Upfront Conclusion

The best DCAA compliant accounting software right now is Sage and AccountingSeed.

Government contractors use different types of business models, but there is one thing in common: the utmost level of oversight. Financial transparency has become really important in the past few decades as governments all over the world demand it. In order to ensure financial transparency, business owners need to exercise full control over accounting and financial management. Businesses are using different accounting software to make accounting processes easy and transparent.

Accounting software has really revolutionized the world of accounting and financing. There are myriads of accounting software currently available in the market, but not all of them ensure total financial transparency. A few of them ensure financial visibility by adhering to government regulatory authorities and compliance with relevant laws and regulations.

If you are looking for DCAA-compliant accounting software, then there isn’t a need to be overwhelmed. We are going to share with you in this post a list of the best DCAA-compliant accounting software that will help government contractors ensure 100% visibility and eventually win bids and contracts.

Best DCAA Compliant Accounting Software Comparison Chart (top highest rated)

| Brand | Starting price | Best for |

|---|---|---|

| FreshBooks | $7/month | Ease of use |

| Zoho Books | $30/month | Most Integrations |

| Sage | $12/month | Comprehensive financial management |

| AccountingSeed | Request quote | Flexibility |

| Aspire GovCon Accounting | $125/month | Indirect Rate Calculation |

| Procas Accounting | $10 – $245/month | Medium-sized government contractors |

| WrkPlan Accounting | Request quote | Enterprise resource planning |

| SYMPAQ SQL | $389/month | Modern DCAA Solution |

| Deltek Costpoint | $30 – $46 | Enterprise Project Management |

What are the best DCAA Compliant Accounting Software 2023? Here’s our 16 list:

1. FreshBooks (Best for ease of use)

FreshBooks is a cloud-based accounting software designed for small businesses, freelancers, and professionals to manage and track invoices, expenses, and time.

With a focus on simplicity and user-friendly interfaces, FreshBooks offers a suite of tools that aid in streamlining financial management tasks, allowing users to focus more on their core business activities.

Key Features

- Easy Invoicing: Create professional invoices in minutes, customize them with your own logo, and set up automatic payment reminders.

- Expense Tracking: Capture expenses on the go with the mobile app and attach receipts digitally, reducing the hassle of paper trails.

- Time Tracking: Monitor the time spent on projects with built-in timers. This is especially useful for professionals billing by the hour.

- Project Management: Assign tasks, set deadlines, and track progress, ensuring projects remain on course.

- Reporting: Access various reports including profit and loss statements, tax summaries, and expense reports, making financial overview and analysis simple.

Pricing

FreshBooks starts at $17 per month. Here is a breakdown of their different plans:

- Lite: Ideal for self-employed professionals or businesses with basic accounting needs.

- Plus: Suitable for businesses that require more robust features and cater to a larger client base.

- Premium: Designed for businesses with a more extensive client list, offering all features to streamline their accounting processes.

- Custom Pricing: For businesses with unique needs, FreshBooks offers custom pricing. This is ideal for larger enterprises or those requiring specialized features.

RELATED: Accounting Software Best For Individuals

2. Zoho Books (Most integrations)

Zoho Books is a comprehensive, cloud-based accounting solution tailored for small to medium-sized businesses. It forms part of the Zoho suite of online applications, designed to facilitate smooth financial management and streamline business processes. Zoho Books is known for its user-friendly interface, scalability, and wide array of integrative functions.

Key Features:

- Invoicing: Customize and send professional invoices, automatically send payment reminders, and receive payments online.

- Expenses Tracking: Record, monitor, and categorize expenses, and attach receipts for organized record-keeping.

- Bank Reconciliation: Connect to bank accounts for real-time updates and reconcile transactions to keep the books accurate.

- Time Tracking: Keep track of the time spent on projects and bill clients accordingly.

- Inventory Management: Manage stock levels, set reorder points, and track inventory in real time.

Pricing:

Starting at $30/ month

Zoho Books offers a tiered pricing model to suit the diverse needs of businesses, with the key differentiator being the number of contacts, users, and workflow rules. As of my last update, the pricing tiers were as follows:

- Professional Plan: Includes all features of the Standard plan along with additional capabilities like inventory tracking and project profitability.

- Premium Plan: Tailored for growing businesses with advanced features like custom domains and budgeting.

- Elite Plan: Includes everything in the Premium plan along with features like a dedicated account manager and enhanced custom fields.

- Ultimate Plan: The top tier with all features of Elite plus Zoho Sign integration and full access to the highest levels of support.

3. Sage (Most integrations)

The DCAA has strict requirements for employers to manage labor costs and expenses, and Sage is made to make it easier for them to do so. Employers may simply manage employee time per project with the security and accuracy required by the DCAA thanks to Sage, which eliminates time-consuming and incorrect manual timekeeping.

Sage uses descriptive capabilities that enable time monitoring by project as well as by job against a specified overall budget to measure labor expenditures against objectives. Each time entry’s up to nine levels of information offer remarkable insight into the allocation of work.

Key features

- NT Authentication, secure passwords, and a login/logout audit trail

- Onsite and online end user training courses are also accessible.

- Monitoring time spent on tasks in comparison to a set overall budget

- Configurable approval processes at many levels, as well as a reportable audit record of all modifications and approvals

- Monitoring employee time against up to 9 levels of specifics and detailed labor reports

- Rates that are specified for employees with the option to adjust them to task-based rates, all changes being recorded in the audit trail

- Comprehensive built-in pay rule capability and transferability to external payroll apps.

- Records of time entries and modifications supported by an audit trail.

Pricing

Sage does not offer free edition but they offer a free trial. Their pricing plan starts at $12.00 per month.

RELATED: Accounting & Payroll Software For Small Business

4. AccountingSeed (Best for flexibility)

AccountingSeed is tailor-made accounting software for government contractors and is among the best DCAA-compliant accounting software. It allows you to run your best according to your own style and handles your accounting activities with perfection besides ensuring DCAA compliance. Apart from that, AccountingSeed is an all-in-one feature-rich and cloud-based accounting software that is flexible, customizable, automated, and connected.

Key features

- Comes with a user-friendly interface that is easy to learn even without practice.

- Offers time tracking and real-time reporting according to the guidelines of DCAA.

- Automates entries of transactions and other financial reporting to ensure quick but accurate accounting and financial management.

- Also automates billing with an easy-to-use billing tool.

- Is a cloud-based software that enables you to access it from anywhere, anytime.

Pricing

AccountingSeed offers no pricing plans. It offers a pricing model that suits your business. AccountingSeed pricing module is tailored according to your needs and requirements. This is also a captivating aspect of this remarkable tool besides being DCAA compliant.

RELATED: Accounting Software For Manufacturing Businesses

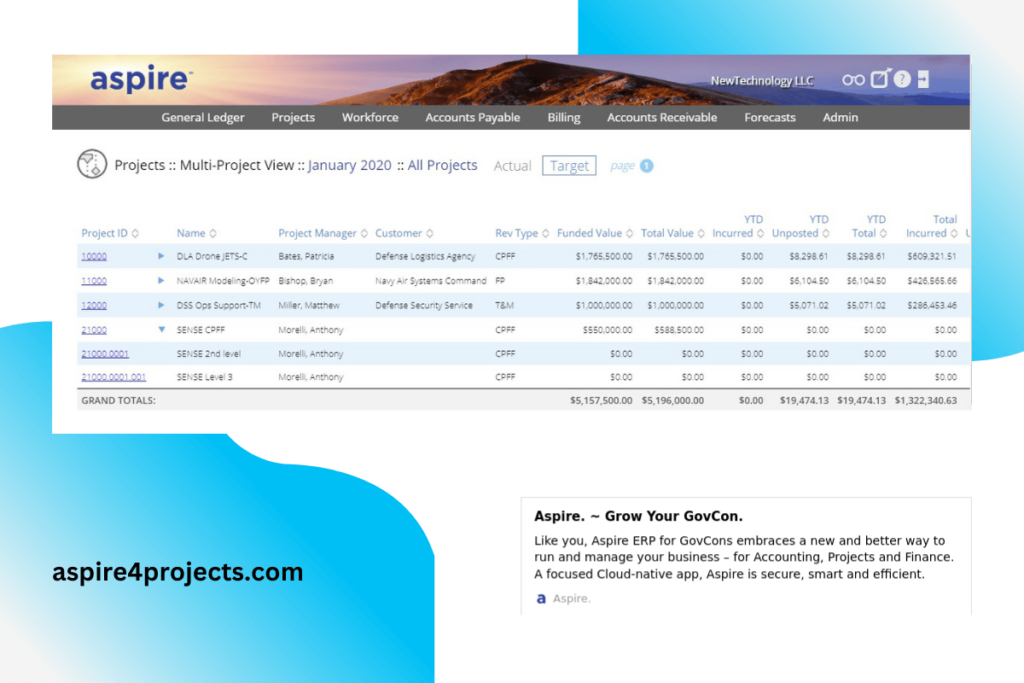

5. Aspire GovCon Accounting (Best for indirect rate calculation)

Aspire GovCon Accounting is another one of the best DCAA-compliant accounting software that can easily get into this list. It is a powerful solution that provides a perfect combination of cloud-based technology and DCAA-compliant bookkeeping features for businesses of all types and sizes. Furthermore, Aspire GovCon Accounting is one of the most cost-effective tools as it offers targeted functions. It allows easy handling of basic accounting activities like recording and tracking income/expenses, creating and sending invoices, project management, budgeting, forecasting, and much more.

Key features

- Is a simple yet powerful tool to ensure the most accurate accounting.

- Helps you track time, cost, and revenue by contract.

- Is designed and developed to comply with DCAA regulations and requirements.

- Offers other enticing features as well such as budgeting, forecasting, payroll, and much more.

Pricing

Aspire GovCon Accounting offers subscription-based pricing and starts at $125 per month for up to 5 employees.

6. Procas Accounting (Best for medium-sized government contractors)

Procas Accounting is another software that is custom-built for government contractors. It is developed with DCAA guidelines and is among the best DCAA-compliant accounting software currently available in the market. Besides, it is an all-inclusive accounting tool that streamlines your accounting and financial management. Procas Accounting offers some advanced features such as timekeeping, management reports, exceptional customer support services, and much more.

Key features

- Ensures the highest level of DCAA compliance and helps you keep your books in compliance with DCAA guidelines.

- Offers exceptional customer support through a highly trained and knowledgeable team.

- Its timekeeping tool helps you manage your projects and comply with DCAA regulations.

- Prepares professional management reports that let you stay on top of your projects.

- Its exceptional add-ons such as business intelligence system, infrastructure, and much more are also really captivating.

Pricing

Procas Accounting offers two options as pricing plans, Accounting Users and Standard Users.

- The Accounting User price is $245 per month

- The Standard User price is $10 per month per user with a minimum of five users

7. WrkPlan Accounting (Best for enterprise resource planning)

WrkPlan Accounting is another complete solution for government contractors. It is among the best DCAA compliant accounting software that is powerful, user-friendly, and DCAA compliant. You can easily keep your finances transparent and visible with this remarkable tool. Besides basic accounting and bookkeeping functions, WrkPlan Accounting comes with advanced features such as project management, contract management, time & expense portal, and much more.

Key features

- Is custom-built accounting software for government contractors as it ensures DCAA compliance.

- Offers a complete project accounting system that automatically generates government invoices and indirect rate calculations.

- Comes with a fully integrated contract management tool to give you insight to manage, control, and analyze your government contracts.

- Its time and expense portal facilitate your supervisors and workers to manage timesheets and business expense reports.

Prices

WrkPlan Accounting pricing plans aren’t fixed. You have to contact the vendor to get price quotes.

RELATED: Accounting Software for Small Businesses

8. SYMPAQ SQL (Best modern DCAA solution)

SYMPAQ SQL is another ideal accounting software for government contractors that provides everything they need for accounting and bookkeeping. It is developed to keep up with all the government demands and is fully DCAA compliant. You can avail of features like general ledger, billing, accounts payables/receivables, cost accounting, and much more. SYMPAQ SQL is also easy to handle with its user-friendly interface. All those characteristics combine and make it one of the best DCAA-compliant accounting software.

Key features

- Fulfills all of the DCAA regulations regarding accounting and financial management.

- Allows easy access to data through a user-friendly interface and saves a lot of time for government contractors.

- Comes with function-based modules that superbly deal with a particular area of accounting.

- Is scalable and you can easily upgrade your SYMPAQ SQL accounting software as your business grows.

Pricing

SYMPAQ SQL subscription pricing starts at $389 per month.

RELATED: Multi-Company Accounting Software

9. Deltek Costpoint (Best for enterprise project management)

Deltek Costpoint is another one of the best DCAA-compliant accounting software that offers intelligence and innovation in the accounting process. It is one of the industry’s leading tools tailor-made for government contractors. Deltek Costpoint makes use of the latest technologies like a smoothly running mobile app with ICR, artificial intelligence capabilities, real-time intelligence reporting, etc. You can also get benefits like financial and project management, increase productivity, manage costs and profitability, and much more that can easily exceed your expectations.

Key features

- Is DCAA compliant and lets you maintain all the compliance requirements provided by DCAA.

- Use of cutting-edge technologies and its advanced modules enable you to control and manage your projects and finances with ease and perfection.

- Automates time and expense management that significantly save your time and money.

- Allows you to gain insight from financial data and make more informed and fact-based decisions.

- Offers some exceptional modules like Business Intelligence, Contract Management, Project Accounting, Contract Management, and much more that make government contractors’ business flourish.

Pricing

Deltek Costpoint pricing plans are;

- The Front Office Suite starts at $30 per user per month

- The Back Office Suite starts at $30 per user per month

- The Full Suite starts at $46 per user per month

- The Accelerated Launch Package (contact vendor for pricing details)

What is DCAA-compliant accounting software & what does it do?

DCAA-compliant accounting software is designed to help contractors meet the specific requirements of the Defense Contract Audit Agency (DCAA), which is responsible for auditing the financial management of defense contractors who bid on or have been awarded defense contracts by the United States Department of Defense (DoD).

The DCAA does not endorse any specific software, but it does require that contractors’ accounting systems meet certain criteria to ensure they are capable of producing data that is accurate, reliable, and timely. DCAA-compliant accounting software typically includes features and functions that allow companies to adhere to these standards, such as:

Which is the best DCAA-compliant accounting software for me? Our conclusion

Identifying the “best” DCAA-compliant accounting software can vary depending on the specific needs of a business, its size, the complexity of its contracts, and the resources available to manage the accounting system.

However, several accounting software systems are popular among government contractors due to their features that support DCAA compliance.

The best DCAA-compliant accounting software for most is probably Freshbooks.

Read More