RELATED: Accounting Software Best For Schools | Best Mobile Device Accounting Tools | Accounting Software Fit For Truck Businesses

Accounting, bookkeeping, and financial management are the key areas of your professional services business such as investment consultancy. You need to handle those areas carefully but that takes time and a lot of money. You have to look for an alternative to time-consuming and expensive manual accounting and bookkeeping. And, accounting software is the best alternative to it that can help you save time and money. Accounting software efficiently and effectively handles the financial aspects of your investment advisory business and lets you focus on what you do best.

The best accounting software for investment advisors is the software that not only saves time and money but also the one you are comfortable with. Besides, it is also a tough endeavor to find the best accounting software for your business. What you need to do is analyze different accounting software currently available and choose one that seems the best option for your business. It is important because complete accounting software will help you stay on top of your accounting and bookkeeping activities while you have the time to focus on your business. In today’s post, we are going to share with you a list of the best accounting software for investment advisors to make your search easy.

Upfront Conclusion

The best accounting software for financial advisors right now is FreshBooks and Zoho Books.

Top 7 Accounting Software for Investment Advisors

- FreshBooks

- Zoho Books

- Bonsai

- QuickBooks

- Xero

- Sage 50

- Wave Accounting

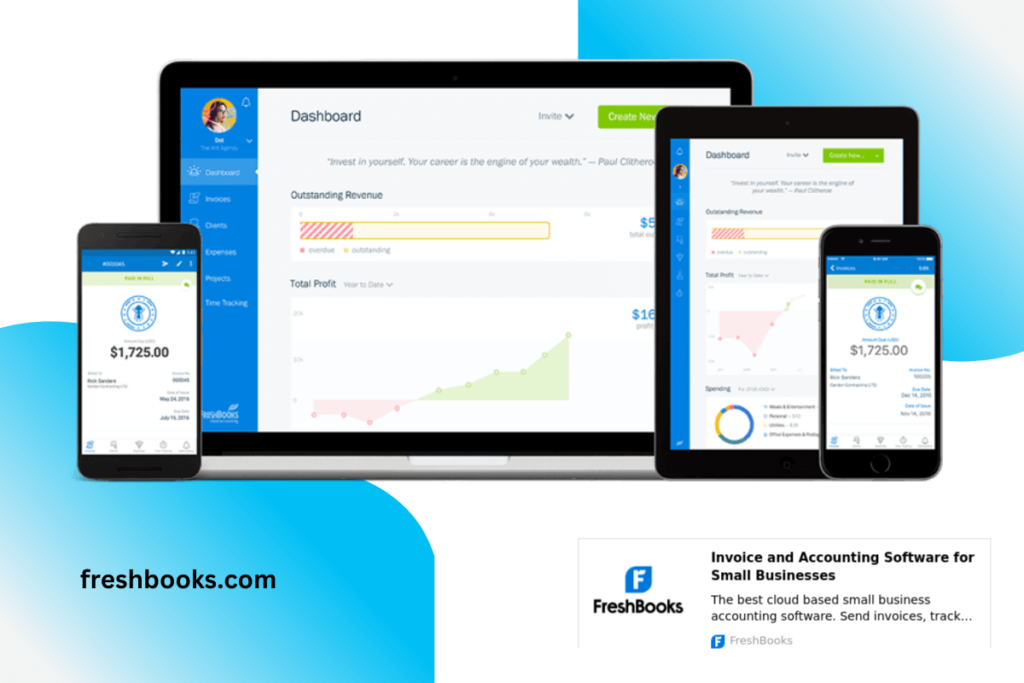

1. FreshBooks

FreshBooks has all the strengths to make its place in the list of the best accounting software for investment advisors. It is among the most user-friendly accounting tools available in the market and that also makes it the best option for investment advisors and consultants who have negligible knowledge of accountancy as well as computer systems. Moreover, FreshBooks offers unique invoicing features such as customizable invoice formats, recurring invoices, etc. FreshBooks lets you do accounting activities ranging from simple to complicated activities. Besides invoicing and income/expense bookkeeping, you can reconcile your bank account, create numerous reports, manage projects, manage and track time, avail automatic payment and fess reminder, and various other remarkable features.

Key features

- Enables you to generate professional invoices and also makes invoicing very easy that takes only a second.

- Organizes your income and expenses effortlessly and help you remain always ready for tax time.

- Also empowers you to manage projects as it keeps your conversations, files, and other relevant data in one place. You can also synchronize your team and projects on schedule.

- Brings automatic depositors and eliminates the chase of clients for checks.

- Ensures to make reports as simple as possible to be more understandable for you while quite powerful for accountants for professional use.

- Its iOS and Android apps empower you to remain in contact with your clients from anywhere, anytime.

- Integrates with other 100+ apps and enables you to streamline your business, connect with your customers, and run your business in a better way.

Pricing

FreshBooks offers four pricing plans to help writers manage their business’s financial aspects.

- The Lite plan starts at $13.50 per month

- The Plus plan starts at $22.50 per month

- The Premium plan starts at $45 per month

- The Custom pricing plan is also available for investment advisors having more advanced businesses.

All four plans come with different features. You can start with the Lite plan at the very outset of your advisory business and scale up to other plans with more advanced features when your business requires it. Overall, FreshBooks is among the best accounting software for investment advisors because of its remarkable features and flexible pricing plans.

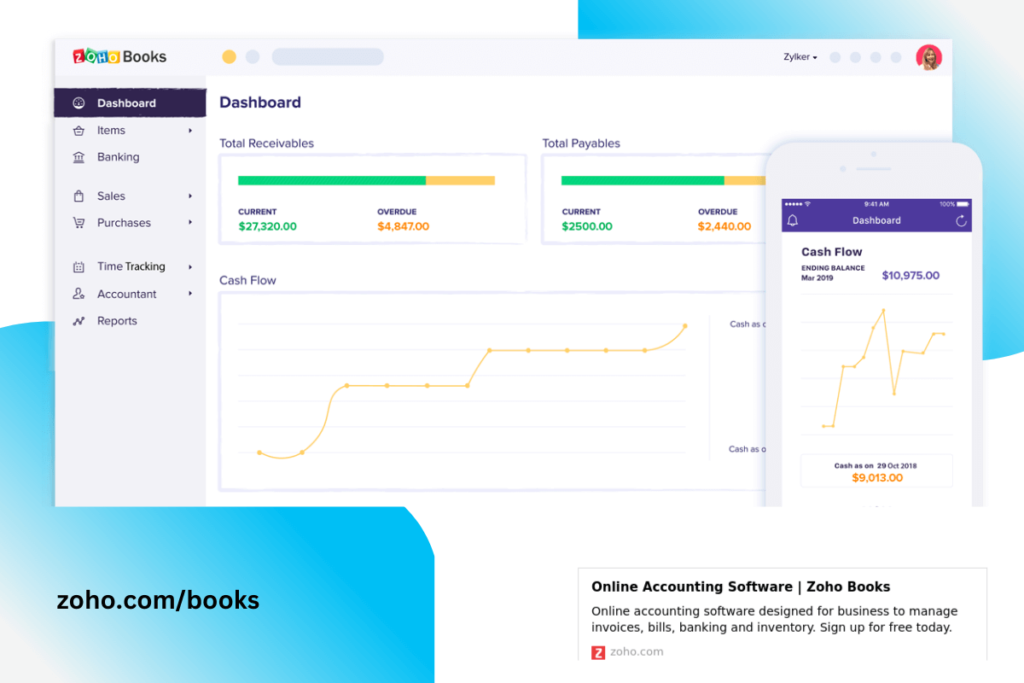

2. Zoho Books

Zoho Books is another option for investment advisors, consultants, and other professional service providers that speed ups accounting activities. It organizes various different activities into a single timesheet workflow to make your work quick, easy, efficient, and effective. Zoho Books is also very easy to handle and user-friendly. You just have to add a customer and mention the projects you will work on for him/her in order to simply track time and expenses, create and send invoices, and manage other activities in a single place. The plus point of Zoho Books is that it is a part of the most comprehensive Zoho tools. You can also choose other Zoho tools such as email hosting, CRM, project management tool, etc.

Key features

- Assists you in tracking your expenses seamlessly. You can upload receipts to the tool, organize your expenses, and easily track where your money is being spent.

- Helps you generate customizable invoices and receive your payments faster.

- Also generates bills to track payments you owe to your service providers such as publishers.

- Offers the easiest bank account reconciliation, fetches bank transactions, and manages them effortlessly.

- Helps you manage your projects more effectively with timesheets to track every minute.

- Its client portal enables your customers to view their transactions in one place.

Pricing

Zoho Books offer three pricing plans that allow you to choose the best options for you according to your business’s needs and requirements.

- The Standard plan starts at $15

- The Professional plan starts at $40

- The Premium plan starts at $60

Zoho Books is slightly expensive as compared to its competitors but all three packages come with exceptional features. You can start with the Standard plan during the initial stages of your investment advisory business and then upgrade to more advanced plans with advanced features to meet the needs of a growing business

3. Bonsai

Bonsai is one of the best software for financial advisors because it helps them manage time and complete projects on time. You can also get paid faster using the different automation tools of this software. These tools will help you get done with your work faster and offer good advice to clients.

The platform will also help you track the time you have worked for each customer to ensure you get paid accurately by the hour. Automatic tracking also ensures you don’t have to spend time keeping a manual time record of each meeting.

Key Features

- It offers online contracts that your clients can modify and sign using an electronic signature to save time and in-person meeting

- You can invite another collaborator to join your advising project and offer clients the best experience

- Sharing tasks, work hours, and project information with clients is a breeze with an efficient communication portal

- Recurrent invoicing can be set up to ensure you are paid on time every month

- Bonsai also helps you visualize your finances by plotting your income and expenses on a graph

- The platform also offers profit and tax estimates to help you maintain your financial position in the industry

- You can also add notes to your invoices and tasks for better business operation

Pricing

Bonsai offers a seven-day free trial to help customers try out different features to make an informed decision. This trial is offered on all three plans of the company. Here is the pricing for all the plans:

- Starter plan – $24 per month ($17 per month if billed annually)

- Professional plan – $39 per month ($32 per month if billed annually)

- Business plan -$79 per month ($52 per month if billed annually)

This software is a great option for freelance financial advisors, small business advisors, and people who run consulting agencies. The platform is reasonable and offers everything that an advisor wants in their management software.

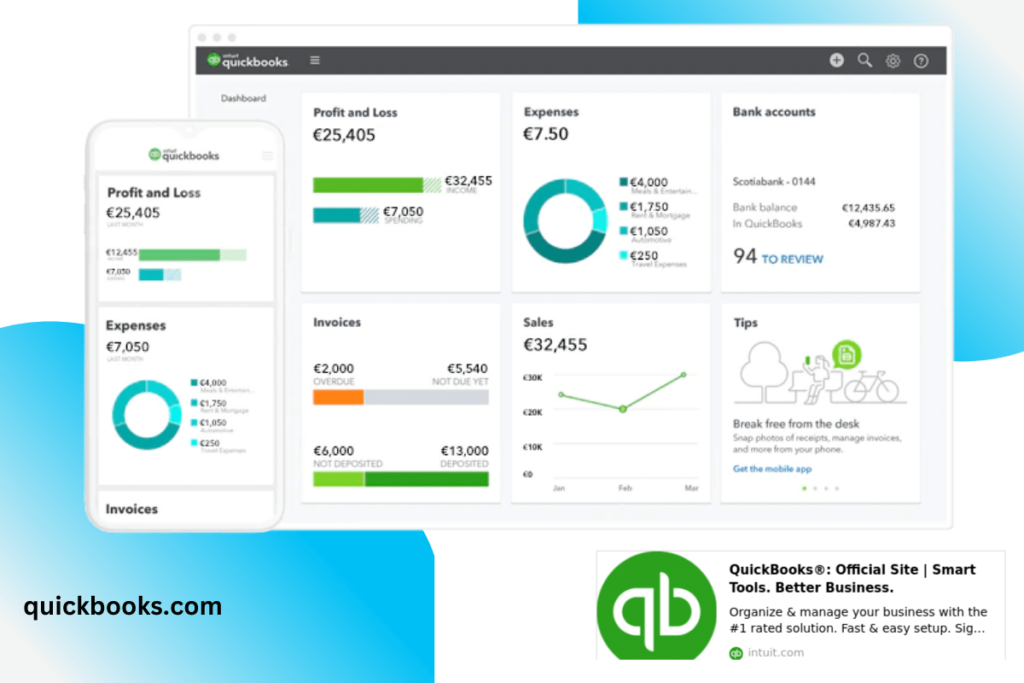

4. QuickBooks

QuickBooks boasts about having 4.5 million customers from across the globe. It tops the list of the best accounting software for investment advisors because it offers numerous unmatchable features that suit professional service businesses. You can take your investment advisory business anywhere with the help of this remarkable tool as all QuickBooks plans include free iOS and Android applications that enable you to handle your financial data from the office, commute to work, or from the comfort of your home. QuickBooks’s astonishing apps let you do any bookkeeping task very easily such as online receipts, online payments, sending invoices, etc. Moreover, it offers customer support that is among the very best in the business. When you contact them through the QuickBooks Online program, ask a question, and provide a cell phone number, you are contacted as soon as possible for a detailed answer to your question.

Key features

- Offers free iOS and Android apps that make your financial record keeping exceptionally easy. You can also handle your professional service business data from anywhere, anytime with the help of mobile applications that run smoothly.

- Ensures secure cloud storage that is an important feature to store your data safely in the cloud. It eliminates your worries to keep your data secure by providing bank-level security.

- Also allows you to let your accountant access the account if you want to share your books.

- Presents customizable reports to observe how your business is going.

- Allows you to send unlimited invoices to ensure nothing stands between you and your money.

Pricing

QuickBooks offers a free 30-day trial to check its usability to its customers. Free trial is available on all three plans.

- The Simple Start plan starts at $8 per month

- The Essentials plan starts at $12.50 per month

- The Plus plan starts at $17 per month

Simple Start is the best option for you if your business is just starting. You can scale up to other plans with the growing needs of your business. Finally, we are recommending this accounting software for investment advisors because they can get features according to their own needs at very reasonable prices.

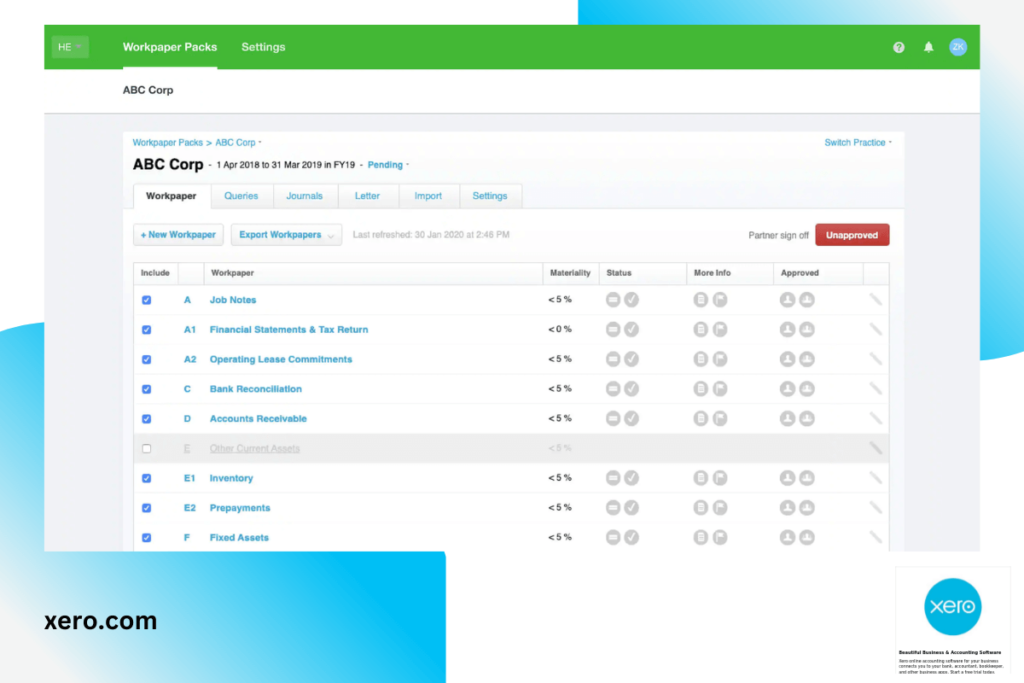

5. Xero

Xero is another feature-rich, cloud-based, and one of the best accounting software for investment advisors. Its interactive and user-friendly interface is highly captivating for users from different industries, especially for professional service providers. Xero has become popular because it offers remarkable features and also makes accounting activities extremely easy. Investment advisors happily leave accounting and bookkeeping to Xero and focus on their clients.

Key features

- Has a mobile application that enables its users to handle bookkeeping activities on the go.

- Enables you to track and timely pay bills and also presents a clear picture of accounts payable and cash flow.

- Instantly reconciles with your bank accounts and you can get bank feeds.

- Empowers you to track projects and their timeframe, costs, and profitability.

- Generates accurate accounting reports to help you track your finances.

Pricing

Xero offers three different pricing plans and all of them cover all accounting essentials. Its three plans are;

- The Starter plan starts at $20 per month

- The Standard plan starts at $30 per month

- The Premium plan starts at $40 per month

The Starter plan is the best plan for professional service providers at the early stages of their business. They can easily upgrade to other plans when businesses begin to grow. Xero is the best accounting software for investment advisors because it makes complex accounting tasks extremely easy and at very affordable prices.

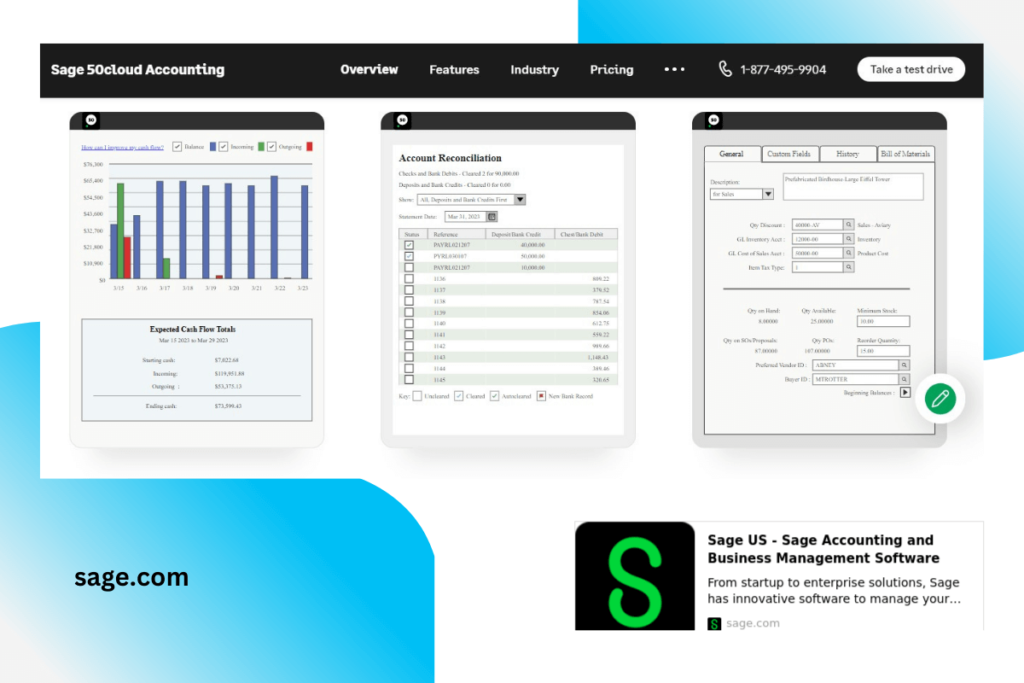

6. Sage 50

Sage 50 is another one of the best accounting software for investment advisors through which they can take control of their finances. It is cloud-based, automated, and an intuitive tool that lets you get paid faster. Sage 50 offers powerful accounting and bookkeeping features that allow you to take full control over your financing processes and also lets you spend more time on providing the best services to your clients.

Key features

- Its Cash Flow Manager is a powerful tool that gives you a crystal clear snapshot of your cash flows. You can tweak settings to have a more granular view of your cash flows.

- Allows you to send numerous invoices within a few seconds. You can also set up recurring invoices and quickly get paid with the online function, “Pay now.”

- Its payment and banking features include invoicing, payments, purchase orders, and bank reconciliation.

- Can present more than 150 financial reports so that you can avail all the data necessary to make informed and timely decisions.

- Also manages your inventory and keeps you updated on what is in the inventory and what is on order.

- Other worthwhile features include payroll simplification, project management, Sage security shield, are much more.

Pricing

Sage 50 offers three different monthly pricing plans. You can also pay annually.

- The Pro Accounting starts at $56.08 per month or $340 per year

- The Premium Accounting starts at $84.58 per month or $510 per year

- The Quantum Accounting starts at $139.58 per month or $ 842 per year

Sage 50’s plans are expensive as compared to other accounting software providers but it offers the most complete packages that can serve in the best possible way for your investment advisory business. Sage 50 makes its place in the list of the best accounting software for investment advisors because its plans and related features suit businesses of all types and sizes.

7. Wave Accounting

Wave Accounting is another great option for investment advisors to take good care of their accounting needs. It is an award-winning accounting software yet absolutely free. You can get almost all features you need for business accounting totally free. Wave allows you to do simple to more advanced accounting activities such as income/expense recording and tracking, sending invoices, etc. You can also avail yourself of superb features like payroll processing and scanning receipts through Wave mobile application. Wave also allows you to reconcile bank accounts and allows you to record old expenses you failed to record in the past through uploading old bank statements.

Key features

- Handles your accounting requirements effortless, easy, more efficient, and effective.

- Enables you to create and send professional invoices within seconds.

- Empowers you to scan receipts from anywhere, anytime through Wave mobile app.

- Allows you to track unlimited income/expenses and get paid easily.

- Also makes your accounting efforts smarts and highly professional through offering to add various collaborators, accountants, and partners.

- Also has all the potential to generate professional reports that clearly display due bills and invoices, profit and loss reports, cash flow reports, etc.

- Also allows you to reconcile multiple bank accounts and credit cards.

Pricing

Wave is accounting software for investment advisors that is absolutely free. It is among the best accounting software for writers not only it is free but also because of its remarkable features. It lets you scale up by presenting numerous collaborators if you want an expert to handle your accounts, manage payroll and payroll taxes, run more than one business from a single Wave account, and much more. Overall, Wave is the best option for investment advisors and consultants to handle their accounting requirements without spending a penny on software that charges a lot each month.