Deciding which payroll service is best for your business can be difficult. There are a factors you should consider when choosing an online payroll service like whether the service can handle the payroll for your business size, or if the service offers the features you need, such as direct deposit and employee self-service then if the service is affordable for your business.

We’ve researched and found the best online payroll services for small businesses. Here are our top ten best online payroll service:

10 Best Online Payroll Services

- Paychex – Best used for large business with multiple offices

- Gusto – Best used for growing businesses to pay and ensure their teams

- ADP Payroll – Best for processing payroll for employees

- OnPay – Best by small businesses in processing payrolls

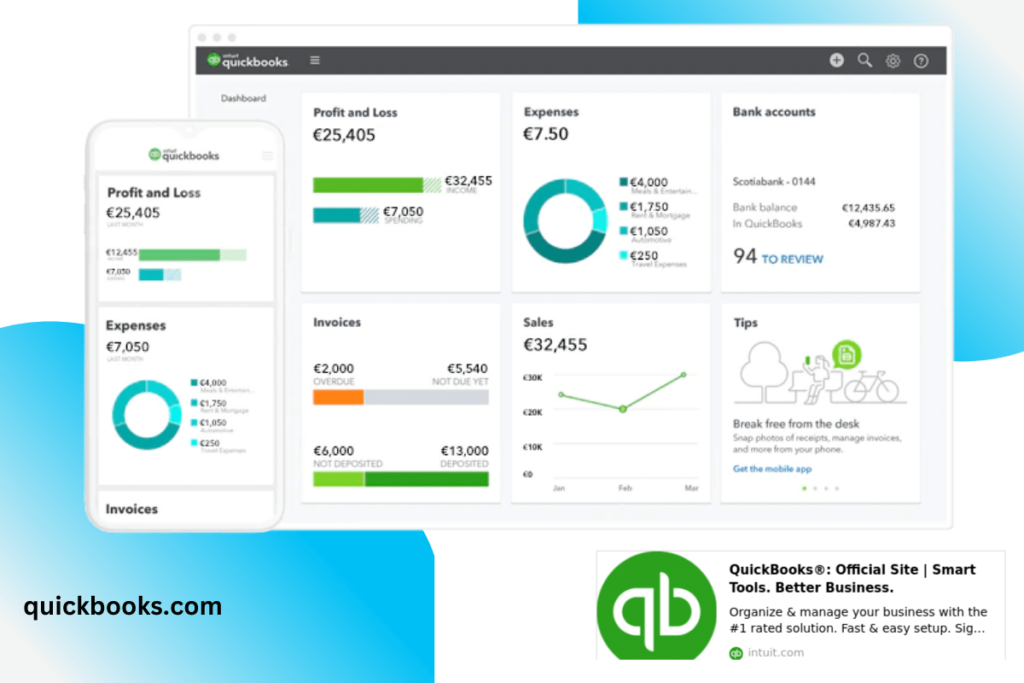

- QuickBooks Online – Best used for tracking income and expenses

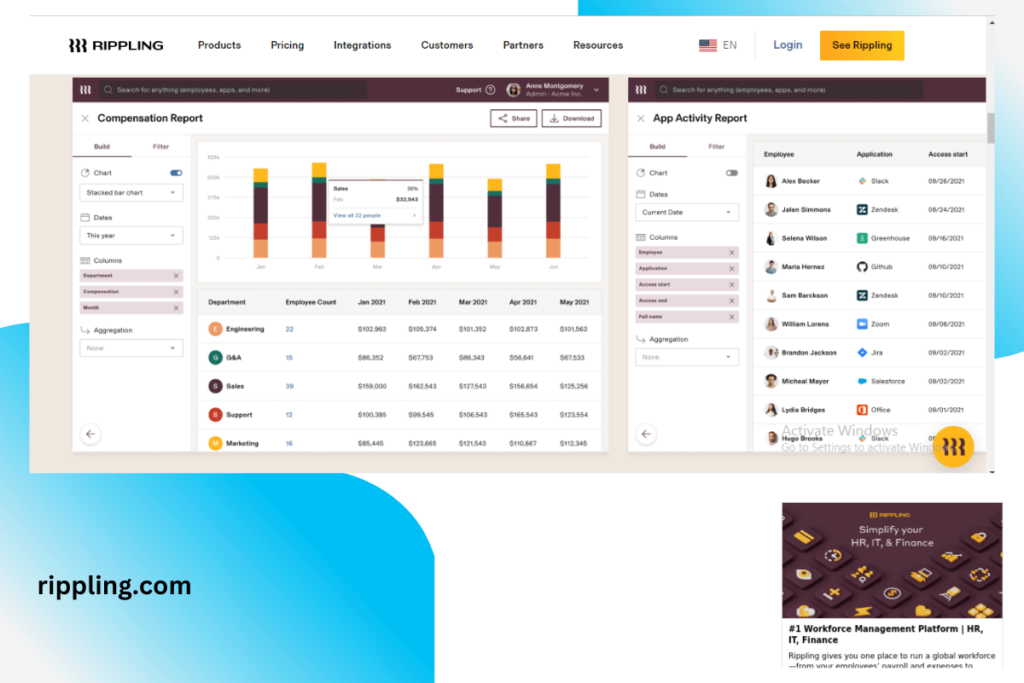

- Rippling – Best used by businesses to manage payroll

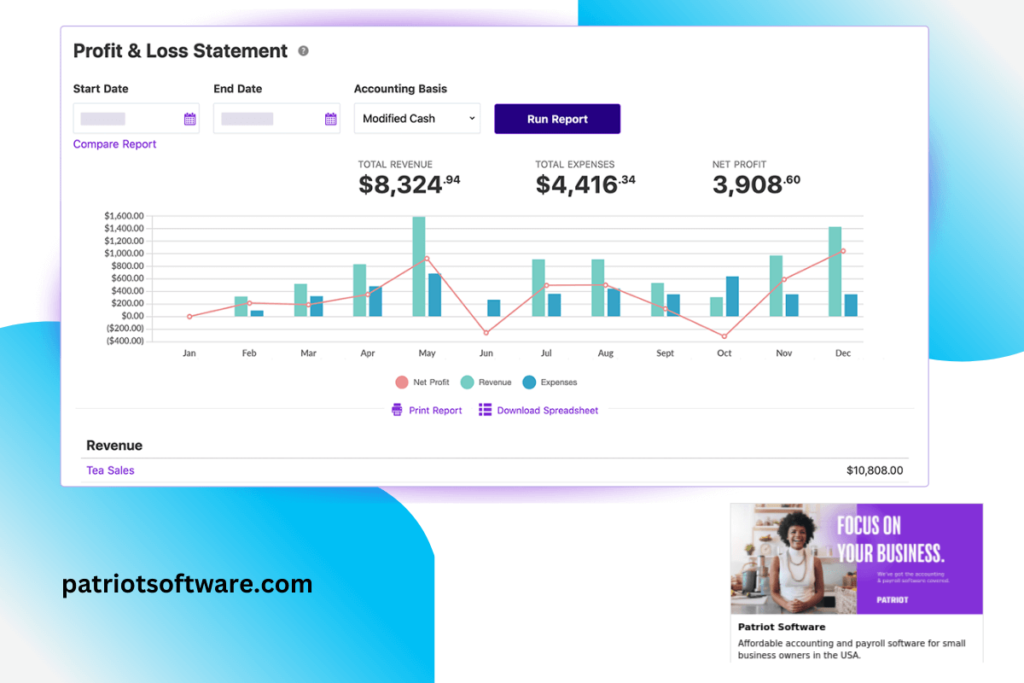

- Patriot – Best used by small businesses in managing their payroll

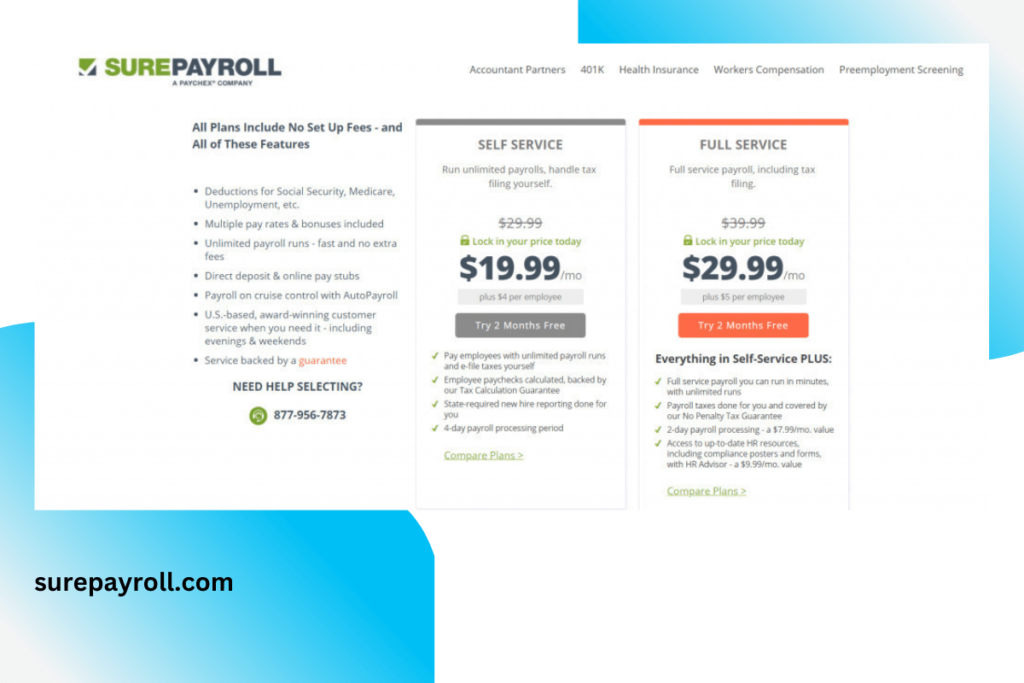

- Sure Payroll – Best for small business owners to simplify the payroll process

- Square Payroll – Best for small business owners to manage their payroll processes

- TriNet – Best used for easing HR tasks by small and medium businesses

1. Paychex – Best used for large business with multiple offices

PRICING: $59/month

Paychex is the most well-known company when it comes to payroll and accounting. Paychex uses a bank-based system to provide results quickly and conveniently to employers and employees

KEY FEATURES:

- Alert/Notifications

- Accounting integration

- Customizable reports

- Payroll reporting

- Payroll management

- Reporting & statistics

REASONS TO BUY:

- User friendly

- Real value for money

- Quite customizable

- Scalable

- Built-in onboarding & HR

- Offers tutorials

REASONS TO AVOID:

- No free trial

- Non-transparent pricing

- Customer not 100% effective

- The browser interface is not attractive

- Program freezes at times

2. Gusto – Best used for growing businesses to pay and ensure their teams

PRICING: Core plan: $39/month+$6/user/month; Complete plan: $39/month+$12/user/month; Concierge plan: $149/month.

Gusto is a well-known software service provider for payroll, customer service, and customer support. Gusto provide streamlined HR and benefits management services so that you can stay ahead of all regulatory requirements.

KEY FEATURES:

- Accounting integration

- HR Management

- Onboarding

- Payroll management

- Payroll reporting

- Time tracking

REASONS TO BUY:

- Great user experience

- User friendly

- Comprehensive mobile access

- Great customer service

- Integration with QuickBooks

- Great HR for small businesses

REASONS TO AVOID:

- No free trial

- Poor customer service

- Not available internationally

- Onboarding is a bit cumbersome

- Limited scheduling tools

- Reporting is not super robust

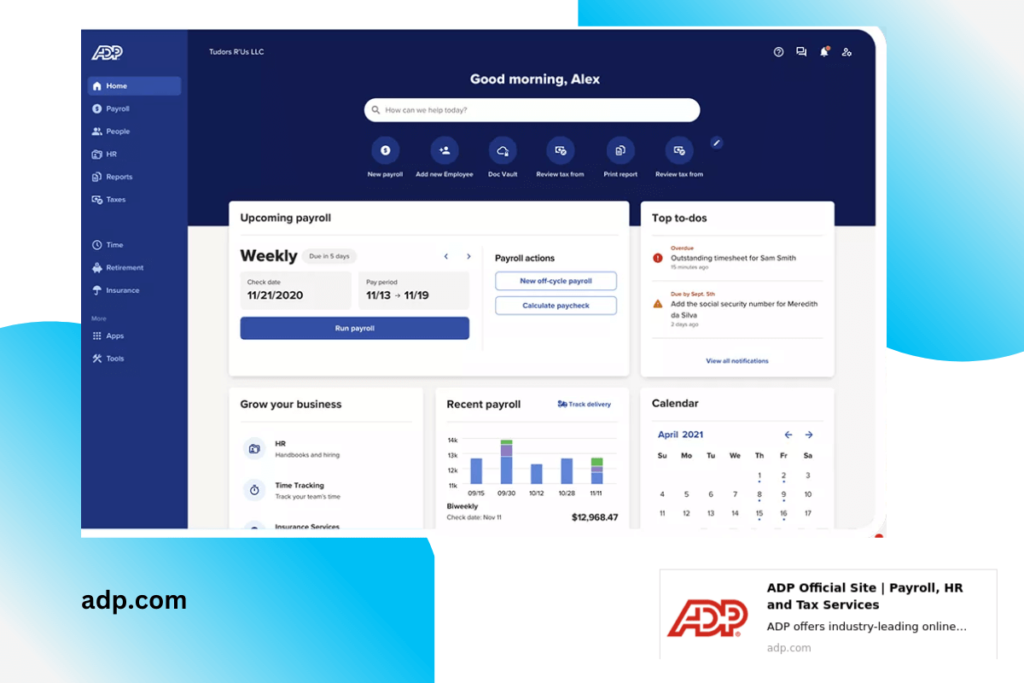

3. ADP Payroll – Best for processing payroll for employees

PRICING: $59/month+$4/user/month

ADP is a payroll service provider that offers a variety of payroll software solutions and services. ADP Payroll offers customized tools for businesses of all sizes. It is one of the best payroll companies in the industry

KEY FEATURES:

- Payroll

- Time tracking

- Payment methods

- Employee management

- Reports

- Paid time off

REASONS TO BUY:

- Automated tax filing

- Payroll support

- Video tutorials are available

- Easy to use

- Excellent customer support

REASONS TO AVOID:

- Integration with other software not optimized

- Time-off policies

- Additional pay for more features

- Non-disclosure of prices online

- No dedicated accounting representative

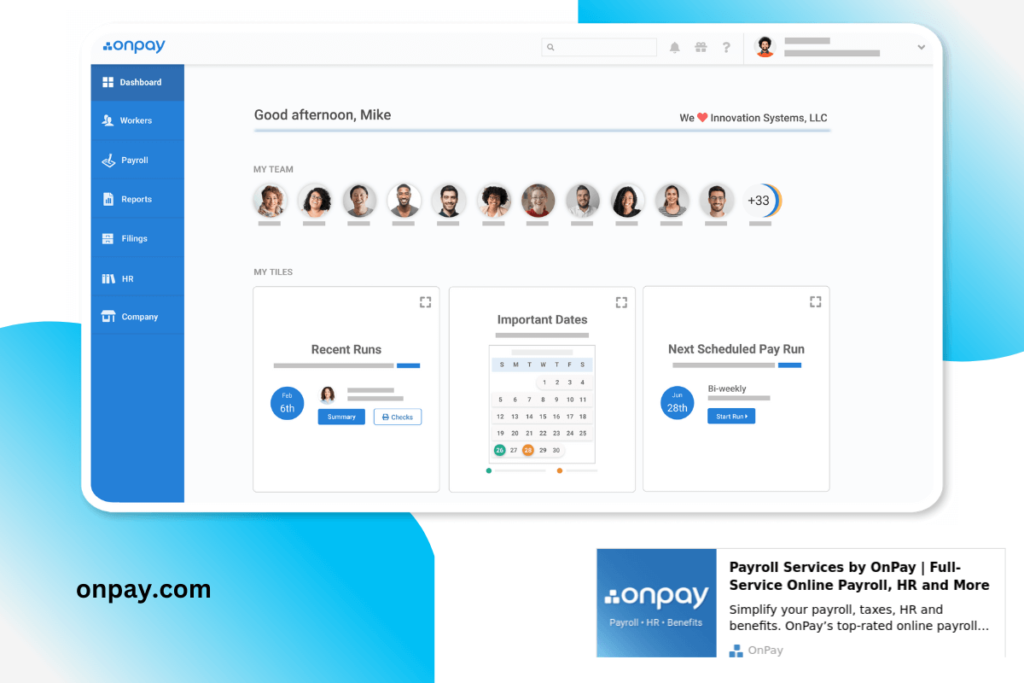

4. OnPay – Best by small businesses in processing payrolls

PRICING: It starts from $36/per month

OnPay is a payroll service provider for businesses of all sizes. It is a leading software service provider that automates tax filing and payment workflows for small businesses

KEY FEATURES:

- Benefits management

- Direct deposit

- HR management

- Payroll management

- Payroll reporting

- Payroll outsourcing

REASONS TO BUY:

- Free trial

- User Friendly

- Integration with 3rd party services

- Great user interface

- Simplifies payroll reporting

- Modestly priced

REASONS TO AVOID:

- Poor mobile version

- No automated payroll submission option

- No quick direct-deposit option

- Customer service is subpar

- Sometimes slow to load pages

- Not easy to set up

5. QuickBooks Online – Best used for tracking income and expenses

PRICING: Monthly plan: $12; Annual plan: $237

QuickBooks is a well-known business accounting software commonly used to easily track employee hours, calculate taxes, and do audits while saving time. You will also have the option to easily track your company’s cash flow if you are looking for additional ways to save money.

KEY FEATURES:

- Third-party integration

- Accounting

- Payroll reporting

- Payroll accounting

- Tax filing

- Online payments

REASONS TO BUY:

- 30 days free trial

- Easy to use

- Save time and efforts

- Cost-effective solution

- Scalability

- Robust security

REASONS TO AVOID:

- No data backup

- Limited transparency

- No invoice design tools

- No direct professional support

- The number of users is limited

6. Rippling – Best used by businesses to manage payroll

PRICING: Starts at $8/month/user

Rippling is an online and cloud-based payroll service provider available to business owners. Rippling helps simplify payroll, HR, and employee management by offering various customizable options and payroll reports and services.

KEY FEATURES:

- Accounting integration

- Onboarding

- Payroll reporting

- Payroll management

- Tax compliance

- Benefits management

REASONS TO BUY:

- Automates tax compliance and filing

- The mobile app is available

- Accurately calculates paychecks

- User friendly

- Easy to setup

- Quite comprehensive

REASONS TO AVOID:

- Limited customer support

- Limited customizable features

- Lacks mobile device support for administrators

- Navigation can be clumsy

- Not fully integrated with software partners

7. Patriot – Best used by small businesses in managing their payroll

PRICING: Basic: $14/month/user; Full-Service Plan: $34/month/user

Patriot is online payroll software available to business owners of all sizes. Patriot helps manage payroll payment in a company.

KEY FEATURES:

- Payroll processing

- Time tracking

- Payroll tax filing

- Dedicated support

- Payroll reports

- Payroll integration with other services

REASONS TO BUY:

- Unlimited pay runs

- Excellent customer support

- Quite affordable

- User friendly

- Easy to set up

- Intuitive employee portals

REASONS TO AVOID:

- Limited integration options

- No access to employee benefits

- Not free

- Reports not robust

- Lacks HR tools

- Slow direct deposit turnaround

8. Sure Payroll – Best for small business owners to simplify the payroll process

PRICING: Self-service: $23.99/user/month; Full service: $34.99/use/month

Sure Payroll is a Cloud-based payroll and HR offering designed to help small businesses streamline and manage the daily manual processes associated with payroll and Human Resource management.

KEY FEATURES:

- Payroll entry

- Direct deposit

- Tax compliance

- Payroll reporting

- Employee portal

- Reminders

REASONS TO BUY:

- Intuitive interface

- Quite affordable

- It saves time and money

- User friendly

- Cost-effective

- Ease of processing payroll

REASONS TO AVOID:

- No online training courses

- Reports are not robust

- Customer support is not effective

- Requires text verification to log in

- Not customizable

9. Square Payroll – Best for small business owners to manage their payroll processes

PRICING: $34/month/user

Square Payroll is an online payroll solution for small businesses. It is a cloud-based service that enables employers to pay, manage and report on payroll from their desktops.

KEY FEATURES:

- Direct deposits

- Payroll reporting

- Payroll management

- Benefit management

- Tax compliance

- Third-party integrations

REASONS TO BUY:

- User friendly

- Unlimited payroll runs

- Transparent pricing

- Numerous integration

- Easy to setup

- Effective customer service

REASONS TO AVOID:

- Limited reports

- Not robust for large businesses

- No payroll history

- Not as advanced as other payroll tools

- Limited payroll functions

- Not free

10. TriNet – Best used for easing HR tasks by small and medium businesses

PRICING: Starts at $80/user/month

TriNet is an HR, payroll, and benefits solution for small and medium-large businesses. It can be used for time tracking, expense tracking, employee self-service portals, and time-off management.

KEY FEATURES:

- Payroll management

- Onboarding

- Payroll reports

- Custom reporting

- Mobile application

- Dashboards

REASONS TO BUY:

- HR support

- Excellent insurance options

- User friendly

- Offers mobile application

- Easy to navigate

- Easy to setup

REASONS TO AVOID:

- Poor customer support

- Quite expensive

- Limited reporting function

- UI looks outdated

Frequently Asked Questions

What is the best online payroll service?

Any of the companies mentioned above are good options to use. You will need to decide what features you want, how difficult it is for employees to get on.

What could lead to problem when you audit?

If you have employees are not recording their time and do not have any other way of keeping track of the time they are logging, this will cause a problem when you audit. It is best to ask your employees to record their time and make sure that they understand the importance of doing so.

Is there a grace period for payment?

Most online payroll systems work on a monthly fee system, which means there is no grace period for payment. However, you can always go to the website and look at the available options and see if there are any other solutions on the market that you can use.

What is the payroll provider’s contract length?

Before choosing a payroll service, keep in mind that you will be signing up for a subscription-based contract. This means you’ll be locked into an agreement with the payroll service provider.

What happens if my employees stop using their computers to log in?

If your employees do not use their computers to log on or log off, this will cause your payroll problems. You need to make sure that your understanding of the software matches up with what is being used by your employees.

Can I get a discount for more than one service?

Some companies offer a discount if you sign up for multiple services. You will have to check with your company to see their policy.

Is there a mobile app for the software?

Yes, most software companies have mobile apps available on your smartphone or tablet. However, if you are using a different company than the one listed above, you may not be able to download this app onto your phone.

Resources & Links

- https://www.quicksprout.com/best-online-payroll-services/

- https://www.pcmag.com/picks/the-best-online-payroll-software

- https://www.softwaretestinghelp.com/best-payroll-services/

- https://www.forbes.com/advisor/business/software/best-payroll-services/

- https://www.fool.com/the-ascent/small-business/payroll/articles/payroll-services/