Upfront Conclusion

The best accounting software for woodworkers right now is Freshbooks and Sage.

6 Best Accounting Software for Woodworkers

- Freshbooks – Best for Client Loyalty

- Sage – Best for Tracking Cashflow

- Intuit Quickbooks – Our #1 Favorite

- Top Notepad – Another Great Choice

- WaveApps – Best for Accepting Payments

- Neat – Best Accounts Receivable

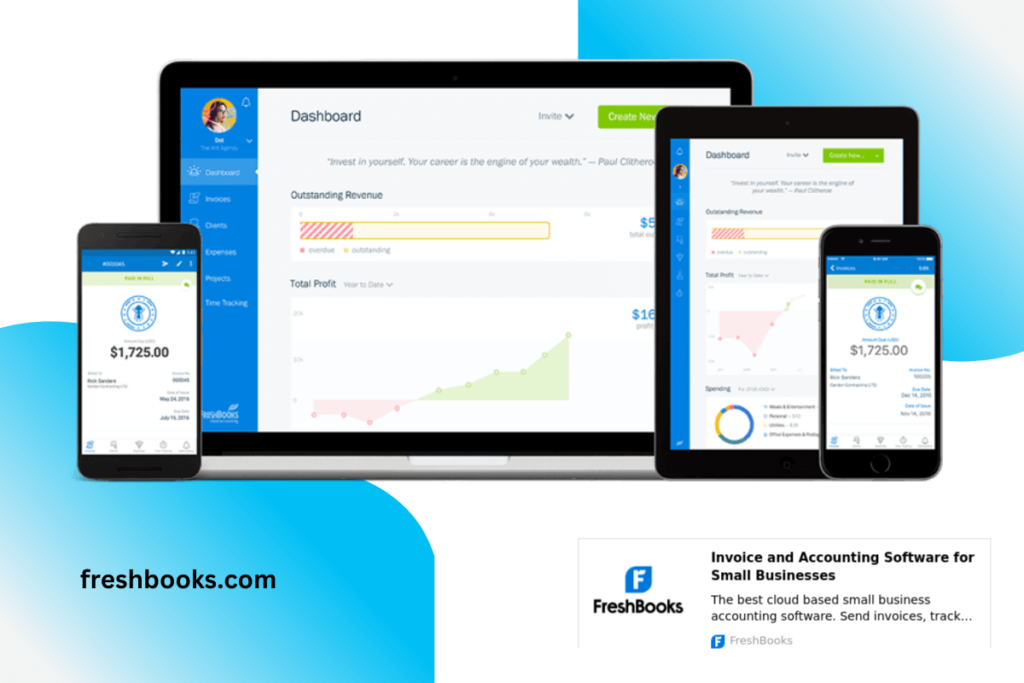

1. FreshBooks – Best for Client Loyalty

PRICING: From $6/month

Mike McDerment founded FreshBooks as an alternative to existing accounting strategies. His goal was to alleviate difficulties and help small business owners. The company started in 2003. It’s currently based in Ontario, Canada. FreshBooks has grown to accommodate users from around the world. It is available in 12 languages and caters to the needs of SMBs.

KEY FEATURES:

- Client management software helps to develop loyalty and keep them coming back.

- Mileage tracking accounts for transportation expenses, whether you bill for them or not.

- Receipt and invoice scanner. When it’s tax time, all the data is accumulated in one easily accessible place.

- Online client portal where clients can communicate and access records.

REASONS TO BUY:

- FreshBooks offers a full spectrum of accounting services. Balances, accounts payable, ledgers, and expenses can all be tracked.

- FreshBooks allows you to accept payments online and through the app. Get paid with major credit cards, PayPal, or Stripe.

- The software is cloud-based and can be accessed anywhere.

REASONS TO AVOID:

- FreshBooks doesn’t allow a lot of customization. If you prefer to design your own templates, you may be frustrated by the limitations.

- The credit card fees can be high.

2. Sage – Best for Tracking Cashflow

PRICING: From $10/month.

Graham Wylie, David Goldman, and Paul Muller founded Sage in 1981. The company headquarters are based in the UK. Sage originally developed accounting solutions back in the 1980s. These accommodated the needs of businesses of the time. As companies embraced new technology, Sage updated alongside them. Sage now has locations across the globe. There are Sage offices in the United States, Canada, South Africa, and France.

KEY FEATURES:

- A mobile app lets you track records wherever you go.

- The receipt photo option saves and documents all expenses and payments.

- Payment processing lets you take credit cards. It also allows you to accept payments in different currencies if you sell to people outside your country of residence.

REASONS TO BUY:

- Sage keeps track of all your payments and expenses. You can easily create invoices based on the stored information, without having to search old records. Sage’s receipt snapper lets you show how and where you spent money.

- The payment processing feature is a great resource for a craftsman who travels or sells online. Payments can be made in a variety of popular currencies and with different online methods. This is a very strong feature for woodworkers who sell on eBay, Amazon, or other online marketplaces. It’s also useful if you work for clients overseas.

REASONS TO AVOID:

- Sage is aimed at mid-sized and larger businesses. Although individuals can use it, Sage may be overly complex for small business needs.

- The UI is a bit outdated and may lack the features some companies expect. Although simple to learn, the dashboard can feel clumsy.

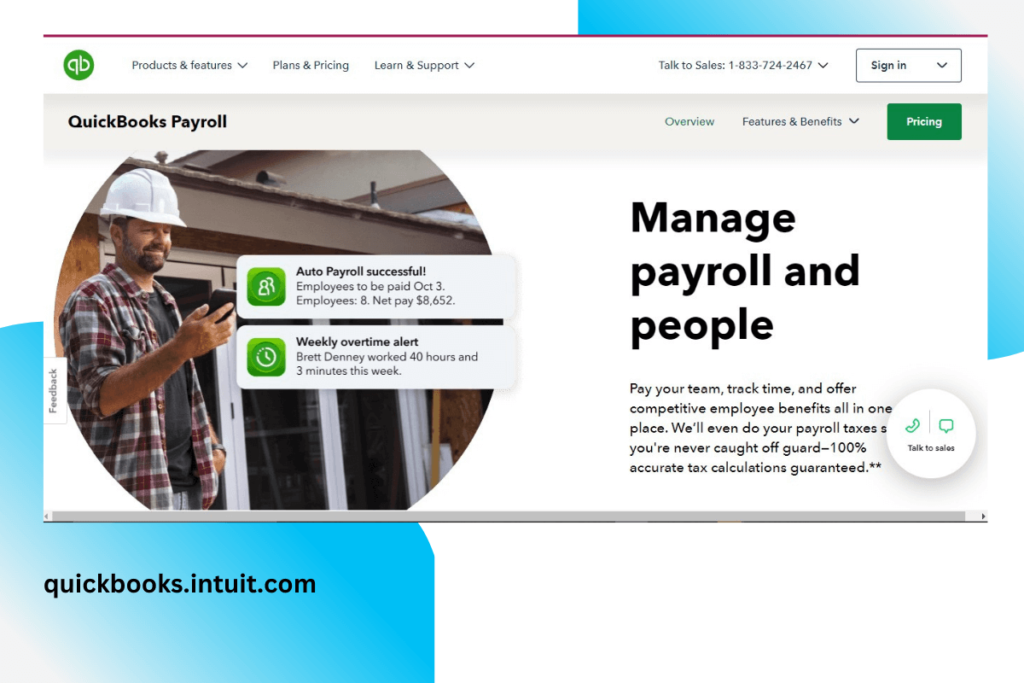

3. Intuit QuickBooks – Our #1 Favorite

PRICING: From $12.50/month.

Intuit QuickBooks has been a small business favourite for many years. Whether you’re an entrepreneur, a contractor, or a solo craftsman, you’ve probably heard about it. Intuit was founded in 1983. Tom Proulx and Scott Cooke developed the company. The brand is known for providing many financial services. This includes their popular Turbo Tax program. QuickBooks has consistently ranked #1 for small business accounting. The strong performance and glowing reviews make it our top choice.

KEY FEATURES:

- Job costing and profitability reports show you which types of jobs make money and which aren’t worth it.

- The inventory manager lets you know what you have on hand.

- Photograph receipts for easy storage and accounting. The organizer files them so you’re not scrambling for paper receipts at tax time.

- Payroll and tax deduction software.

REASONS TO BUY:

- QuickBooks makes it easy to account for all your expenses in one location. It charts gas mileage, drive time, inventory costs, and more. You get a fuller picture of how much you really earn on a job.

- Freelancers, contractors, and individual business owners will find QuickBooks has everything they need. Small business owners can get everything done with the software.

REASONS TO AVOID:

- Intuit QuickBooks is intended for small and mid-sized businesses only. It works well for individuals and companies with a few employees. Larger businesses likely won’t find it sufficient.

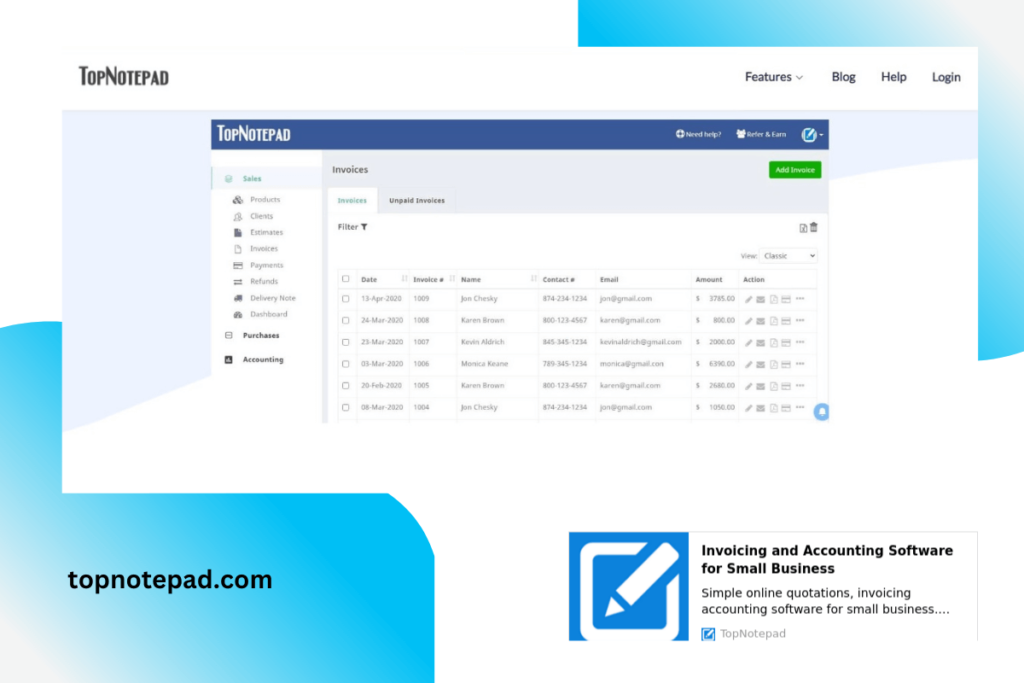

4. Top Notepad – Another Great Choice

PRICING: From $12.50/month.

Top Notepad is designed to work for individuals without strong accounting backgrounds. It can be used by woodworking professionals who don’t have a lot of technical experience. The company is based in India. Top Notepad’s founder is Mahesh Kumar Soni. He launched the software in 2015.

KEY FEATURES:

- A range of predesigned templates for invoices, quotes, and other business documents.

- The profit tracker accounts for expenses such as shop rental, tools, utilities, and drive time. You can see what you’re actually earning. You can also focus on reducing or eliminating significant expenses that cut into your profits.

REASONS TO BUY:

- Top Notepad has personalized solutions uniquely for the woodworking industry. You won’t have to make generic options fit your business.

- The solutions offered to make your company look more professional and get you more jobs.

- Top Notepad allows you to accept additional forms of payment, such as Paypal.

REASONS TO AVOID:

- Top Notepad lacks some of the more advanced features some businesses seek.

- The user guide is not especially well-written. It can be confusing to understand and make lack clarity. There is not much support offered.

5. WaveApps – Best for Accepting Payments

PRICING: Prices vary based on the services request, please contact.

Kirk Simpson founded Wave intending to support very small businesses. His focus remains on companies with 1-9 employees. He launched Wave in 2009. Originally, it was a double-entry accounting tool. Now, the app offers a variety of useful small business accounting tools. Wave is based in Toronto, Ontario, Canada. The company is currently owned by H&R Block.

KEY FEATURES:

- Bank and credit card connections let you funnel payments and pay expenses with ease.

- Wave sends out reminders for unpaid invoices so you don’t spend time tracking down payments.

- The cloud-based or downloadable app lets you choose your style.

REASONS TO BUY:

- Wave promises frequent upgrades and new features. Getting started now will enable you to make the most of new features when they arrive.

- The company handles all payroll and tax features so you can concentrate on woodworking and management. In some states, the company can compile and file business taxes for you.

REASONS TO AVOID:

- WaveApps is intended for very small businesses only. It’s best used by individuals and companies with only a few employees. It might not suit the needs of all SMBs. It won’t be sufficient for the enterprise.

- Payment percentages can be quite high. American Express charges are 3.4% of the transaction plus the base fee. Payroll features are also expensive.

6. Neat – Best Accounts Receivable

PRICING: $430/year.

Danielle Kleinrichert came up with the concept of Neat while working at a family-owned restaurant. Her goal was to create software that helped small businesses effectively manage accounts. Neat started in 2015. The software is primarily aimed at consultants and freelancers. However, some small businesses also use Neat.

KEY FEATURES:

- Vendor mapping lets you categorize vendors by the department. You can see how much of your money is going into particular areas or for certain kinds of expenses.

- Data importer lets you input receipts, statements, invoices, and more.

- Clear, concise invoice creator.

REASONS TO BUY:

- Neat automatically interpret information based on the documents you provide. It automatically applies this data to your records, so you don’t need to spend time on paperwork.

- The software helps you match data to bank transactions, so you aren’t hunting for information on where your money went.

REASONS TO AVOID:

- Neat only offers accounts receivable. It doesn’t come with other important features such as accounts payable, inventory management, or customized tax forms.

- Neat is considerably more expensive than some alternatives. It may not fit in the budget of a very small business.

FAQ

Why do woodworkers need accounting software? What’s wrong with handwritten notes or Excel?

A. Many small business craftsmen rely on traditional accounting methods. This can mean inputting data on a spreadsheet or even toting up figures with a calculator and a pen. However, those methods aren’t very effective. Data can easily get lost or be miscalculated. With accounting software, most of these risks are eliminated. Information is carefully and accurately compiled. Most software options store your data in the cloud, where it won’t get lost or misplaced. You won’t have to worry about checking and re-checking notes and calculations. Accounting software also helps you better evaluate how much you’re really earning from your work. You may not remember to factor in small expenses or delays, but the software will. In many cases, it will take the information directly from receipts, checks, and invoices. It will automatically assign the expense to the right job or client. You’ll be able to provide a more accurate itemized bill to the client. You’ll also find out exactly how much you spent on the job. This helps you determine the kinds of jobs or the clients who are most profitable for you. Accounting software adds professionalism, too. Custom invoices and online payments give your company more respect.

How does this software help me at tax time?

A. Tax time is difficult for many working people. Fortunately, accounting software can be a solution. Most options store your records so you can easily access them at tax time. You won’t be scrambling to find invoices, cancelled checks, or old receipts. All your data will be in one convenient place, already sorted by category or keyword. You can easily determine expenses, deductions, and income with this data. Some options also communicate directly with your bank. They may even let you scan tax records and documentation. A few, like QuickBooks, can input the information right into online tax forms for you. You’ll more easily qualify for work-related expense deductions such as transportation and tools.

How do I choose the right accounting software for me?

A. When buying new software, make sure you understand your goals. You’re probably buying because you need more organization or want to simplify your accounting process. There are also many others to buy this kind of software. Pull together a list of goals. For instance, you might want something that manages your inventory and alerts you when you need to reorder supplies. Or, you might want software that automatically bills clients for drive-time or gas expenses. Perhaps you want to be able to store vendor or client information to improve relationships. All these things are possibilities. Consider other important factors as well. These include your budget and your familiarity with computer software. Some solutions are very simple and easy to learn, even if you’re not very technical. Others have advanced and very useful features, but you need the know-how to take advantage of them. Consider free trials so you get a feel for how the software performs. You can also arrange a consultation or phone call with support staff before ordering.

RELATED: Top Graphic Designers Accounting Tools | Accounting Tools for Artists | Accounting Tools for House Flippers