RELATED: Top Accounting DCAA Compliant Software | Accounting Tools Fit For Financial Advisors | Best Accounting Writers & Authors Software

There is a lot to think about when you’re running an investment business. From tracking portfolios and analyzing performance to making decisions about where to allocate resources, there’s a lot to keep track of.

The right accounting software can make a huge difference in your investment business. It can help you track and manage your finances, keep tabs on your investments, and make informed decisions about where to invest your money.

However, with so many different options on the market, it can be tough to know which accounting software is right for your business. That’s why we’ve put together this guide to the best accounting software for investors. Let’s get into it.

Upfront Conclusion

The best accounting software for investors right now is Quickbooks and FreshBooks.

Best 8 Accounting Software For Investors

| Brand | Starting price | Best for |

|---|---|---|

| 1. Quickbooks | £3/month | All-Round Accounting |

| 2. FreshBooks | £4.40/month | Affordable Accounting |

| 3. Wave Accounting | 1.4% + 20 per transaction | Small Businesses and Independents |

| 4. Xero Accounting | £6/month | Medium Businesses and Investors |

| 5. Mint | Free | Investors on a Budget |

| 6. Quicken | $35.99/month | Reliable Experience |

| 7. Backstop Solutions Suite | Quote available upon request | Automating Tasks |

| 8. Altair | $1,995/year | Ultimate Investor Accounting |

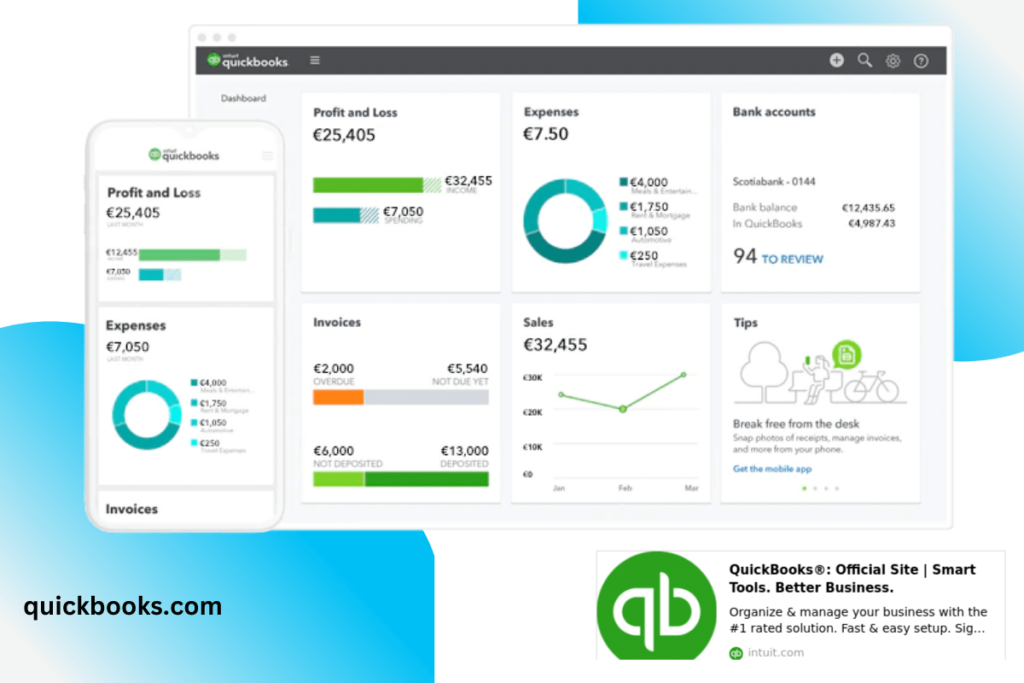

1. Quickbooks – Best All-Round Accounting Sofware for Investors

Pricing: £3 per month, with a 30-day free trial

Quickbooks is one of the most popular accounting software options on the market. It’s versatile, easy to use, and packed with features to help you run your investment business. Quickbooks can help you track your finances, manage your investments, and make informed decisions about where to allocate your resources.

From an investment standpoint, it can help you track your portfolios, analyse your performance, and make decisions about where to invest your money. Quickbooks is an excellent option for investors who are looking for an all-in-one accounting solution.

Key features:

- Manage your entire budget, income, expenditure, and investment portfolios in one place

- Free phone support whenever you need it

- Multiple currencies supported

- Set smart, AI-driven targets to help you manage your goals and investments

Reasons to buy:

- Versatile and easy to use

- A very affordable pricing structure

- Available for solo investors, multiple users, or businesses

Reasons to avoid:

- Several bugs that can cause issues with the experience

- Can feel slow and clunky in some places

>>MORE: Personal Investing Software | Investing Software For Startups | Real Estate Investing Software | Investment Group Name Ideas

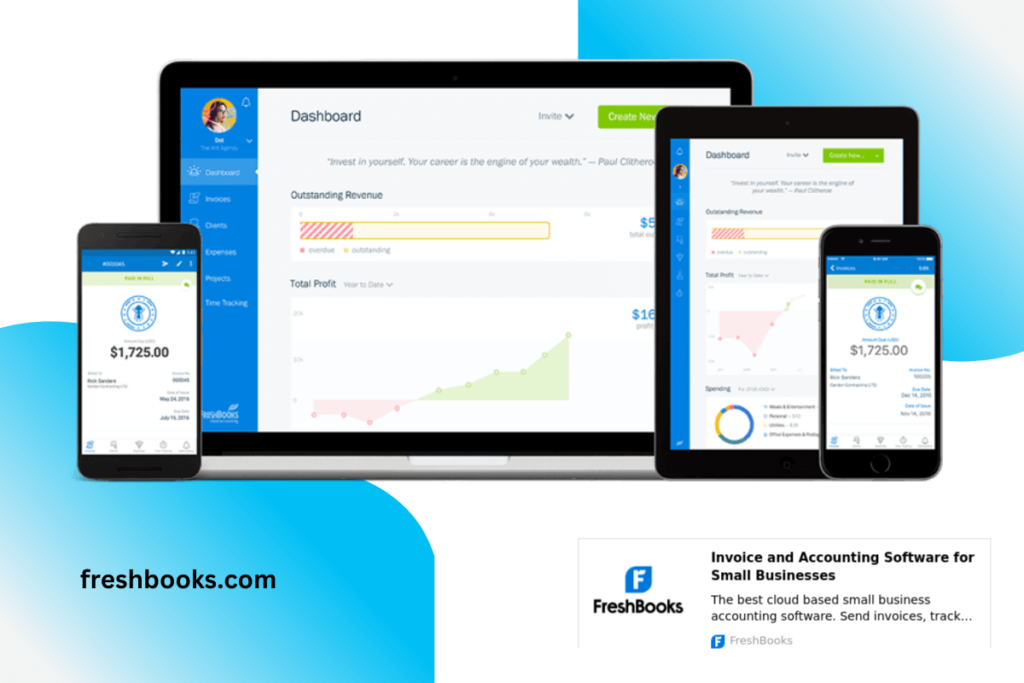

2. FreshBooks – Best Affordable Accounting Software for Investors

Pricing: £4.40 per month

FreshBooks is a cloud-based accounting software that’s designed for small businesses. It’s simple to use and comes with all the features you need to manage your finances, including invoicing, tracking expenses, and accepting payments. Plus, it integrates with a range of other business tools, such as project management software and CRMs.

From an investment standpoint, FreshBooks can help you track your portfolios, analyse your performance, and make decisions about where to allocate your resources. It’s a great option for investors who are looking for a simple, effective way to manage their finances.

Key features:

- Track your income and expenses

- Manage and track your investment portfolios

- Integrates with a range of other business tools

Reasons to buy:

- Very affordable

- Simple and easy to use

- Full project management suite, including time trackers and mobile functions

Reasons to avoid:

- Can be difficult to set up in some cases

- Limited customer support options

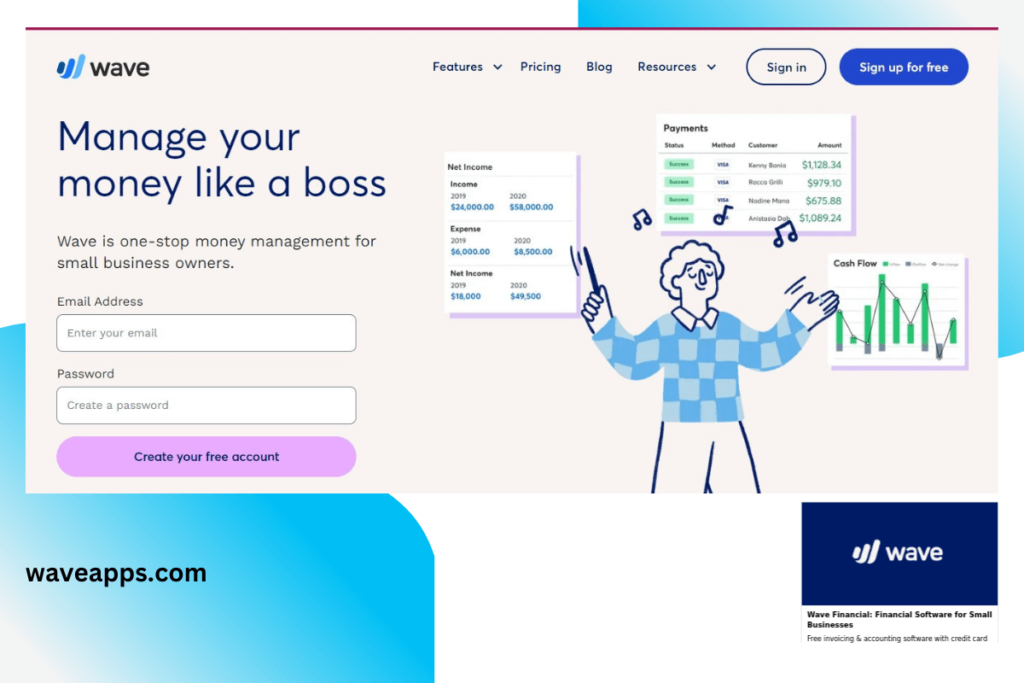

3. Wave Accounting – Best Accounting Software for Small Businesses and Independents

Pricing: 1.4% + 20 per transaction (2.9% for non-European accounts)

Wave is a popular accounting software for small businesses and freelancers. It’s simple to use, packed with features, and very affordable. Wave can help you track your finances, manage your investments, and make informed decisions about allocating your resources.

Regarding being investor-friendly, you can easily sync and add in your own investment assets into Wave with the click of a button and your accounts. So, if you have a brokerage account, for example, and invest in stocks, you can manage everything directly within the suite. Everything is easy when you’re using Wave.

Key Features:

- Manage your finances and investments in one place

- Wave syncs with all of your accounts automatically

- You can add an unlimited number of users for free

Reasons to buy:

- Very affordable

- Simple and easy to use

- Integrates with a range of other business tools

Reasons to avoid:

- Customer support could be better

- There have been reports of occasional glitches

>>MORE: Real Estate Investment Software | Value Investing Software | Is Pipedrive good for real estate investors? | Venture Capital CRMs

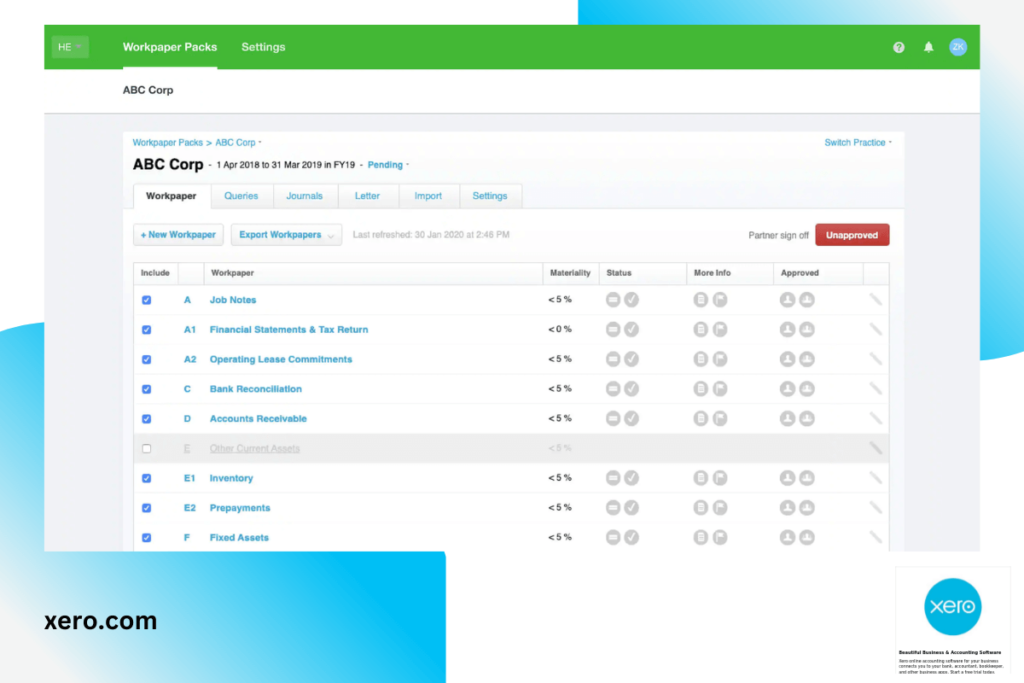

4. Xero Accounting – Best Accounting Software for Medium Businesses and Investors

Pricing: £6 per month (1st month free for new customers)

Xero is a cloud-based accounting software suitable for small businesses and freelancers, but it can be scaled up to mid-range businesses, too, which is great if you’re planning to grow your portfolio and transactions. It’s packed with features, including invoicing, tracking expenses, and accepting payments. Plus, it integrates with a range of other business tools, such as project management software and CRMs.

Xero can help you track your investment portfolios, analyse your performance, and can even provide you with important investor information, market releases, announcements from the industry, updates, and even pulls financial documents as and when you need them.

Key Features:

- Track your income and expenses

- Manage your investment portfolios

- Get important investor information and updates

Reasons to buy:

- Packed with features

- Integrates with a range of other business tools

- Reasonably priced

Reasons to avoid:

- Can be challenging to set up in some cases

- Limited customer support options

5. Mint – Best Accounting Software for Investors on a Budget

Pricing: Free (with variable premium plans)

While Mint is actually a budgeting app, I’m including it here because it’s a great tool for managing your finances and tracking your investments. Mint is simple to use and gives you a clear overview of your finances, including your income, expenses, and investments.

You can also add and connect your investments and portfolios to easily keep an eye on them and then see how they will affect your budget. That means monitoring all your accounts is super-easy and affordable.

Key Features:

- Free to use

- Very simple and easy to use

- Clear overview of your finances, including investments

Reasons to buy:

- Can be used for budgeting and managing investments

- Integrates with a range of other business tools

- Easy to setup and connect all your accounts

Reasons to avoid:

- Limited customer support options

- Less robust investment tracking than some other options

6. Quicken – Best Accounting Software for a Reliable Experience

Pricing: From $35.99 per month

Quicken is one of the most popular and well-known accounting software options on the market. It’s suitable for small businesses and freelancers, and it can help you track your finances, manage your investments, and make informed decisions about where to allocate your resources.

Quicken is a great option for investors as it offers a range of features specifically designed for tracking and managing investments. For example, you can connect your investment accounts and easily track your portfolios, performance, and fees. Plus, Quicken will provide you with important investor information, market releases, announcements from the industry, updates, and even pulls financial documents as and when you need them.

Key Features:

- Track your income and expenses

- Manage your investment portfolios

- Get important investor information and updates

- View, manage and even pay your bills from within the app

Reasons to buy:

- Packed with features

- Designed specifically for investors

- Integrates with a range of other business tools

Reasons to avoid:

- Can be difficult to set up in some cases

- Fairly expensive compared with other platforms

- Limited customer support options

7. Backstop Solutions Suite – Best Accounting Software for Automating Tasks

Pricing: Quote available upon request

Backstop Solutions Suite is a cloud-based software platform that’s designed specifically for investment professionals. It offers a range of features, including portfolio management, performance reporting, and compliance monitoring.

However, what Backstop really excels in is saving you time when it comes to carrying out all those little yet essential tasks. For example, you can automate data entry, set up recurring tasks, and receive real-time alerts when things need your attention.

Key Features:

- Portfolio management

- Performance reporting

- Compliance monitoring

- Automate data entry and set up recurring tasks

- Receive real-time alerts when things need your attention

Reasons to buy:

- Saves you time on essential yet tedious tasks

- A range of features for investment professionals

- Can be customised to your specific needs

Reasons to avoid:

- Relatively expensive compared with other options

- Customer support can be difficult to reach

8. Altair – Best Accounting Software for the Ultimate Investor Accounting Experience

Pricing: $1,995 per year per user

When it comes to accounting, automated investment account tracking and monitoring, at the top of the food chain sit Altair. It’s a web-based solution that gives you all the features and functionality you need to manage your finances, investments, and business operations in one place.

Although it’s not the cheapest option on the market, Altair is packed with features that make it worth the investment. For example, you can connect all your investment accounts and track your portfolios in real-time. Plus, you can use the software to generate performance reports, monitor compliance, and automate tasks such as data entry and bill payments.

Most importantly, you can process an absolute TON of data in next-to-no time at all, making it a great way to get actionable data for your decision making fast.

Key Features:

- Web-based solution

- Connect all your investment accounts

- Track portfolios in real-time

- Generate performance reports

- Monitor compliance

- Automate tasks such as data entry and bill payments

Reasons to buy:

- Packed with features

- Can process a huge amount of data very quickly

- Great for making fast, informed decisions

Reasons to avoid:

- One of the more expensive options

- Customer support could be better

Frequently Asked Questions

What is accounting software?

Accounting software is a type of business software that helps businesses manage their finances, including tracking income and expenses, preparing financial statements, and managing tax compliance.

What are the benefits of using accounting software?

There are many benefits of using accounting software, including:

- saving time on tasks such as data entry and bill payments

- generating accurate financial reports

- improving financial decision making

- complying with tax regulations.

What are some of the features to look for in accounting software?

Some features to look for in accounting software include:

- support for multiple investment accounts

- real-time portfolio tracking

- performance reporting

- compliance monitoring

- automation of tasks such as data entry and bill payments.

Will any old accounting software do the job?

No, not all accounting software is created equal. You’ll want to make sure that the software you choose has features that are specific to the needs of investment professionals. This is because investment accounting is generally more complex than other types of accounting due to the need to track portfolios and performance.

You also need software that is connected to the internet and can update data in real-time, sometimes at instant speed, depending on the markets you’re working with.

Is this the same as wealth management software?

No, accounting software is not the same as wealth management software. Wealth management software is designed to help individuals and families manage their finances, including budgeting, goal setting, and investment planning. Accounting software is designed to help businesses manage their finances, including tracking income and expenses, preparing financial statements, and managing tax compliance.