Payroll can be a major headache for you as a business owner, especially if you have a large team that you have to keep track of. Paid time off, workers comp., and worst of all, tax season can take hours and hours of your time.

Top 5 Payroll Software for Healthcare 2022

- Paycor – Best for Large Companies

- Patriot – Flat-Rate Pricing

- Remote – Modern Work-Force Oriented

- Onpay – Fully-Automated Taxes

- Keka– Payroll & HR Wrapped Together

1. Paycor – Best for Large Companies

PRICING: Based on a Consultation

Paycor automates the payroll and tax-compliance process to make payroll as easy as clicking a few buttons. All of your tax compliance-related issues are taken care of by a team of Paycor employees who work behind the scenes to ensure that your business complies with your state and county’s tax and employment laws. It really is that simple. The payroll software works much the same way; after the software collects the data on how much your employees have worked and their salaries, it gives you the option to select the pay interval and the ability to manually correct any errors. Then, the software runs the timecards and pays your employees. It even calculates workers’ comp, paid time off, and other more specific situations. Paycor is compatible with up to 1000 employees, so you can use it whether your company is large or small.

REASONS TO USE:

- Up to 1000 employee support

- Tax compliance made easy

- Set your own pay intervals

REASONS TO AVOID:

- Ambiguous pricing

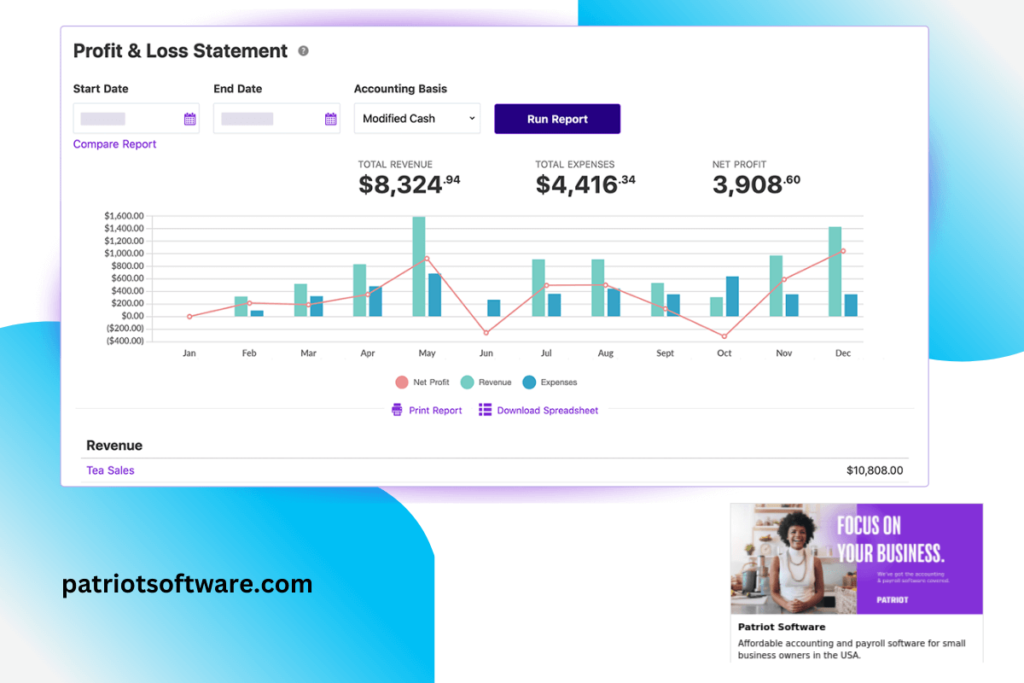

2. Patriot – Flat-Rate Pricing

PRICING: $17/mo.-$37/mo.

Patriot features many of the same features as Paycor, but with even more features and conveniences to make it the best choice for many users. One thing that stands out about Paycor immediately is its non-ambiguous pricing structure; you do not have to get a consultation in order to determine what you pay. Instead, you are told the prices upfront. One advantage of the “Full-Service Payroll” plan is that your taxes are not only calculated for you but are actually filed for you by the software, so the tax process is completely hands-off and automated. However, all of the software’s other features are included in the “Basic Payroll” plan, which includes neat things like net to gross calculations to decide exactly how much you want your employees to earn after taxes. Each aspect of your business can be split into departments whose payroll costs are calculated individually so you can see how much each team is costing you. Hours can be adjusted with just a few clicks, and the payroll will be automatically updated accordingly. Direct deposit only takes 2-4 days, so you can get your employees their wages quickly, and the software is also compatible with checks if some of your employees prefer them. Best of all, the setup of Patriot is entirely taken care of by the company, so you don’t have to go through the headache of switching to the software yourself.

REASONS TO USE:

- Taxes are filed automatically with the “Full-Service Payroll” plan

- 2-4 days direct deposit

- Changing one payroll parameter automatically changes the others in the software

REASONS TO AVOID:

- It can be expensive compared to some other payroll providers

3. Remote – Modern Work-Force Oriented

PRICING: Based on a Quote from Remote

As the name implies, Remote is designed with the modern remote workforce in mind and is capable of managing teams across national borders. Remote has the unique ability to manage tax regulations in multiple countries, so you do not have to worry about being non-compliant in other countries if you have employees around the world, and you also do not have to learn the tax codes of those particular nations. Instead, Remote takes care of all of it for you. It treats payroll the same way, and helps you send your money over to other countries, not just for salary but also for benefits and paid vacation time. It also includes other features such as; secure document storage, expense management, pension collections, and payslips. Expense management is a huge benefit to your company because it gives you the lenses you need to manage payroll with a fine-tooth comb and determine which employees are the most expensive to retain. This is especially important for remote work because you do not have as much direct access and interaction with your employees as a brick-and-mortar business does. Overall, if you are running a remote business and are looking for a modern payroll solution, ask Remote for a quote!

REASONS TO USE:

- Designed exclusively for remote workplaces

- Makes paying international employees extremely easy

- Expenses are tracked and easy to review

REASONS TO AVOID:

- Pricing is ambiguous

- Not suitable for brick and mortar businesses

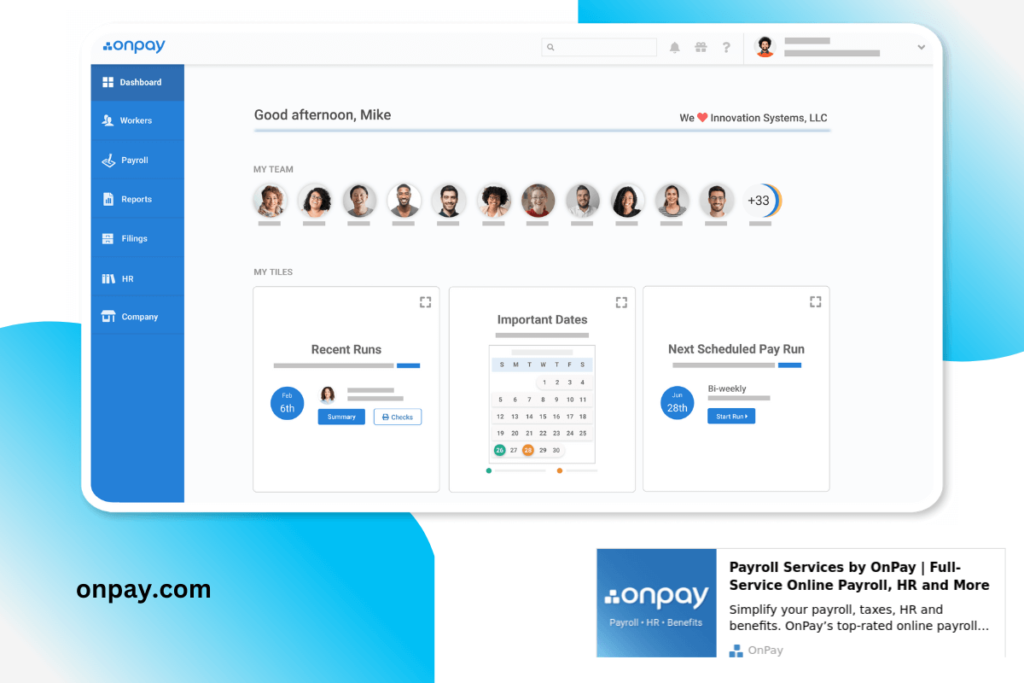

4. Onpay – Fully-Automated Taxes

PRICING: $36/mo. + $4/employee/mo.

OnPay provides a vast payroll feature set for an unambiguous affordable price that includes features usually reserved for more expensive payroll software. The most important of these features is automatic tax filing and payment, which is huge for you as the business owner, as it takes the burden of tax season completely off your shoulders. It also entirely automates the payroll process from top to bottom; simply put in the parameters for your employees and let OnPay take care of the rest. As far as paying your employees is concerned, OnPay provides unlimited monthly pay runs, the ability to pay by direct deposit, credit card, or check, automatic wage garnishments, and mobile optimization, meaning that you can keep your employees up to date from the comfort of their cell phones. OnPay has options available for various industries. However, the website does not specify if healthcare is on the list, so that is something that you will have to speak to OnPay about directly.

REASONS TO USE:

- Flat rate pricing makes it easy to include OnPay into your budget

- Mobile support

REASONS TO AVOID:

- It is not necessarily optimized for healthcare

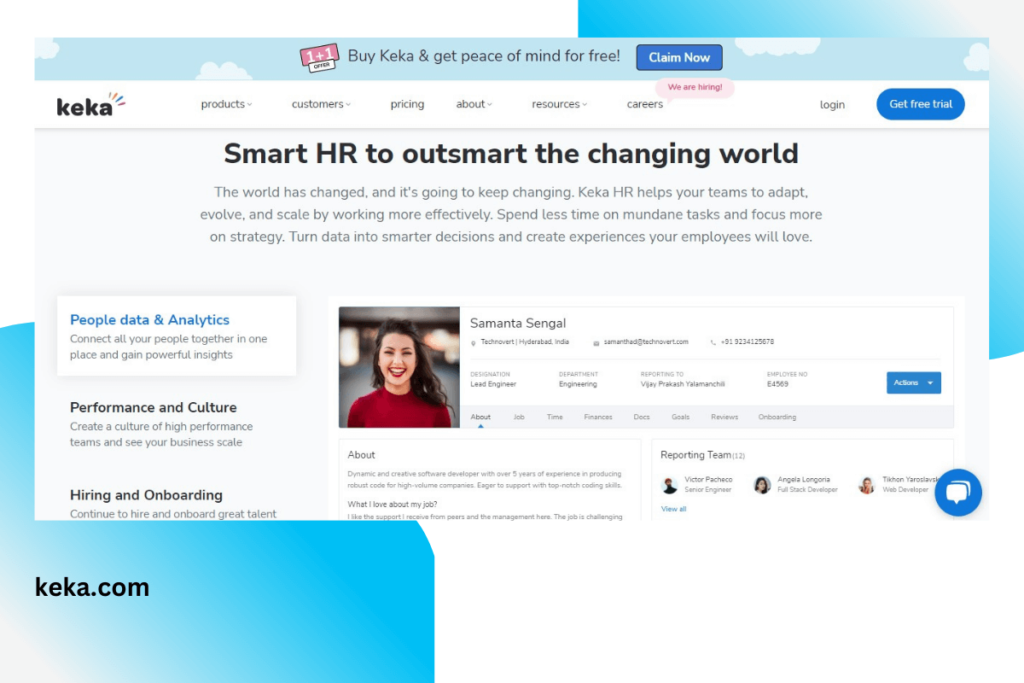

5. Keka – Payroll & HR Wrapped Together

PRICING: $500/mo.-$1100/mo.

Keka is an all-in-one HR and Payroll suite that provides a number of features, all in an aesthetically appealing UI. However, unless you need HR features as well as payroll features, Keka’s enormous price tag is not worth it for your business. The HR features are something you can look up on your own, but the payroll features are extensive and provide you with what you need to track your team’s attendance, their paid time off, etc., and pay them accordingly. While its payroll features are not very different than other payroll software if you need an HR suite to go with your payroll software Keka is for you.

REASONS TO USE:

- HR Suite as well as Payroll

- Gorgeous UI

REASONS TO AVOID:

- Extremely expensive

References and Links

- https://www.paycor.com/

- https://www.patriotsoftware.com/

- https://remote.com/

- https://onpay.com/

- https://www.keka.com/