RELATED: Software For Universities Project Management | Open Source Project Management Solutions | Salesforce And Project Management Integration Software

Data breaches, IT system failures, and oversight regarding compliance with state regulations can cost businesses millions. Having the best integrated risk management software in place can help to mitigate these risks and ensure systems remain robust, so the organisation can focus on providing its day-to-day services. This article will highlight some of the best integrated risk management software available today.

Upfront Conclusion

The best integrated risk management software right now is A1 Tracker and C1 Risk

Top 7 Best Integrated Risk Management Software

- A1 Tracker – Best Integrated Risk Management Software For Scalability

- C1 Risk – Best Integrated Risk Management Software For Pricing

- AuditBoard – Best Integrated Risk Management Software For Managing Audit Programs

- WorkViva – Best Integrated Risk Management Software For Project Collaboration

- Tandem Software – Best Integrated Risk Management Software For Financial Organizations

- Qualys – Best Integrated Risk Management Software For IT Departments

- Resolver – Best Integrated Risk Management Software For Customization

1. A1 Tracker – Best Integrated Risk Management Software For Scalability

PRICING: Bespoke, based on business requirements

A1 Tracker’s integrated risk management software offers tools to help businesses deal with various risks, including corporate, compliance, legal, insurance or political. These tools include impact analysis, probability management, risk factor metrics, threat assessments, risk alerts and risk management workflows. It’s a highly scalable platform and so A1 Tracker don’t offer standard pricing: instead, they consult with your business and provide the software tools you need in line with your budget.

KEY FEATURES:

- Suitable for any business or department managing risk

- Quick reports on risk data

- Works on mobile devices

- Secure portal for sensitive risk management data

REASONS TO BUY:

- Strong customer support

- Migration tools make switching to A1 Tracker simple

- Scalable: you need only use the integrated risk management software tools that your business needs

REASONS TO AVOID:

- Some reviewers would like to see customisable dashboard views

- Lots of up-front decisions to be made in order to customise the platform to your business needs

2. C1Risk – Best Integrated Risk Management Software For Pricing

PRICING: $4,500 annual fee

C1Risk is an integrated risk management software that promises to give your company “a single source of truth” for its governance, risk and compliance. To achieve that, it helps you create risk scorecards and monitor risk continuously across your organisation. It features reporting tools for real-time insights and enables you to store all your policy documentation in one place. C1Risk is an open-source platform, which means it’s possible to integrate into applications your business might already be using.

KEY FEATURES:

- Simple, all-in-one pricing structure

- Highly configurable

- Automates governance, risk assessment processes and monitoring tasks

REASONS TO BUY:

- Excellent customer support for training, reporting and customising the platform

- User-friendly interface

REASONS TO AVOID:

- Some platform onboarding is required at the outset

3. AuditBoard – Best Integrated Risk Management Software For Managing Audit Programs

PRICING: Bespoke, based on business requirements

AuditBoard is used by a quarter of all Fortune500 companies to manage their governance, risk and compliance processes. The integrated risk management software provides a central hub for audit projects, allowing stakeholders to collaborate and monitor progress. A lot of the more repetitive audit processes can be automated using the software and it’s possible to template projects to speed up future audits.

KEY FEATURES:

- Compliance and audit dashboard tracks audit and compliance status in real-time

- Central document hub for testing documentation

- Workflow tools allow users to identify audit issues and assign to relevant stakeholders for resolution

REASONS TO BUY:

- Trusted by a number of large businesses, including Tripadvisor, Chipotle and Hawaiian Airlines

- The software is customisable, so it can be adapted to suit your business

- Platform training is available

REASONS TO AVOID:

- Some reviewers feel reporting lacks sophistication

4. WorkViva – Best Integrated Risk Management Software For Project Collaboration

PRICING: Bespoke, based on business requirements

Workiva’s integrated risk management software can be used by businesses in finance, legal and insurance. It provides a central storage hub for all business process data, enables easy analysis and reporting and automates many repetitive tasks you’d associate with regulatory and financial reporting. Where it really excels is collaborative working tools, allowing users to share and access important documents.

KEY FEATURES:

- Manage risk assessments, workflows and reporting

- Audit tools include templates, analytics and reporting

- Software facilitates policy management across organisations

REASONS TO BUY:

- Highly-rated customer support

- Reviewers praise the platform’s automations

- The integrated risk management software makes it easy to collaborate on and share policy documentation

REASONS TO AVOID:

- Bugs and glitches reported

- Pricey subscription model

- It’s a complex platform with a steep learning curve

5. Tandem Software – Best Integrated Risk Management Software For Financial Organizations

PRICING: Bespoke, based on business requirements

Tandem Software’s integrated risk management software was created in response to the specific threats faced by financial institutions. It offers risk assessment tools to evaluate the likelihood of cybersecurity, identity theft and phishing attacks as well as measures to protect against them, including the ability to create education programs and landing pages for employees.

KEY FEATURES:

- All in one information security and compliance solution

- Offers tools to help manage, track and report on audits

- Includes business continuity planning software

- Tools to build cybersecurity frameworks

REASONS TO BUY:

- Tandem provide detailed instructions and webinars on their software functionality

- Reviewers praise its ease of use

- Frequent upgrades to keep in line with changing regulations and best practices

- Responsive support team

- Products also assist with risks around phishing, policies, social media management and vendor management

REASONS TO AVOID:

- Limited online reporting features

6. Qualys Cloud Platform – Best Integrated Risk Management Software For IT Departments

PRICING: Bespoke, based on business requirements

This integrated risk management software helps businesses keep tabs on the security of every device that’s connected to its systems and react to threats as and when required. Qualys comes with various bolt-on modules, which you can add to your stack depending on your business requirements. These include various asset management systems, IT and cloud security apps, protection for your web apps and compliance tools.

KEY FEATURES:

- Customisable IT security platform: modules can be added based on your business needs

REASONS TO BUY:

- Clean interface

- High-quality reporting

- Easy-to-install agents

- Software enables 24/7 security data on all connected devices

- Patch manager highly rated by reviewers

REASONS TO AVOID:

- Some reviewers report problems configuring and running scans

- Pricing structure can be expensive

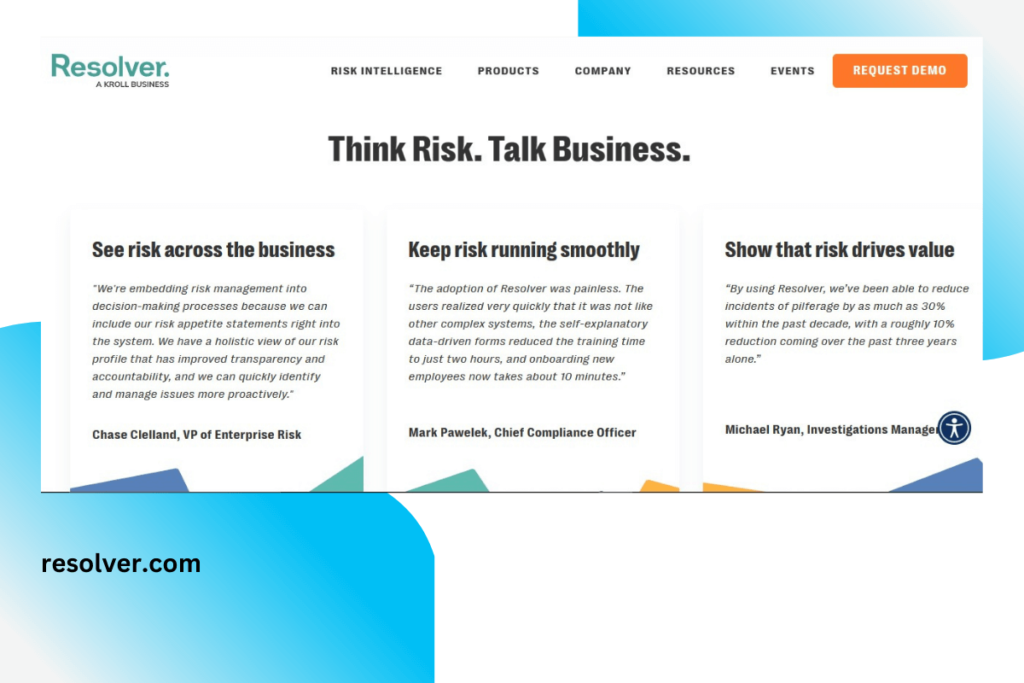

7. Resolver – Best Integrated Risk Management Software For Customization

PRICING: Bespoke, based on business requirements

All businesses face a number of risks, from corporate security to data to IT. Resolver is a one-stop shop to help organizations manage these different risks. It has tools to assist with managing risk data across business units, setting up workflows for risk managers, risk reporting and continual risk analysis. Resolver is used by companies across many industries from finance, pharmaceuticals and healthcare to technology or transportation.

KEY FEATURES:

- Scalable software: the platform is configured to your business requirements

- Generate incident reports easily

- Handles risk assessments, documentation and work papers, report generation and workflows

REASONS TO BUY:

- Fast and reliable

- High level of customisable reporting

- Good customer service

- Intuitive UI

REASONS TO AVOID:

- Lengthy onboarding process

- Lacks integration options

References and Links

https://www.capterra.co.uk/directory/31545/integrated-risk-management/software

https://www.softwareadvice.co.uk/directory/4101/integrated-risk-management/software

https://www.gartner.com/reviews/market/integrated-risk-management

https://softwareconnect.com/integrated-risk-management/

https://www.getapp.co.uk/directory/1759/integrated-risk-management/software

https://www.softwaresuggest.com/us/integrated-risk-management-software

https://www.selecthub.com/risk-management-software/