RELATED: Best S-Corps Accounting Tools | Accounting Tools Best for Service Companies | Accounting Tools Best For Freelancers

Accounting for trucking companies seems to have some quirks as trucking companies have more peculiar needs than other business industries. From proper bookkeeping to billing, and from invoicing to accounting for assets depreciation, there are so many specialized accounting needs to cater for.

The needs don’t end there; there is also the need for maintaining adequate inventory management and keeping track of their traveling. All of these can be so cumbersome without the right accounting software to stay on top of your business finances.

The right accounting software for trucking companies should streamline all the accounting sides including easy management of your expenses, receivables, payables, general ledger, and loads. It should also provide you with the right features for transportation-related pricing based on mileage, freight, and pricing methods.

Considering all these features you have to take into consideration, and the number of accounting software available in the market, it can be time-consuming to sift through the market for the best option.

Fortunately, we have waded through the market and rounded up for you the best accounting software for your trucking company. The good thing is, you don’t have to go through all the stress of searching endlessly for the best trucking accounting software anymore and you can also weigh each of our options based on your specific needs and budget.

Upfront Conclusion

The best accounting software for trucking companies right now is Sage and TruckingOffice.

What Is Trucking Software?

If you’re already in the trucking business you probably already know what this is, but in case you don’t trucking software is a digital app designed for the trucking industry to help them run their business and stay on top of the business. This type of transportation management solution will help such companies to automate all their workflows and enhance their productivity. Some typical features of good trucking software include invoicing, mileage and IFTA reports, expense reports, among others.

Fundamental Accounting Terms You Need To Understand

When we talk about using accounting software for trucking companies, most business owners fret and think it’s not going to work. For some people, their fear is not having a background in accounting, while others think accounting software could complicate things for them. Either of these thoughts is not true as all you need to get your trucking business accounting right is the understanding of the fundamental of accounting. With this, we mean your ability to decipher not only basic financial documents but also accounting terms that relate to your business.

Here are some common accounting terms and financial documents used in the accounting profession:

Accounting Equation

The accounting equation is a fundamental principle in accounting which states that a company’s assets are made up of its liabilities and equity. In other words, what this means is that for any business its assets must equal its liabilities and equity. In the formula, the accounting equation is given as Assets = Liabilities + Shareholder’s Equity.

Assets

Assets are the resources owned by a business that it can use for running the business or for generating revenue for the business. There are basically two types of assets and these include fixed and non-fixed or current assets.

Fixed assets are otherwise known as long-term assets. They are referred to as long-term assets because of their not being easy to convert readily into cash or cash equivalents. These types of assets are expected to have an economic value or life span above one year. Examples of fixed assets include land, building, machinery, equipment, etc. On the other hand, current or non-fixed assets can be readily converted into cash or cash equivalents. They’re those assets with a life span below a year.

Current assets examples include stock, debtors, cash equivalents, etc.

Liabilities

Liabilities are the financial obligations a company owes its suppliers and outsiders. These include accounts payables, loans from banks, overdrafts from the bank, etc. Liabilities can be divided into two namely, limited and unlimited liabilities. Limited liabilities involve a situation whereby in case of liquidation the loss or liabilities resulting from the business is limited only to the owner’s investment in the business. In the case of unlimited liabilities, there is no limitation in using the business owner’s assets and investment for offsetting the liability of the company.

Equity

This is the owner’s interest in the business. This is the net value after liabilities are subtracted from the assets. It denotes the value left to be given to the business owners after liabilities were paid off and assets liquidated. In the accounting equation, equity is expressed as Equity = Assets – Liabilities.

Revenue

This is otherwise known as income. It represents the amount of money that a company receives for selling its goods and services over a given period of time. This value is one of the elements of the income statement and it’s considered in determining the top-line or bottom-line of a business. A business is said to be making a profit if the revenue (gross income) is higher than the cost of sales and operating expenses of the business. While the reverse means a loss for a business (that is, excess of expenses over income).

Expenses

These are the costs incurred by the company to produce the goods and services used for generating income for the business. There are basically two types of expenses and these include direct and indirect expenses. Direct expenses are those costs that can be directly linked to the production of goods and services in which the company deals. Examples include the cost of direct labor, materials, etc.

Indirect expenses, on the other hand, cannot be directly linked to the company’s core product line. Examples include expenses like utilities, rent, insurance, etc.

Expenses can also be divided into fixed and variable costs. Fixed costs include those costs that do not change with the level of output, while variable costs are those expenses that vary with the level of output. Some examples of fixed expenses are depreciation, salary, rent, insurance, while examples of variable costs include wages, commission on sales, etc.

Financial Statements

These are made up of income statements (otherwise known as profit and loss), statements of financial position (also known as the balance sheet), and cash flow statements. The income statement shows the summary of the company’s profit or loss over a period of time usually monthly, quarterly, or yearly. The balance sheet shows the financial position of the business for a given period of time. A cash flow statement is a statement showing the movement of cash in and out of the business for a period of time usually a year. It shows the amount of cash a business has in hand to meet its financial needs over a period of time.

Understanding all these accounting nuances will help you decipher what they’re saying about your business. And more so, they will give a clear insight into your business’s financial health.

Best Accounting software For Trucking Companies

| Brand | Starting price | Best for |

|---|---|---|

| 1. Sage | €6.00 – €13.50 | Ease of use |

| 2. TruckingOffice | $20 – $75.00/month | Essential features |

| 3. Q7 | Custom pricing | Single-entry accounting |

| 4. Axon | $1 | Real-time integrated app |

| 5. PowerPRO | Custom pricing | Full integrations |

| 6. QuickBooks Online | $15 – $150/month | All-inclusive accounting |

1. Sage

Regardless of whether you run a cab, trucking, or courier business, Sage Accounting enables you to take control of your finances. Use the cloud-based software to streamline time-consuming administrative tasks, monitor money coming into and leaving the company, and view projections based on current data.

What We Like About Sage

- Increase payment speed by automating and establishing regular invoices.

- Invoice management, creation, and customization are quick and simple.

- Viewing a cash flow projection with current information will help you maintain control.

- You can use your mobile device to manage your funds from anywhere.

Pricing

Sage offers two pricing plan for trucking business which are:

- Accounting Start Plan: €6.00

- Accounting Plan: €13.50

Note: Accounting start plan only support one user.

2. TruckingOffice

The TruckingOffice is actually a blend of multiple apps in one software in that it combines so many essential features for trucking companies. These include amazing features for creating IFTA reports, tracking dispatches, generating trucking invoices, and managing expenses. Others include driver trucking app, maintenance trucking apps, truck tracking apps, and more.

Overall, TruckingOffice offers you all the most essential features you’ll ever need to make your trucking business easier.

What We Like About TruckingOffice

- Automatic IFTA repots capability

- Professional and speedy invoice generation

- Seamless fleet tracker capability

- Accurate Mileage tracker

- Real-time and insightful financial reports

Pricing

You can get started free of charge with TruckingOffice but you’ll need to fill out their online form here. They also offer different paid pricing options that reflect different business needs and sizes of fleets. They have paid plans are as follows:

- Plan For Owner or Truck Operator (1-2 trucks): $20.00 per month

- Plan for Mid-Size (3-7 trucks): $45.00 per month

- For Fleet (from 8 trucks and above): $75.00

- Plan for Broker (unlimited dispatches): $45.00

Note: There is also some pricing for add-on features, you can check out their website for more detail.

>>MORE: Website Builder For Food Trucks | Trucking Accounting Software | Mechanic POS Systems | Accounting Software For Auto Repair Shops

3. Q7

Q7 accounting software is a great option for a trucking company that needs accounting software with single-entry accounting. It is an all-in-one software with exciting capabilities for fleet management, dispatch tracking, and freight billing. Q7’s accounting features include accounts payable management, pay settlement, payroll, and fuel taxes, among others.

What We Like About Q7

- Easy-to-use mileage interface

- Accurate and insightful management reports

- Excellent fleet management capability

Pricing

Q7 offers varied pricing plans that reflect different sizes of trucking companies. You can visit their website here for the most suitable pricing option for your company.

4. Axon

Axon’s trucking software offers an amazing way to eliminate the stress of running your cumbersome workloads, paying your drivers, and improving your cash flow. Axon comes with a real-time integrated app that lets you run your business effectively and manage your time efficiently.

From filling fuel reports to having timely fleet maintenance, and from updating your dispatch to doing the core accounting side of your business, this trucking software offers the needed integration and automation to get things done faster.

While Axon software helps you track all trucking-related information you’ll ever need for accurately filing your IFTA and fuel tax, there are other uses it offers such as freight brokerage, fleet management, and oilfield trucking, to mention but a few.

What We Like About Axon

- Efficient billing

- Effective workload and dispatch management

- Excellent mileage tracking capability

- Easy fuel and IFTA tax compliant filling

Pricing

Getting started with Axon trucking software requires only a one-time fee of $1.00 and there is no free version for the software.

>>MORE: Project Management Software For Automotive Shops | Low-Stress Jobs That Pay Well Without a Degree | Is eBay Motors Legit & Safe? | Is Peddle Legit & Reliable?

5. PowerPRO

PowerPro is a transportation management solution with full integrations, EDI modules, and trucking accounting software for truckers to succeed in their business. This trucking software is great when it comes to helping freight brokers with efficient back-office operations. It’s also a go-to software when it comes to having trucking software that you can seamlessly integrate with your existing apps. In other words, PowerPRO supports integration with other third-party apps.

What We Like About PowerPRO

- Suitable for all sizes of trucking companies

- Easy to integrate with other apps

- Great for freight brokers for back-office operation

Pricing

You can contact PowerPRO for pricing that suits your business needs.

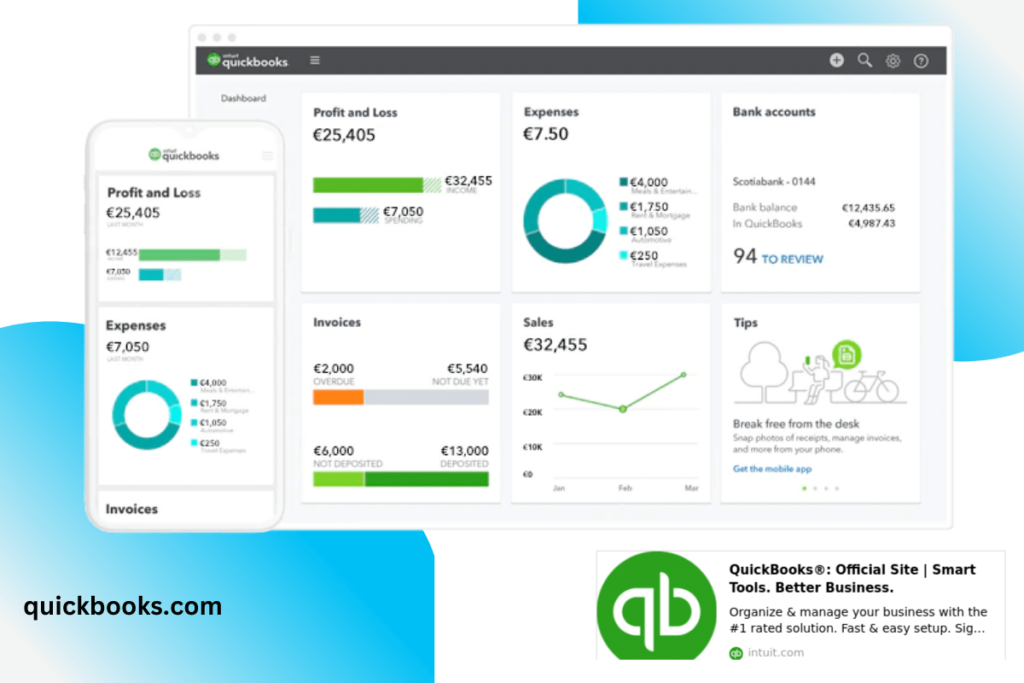

6. QuickBooks Online

Although QuickBooks Online was not originally designed for trucking it offers all-inclusive accounting software suitable for almost all business industries. You only need the right subscription and version of QuickBooks to use this software for your trucking business. The QuickBooks Online version can be suitably used for any business including trucking companies.

Also, by integrating QuickBooks with other third-party trucking apps like RAMA Logistics and PortPro software, you can use the software for managing your trucking operations like dispatching, fleet management, and more.

What We Like About QuickBooks Online

- Versatility of usage

- Seamless integration with other trucking apps

- Easy accessibility regardless of where you are

Pricing

QuickBooks offers different and tiered pricing options for users depending on your budget and business needs. There is a plan for the Self-Employed which is priced at $15.00 per month. The Simple Start and Essentials costs $25.00 and $40.00 to start per month respectively, while the Plus and the Advanced plans go for $70.00 and $150 per month respectively.

Wrapping Up On The Best Accounting software For Trucking Companies

When you’re set to choose accounting software for your trucking company, there are so many factors that should go into consideration such as the ease of use and access, IFTA and fuel compliant capability, and ease of integration, among many others.

Since accounting is a necessity for your business to grow and considering that accounting software is designed for specific purpose and businesses, you need to be very careful with the accounting software you choose for your trucking business. The good thing is with our list of the best accounting software for trucking companies highlighted above, you can rest assured they’re good and dedicated accounting software you can rely on for your trucking accounting.

Not only will you not going wrong choosing from our list above, but you’ll also save yourself the stress of wading through the crowded market.