RELATED: Platforms Best For Personal Accounting | Farmer-Friendly Accounting Tools | Top Boutique Accounting Tools

It has been said that mobile accounting is the future for CPAs. But what benefits does mobile accounting have over other techniques used by businesses?

The best mobile apps should be user-friendly, and allow both personal accountants and business owners to access their emails, tax forms, balance sheets, and other accounting documents anytime anywhere.

Each app has its differences so we’ve put together a list of the top 5 best mobile accounting software so you can confidently choose which is best for your company.

Upfront Conclusion

The best mobile accounting software right now is FreshBooks and Zoho Books.

Top 5 Best Mobile Accounting Software:

- FreshBooks: Best cloud-hosted mobile accounting software

- Zoho Books: Best mobile accounting software for small to midsize businesses

- Quick Books: Best mobile accounting software overall

- Sage Accounting: Best mobile accounting software for inventory management

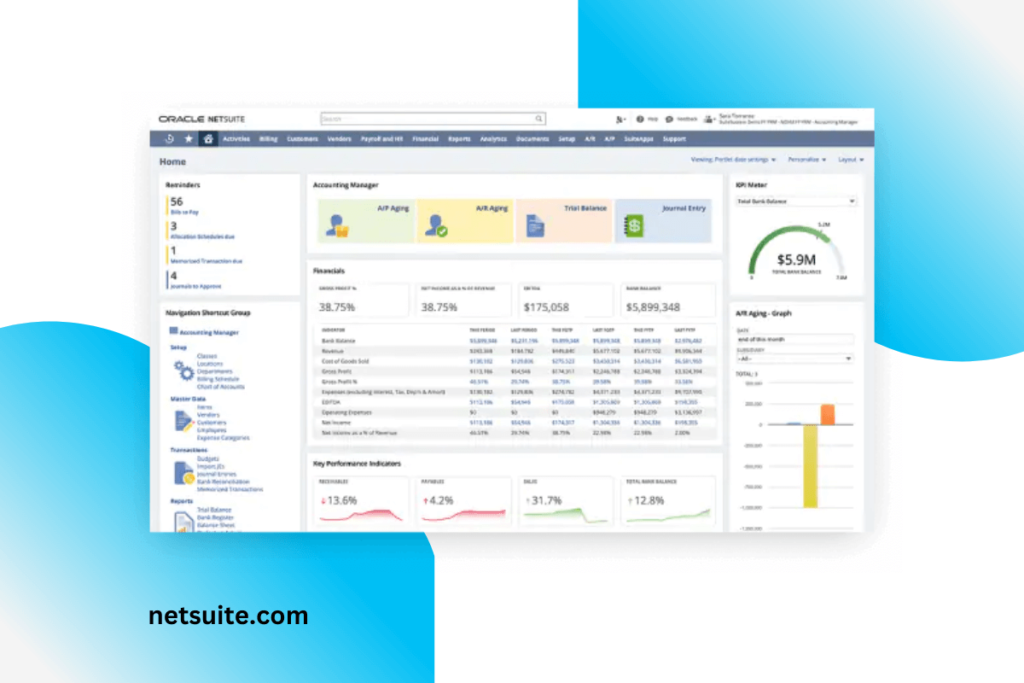

- NetSuite by Oracle: Best customizable mobile accounting software

1. FreshBooks: Best cloud-hosted mobile accounting software

PRICING:

60% off for 6 months, and then:

- Lite: $15.00/month

- Plus: $25.00/month

- Premium: $50.00/month

- Select: Customizable

FreshBooks is one of the best affordable, and user-friendly cloud-hosted mobile accounting softwares out there. Cloud-hosting enables FreshBooks to split its physical server into multiple virtual servers, all of which connect together to create a single unified network. Due to this interconnectedness, FreshBooks is incredibly flexible and easily accessible. Each tier within FreshBooks coincides with how many billable clients a business needs. This makes it easy to determine which pricing plan is right for your company.

KEY FEATURES:

- Track business expenses

- Create invoices easily

- Create records for individual suppliers to organize future payments from them

- Upload business receipts

- Organize expenses by required categorization

- Dashboard homepage

- “Owed and owing” is shown on the homepage

- Bank integration to capture inbound and outgoing payments

REASONS TO BUY:

- Cloud hosted

- Optimized mobile application

- Simple, all-encompassing business app

- Integration with major ecommerce sites such as Shopify and Squarespace

- Integration with Zoom for easy meeting access

REASONS TO AVOID:

- Not an extensive ability to customize

- Payroll isn’t a built-in feature, must integrate through Gusto

2. Zoho Books – Best mobile accounting software for small to midsize businesses

PRICING:

- Free: $0/month

- Standard: $10/month

- Professional: $20/month

- Premium: $30/month

ZohoBooks is known for its user-friendly interface that provides a clear and straightforward setup process. This mobile accounting software is ideal for small business to midsize businesses due to its ability to expand within the platform as the company grows. Each tier is designed to optimize the financial needs of your company based on how many employees need to access it.

KEY FEATURES:

- Homepage dashboard with data and financial statistics

- Expense tracking and organization by linking a company credit card or bank account

- Project cost functions

- Initiate purchase and sales orders

- Directly pay company bills within app

- Project management (professional and premium plans)

- Time tracking (professional and premium plans)

- Custom project reporting (professional and premium plans)

REASONS TO BUY:

- Can integrate with many other payroll and financial platforms

- Mobile app optimized for both Android and iOS

- Free option

- Simple monthly pricing with no hidden fees

- Simple onboarding process with videos for assistance on Zoho’s website

REASONS TO AVOID:

- Payroll support is limited to 4 states (CA, TX, FL, and NY)

- No plans available for larger firms

- No end to end inventory management features

3. QuickBooks – Best Mobile Accounting Software Overall

PRICING:

50% off for 3 months, and then:

- Simple: $25/month

- Plus: $80/month

- Advanced: $180/month

- Desktop ProPlus: $350/year

QuickBooks has been in business for nearly 3 decades, helping over 7 million business owners globally. One aspect of QuickBooks that has shot its software to the top is its dedication to customer service. When new users begin the onboarding process they are referred to the QuickBooks sales team to ensure they’re choosing the plan best fit for their business. Once this has been initiated, users are given a comprehensive guide to make the software setup as painless as possible.

QuickBooks allows users to choose different tiers based on the size and needs of their company. Depending on which tier is chosen, users can track income and expenses, store business receipts, track mileage, track project profitability, and more.

KEY FEATURES:

- Track project profitability

- Inventory Tracking

- Capture receipts and track expenses

- Bill organization

- Create and send professional invoices

REASONS TO BUY:

- QuickBooks can integrate with a wide variety of other platforms

- BigCommerce QuickBooks app: allows users to automatically generate documentation needed for online sales

- Ability to choose a tier according to needs

- Business insights dashboard

- Excellent customer support

REASONS TO AVOID:

- No free option

- Plans can be relatively expensive

- Inability to enter in ‘time worked’ for employees

4. Sage Accounting: Best mobile accounting software for inventory management

PRICING:

40% off for the first year, and then:

- ANNUAL:

- Pro Accounting: $567.00/year

- Premium Accounting: $888.00/year

- Quantum Accounting: $1460.00/year

- MONTHLY:

- Pro Accounting: $56.00/month

- Premium Accounting: $87.00/month

- Quantum Accounting: $145.00/month

Sage Accounting is the most in-depth, comprehensive business and inventory management app on the market. Upon setting up, you will find it’s quite simple despite it being a lengthy process. Sage Accounting is known for being the most advanced accounting app for inventory with its all-encompassing inventory management overview. See what’s in stock, what’s processing, and what’s on backorder with a simple click. Upon a purchase being made, the inventory system automatically adjusts so it’s always accurate and up to date.

KEY FEATURES:

- Bank integration – see a clear snapshot of your account balances in one place

- Custom recurring invoices

- Ability to scan business receipts with a smartphone

- In depth inventory management

- Insight into job costings

- Create and send invoices

- Summary homepage

REASONS TO BUY:

- “Pay Now” invoice button

- Payroll support

- A large number of integration possibilities

- 150 data reports available at any time

REASONS TO AVOID:

- Lack of aesthetic personality

- Some extremely helpful features cost extra

- Plans can be expensive

- The startup process is time-consuming

5. NetSuite by Oracle: Best customizable mobile accounting software

PRICING:

- $999/month base price

- Customizable pricing plans based on companies size and needs

NetSuite is the most customizable mobile accounting app on the market to date. With an impressive amount of information packed into a user-friendly interface, NetSuite offers custom mobile support and unique software for businesses looking to keep all financial data, enterprise resource planning, business management, customer relationship management, human capital, email marketing, analytics, and more within one app.

KEY FEATURES:

- Wide variety of software for different aspects of business management that are all able to integrate together

- Customization of the ‘General Ledger’ (the means by which a company records total financial accounts – such as assets, liability, income, expenses, and more).

- Automated services: exemption processing from mismatched orders, discount calculations, etc..

- Billing and invoicing power

- Payment acceptance for nearly every payment method globally

- Massive integration list

REASONS TO BUY:

- Extremely customizable

- Optimal for large businesses

- Significant ability to budget finances

- Forecast and report financial data automatically

- All in one solution for every department within a company

REASONS TO AVOID:

- Expensive

- Steep learning curve

- Lengthy setup process

Frequently Asked Questions:

Do I Need An App For Accounting?

It’s not a requirement, however, many small business owners benefit greatly from utilizing an accounting app. Accounting within any business is a time-consuming process. This takes away from time spent on your business. Accounting apps help business owners track accounts, income, cash flow, employee payroll, and allow them to be confident and prepared come tax season.

What Kinds of Accounting Is Needed For a Small Business?

When it comes to small business accounting there are generally three important reports: balance sheet, cash flow statement, and income statement. The balance sheet is a statement of the owner’s assets, liability, and equity. The cash flow statement provides a picture of how much cash is both entering and leaving your business at any given time. The income statement details a business’s revenue, expenses, profits, and losses for a specific time frame.

Why Do Small Businesses Need Accounting?

When it comes to the IRS, there are no second chances. This is why small businesses need accounting software to collect vital information come tax season. Accounting provides a snapshot of business costs, earnings, liabilities, payroll, and assets in order to create sound and beneficial decisions for your company.

Do I Need To Hire An Accountant For My Small Business?

Not all companies grow at the same rate. If you’re just starting out and you feel confident in your knowledge and free time, you may not need an accountant right away. However, when your business begins to pick up speed, it’s wise to hire an accountant. Not only are they professionally trained to ensure no mistakes are made, you can utilize your free time to run your company. Many companies choose to hire an accountant just around tax season, and while this is recommended no matter what, accountants can help you interact with the government year-round.

Do I Need An Accountant Even If I Use QuickBooks?

Even if you utilize the most comprehensive financial app on the market, it’s always encouraged to hire an accountant, especially around tax season. When it comes to your business you want to make sure there are no vital gaps missing in the financial forms that you may not realize. Detailed knowledge is required when filing a business’s taxes, so in order to maintain accuracy and avoid a headache, it’s advised to hire an accountant.