RELATED: Top Accounting Tools Fit For Partnerships | Top Accounting Landscaping Tools | Best Investor Accounting Software

Regular consultant practices are the only way to take care of your business; otherwise, get ready for the wrong end. Your client will only value the business if you give enough importance to your work. All the consultants need a system in which they can manage everything with stability.

If you are a consultant, you must have a firm grasp on managing accounts and preparing for the tax times. You will love tracking your finances or handling your books by using accounting software. The best accounting software for consultants is the one that makes the task easy and has all the features required.

Fortunately, there is much software that can be your partner, but here we have discussed our 6 top picks. Let’s dive into them!

Upfront Conclusion

The best accounting software for consultants right now is Bonsai and Zoho Books.

Why Consultants Needs Accounting Software

Before discussing the software details, it is pretty essential to know that as a consultant why do you need accounting software. Some of the significant reasons are as follows:

Tracking of Time

In this era, time is money. You charge according to the value and time that you provide to the particular client. Your business exchange time for dollars, so you must track it accurately. The accounting software helps track the time perfectly and allows you to analyze where your most energy and effort are draining. You can also charge the client appropriately after having an idea of the time spent on his project.

Billable Expenses

Accounting software will correctly track billable expenses and generates the invoice for the clients. By using this, you can pass many business expenses to your clients. Furthermore, the software will automatically include the markup charges on the expenses. Even if your client needs proof, you can also add an image of the receipt.

Tracking of Miles

Being a consultant, you will often find yourself on the road. So, mileage tracking is vital so that you can charge the client accordingly. For this, you need software that can easily track those miles that you have spent. You can also use this report for an annual tax deduction.

Maintaining Balance

Having a balanced sheet is essential to track every record accurately; otherwise, you will be left with an open accounting system. You won’t be able to record your income and expenses correctly in an open bookkeeping system. Although you don’t need a balance sheet, it is better to have this as a consultant. You can keep everything balanced by having this sheet.

6 Best Accounting Software For Consultants

1. Bonsai

Whether you are a freelancer consultant or run a consulting agency, Bonsai will fulfill all your needs. The platform is best for advisors because of the numerous templates and collaboration options it offers. You can also use invoicing and payment features to bill your clients without manually working out different calculations.

Bonsai is also excellent for scheduling events or meetings with your clients. The client portal can also help you track various customers and send them their bills. You can also create forms and questionnaires for your clients to understand their needs and offer them advice accordingly.

Features

Intuitive Interface

Bonsai’s main feature is its intuitive interface, which makes it easy to use. Many consultants use this software for tracking time spent with the client, billing, and much more. The best thing is that the simple interface reduces workload by saving time on tasks such as creating invoices manually.

Multiple Workflow Automation

When running a consulting agency, it may be hard for your team to share details and manage the needs of different clients. That is where Bonsai’s workflow automation will make things a breeze.

It makes it easy to manage different projects and offer clients good advice. You can also save time by using workflow automation to tackle the customer’s problems.

Excellent Integration Capacity

Another great feature of Bonsai is its integrating ability. You may require the resources of other platforms to run your consultant business smoothly. Bonsai helps you do that because it can integrate with various platforms such as Zapier, QuickBooks, Calendly, and much more.

Extensive Variety Of Templates

The wide variety of Bonsai templates is also a useful feature for consultants. You can use the templates to create contracts for new clients in a short time. Hiring agreements can also be made using the different templates Bonsai offers.

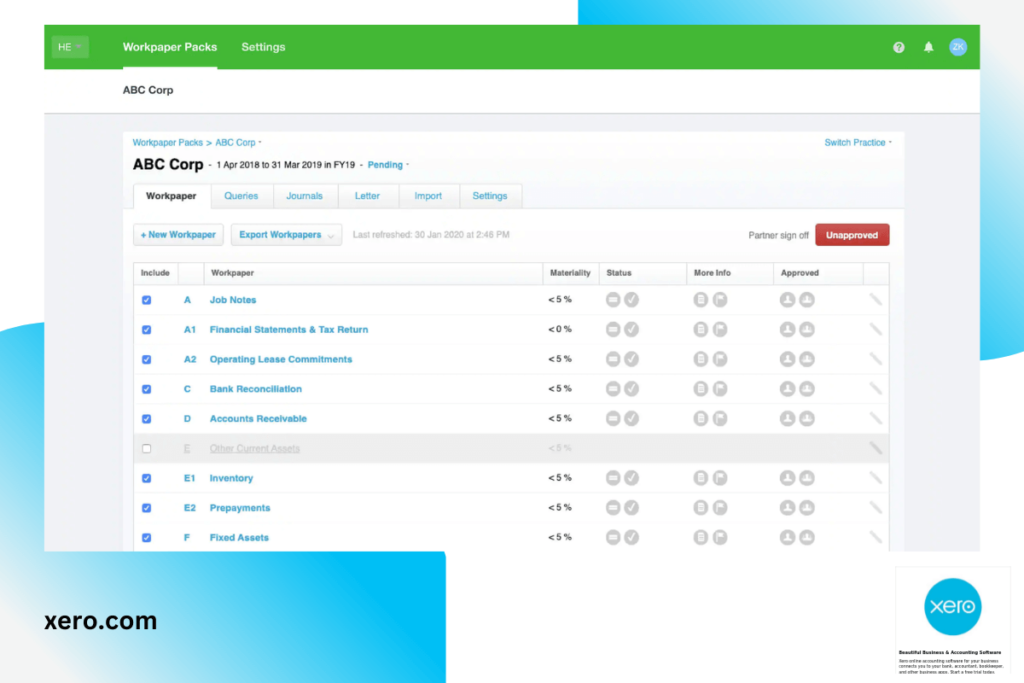

2. Xero

Whether you are having a large or a small business, Xero will help you a lot in every aspect as it one of the best accounting software for consultants. It is a global financial technology brand that provides online accounting solutions for bookkeepers, accountants, and all businesses.

It is considered the market’s favorite app for financial management. This is specially and thoughtfully designed for the consultant-sized business. One of the best features of Xero is its simplicity. No matter how busy your business is, it will keep your accounting at the top.

Expert bookkeepers and accountants back it, and it will help you on sailing smoothly. Xero is our top pick because of its interface and customization. You can customize your dashboard as per your requirements, and the language used in it is straightforward.

Features

Easy Setup

You can set up this software quickly without any difficulty. You just have to add your organization, and it’s ready to go.

Simple Transactions

It includes the transaction forms that you can customize within seconds. You just have to check the uncheck the data, and you will get personalized documents.

Error-free transactions

Xero reduces the chances of financial fraud, as it has a multiple-approval method. You will see a list of actions performed for every transaction that includes manual notes, dates, and users.

Mobile-Friendly

Consultants are mostly traveling, so they spend the majority of their time on their phones. Xero’s mobile app is simple, convenient, and handy. The app allows you to categorize your expenses, keep your tabs, see client invoices, and many other bookkeeping tasks.

Tracks profit

Xero will track all your projects and the respective profits. It will help you in giving an idea about your progress. You can estimate and quote on job, costs, and track time. On your dashboard, you will see every project’s profit margin, which tells you what part the project is playing in your business’s success.

Track money

Track all the money going in and out of your bank accounts. For this, you have to connect your bank to Xero and then receive bank feeds. You will have complete access to all bank transactions.

Track Financial health of the business

One of the best features of this software is financial reporting that tells you everything you need to know. Besides telling you about income statements, balance sheets, cash flow forecasting records, it will also give you minor details. The specific reports that it provides are expenses per contact, sales per item, ages payables, and much more. For advanced accountants, it will also track net value per sale and equity ratio debts.

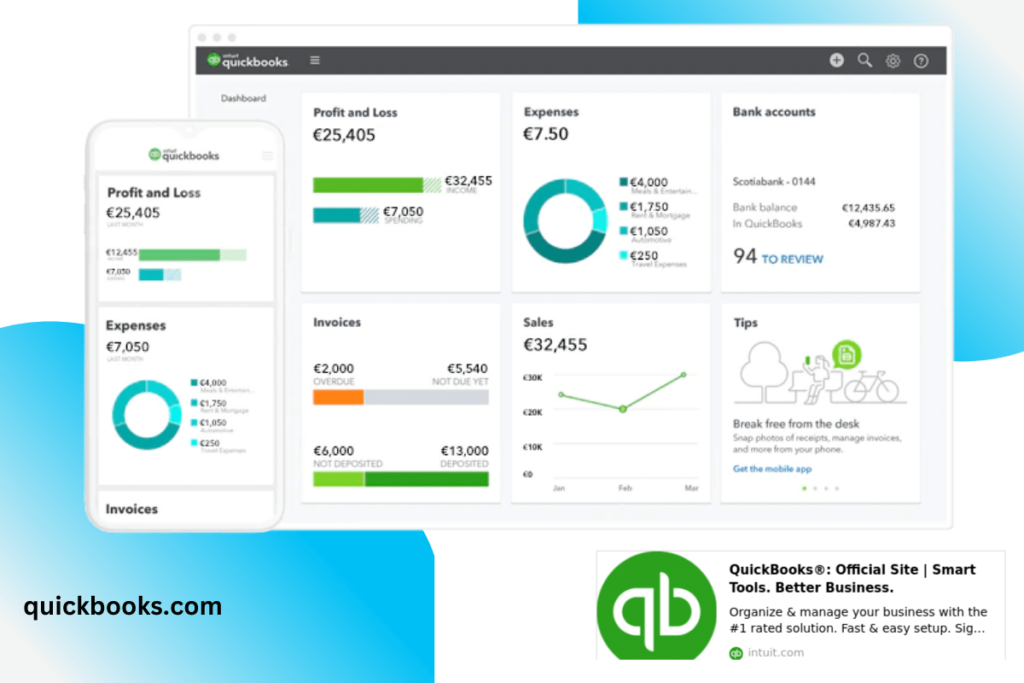

3. QuickBooks Online

The only accounting solution for all freelance bookkeepers, small businesses, startups, and independent firms is QuickBooks Online. It comes with many features, and you can update it anytime when you want to scale your business.

Make sure to watch some tutorials to make the most of its unique features. You don’t have to worry about the software setup, as they have a network of accountants to guide you at every step.

Compared to Xero, it has many similar features that include a simple interface, mileage tracking, time tracking, mobile app, and billable tracking. The only drawback of QuickBooks is that it offers minor customization than Xero, and is also not very appealing.

Features

Updates financial information

Besides providing you with the best customer service, it also deals with all clients’ needs. It offers multiple payment methods and delivery options to the client. QuickBooks will automatically collect all the data and will update the financial information instantly. In this way, this software helps in arranging your data quickly and easily.

Data Protection

The protection of data is a core element of every business. In QuickBooks Online, you get access to security options that protect your confidential data. All the data that passes through the accounting system is safe from unauthorized individuals. Even if you want to keep the record, you can back up your data to the cloud.

Affordable pricing

You won’t regret spending on the subscription. QuickBooks Online has flexible packages that allow you to get the maximum benefit out of your investment. The pricing plans vary according to the accounting toolsets that your company needs. You will only pay for the features you need; however regular software updates are included in all packages.

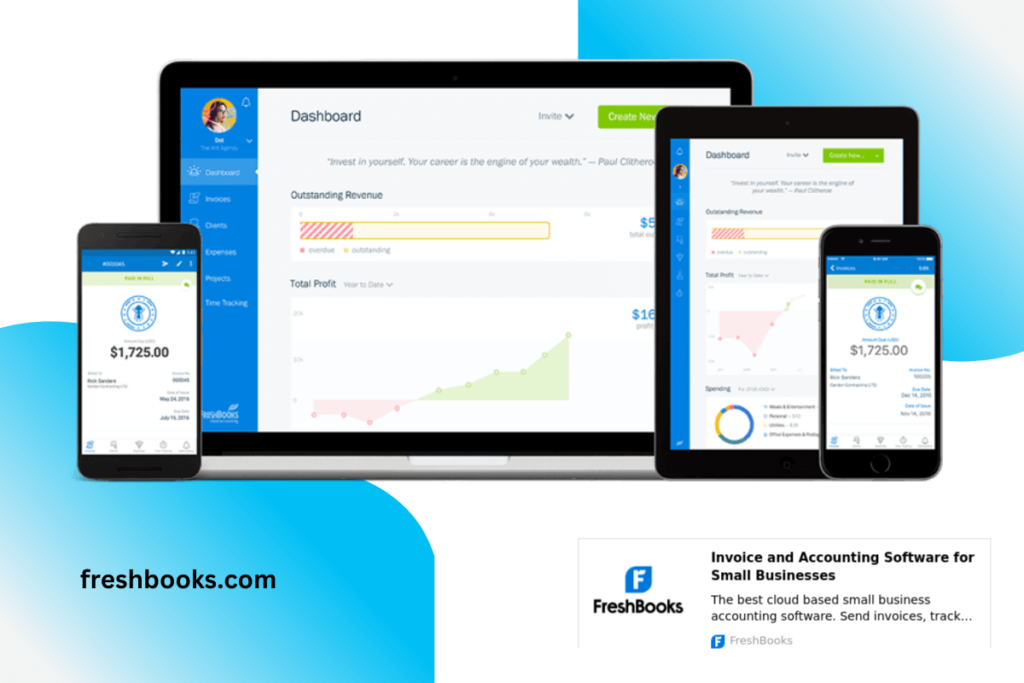

4. FreshBooks

FreshBooks is another best accounting software for consultants. Investing in this software would be a game-changing decision for every business. It is top cloud accounting software that is majorly designed for small businesses.

Unlike other software, it is less overwhelming and more functional. It collects, tracks, and sends all the relevant information to the clients quickly. Furthermore, it also manages front-end accounting and tracks customer invoices and payments.

Although this software does not come with a balance sheet, it provides you a template that you can use. Consultants and accountants can come together out with the best usage of this software. It is less robotic than QuickBooks Online and Xero but has the same functionality.

Features

Connects to bank

You don’t have to worry about the payment methods or entering the data manually. FreshBooks connects to the bank and credit card account directly. Without a separate reconciliation feature, you can directly monitor your bank feed.

Customizable Invoices

Give a wow factor to your invoices by customizing them according to your style. Choose your template, add a logo, select font, adjust colors, and send the invoice to your client in your style.

Payment Reminders

Some of the clients forget to pay their invoices. It is better to remind them, and nothing can do it better than FreshBooks. It will automatically remind the due payment to the client, thus making the system efficient.

Automatic calculations

FreshBooks will automatically calculate the right amount of sales tax; you just have to apply it to the invoice. Moreover, if an invoice becomes overdue, it will also apply late fees to give to your client.

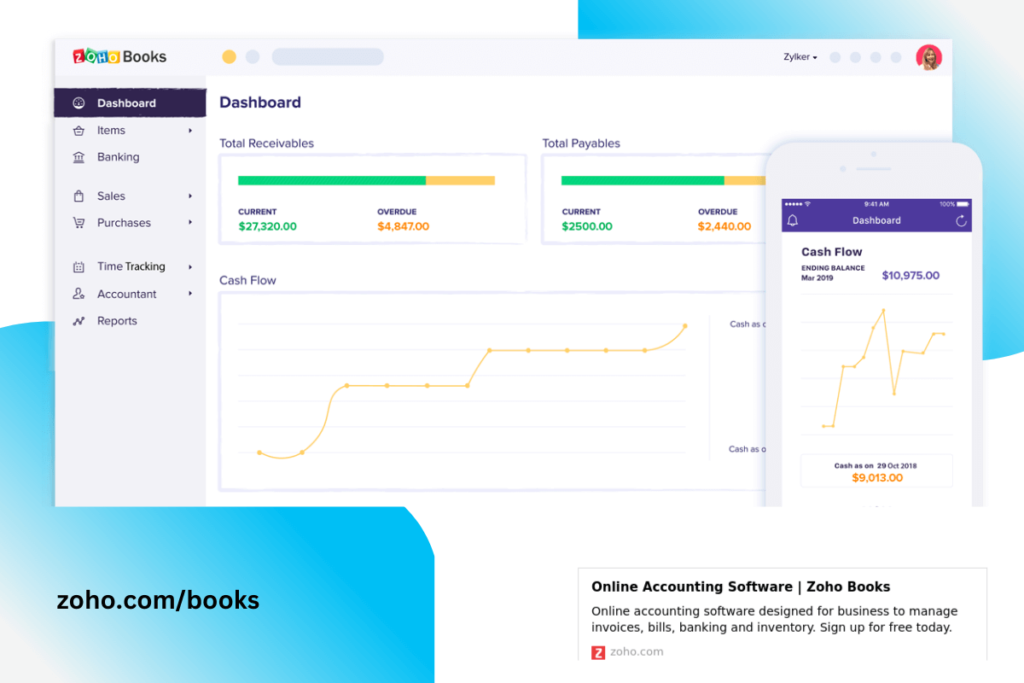

5. Zoho Books

All the small to mid-sized businesses will love using this cloud-based accounting solution. If you are the one who doesn’t want to manage the suite of apps, then get yourself away from the app exhaustion by having Zoho. Once you have got all the Zoho products, you don’t need to search out for other applications,

Features

Automates feeds

The most significant advantage of Zoho Books is that it eliminates the need for data entry. You can import all the bank transactions and credit card transactions and then deal with them as per the bank’s rules. This not only saves wastage of time but also reduces the chances of mistakes.

Payment Reminders

Customize the personalized message to remind clients about their due payment. You can also schedule the frequency of messages that you want the software to follow.

Engage Customers

Unlike other software, Zoho Books has impressive features that engage the customers. They will feel involved in the payment process, as the software gives them access to estimate the invoices. They can accept or decline estimates and can also make comments. Direct payments are made through the online client portal.

Tracks and send Invoices

Zoho Books tracks the time you spend on the customer’s project and then sends the invoices accordingly. You can even record your offline payment, pull off invoices for every estimate, and associate invoices of selected projects. You will get a detailed report of all your regular clients.

Mobile Friendly

You can manage all your finances anywhere you want to. It is fully responsive, and you can use them on your android, iOS, Mac, or Windows easily.

Multiple languages

Consultants love this software because they can operate it in multiple languages. Along with English, you can also use this in Italian, French, German, Swedish, Spanish, Chinese, Japanese, and Dutch.

In real-time. Creating and sending purchase orders takes almost no time,

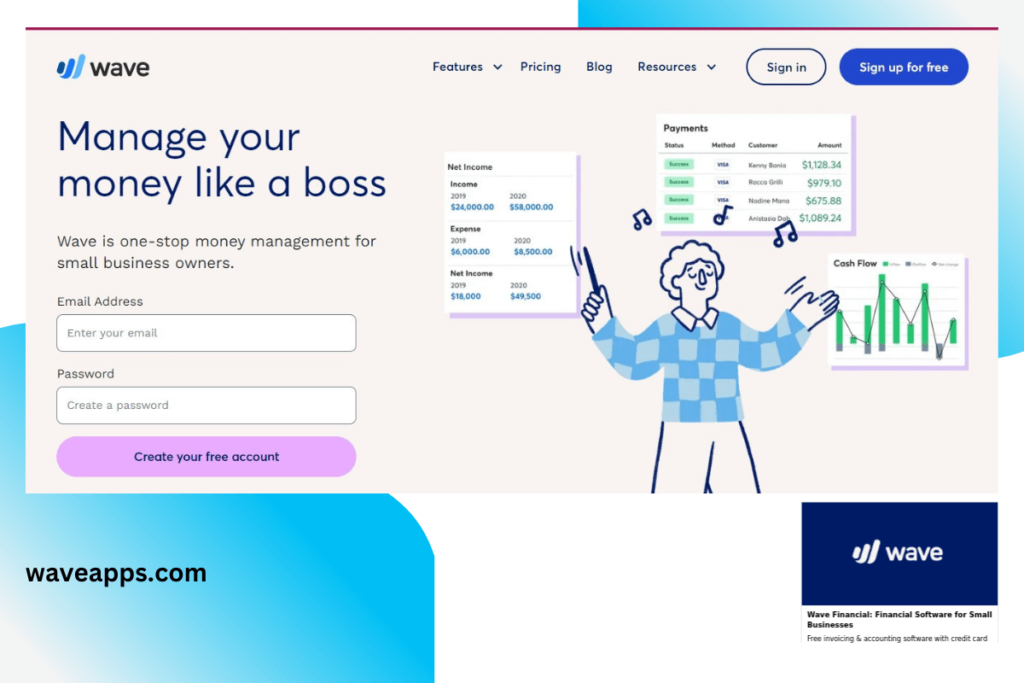

6. Wave Accounting

Wave accounting is specially designed for consultants, freelancers, and business owners. You can manage your multiple businesses under the same wave. You don’t need to keep your every venture separate; all can be managed under a single wave account.

It will keep the bookkeeping process of businesses streamline. The software provides you with payment tracking, accounting, billing, invoicing, receipt scanning, finance management, generate reports of profit/loss or cash flow.

Keep in mind that wave manages money and accounts, but not employees. So if you have employees and want to manage them, you can go for QuickBooks Online or Xero.

Features

Accounting

You no more have to tackle the accounting of your business. It includes a chart of accounts, transactions, and reconciliation. It provides you with: unlimited income tracking, unlimited credit card connections, unlimited expense tracking, unlimited receipt scanning, financial statements, sales tax reports, and much more.

Banking

It allows you to manage all your connected accounts easily. Using the Wave payments, you can add the new account and make all online transactions through the wave account. Wave also provides you with the option of insurance that allows you to have a quote for business.

Support

You can submit the support request through the wave website. For the new users, support is available for 60 days; after this, chat support is only for payroll and payment customers. Moreover, you can also join the wave’s help center or user community to ask your questions.

Final Verdict

No matter which software you choose, these all will help you and keep you on the top of accounting. It will keep your consulting business strong and increase profitability. Help your clients and grow together!