RELATED: Accounting Tools Best For Amazon FBASellers | Top Accounting Tools Fit For Interior Designers | Accounting Tools Best In India

Almost sixteen million workers in the United States identify as self-employed. If you are one of them, you know how challenging it is to manage all aspects of your work or business. That is where the best accounting software for self-employed comes in.

It makes your life easy and convenient by offering you an accounting solution to reduce your burdens. So, here are the top ten accounting software for self-employed individuals.

Upfront Conclusion

The best accounting software for self-employed right now is Bonsai and QuickBooks Self-Employed.

Top 11 Best Accounting Software For Self-Employed

- Bonsai – Best for Growing Small Businesses

- QuickBooks Self-Employed – Best for Part-Time Freelancers

- OneUp – Best for Small Sales Teams

- Xero – Best for User-Friendly Features

- SageOne – Best for Self-Employed People On a Budget

- FreshBooks – Best for Independent Contractors

- Wave – Best for Free Accounting Service

- Sunrise – Best for Tracking Income and Expenses

- NeatBooks – Best for Accounts Receivable-Only Accounting

- Expensify – Best for Tracking Receipts

- ZipBooks – Best for Professional Accounting Help

1. Bonsai – Best for Growing Small Businesses

Pricing: $17/Per User (Business Packages with additional features are also available)

With over 500,000 clients, Bonsai is one of the most efficient business management tools in the market for self-employed business owners. No matter what industry your business is involved in, Bonsai can help you grow. Bonsai can help to organize your tasks, manage proposals, generate invoices, and perform a lot of other tasks based on the package you purchase.

One of the best features of Bonsai is that it makes it easier for you invite other professionals like Tax Assistants to your project who can be of great assistance to you when you are preparing to file you returns for the year.

Key Features

- Track all your projects from start to finish

- Manage finances through bookkeeping

- Customize proposal and invoices

- Bonsai Tax to track income and expenses

Reasons To Buy

- It will help you with doing taxes

- You can use the Clients Portal to provide a positive experience to clients

- Create a professional look for invoices and proposals

- You can use the application to get notifications wherever you are

Reasons To Avoid

- The payment options are limited to some geographical locations

- Only users in US and Canada can use the automated expense tracking feature

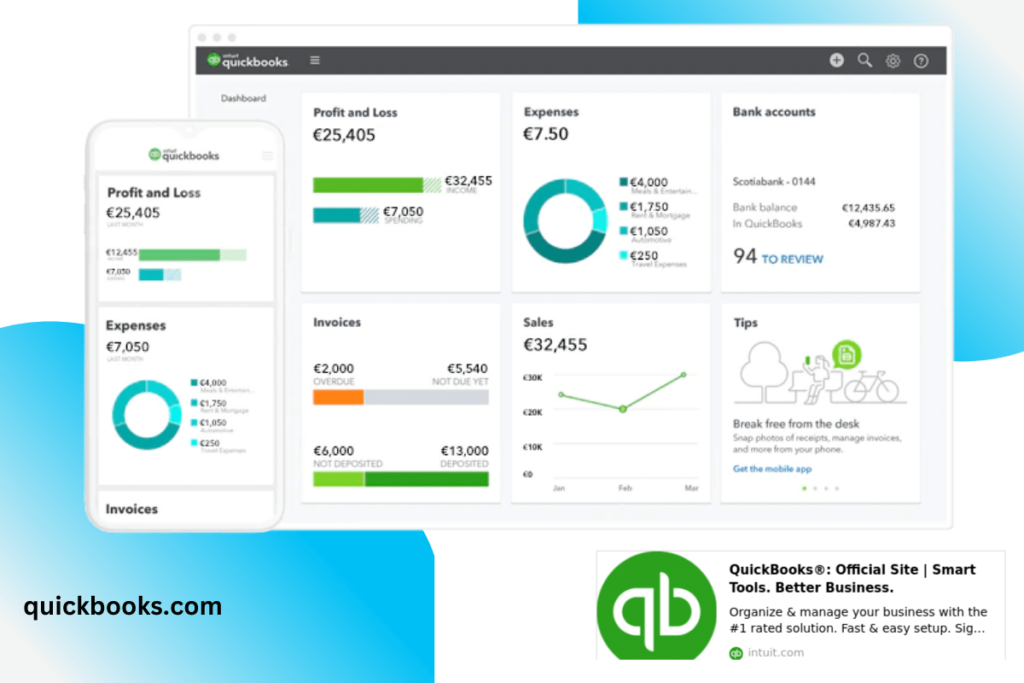

2. QuickBooks Self-Employed – Best for Part-Time Freelancers

Pricing:$5/month

If you want to save your time during tax season, QuickBooks Self-Employed is the ideal solution for you. It is one of the best bookkeeping tools for tracking your expenses and tax payments. In addition, you can connect it to your credit or bank account to track all transactions.

Key Features

- Calculate quarterly estimated tax payments

- Track mileage and expensive

- Intuitive navigation and user interface

Reasons To Buy

- It syncs with TurboTax

- Offers a mobile app

- Differentiate between personal and business expenses

Reasons To Avoid

- Limited functionality of invoices and customization

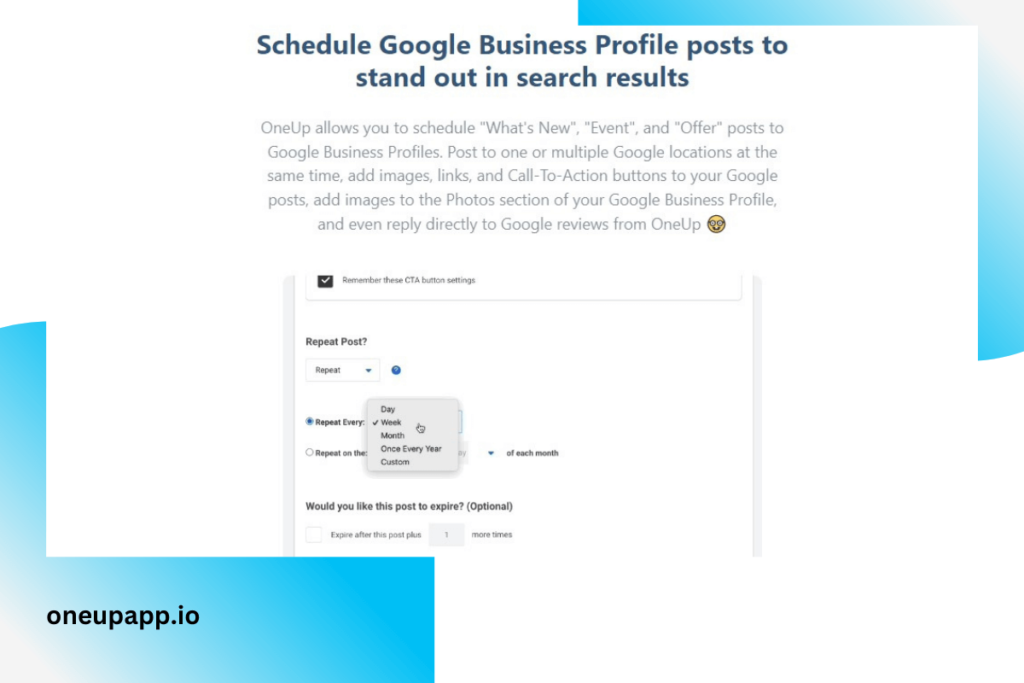

3. OneUp – Best for Small Sales Teams

Pricing:$9 to $169/month

Self-employed business owners can leverage the power of OneUp for their small sales teams. It allows people to close the books quickly and comes with an invoicing option. You can also use it from your mobile for ease of use and convenience.

Key Features

- Bank automation

- Invoice management

- Thirty-day free trial

Reasons To Buy

- You can close your books in less than a minute

- Ideal for people who are always on-the-go

- The mobile software makes it perfect to use for inexperienced accounting users

Reasons To Avoid

- It does not focus on features, such as the calculation of quarterly tax obligations

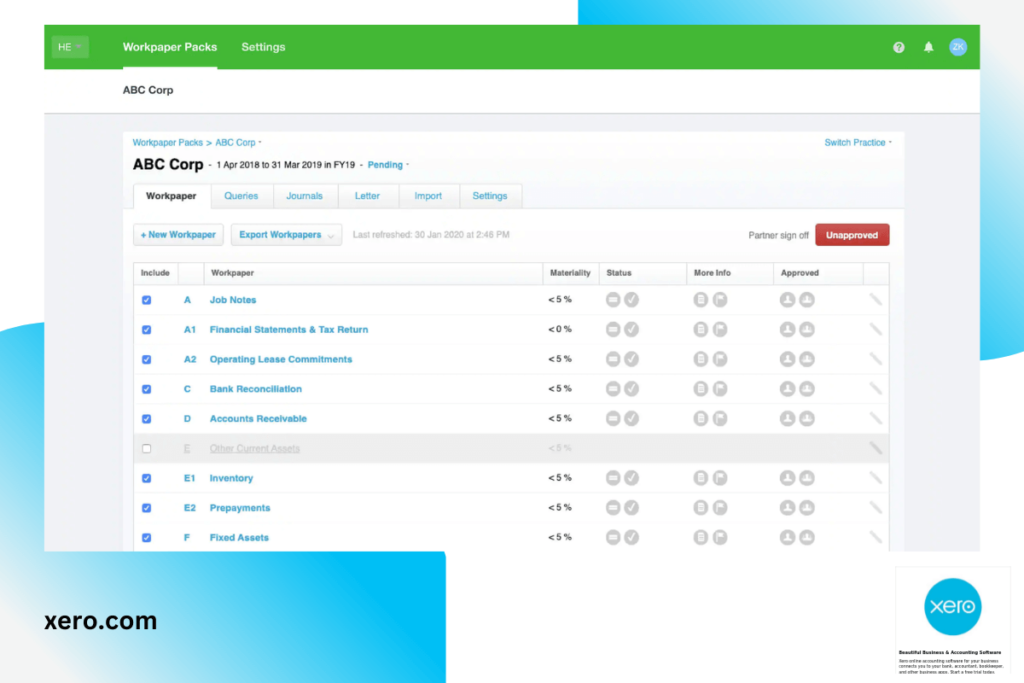

4. Xero – Best for User-Friendly Features

Pricing:$12 to $65 per month with a thirty-days free trial

Xero might be difficult to use for some inexperienced individuals, but it offers an extensive accounting solution. That is because the invoicing and receipt options are incredibly helpful for people trying to manage their business alone. Their customer support is also responsive and knowledgeable, so you will get the most out of their service.

Key Features

- Connect with over a 1,000 tools for POS, CRM, and payroll

- Online invoice

- Tracking of tax obligations

Reasons To Buy

- The best solution for experienced bookkeepers

- Organizes receipts in no time

- There is a free trial of thirty days

Reasons To Avoid

- It might not be the best solution for individuals who have never done bookkeeping before

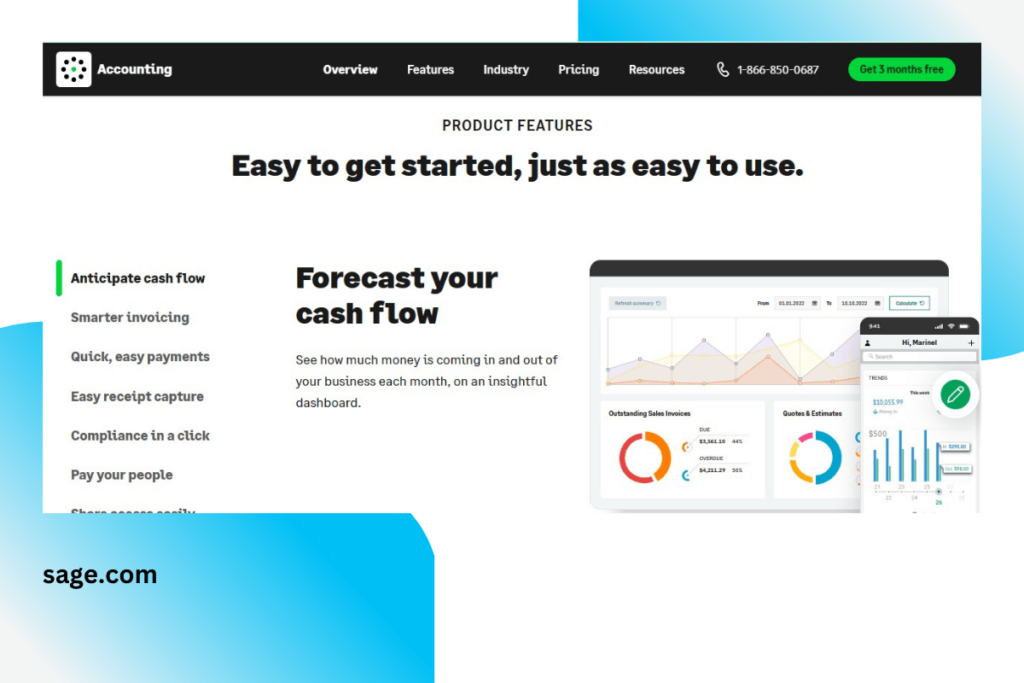

5. SageOne – Best for Self-Employed People On a Budget

Pricing:Starts at $10/month

SageOne offers cloud accounting solutions, which is why it is ideal for self-employed people that are always traveling. You can access the software anywhere and manage everything from inventory to accounting. In addition, the reporting features are excellent, as you can look at them to learn more about your cash flow.

Key Features

- Cash flow reporting

- Invoice creation

- SageOne mobile app

Reasons To Buy

- Easy to use

- Ideal for small start-ups

- The reporting tool is excellent

Reasons To Avoid

- It does not offer a time tracking feature

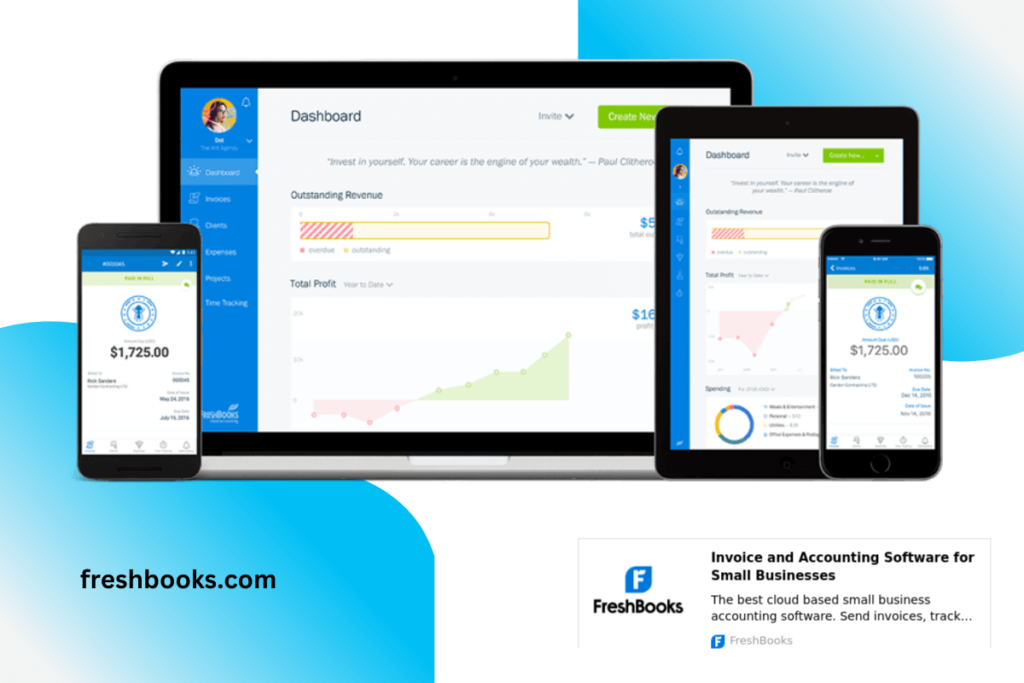

6. FreshBooks – Best for Independent Contractors

Pricing:$15 to $50 per month with a free trial of thirty days

FreshBooks offers some of the best features for self-employed contractors. That is because it will enable you to track your time and business expenses while helping you with invoicing your clients. In the long run, it will also help make tax season easier.

Key Features

- Unlimited time tracking

- Sending estimates

- Reports for tax obligations

Reasons To Buy

- It is a cloud-based accounting solution

- The invoicing features are advanced

- It offers third-party app integrations

Reasons To Avoid

- It does not offer a payroll service

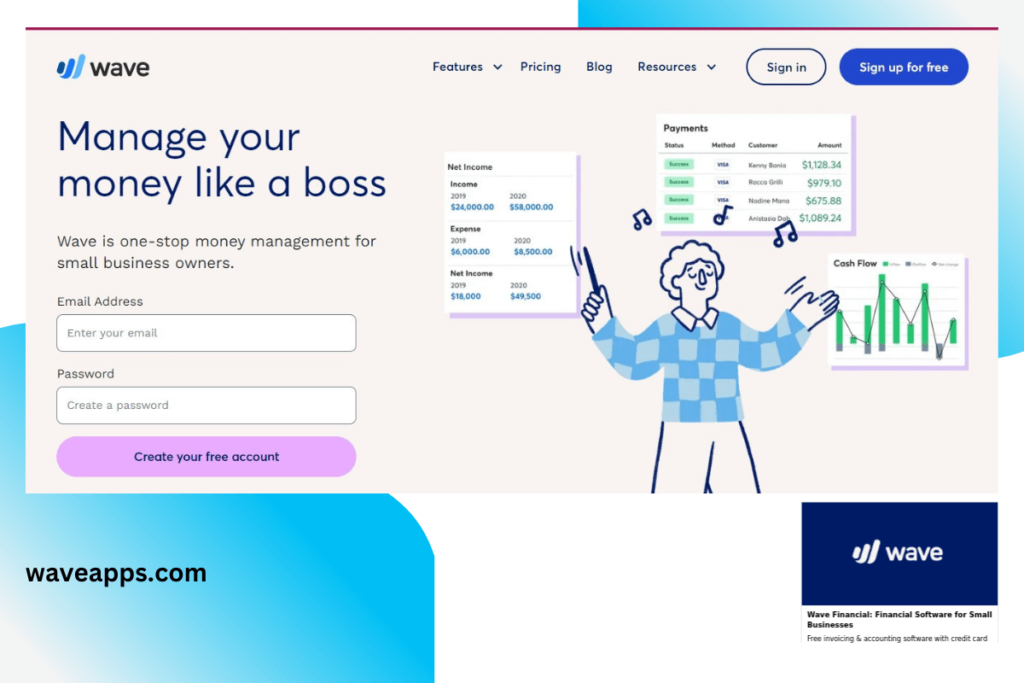

7. Wave – Best for Free Accounting Service

Pricing:Free

Wave is a completely free platform that offers you a lot without having to put a dent in your pocket. You can calculate tax obligations, payment collections, separation of business and personal expenses, and more. The customer support team is also incredibly responsive, and they will help you out in no time.

Key Features

- Tax obligation calculation

- Payment collection

- Add-on service for payroll plans

Reasons To Buy

- You can run multiple businesses from one account

- Unlimited number of users

- There are billing or transaction limits

Reasons To Avoid

- The full-service payroll is only available in fourteen states

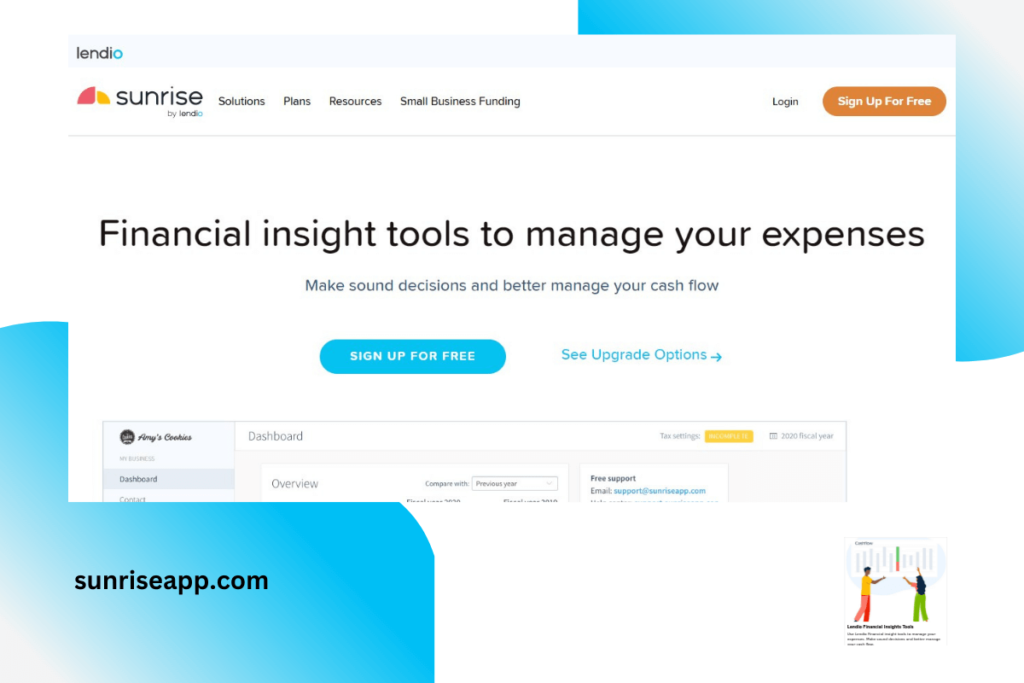

8. Sunrise – Best for Tracking Income and Expenses

Pricing:$19.99 per month

If you are a freelancer who needs to track income and expenses, this will be the ideal solution. Besides that, small businesses that need double-entry accounting will also benefit from Sunrise. Even sole proprietors can use Sunrise to keep track of these things for better cash flow management.

Key Features

- Cash management and banking

- Accounts payable and receivable

- Inventory

Reasons To Buy

- The invoicing tools are good

- The dashboard is intuitive and easy to use

- It supports estimates, quotes, and invoices

Reasons To Avoid

- It does not offer project or time tracking

9. NeatBooks – Best for Accounts Receivable-Only Accounting

Pricing:$36 per month

NeatBooks can help you download all the transactions from your online bank account and sort them into categories. It can help you reconcile your transactions so you know everything coming in and going out of your business. You can also use the software to generate customizable reports, send invoices, and access the reconciliation tools.

Key Features

- Transaction management

- Reporting and reconciliation

- Mobile access

Reasons To Buy

- It offers customizable reports

- There are multiple ways to upload transactions

- The user experience is excellent

Reasons To Avoid

- It is expensive

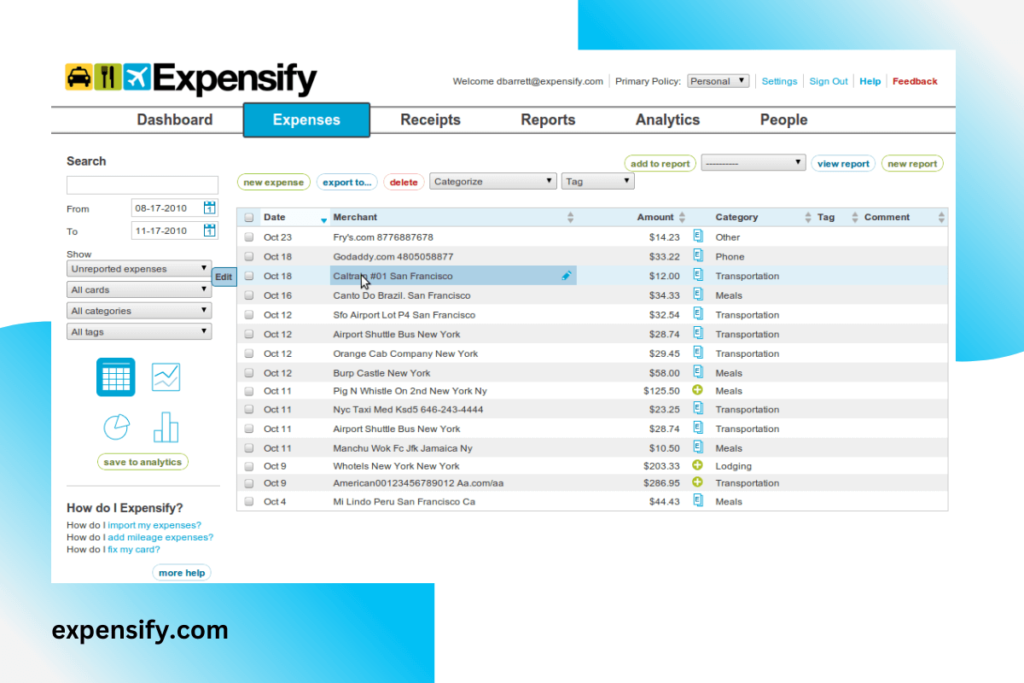

10. Expensify – Best for Tracking Receipts

Pricing:Starts at $4.99 per month

If you are looking for the simplest accounting app to use, it doesn’t get better than Expensify. However, it only has one aim: to enable you to track all your receipts from one place. You can use the app to categorize expenses, capture receipt images, save transaction details, and more that will help you run your business.

Key Features

- Third-party integrations

- Reporting

- Receipt tracking

Reasons To Buy

- Simple to use

- You can add entries for hours and mileage worked

- You can turn the expenses into PDF files or emailable reports

Reasons To Avoid

- It does not offer auto-calculations of quarterly taxes

11. ZipBooks – Best for Professional Accounting Help

Pricing:Starts at $125 per month, and Starter Plan is free

ZipBooks will enable you to automatically pull transactions, edit expense details, and connect your credit card and bank account. You can use your mobile to capture receipt images and then upload them to ZipBooks for ease of use. Besides that, you can also use it to create and send invoices for a complete accounting solution.

Key Features

- Mobile app

- Bank account reconciliation

- Tax preparation

Reasons To Buy

- A professional accounting solution

- You can connect your bank account

- Upload the receipts to ZipBooks

Reasons To Avoid

- It does not offer a complete solution for inexperienced bookkeepers

Frequently Asked Questions

What is the difference between QuickBooks and Quicken?

The main difference between QuickBooks and Quicken is that Quicken emphasizes the finances of families and individuals. On the other hand, the main emphasis of QuickBooks is on small businesses. Besides that, Quicken also offers local software that you can access on your computer.

However, QuickBooks offers an online version of the software so that businesses can easily use it with convenience. Of course, the pricing and plans of these solutions are also different. Self-employed individuals and entrepreneurs can use QuickBooks, while Quicken is ideal for individuals or families.

How do I keep track of income when self-employed?

The least you can do to keep track of income when you are self-employed is you can categorize all your receipts in one folder. Besides that, you must also note all your expenses so that you don’t face any problems during tax season. That is why the best accounting software is ideal to have.

These platforms can help you track your expenses and income to reconcile them for tax purposes. Besides that, it will also help you manage your money better to take care of the business. So, check out the accounting software for the ideal solution for tracking income.

Do I need an accountant if self-employed?

Thanks to technology, you don’t need an accountant if you are self-employed. Instead, you can invest in the best accounting software for self-employed that will offer you such services at a fraction of the cost. In addition, these platforms are easy to use and offer advanced functionalities for a comprehensive solution.

Of course, the platform you select depends on your preferences, budget, and others. So, be sure to go through all platforms and select the one that suits your business or self-employed situation in the best way possible.

What is the easiest bookkeeping software?

There are many easy bookkeeping software you can use for your business. These include ZipBooks, QuickBooks Online, and many others. But, of course, the one that is best for you will depend on what features you want from the bookkeeping software.

Many of them also offer free plans and trials. You can opt for them and then decide if the software is easy to use for you. Once you find one, you will get the most use out of it for a long time.