Work Is Where The Heart Is: Payroll Clerk

If you’ve been looking for a job you can start immediately and build your career on, consider becoming a payroll clerk.

Payroll clerks perform essential business tasks, including calculating and paying out wages, recording workers’ hours, and communicating with people around the office about their benefits.

This is a job for anyone who has completed their secondary school education and is ready to get to work – no university required.

Learning on the job allows you to make a salary from the first day you start, earning as you train.

Working in payroll also opens doors to a long-lasting, successful career, all without the hassle of a four-year degree or student debt.

Interested in working from home?

Remote payroll clerk positions abound, and the work can easily be performed off-site.

Best of all, because this is a “9 to 5” job, you’re practically guaranteed every weekend off!

Payroll Clerk Information Table

| Official Job Title | Payroll Clerk |

| Average Salary | $46,681 |

| Stress Level | Low |

| Work/ Life | Average |

| Job Satisfaction | Average |

| Career Advancement | High |

Payroll Clerk Job Description

What Is A Payroll Clerk?

A payroll clerk is someone responsible for ensuring the company they work for is paying all employees accurately.

They need to verify that employees have worked the correct number of hours and see that the right amount of funds are paid out to each individual employee.

When mistakes are made, such as overpaying a worker, the payroll clerk is the person who needs to determine and rectify the problem.

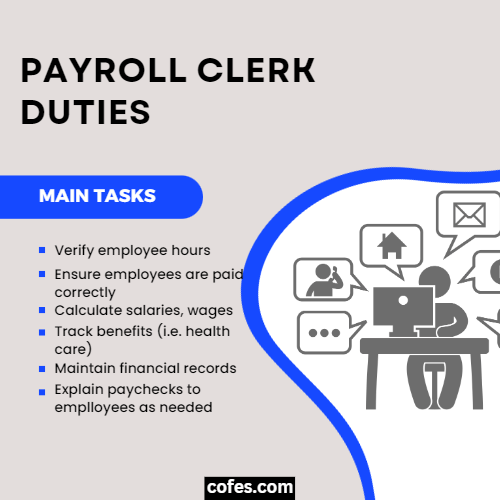

What Does A Payroll Clerk Do On A Daily Basis?

In order to ensure every employee’s pay is accurate, payroll clerks need to verify the number of hours worked by each person.

This involves studying the timecards, a punch clock, or the sign-in sheets to ensure employees arrive on time and work the full number of hours expected.

After they know how many hours someone worked, payroll clerks then need to calculate the amount of pay based on the employee’s salary or an hourly wage.

It is important that payroll clerks verify the right amount of taxes and fees are deducted from the total and that bonuses and overtime are added in.

Payroll clerks also need to keep track of related benefits, such as health care, paid vacation, and sick time.

This prevents employees from being paid too much or not receiving the full wage due to them.

Finally, payroll clerks maintain financial records regarding taxes, benefits, retirement accounts, and employee bonuses.

Responsibilities, Duties & Roles Of A Payroll Clerk

Payroll clerks must be skilled with basic office software because the job usually involves keeping a database of employee payroll information.

Keeping track of employee hours, wages, and benefits is of primary importance.

Some payroll clerks also assist with scheduling and keeping track of changes to workloads.

This prevents multiple employees from taking the same dates off and leaving a department short-staffed during a busy time or from individuals requesting more paid time off than they are entitled to.

Payroll clerks must be able to communicate effectively with employees to answer questions about taxes, salary, expenses, payment schedules, direct deposit information, and the like.

Payroll Clerk Salary

Average Salary

The average salary for a payroll clerk is $46,681, according to Indeed.

Most payroll clerks also qualify for benefits such as retirement savings, health insurance, and paid holidays on top of this base salary.

Entry-level payroll clerks with a high school diploma or equivalent can expect to earn $33,821.

Those with post-secondary education or work experience may start significantly higher, around $40,000.

The senior-level salary for payroll clerks averages $63,573.

For those with an exceptional work history and a university degree, senior-level salaries can reach as high as $75,000.

Those who become payroll supervisors can expect to earn closer to $100,000.

How To Become A Payroll Clerk

The Entry Level: Certification, Training & Degree

The position of a payroll clerk is open to anyone with a high school diploma or equivalent.

Many of the skills required to be a successful payroll clerk can be learned on the job, and no university degree is required to get started.

However, individuals who go after a tertiary degree or certificate will often earn a higher starting salary and may rise through the various career levels more swiftly.

Consider studying business administration, accounting, clerical, bookkeeping, or computing.

Other Skill Sets, Requirements & Qualifications

It is essential for payroll clerks to make no mistakes, so attention to detail and the ability to focus are essential to anyone wishing to pursue this type of career.

Candidates interested in becoming payroll clerks should understand mathematics and be able to perform basic calculations quickly and accurately.

Although computers are used in payroll, payroll clerks should be able to figure out calculations without looking up the answer when asked by an employee or manager.

Being a payroll clerk requires basic familiarity with computers and office software.

Payroll clerks must understand how to set up and use databases, charts, and payroll software in order to keep track of employee hours, wages, pay, and deductions.

In most businesses, payroll clerks will be expected to communicate effectively through email and over the phone.

While much of the work is done independently, payroll clerks must have the ability to answer questions and explain payroll issues such as sick pay to workers and supervisors.

How Long Does It Take To Become A Payroll Clerk?

A payroll clerk is an entry-level position.

Anyone who has completed high school or the equivalent can apply for the job.

Most training is provided on-site by the employer and learned within the first few weeks on the job.

Is It Hard To Become A Payroll Clerk?

Becoming a payroll clerk is easy for anyone who is capable of staying on-task and performing basic mathematic and clerical functions.

Since the job is entry-level, most people start without any prior training or education in the field.

Within several weeks or months of work, payroll clerks are usually capable of performing their tasks independently and can move up to higher levels after attaining a year or more of experience.

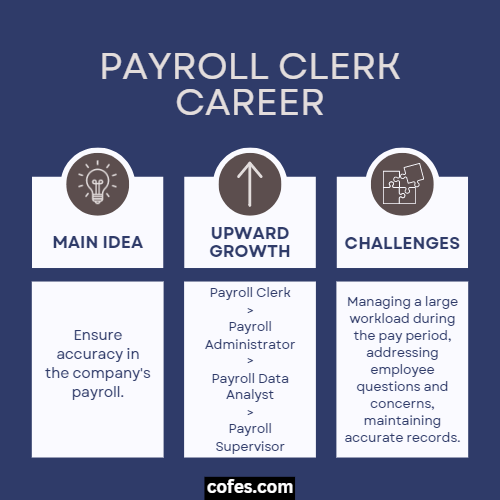

Payroll Clerk Career Paths

The Payroll Clerk Roadmap

Payroll Clerk I is an entry-level job open to applicants who have finished their secondary education.

There is potential to move up the ladder into higher positions.

From Payroll Clerk I, the individual moves to Payroll Clerk II, then Payroll Clerk III.

The next step for qualified candidates is Payroll Coordinator or Administrator.

Earning this position requires demonstrated proficiency in payroll software, strong communication skills, and proven problem-solving skills.

Many candidates for Payroll Administrator attain a 2-year or 4-year university degree or certificate.

After working as a Payroll Administrator, it is possible to move on to Payroll Analyst or Supervisor.

Projections For Growth In Payroll Clerk Jobs

Recently, there has been a slight decline in the number of payroll clerking positions available.

With automated payroll software and new technologies, the number of payroll clerks may continue to decline at a small but steady rate of around 4% or less in the next ten years.

However, many companies continue to hire payroll clerks.

Since all industries need payroll maintenance or supervision, this position can also be a stepping stone into the industry you wish to move into in the future.

In Summary: Is Payroll Clerk A Good Career?

Being a payroll clerk is a good career for anyone who enjoys working independently in an office setting.

Most payroll clerks report liking their work and feeling respected in their position.

The career is an ideal choice for individuals who are able to focus on numbers and be precise in their decision-making.

The job requires accuracy and careful attention to detail.

This causes some to find the job tedious, but others appreciate the challenge and enjoy contributing to the performance of the companies they work for.

A payroll clerk is a good job for someone ready to get to work without going through university.

It offers an opportunity for interested candidates to work their way up to a successful, lasting career.

Working Conditions

Can A Payroll Clerk Work Remotely From Home?

Much of the work of a payroll clerk can be done remotely from home.

Payroll processing, in particular, is often done remotely as it saves time, and there is no need for the payroll clerk to be in the office.

How Many Hours Does A Payroll Clerk Work?

Being a payroll clerk is typically a full-time job.

Most payroll clerks work a forty-hour work week Monday-Friday from 9 am-5 pm.

Although some payroll clerks may come in a little early or stay an hour later, it is generally a “9 to 5” job.

Payroll clerks normally don’t work on weekends unless they have fallen behind or there is a large project in need of completion.

The work schedule tends to be consistent.

Can A Payroll Clerk Work Part-Time?

It is possible to work part-time as a payroll clerk.

However, most employers do advertise full-time payroll clerk positions.

Balancing a full-time schedule by working part of the time in the office and part of the time remotely is more feasible than part-time work alone.

What Are The Average Vacation Days Of A Payroll Clerk?

Payroll clerks typically receive between 7-10 paid vacation days annually.

Senior-level payroll clerks may receive as much as 14 paid vacation days.

In addition, most payroll clerks qualify for several paid sick days as well as several weeks of unpaid leave.

Alternative Careers & Similar Jobs to a Payroll Clerk

- Pharmacy Assistant

- Purchasing Manager

- Personal Assistant

- Research Assistant

- Administrative Assistant

- Executive Assistant

- Administrative Manager

- Medical Assistant

- Office Manager

- Bookkeeper

Payroll Clerk Resume Tips

Make sure your resume displays the attention to detail and consistency you plan to display on the job.

Cite any relevant experience, even mathematics classes or independent projects, which show you’re able to stay motivated and focused.

At the top of your resume, sum up your experience or the qualities you bring to the job.

Give the hiring manager several sentences about relevant education or experience.

If you know anything about payroll law, local taxes, or industry best practices, include that information near the top.

Also, list specific skills you possess which will be valuable on the job, such as attention to detail, communications, or software you’ve worked with before.

Payroll Clerk Interview Questions

Q1: How do you avoid making errors when doing your work?

Why it works: The question helps the hiring manager understand whether or not the candidate is dedicated to accuracy and doing the best job possible.

The right candidate for a payroll clerk position will have some strategies to avoid on-the-job errors.

Even if they are coming directly from secondary education with little or no work experience, they should have learned methods to prevent careless mistakes.

Q2: What payroll software are you familiar with?

Why it works: Learning about the applicant’s specific experience allows the hiring manager to determine whether the applicant is ready to perform the duties expected of someone in the payroll clerk position.

This question also gauges employee interest.

Even if the applicant has no relevant work or training experience, a candidate who is passionate about the work will have done some research on payroll software and may have even completed some independent projects.

Q3. How do you stay on task when there is no supervisor present?

Why it works: While there may be a manager or supervisor in the office, payroll work is usually done independently.

It is uncommon for payroll staff to work as a team or collaborate.

Instead, everyone has their own task to do.

Asking how the candidate remains focused without constant supervision tells the hiring manager whether the applicant is ready for self-directed work.

Only applicants who can remain self-motivated and driven without constant oversight are prepared for payroll clerk positions.

Q4. If an employee requests reimbursement for a personal expense, how will you respond?

Why it works: Payroll clerks must be careful to issue only approved payments and reimbursements.

However, some applicants may feel insecure and, therefore, could be willing to go along with pushy employees trying to take advantage of the employer.

Asking a question like this one verifies the applicant is prepared to deny unscrupulous workers and won’t crumble under pressure.

It lets the hiring manager know the candidate intends to perform honest, reliable service and won’t be tempted to mishandle the company’s monies in order to appease workmates and coworkers.

Jobs Related To Payroll Clerk

- Account Executive

- Accountant

- Accounting Clerk

- Accounting Specialist

- Accounts Payable Clerk

- Accounts Receivable Clerk

- Bank Clerk

- Benefits Coordinator

- Billing Clerk

- Bookkeeper

- Compliance Manager

- Human Resources Specialist

- Lead Payroll Administrator

- Payroll Analyst

- Payroll Coordinator

- Senior Payroll Specialist

- Staff Accountant

- Tax and Compliance Manager

For HR Manager: Tips For Hiring A Payroll Clerk

Key Characteristics To Look For In A Payroll Clerk

- Attention to Detail:

- Payroll clerks must pay close attention to detail and be highly accurate in their work.

- Even a simple mistake such as an extra or missing number in the calculation could lead to problems such as payment delays or the company losing money.

- Because payroll clerks are expected to figure out taxes, deductions, fees, and so forth, there can be no errors.

- Seemingly small errors can result in legal problems for affected employees or the company.

- Therefore, applicants must be able to stay focused and catch any incorrect data during processing.

- Strong Communication Skills:

- A payroll clerk must be able to communicate effectively with a diverse group of people.

- Employees expect their pay and benefits to be accurate and may become upset if any mistakes or confusions occur.

- Payroll can also strike some employees as confusing, even overwhelming.

- Because of this, payroll clerks need to have the ability to communicate calmly and clearly about this important topic.

- Payroll clerks will likely need to answer questions about benefits schedules, taxes, earnings, and commissions.

- Being able to communicate in person, on the phone, and through email is essential.

- Mathematical Ability:

- Every payroll clerk will be expected to handle calculations and figures.

- Candidates will need to be able to perform a variety of math functions and to feel confident in their ability to determine payments, fees, deductions, and more.

- While many payroll clerks use software to help them, applicants should have the ability to comprehend essential functions, statistics, and simple calculations without relying on the computer.

- Without these skills, the payroll clerk is unlikely to catch errors.

Minimum Level Of Education & Experience

Payroll Clerk is an entry-level position that requires the completion of secondary education and does not require any post-secondary education.

However, some applicants choose to earn a 2- or 4-year university degree or 1–2-year certification for this position.

As an entry-level job, many payroll clerks have no work history and no background in the field.

Typically, they learn on the job while working with the payroll department under the leadership of a manager or supervisor.