Upfront Conclusion

The best accounting software for artists right now is FreshBooks and Zoho Books.

As an artist, you are likely far more inspired to pursue creative projects than you are to generate financial reports. However, if you are serious about pursuing your passion for art and creativity as a career, finding the right accounting software for your creative business can make bookkeeping and accounting tasks feel less like a complicated chore and more like an empowering way to track your growth and success.

With so many options for accounting software, we’ve compiled a list of the top 7 best accounting software solutions for artists so you can spend less time on paperwork, and more time doing the work you love.

Top 8 Best Accounting Software for Artists

- FreshBooks – Best Artist Accounting Software for Collaboration

- Zoho Books – Best Artist Accounting Software for Scaling Your Business

- Sage Accounting – Best Artist Accounting Software for Multiple users

- Bonsai – Best For Managing Income And Expenses

- QuickBooks Self Employed – Best Artist Accounting Software for Tax Savings

- Wave – Best Artist Accounting Software for New Businesses

- FreeAgent – Best Artist Accounting Software for Project Estimates

- Xero – Best Artist Accounting Software for App Integration

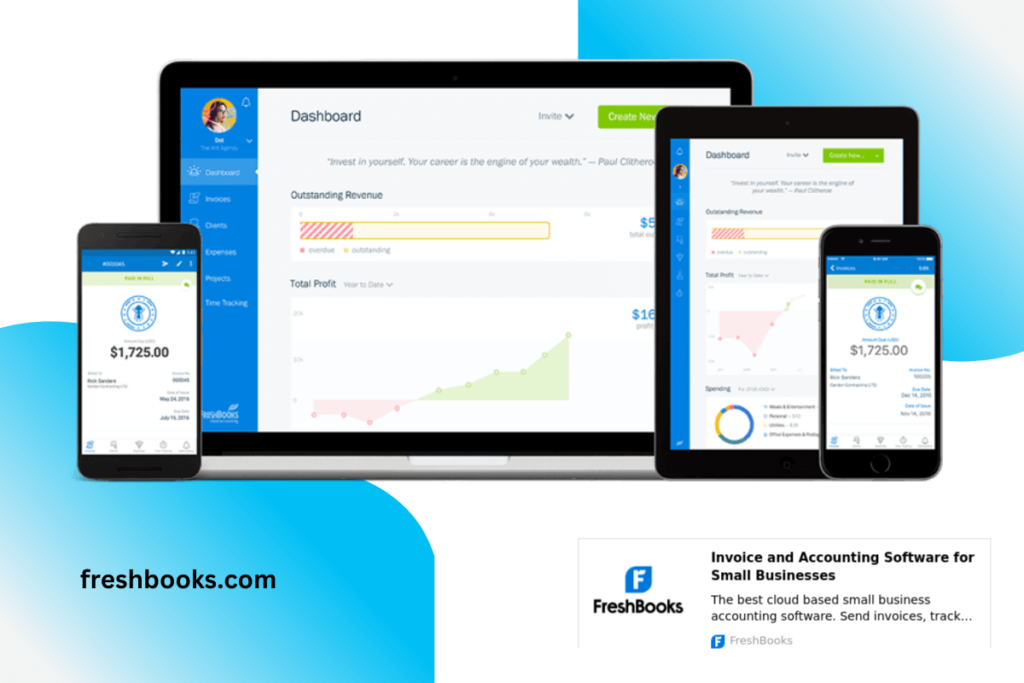

1. FreshBooks – Best Artist Accounting Software for Collaboration

PRICING: Plans start at $15/month after a free 30-day risk-free trial

FreshBooks accounting software for artists helps you send invoices to clients quickly and easily, keep track of billable hours down to the second, and collaborate with clients by sending sketches and digital assets all in one space. Professionally communicate your creative brand as an artist with polished, customizable estimates, invoices, and thank-you emails. FreshBooks accounting software supports your creative business from first initial concept to final project delivery.

KEY FEATURES:

- Excellent collaboration tools

- Track billable hours for accurate time logs and detailed productivity insights

- Create and customize fully branded estimates for project scope and cost

REASONS TO BUY:

- Highly customizable for maintaining brand consistency

- Well-rated and reliable customer support

- User-friendly dashboard with an easy to navigate interface

REASONS TO AVOID:

- Lacking enterprise-grade capacity – not suitable for larger, more complex creative businesses

- Mobile app doesn’t allow you to access all reports

- No bank reconciliation features or accountant access in lowest-tier plan

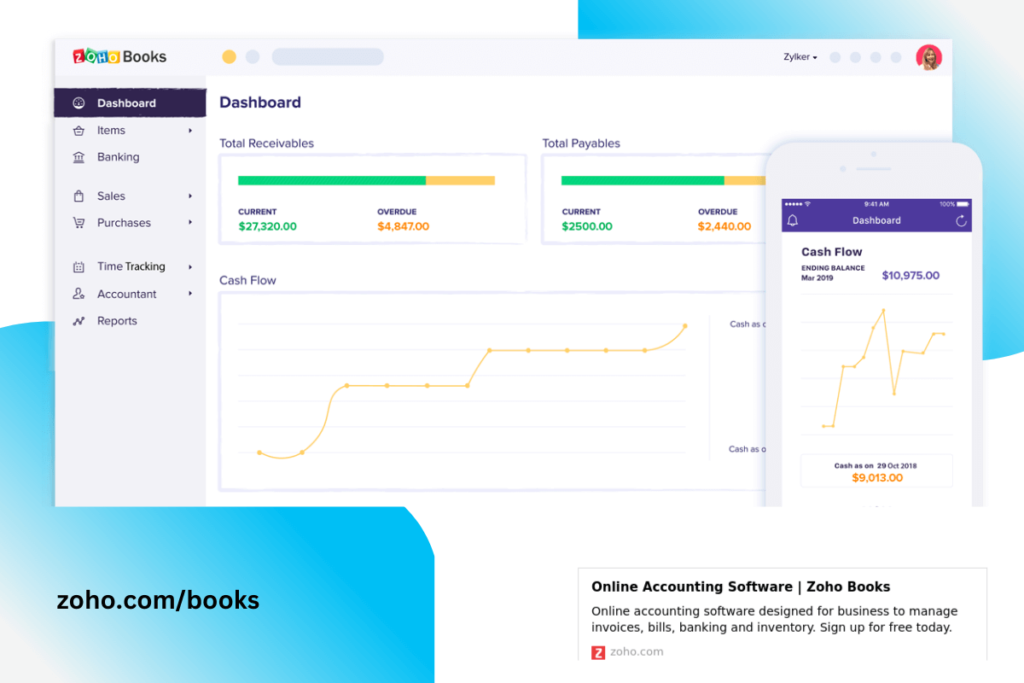

2. Zoho Books – Best Artist Accounting Software for Scaling Your Business

PRICING: Free, limited-feature version available for businesses with annual revenue less than $50,000; standard plan starts at $10 per month after a 14-day free trial

Zoho Books is part of a full suite of business applications created by Zoho that includes CRM solutions, e-mail hosting, project management tools, and inventory tracking. If you are artist with an established business and are looking to scale with the support of additional features and software, Zoho Books might be a great choice for you to synthesize your business operations using the Zoho suite of apps.

KEY FEATURES:

- Create customized invoices and accept payments online

- Share, collaborate and deliver in the client portal

- Create project quotes and convert them into invoices

REASONS TO BUY:

- Highly functional mobile app

- Modern, clean user interface and navigation

- Numerous guidance tools, educational and self-help resources

REASONS TO AVOID:

- No payroll functionality

- Customer service is slow to respond

- Not all banks currently supported for linking

3. Sage Accounting – Best Artist Accounting Software for Multiple users

PRICING: Sage Accounting Start costs $10 per month and Sage Accounting costs $25 per month.

Sage Accounting is a cloud – based accounting software suitable for artists. Sage Accounting provides necessary bookkeeping and accounting functions, thorough reporting, and inventory management with two reasonably priced plans to select from. With the Sage Accounting plan, you may invite multiple users to your account and give them one of five user roles. You can receive an email notification from your professional bookkeeper or accountant if they sign up for Sage Accounting Accountants Edition and send it to you via their account. Your accountant will have total access to the information in your Sage account after you accept the invitation.

KEY FEATURES:

- Inventory management

- Invoicing

- Finance management

- Third-party software integration

REASONS TO BUY

- Free trial.

- Double-entry accounting.

- Affordable monthly costs.

- Inventory tracking and comprehensive reporting.

REASONS TO AVOID:

- Time tracking is not included in the two plans.

- User interface is outdated.

4. Bonsai – Best For Managing Income And Expenses

PRICING: The starting package will cost you $24 per month

Bonsai is used by many artists to manage their income and expenses. The time tracker will allow you to understand the time you spend on each project. You can use the billing hours to charge your customer accordingly and ensure your business does not suffer any losses.

Keeping track of your expenses will also be a breeze with the expense tracker. The best thing is that the software will help you compare these values by displaying them on a single graph. You will also be able to see how much you have earned after paying all your fees.

KEY FEATURES:

- Grow your business by saving money on deductible expenses

- Use invoicing feature to send authentic receipts to clients

- Bill customers by updating them through the client portal system

- Prepare yourself for tax season by using a Tax Assistant add-on for only $10 extra per month

- Offer an accountant access to your Bonsai account on Business packages

- Work on unlimited projects and clients even with the Starter plan

REASONS TO BUY:

- Easy to use

- Organized dashboard for managing different tasks

- Separate trackers for income, expenses, and other payments

- Enhance the security of your books by integrating Bonsai with other apps such as QuickBooks

- You don’t have to use a separate platform for chatting with clients

- Get new customers easily by sending them excellent proposals

- The platform lets you add additional seats if you have a large artist team

REASONS TO AVOID:

- Integrations are available on Professional and Business packages only

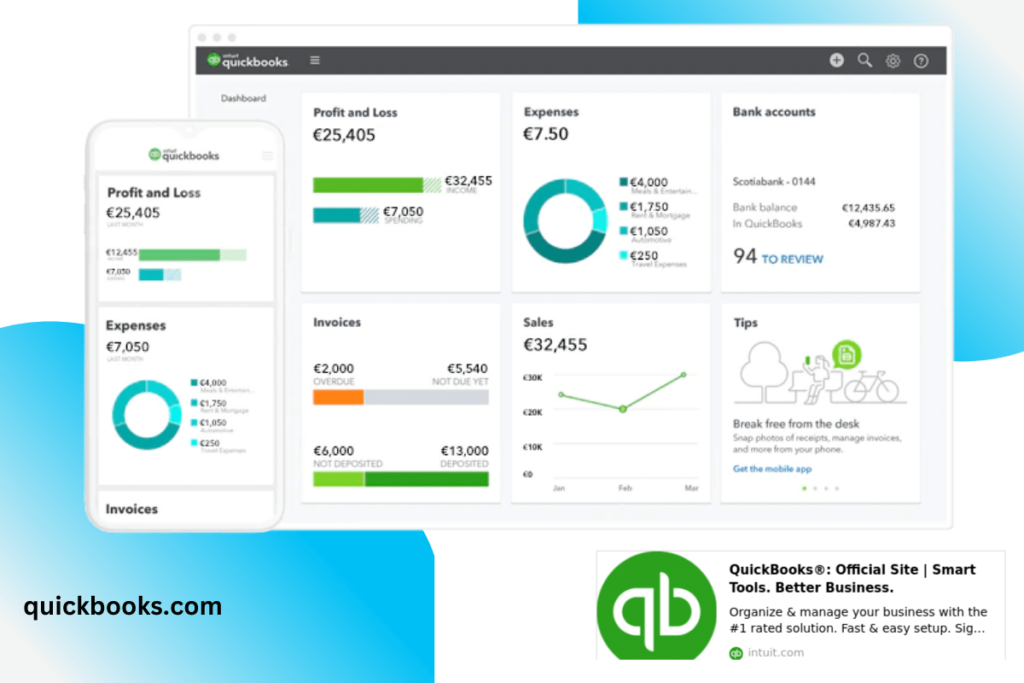

5. QuickBooks Self Employed – Best Artist Accounting Software for Tax Savings

PRICING: $15 per month after free 30-day trial

Since QuickBooks and TurboTax are both owned by Intuit, both products work wonderfully together at tax time saving you days worth of tedious calculations and manual data entry. According to their website, QuickBooks Self-Employed customers find an average of $3,906 in tax savings per year. Whether you are an independent contractor, freelancer, or sole proprietor within your creative business, QuickBooks Self Employed offers tools and resources for you to find work-life balance and stay on track – all while maximizing tax savings.

KEY FEATURES:

- Integrate with Intuit TurboTax to seamlessly transfer financial data come tax time

- Log and track mileage with the QuickBooks mobile app to further maximize tax deductions

- Sort business and personal transactions so you can deduct every eligible expense

REASONS TO BUY:

- Added features and integrations to save on taxes

- Access to QuickBooks Assistant for instant guidance and how-to’s

- Video tutorials, webinars, and articles available to help you learn

REASONS TO AVOID:

- Not suitable for larger businesses with employees or contractors

- Does not offer balance sheet reporting or inventory tracking

- Limited invoicing capabilities – cannot customize or set up recurring invoices

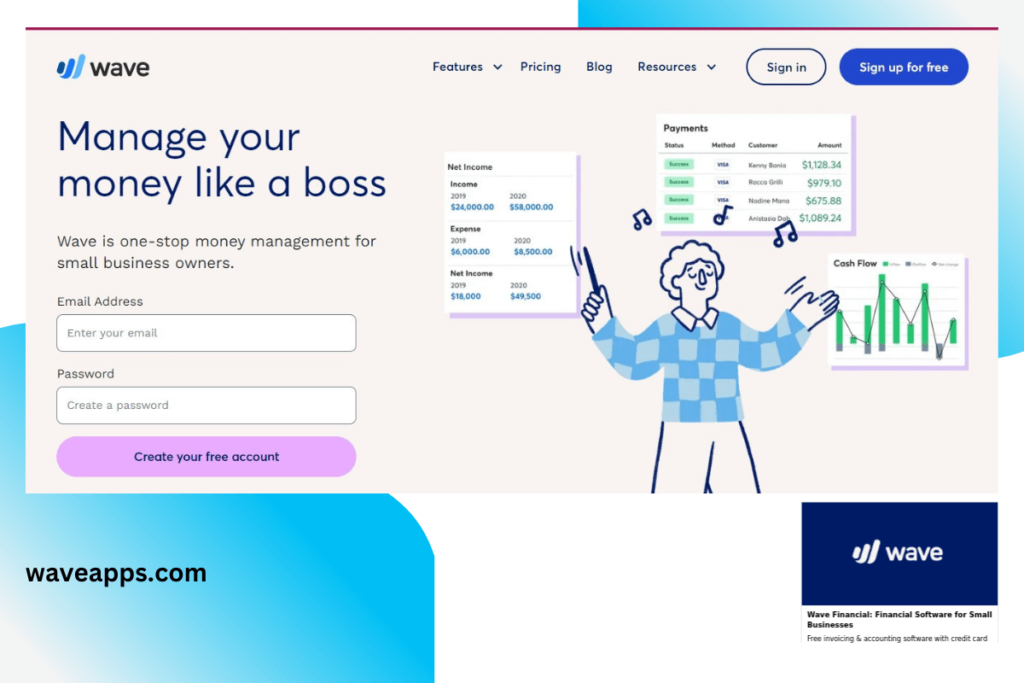

6. Wave – Best Artist Accounting Software for New Businesses

PRICING: Free for accounting, invoicing, and expense tracking; $20/month plus $4/employee or contractor for payroll

Wave is a free, cloud-based accounting software solution for artists who are in the beginning stages of their journey as creative professionals and business owners. Additional features such as payroll, payment processing, and professional bookkeeping services are available to be added to your account for additional fees. If you are running your new creative business on a budget, Wave has no hidden fees or contracts in place, and doesn’t require than you purchase expensive add-ons to serve as fully-functioning software for accounting, bookkeeping, and invoicing – it is genuinely free to use.

KEY FEATURES:

- Third-party integration with Zapier for additional business tools and applications

- Unlimited bank and credit card connections

- Automatic exchange rate calculations

REASONS TO BUY:

- Free to use

- Extremely fast setup with no training required

- Run multiple businesses in one account

REASONS TO AVOID:

- Additional features only support up to 9 employees

- Recurring invoice numbers are not consecutive

- Customer service limited to bot chat and e-mail

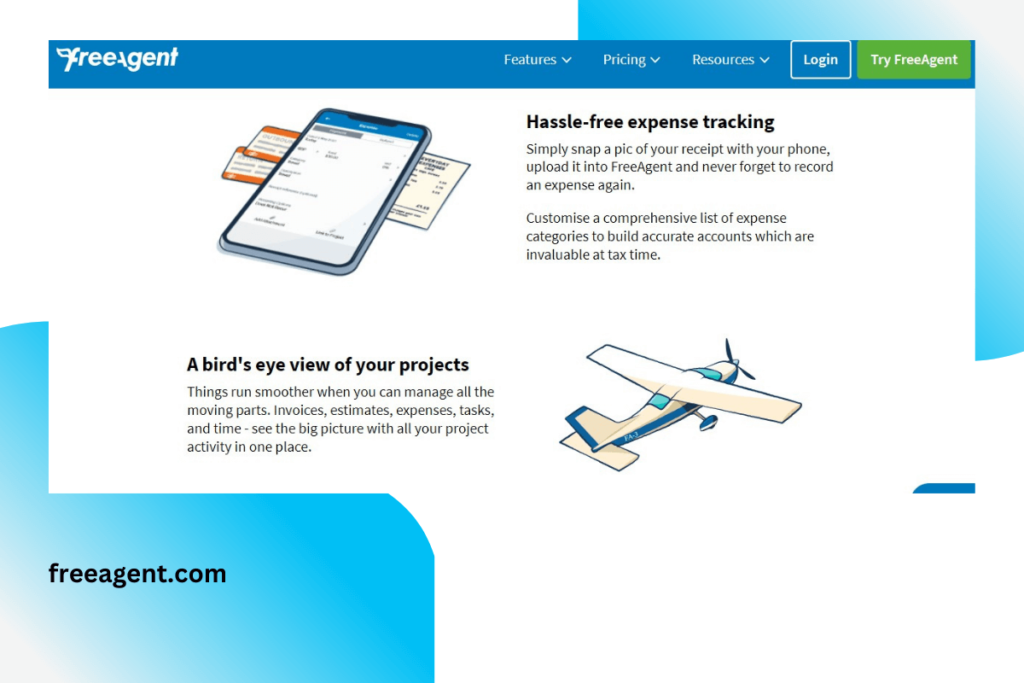

7. FreeAgent – Best Artist Accounting Software for Project Estimates

PRICING: $12/month for the first 6 months, then $24/month

FreeAgent is an award-winning online accounting software made specifically for freelancers, small business owners, and their accountants. It has enhanced functionality for creating project estimates, so if you are an artist that works on a larger and more complex project-basis with clients, FreeAgent could be the perfect accounting software for your creative business.

KEY FEATURES:

- Send project estimates and invoices

- Record time with built-in stopwatch or smart timesheets

- Personalized “Tax Timeline” of upcoming deadlines and amounts due

REASONS TO BUY:

- Ability to anticipate income and potential future profits with estimates

- Recurring invoices with automated reminders for easy payment

- Clear, straight forward user interface and design

REASONS TO AVOID:

- Limited app integration

- Mobile app is limited

- Receipt numbering is not automatic

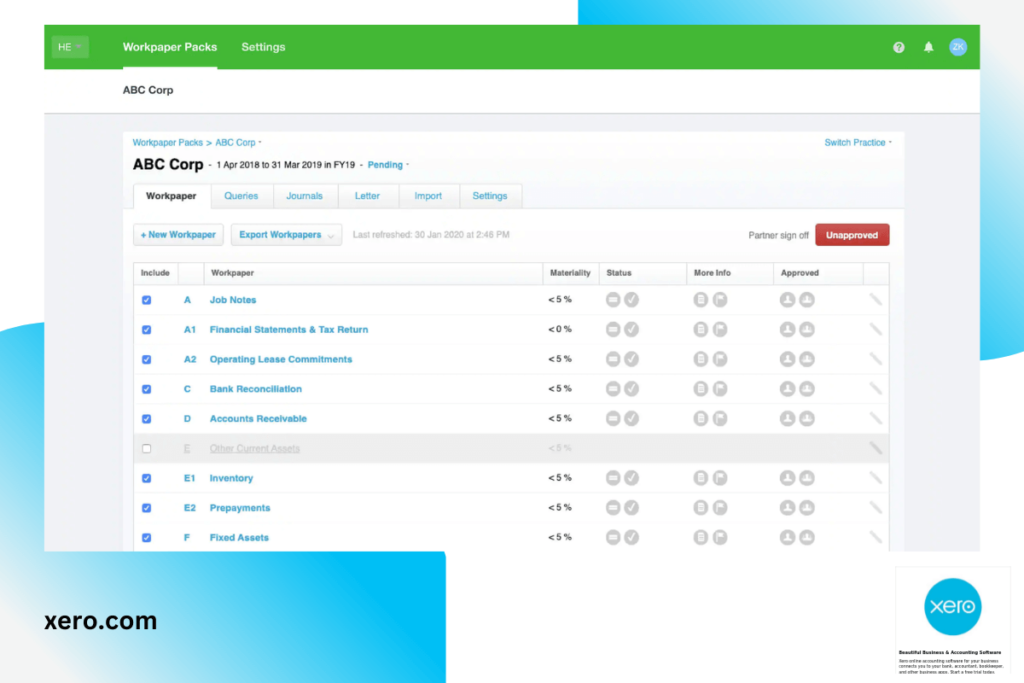

8. Xero – Best Artist Accounting Software for App Integration

PRICING: Plans start at $12/month after free 30-day trial

Xero is a cloud-based accounting software for small business owners that allows you to collaborate with your accountant or bookkeeper from anywhere. It offers over 1,000 available apps in the Xero App Marketplace and over 300 connections to banks and financial service providers. Xero is a well-developed software with extensive capabilities, and would make a good option for you if you are an artist with an established, mid-to-large-sized business.

KEY FEATURES:

- 1,000+ small-business app integrations

- Budget manager for tracking financial goals

- Advanced customer and client management organization tools

REASONS TO BUY:

- Add unlimited users to your account on any subscription tier

- Full reporting included on all subscription levels

- Small learning curve to use efficiently, includes online courses and webinars to help get you set up

REASONS TO AVOID:

- No live phone support

- Low limits on bills and invoices in the entry-level plan

- Limited tax support

Frequently Asked Questions

What is considered a professional artist?

Being an artist can be considered a profession if your creative pursuits are carried out in a businesslike manner and you intend to profit from the sale of your artwork. If you rely on the income you generate from selling your artwork to cover the cost of living, or consistently plan to increase your profitability, then you are classified as a working professional artist who pays taxes on their work and can deduct expenses incurred from running your business. Defining who and who isn’t a professional artist is important for identifying qualifications and eligibility for studio space, funding, and tax considerations.

Is being an artist self-employed?

Freelance artists are self-employed, and they are hired by multiple clients to create art or creative projects on a per-project basis. You are your own business and must handle your own finances and taxes with the help of an accountant or appropriate accounting software catered specifically to artists, freelancers, and self-employed small business owners. As a self-employed artist, you are are responsible for creating project estimates, invoicing clients, and keeping a close eye on both your income and expenses.

How do artistic skills make money?

There are plenty of creative ways to make money as a professional artist by using your artistic skills. Whether you are an illustrators, graphic designers, photographer, or other creative professional, you can make a profit and earn a living from your artistic skills by selling art prints of your work, starting a print-on-demand art brand, selling digital stock artwork, offering commission jobs, working on freelance projects, teaching art online, creating a book, entering art contests, applying for grants, and starting a crowdfunding project to raise money for your next creative project.

RELATED: Accounting Software Best For Homeowners | Top Accounting Tools For Financial Advisors | Midsize Company Accounting Software