When attempting to start a business, assessing annual or monthly recurring income as compared to investments in sales and marketing is essential for getting the company on a growth trajectory. For example, if a company over-invests in marketing, it may not reach its goal margin expansion or cash creation; but if the company under-invests, it may miss out on opportunities for growth.

To determine a company’s ideal spending model, there are various metrics we can employ to inform the coming quarters. One such model is the SaaS magic number.

What is the SaaS Magic Number?

Coined in the mid 2000s by Lars Leckie, the SaaS magic number was designed to empower companies to make an educated guess as to “how much gasoline to pour on the fire” of their startup. In short, the SaaS magic number analyzes expenditures in sales and marketing as it relates to quarterly revenue and helps companies target maximum growth.

How to Calculate the SaaS Magic Number

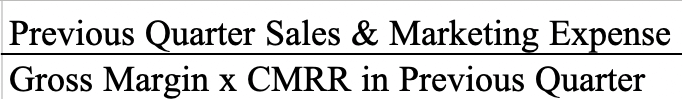

Understanding your company’s sales efficiency is instrumental in knowing how much to invest to maximize potential. The formula for this magic number is as follows:

>>MORE: SaaS Blogs You Need To Read

To break this down further, let’s imagine that you spent $10 on sales and marketing to create a monthly recurring revenue (MRR) of $2.50. After four quarters, the MRR will become $10 in annually recurring revenue (ARR); consequentially, you will have a SaaS magic number of 1.0 for the quarter.

To put this into context, a SaaS magic number of 0.75 or greater indicates that a company should continue to invest in acquiring customers, whereas anything less than that number means a company should reevaluate spending habits.

Bessemer CAC Ratio

While a SaaS number of 1.0 is widely considered to be ideal, knowing your company’s magic number is just one piece of the puzzle in evaluating spending habits as they relate to growth. Another aspect of understanding company spending is the Bessemer CAC Ratio, which focuses on efficiency of customer acquisition. In other words, the ratio determines how quickly a company’s gross margin pays for new customers.

>>MORE: Best SaaS Helpdesk Software

To break even, a company must cover new customer acquisition costs as well as gross expenses. Therefore, a ratio of 1.0 means that within 1 year a company completely breaks even on a customer.

While a SaaS magic number of 1.0 indicates that a company has covered its sales and marketing expenses for the first year, it does not indicate coverage of gross expenses at the end of 12 months. Therefore, a Bessemer CAC Ratio of 1.0 or higher indicates a company has room to invest further into sales and marketing, whereas a ratio of less than 1.0 indicates they should continue to assess their spending.

CAC Payback Period

Similar to Bessemer’s CAC Ratio, this formula uses CMRR to convert the ratio to a monthly payback number.

>>MORE: Vertical SaaS: Definition, Growth Potential, Challenges & More

Typically, there is a lag between when a company invests in sales and marketing and when the company acquires new monthly or annual recurring revenue due to their expenditures. Because every company’s sales cycle is different, it is important to calculate timing accordingly.

For example, if we take the MRR in a company’s current quarter versus the quarter prior’s customer acquisition cost, we can dial in the right payback period for the quarter. For longer sales cycles, we can measure against sales and marketing expenditures from a company’s previous year.

>>MORE: Rule of 40: What It Is & How To Calculate It (SaaS)

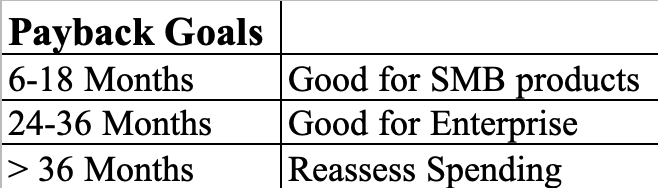

From this table we can see the ideal payback target to help companies understand how to scale their business.

Other Factors to Consider When Looking at the SaaS Magic Number

Clearly, there is more to understanding a company’s spending analysis than simply looking at the SaaS magic number alone. Here are some other concepts to keep in mind when assessing your company’s spending habits.

#1 Gross Margins

Gross margins are calculated by subtracting a company’s cost of goods sold (COGS) from its net sales revenue. High COGS translates to lower gross margins, which generally means that the CAC Payback Period will be longer. Understanding a company’s payback period as it interacts with your gross margins means that the company can discern the true cost of new customers.

To comprehend the value versus cost of newly acquired customers means a business can be empowered to give their SaaS magic number appropriate context. A SaaS magic number of 1.0 means little without a backdrop of business metrics to further educate spending decisions.

#2 Churn

When using Bessemer’s formula to calculate the CAC Payback Period, we understand that using CMRR in the denominator includes churn from existing customers. Monitoring churn rate, or the rate at which customers stop doing business with a company, is key to understanding how to scale a business.

Keeping churn rates low is important to consider when analyzing ARR because customer acquisition means little in the context of company growth if they don’t stick around for continued business.

#3 Liquid Assets and Margin Flexibility

If we’ve learned anything from looking at SaaS, it’s that efficiency without sustainability means little at all. If a company is extremely adept at acquiring new customers but has little incentive for clients to maintain business with their company, there’s little point in spending exorbitant amounts of money on marketing and sales in the first place.

Servicing new customers takes liquid assets, and because unexpected market events and downturns do happen, it’s important to have flexibility in your margins for keeping return customers around. Therefore, it is in a company’s best interest to have their cash flow modeled to add even more dimension to analyzing their SaaS magic number.

>>MORE: SaaS Accounting 101: Basics & Best Practices

Conclusion

To best understand the efficiency of a company’s dollar, striking a balance of spending and earning becomes pivotal to long-term success and margin expansion. Looking at the SaaS magic number alone will not describe company spending in full; therefore, analyzing other factors, such as churn and gross income, becomes key to further informing spending decisions. Additionally, understanding a company’s payback period and break-even point can paint an even clearer backdrop for understanding the SaaS magic number.

With these tools, it becomes possible to break dollar values into meaningful chunks to plug into the formula for growth. In this way, the SaaS magic number helps us to make sense of the turbulent aspects of starting a company and to build a lasting foundation for long-term success.