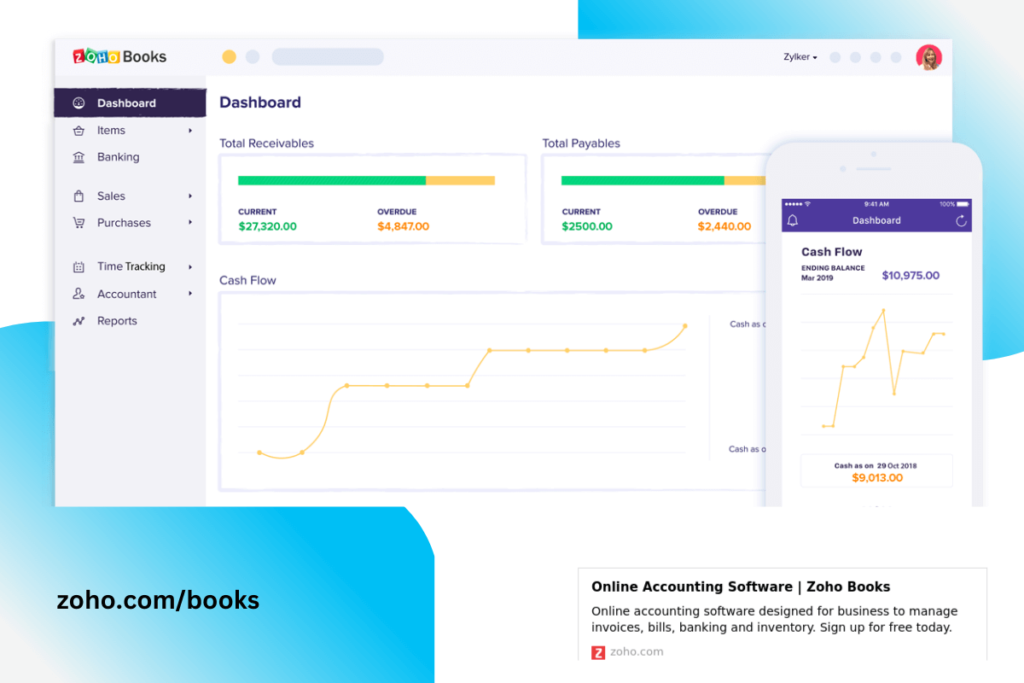

2. Zoho Books – Best for small businesses looking to scale

Pricing: Zoho Books is free for businesses with a revenue of under $50,000 per year. The free version includes one user and one accountant. For a more comprehensive set of tools, Zoho Books costs between $15/organization/month and $60/organization/month billed annually.

Zoho Books offers over 40 integrated business operation applications, helping small businesses automate workflows and manage their finances and accounting. The software is very accessible and straightforward. It includes numerous useful features that will help you manage and track expenses, stay in touch with your customers, and customize invoices. Another neat feature will let you manage project billing through integrated time tracking. Zoho Books is a great solution to consider, especially if your business meets the revenue requirement for the free version.

| Pros | Cons |

| Free version offers a great set of tools | Customer support via email only |

| Numerous plan options and add-ons | Revenue requirements to qualify |

| Robust set of features | Lacks payroll management resources |

| Easy to use | Limited integration options |

| Excellent mobile app | – |

| End-to-end accounting features | – |

3. Sage – Best for Multiple Features

Pricing: Sage plans start at $10/month.

For over four decades, the UK-based corporation Sage has been making accounting software. The company was established in 1981, and its most recent product, Sage Business Cloud Accounting, is a cloud-based accounting system ideal for companies of all sizes.

Sage Business Cloud Accounting has award-winning customer support in addition to everything you’d anticipate from cloud-based accounting software in 2022, such as open banking connectivity, invoice production, and Making Tax Digital VAT reports. This is essential for small business owners whose business time regularly extend beyond the typical 9 to 5 hours and is available 24/7 through phone and live chat.

| Pros | Cons |

| Easy to use | No time tracking |

| Run multiple report | Data storage limit |

| Free trial | – |

| Multiple customization features | – |

| Strong inventory function | – |

4. Bonsai – Best For Freelancers And Medium Businesses

Pricing: The starting price for monthly plans is $24 per month, and for annual packages, it is $17 every month.

Whether you are a small business or a medium-sized business, choosing Bonsai for your accounting needs will be great. The platform has various invoicing and payment features to enhance your income. It also has a simple interface to allow all types of users to use the software.

The best part is that Bonsai also offers a free trial on all premium packages. You can test the software for seven days without limitations to decide whether the platform has what you require to manage your finances. Small businesses love the app because of its organized dashboard and robust tax assistant.

There is also no need to worry about downtime of the software. Bonsai works seamlessly on various browsers with little to no downtime. So you don’t have to worry about some transactions not being tracked by the app.

| Pros | Cons |

| It allows you to track the hours you have spent working to create accurate bills | There is a limit of 5 project collaborators on the Starter plan |

| Use thorough reports to understand the financial health of your small business | |

| It helps you prepare for tax season with quarterly estimates and avoid errors in your books | |

| You can create a list of goals for a project and share it with clients through the customer portal | |

| The app can be used on desktops, iOS, and macOS devices |

5. Wave – Best Overall

Pricing: Wave offers free accounting software with no set-up fees or hidden charges. Their pay-per-use option charges a credit card processing fee and they also offer a monthly subscription for tax service and self-service states. In tax service states, Wave’s accounting software’s base fee is $35/month, and in self-service states, the monthly base fee is $20/month.

Wave, founded in 2009, offers one of the best accounting software for small businesses and freelancers. By using Wave, you will have access to key tools like accounting, invoicing and your company’s bank account. You will also be able to add unlimited income and expense tracking, create accounting reports and take advantage of bookkeeping services all on one user-friendly platform. Over 4 million users from 400,000 small businesses use Wave’s accounting software.

| Pros | Cons |

| User-friendly interface | Difficult to increase functionality |

| Comprehensive set of tools for free | No phone, only live chat support |

| Unlimited income and expense tracking, and invoicing | – |

| Customizable templates | – |

| Great reporting features | – |

| New features added constantly | – |

6. Sunrise – Best bookkeeping solutions

Pricing: You can sign up to use Sunrise’s accounting software for free. The free version includes low payment processing fees of 3.55% + $.0.30 per CC transaction, or 1.5% + $0.30 per ACH transaction. Sunrise Plus plan offers a wider range of tools for $19.99 per month and lower payment processing fees of 2.55% + $0.30 per CC transaction, or 0.5% + $0.30 per ACH transaction.

Sunrise is a cloud-based accounting solution that is packed with some great tools for small businesses. The software is easy to set up and users can import or modify chart accounts. Sunrise is known for its bookkeeping tools which let users quickly find customized invoices, payments, and business expenses. This software is an excellent choice for small business owners who need to track the basics like income, expenses, and invoices.

| Pros | Cons |

| Most features are available through the free version | No inventory tracking or cost of goods sold features |

| Great invoicing and A/R management tools | No bank account reconciliation |

| Most functions are available on their mobile app | Only one user per free account |

| Excellent customer service | – |

| User-friendly and easy to set up | – |

7. GnuCash – Best for sole proprietors

Pricing: GnuCash is a free accounting software. All you have to do to get access to the software is download and install it onto your computer.

GnuCash is an open-source platform, so you will be able to edit the code as you see fit. The software is compatible with iOS and Windows computers, but it is also available through Linux. Some key features include customizable reporting, double-entry accounting, and scheduled transactions. Even though the interface is somewhat outdated and the initial setup can be tricky, this software provides a wide range of tools that are sure to benefit small business owners.

| Pros | Cons |

| Free | No remote access |

| Great set of essential features | Limited customer support |

| Double-entry accounting | Could require some programming expertise |

| No internet connection is required post-installation | – |

| Software can be installed on multiple platforms | – |

| Highly customizable | – |

8. Akaunting – Best one-stop free accounting solution

Pricing: Akaunting Free Cloud is completely free. It includes one user and one accountant. The Premium cloud option is best for more established businesses of all sizes, starting at $36/month or $24/month if paid yearly, for an unlimited number of users.

Akaunting is an open-source solution with a full range of features that can be accessed for free. Over 270,000 people worldwide use this software. You will be able to access the software from any computer or mobile device. By using Akaunting, you will be able to manage your company’s cash flows, track invoicing and expenses, create transaction categories, and set up recurring bills.

| Pros | Cons |

| One-stop free accounting solution | Customer support could use improvement |

| Accessible from anywhere (desktop, tablet, mobile device) | Software could be difficult to operate |

| Secure, open-source solution | – |

| Excellent set of useful features | – |

9. ZipBooks – Best for easy invoicing

Pricing: ZipBooks offers four plans at different price points. Their Starter plan is completely free and includes unlimited invoices, vendors, and customers, as well as digital payments. To access a more comprehensive set of tools, users will have to pay between $15/month to $35/month. The Accountant plan is subject to custom pricing.

ZipBooks, a web-based financial software, is a great solution that offers all the key features that accounting software should. Those features include billing, invoicing, and expense management, as well as vendor and client management tools. The software’s basic bookkeeping tools will undoubtedly help small businesses keep up with their workload. Invoiced customers can complete online payments through Square or PayPal, but those transactions will be subject to standard rates. Keep in mind that the free version has its limits, such as the ability to link only one bank account. If you think you’ll require more functionality as your business grows, consider other options or decide whether you can afford to upgrade to a paid plan.

| Pros | Cons |

| Unlimited transactions and clients for free | Paid plans include more useful tools |

| Easy to use | No inventory tracker |

| Great integrated time tracking tool | Multi-entity accounting isn’t supported |

| Cash and accrual accounting | Lacks advanced integration options |

| Wide range of assisted bookkeeping options | – |

10. CloudBooks – Best for freelancers

Pricing: CloudBooks is available for free for a limited set of tools.

Over 2 million people use CloudBooks, a free invoicing and accounting software. The software includes a range of useful features that can help small businesses and freelancers manage invoicing, reporting and payments. CloudBooks is best known for its invoice management tools since it lacks some of the more robust accounting tools that other solutions provide. With CloudBooks, you’ll only be able to send up to five invoices per month if you don’t upgrade your plan. However, you can brand your invoices using this solution and offer online payments to your customers.

| Pros | Cons |

| Friendly and helpful support team | Free version offers limited solutions |

| User-friendly | Free version allows only up to 5 invoices |

| Great invoicing tools | Lacks robust accounting solutions |

| Email support | – |

| Free cloud data storage | – |

| Reasonably priced upgraded plans | – |

11. NCH Express Accounts – Best for small businesses with less than 5 employees

Pricing: NCH Express Accounts software is free for businesses with under 5 employees.

NCH Express Accounts is a desktop accounting software free for companies with less than 5 employees. If you own a small business, this could be a great solution for you. With NCH Express Accounts, you’ll be able to generate financial reports and analyze revenue. The software offers various integrations and you can even set up web access within a local network. However, you will need to purchase NCH Express Accounts cloud version in order to access the solution online.

| Pros | Cons |

| Free for businesses with less than five employees | No bank account connection |

| Extremely easy to use | Cost of goods can’t be automatically recorded without integration |

| Intuitive user interface | – |

| Easy to navigate between tasks | – |

RELATED: Top Affordable Accounting Software | Accounting Tools For International Businesses | Farmers Accounting Software