RELATED: Accounting Tools Best For Ecommerce | Insurance Agency Accounting Software | Accounting Tools Best In India

What kind of images come into your mind when you think about owning a bar? Mixing delicious cocktails, pouring pints of beer, talking with customers about their day, or picking a playlist to get everyone moving might be a few. Bars, like all business, must work on their accounting to ensure that they are maintaining a healthy cash flow. We have put together a list of accounting software to help you manage your bar’s finance just a little easier, so you can get back to enjoying what you do best!

Upfront Conclusion

The best accounting software for bars right now is ZipBooks and Lightspeed Accounting.

Top 5 accounting software’s for bars.

- ZipBooks – best for insights and analytics

- Lightspeed Accounting – best for streamlining your operations

- Kashoo – best for small business owners

- Zoho Books – best for automation

- Tipalti – best for large, growing businesses

1. ZipBooks – best for insights and analytics

Pricing: free for a basic account, $15 and $35 a month options available

ZipBooks is an accounting software to help business owners simplify their accounting needs and offers analytics about the financial position of your bar to help you improve performance. The software allows you to track all your income and expenses, and the more you follow, the more insights you get back. For example, ZipBooks will make suggestions regarding how to get paid quicker, how to reduce your costs and how to ensure your customers are returning to your bar.

Key features:

- Track all your transactions, expenses, and payments

- Customize invoices and add your branding

- Set up automated reminders to be sent several days after an invoice is due

- Manage a database of customers

- Benefit from data and analytics about the financial position of your business and suggestions on how to improve performance

Reasons to buy:

- The most premium package is affordable, but you can try it out for free initially

- It is easy to use, and the design of the software is clean and user friendly

- The software will make suggestions using analytics to improve your financial position

- Manage payments, expenses, and income

- Send out personalized, on-brand invoices

Reasons to avoid:

- There is no option for tailored support from a ZipBooks professional

- No payroll features

- Little opportunity for integration with other software

- The simplicity of the software makes it more ideal for smaller to medium-sized bars rather than large bars that may have multiple locations

2. Lightspeed Accounting – best for streamlining your operations

Pricing: starting from $39 per month

Lightspeed Accounting is a one-stop-shop software for the hospitality industry, ideal for bars that want to combine day-to-day operations with financial planning. Lightspeed Accounting offers accounting tools to help you manage your cash flow, as well as products that enable you to enter orders into the system, open tabs, and split bills for customers. Lightspeed is available on desktop, mobile, and tablets so that you can use the tools on the go.

Key features:

- Integrates with other accounting software

- Automated sales report each day

- Track revenue from multiple locations

- Notifications when any potential errors have occurred

- Take orders and process payments

Reasons to buy:

- 24/7 unlimited support, plus free onboarding sessions and access to free guides

- Integration with other software plus POS and restaurant hardware integration

- Great for larger bars who that have expanded to more than one location

- Take customer orders, use QR codes for contactless ordering and display digital menus to reduce printing costs

Reasons to avoid

- It is a complex software with lots of integration with other software

- For the professional package with all the features, the price increases to $289 per month

- If you are a small business, there may be too many unwanted features

3. Kashoo – best for small business owners

Pricing: starting from $20 per month. There is a rree monthly version available

Kashoo is accounting software designed specifically for small businesses. Ideal for bars that have just started and are looking to understand how accounting works. Kashoo connects to over 5000 banks and credit unions to help you manage your income and expenses. The software has packages for small of bars, and those who are looking to grow.

Key features:

- A free monthly version called Truly Small Invoices

- Send invoices and accept payments

- A $20 per month package called Truly Small Accounting allows for more in-depth tracking of finances

- Reporting and analytics tools

- Manage inventory, payroll, and projects

Reasons to buy:

- New entrepreneurs can learn more about the process of accounting

- Can upgrade packages as your small business grows

- Easy to send invoices and make payments

- Connects to banks worldwide

- Easy to upload digital copies of paper receipts

Reasons to avoid

- Reporting is only available with the paid packaging

- The software is straightforward, so maybe not ideal for larger businesses

- No 1-2-1 support or online chat

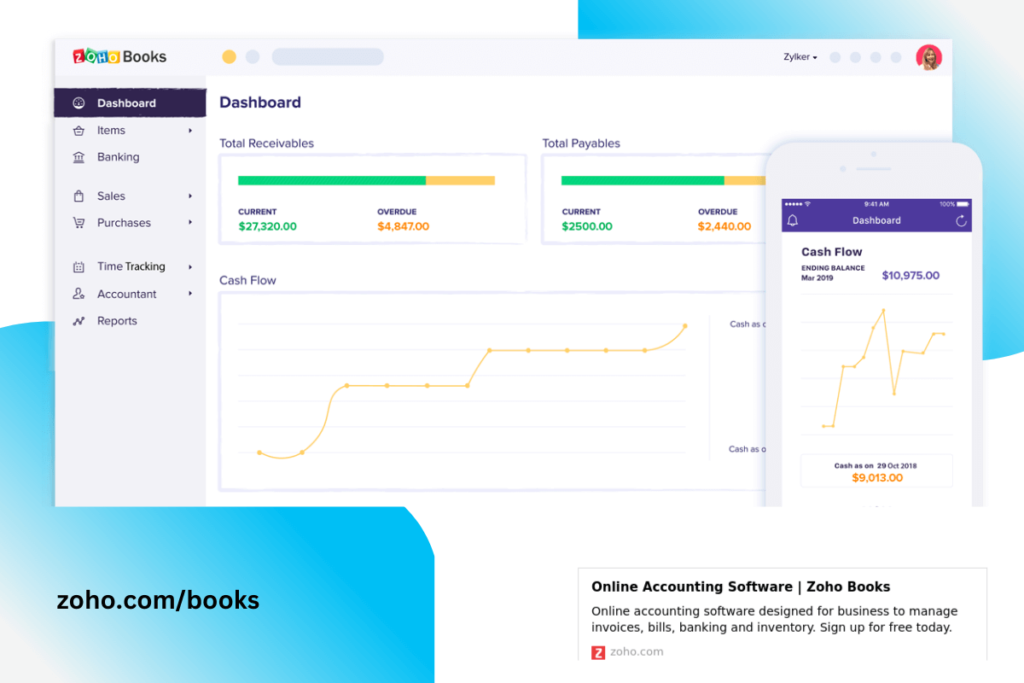

4. ZohoBooks – best for automation

Pricing: starting from $15 per month. Free package available for businesses with revenue <$45,000 per annum

ZohoBooks is online accounting software that can be used on desktops, iPhones, and Android devices. It allows business owners to manage their finances more easily through automated tools. For the more repetitive tasks that a bar owner needs to do, such as sending recurring invoices, sending payment reminders, and billing customers, ZohoBooks will automate these tasks for you, so you don’t have to worry about remembering to do them.

Key features:

- Manage invoices, expenses, and bills

- Extensive support is available in the form of FAQs, guides, videos, as well as email and telephone with a professional

- Use automation to save time and avoid repetitive tasks

- Links to your bank accounts

- Project management and workflow tools included

Reasons to buy:

- Improve time management with automation

- Try it for free up until your business earns more than $45,000 in revenue

- The premium package offers 50% off for the first 12 months

- Manage invoices and payments at the same time as projects

- Easily convert your purchase orders into a bill with one click

Reasons to avoid:

- No payroll integration outside of the US, which may be difficult for larger businesses with lots of staff

- Only integrates with other Zoho products

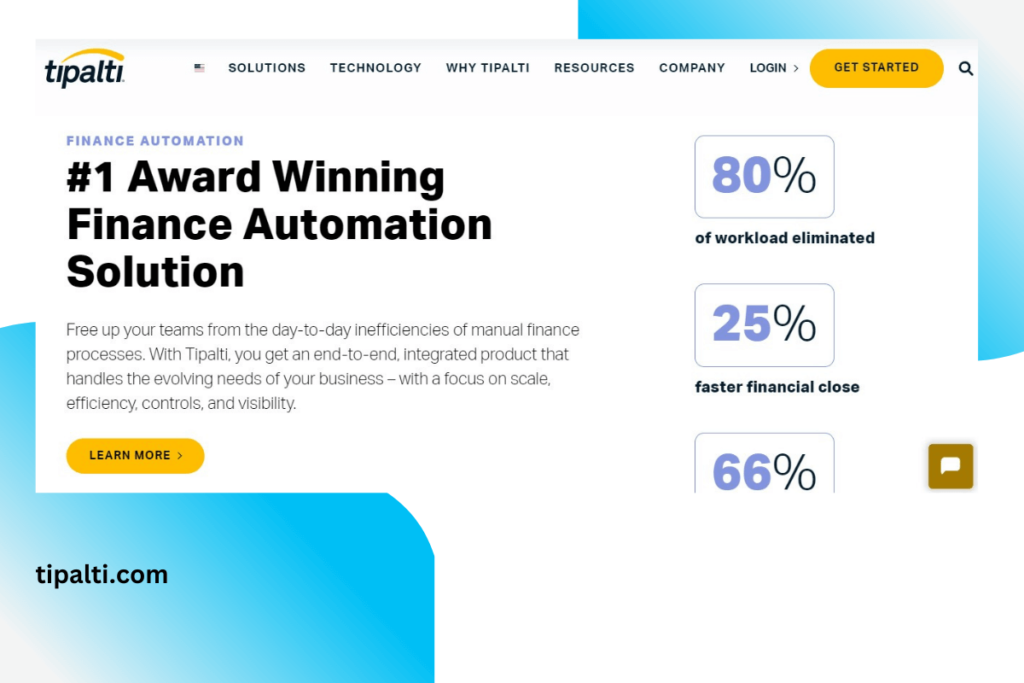

5. Tipalti – best for large, growing businesses

Pricing: starting from $149 per year

Tipalti is an end-to-end accounting software to help large businesses that may be experiencing rapid growth. The software has built-in infrastructure so that as your business grows, you can still use the same accounting platform. Within Tipalti, bar managers can manage their supplier and procurement relationships and track invoices and PO maintenance.

Key features:

- Create end-to-end workflows for all accounting needs on a global scale

- Manage relationships with suppliers

- Organize invoices and match them to purchase orders and receipts

- Accounting on a worldwide scale. It can be used in over 190 countries and 120 currencies

Reasons to buy:

- Keep using Tipalti as your business grows

- Manage your finances and payments as well as supplier relations

- One package available takes the guesswork out of which option to buy

- Suitable for bars that may have locations in other countries

Reason to avoid:

- You will need to devote time to learning how to use the software

- FAQs and guides are available but no 1-2-1 support from a professional

Frequently Asked Questions (FAQs)

Does managing accounts in a bar differ from other sectors?

Although the fundamentals of accounting are very similar cross-sector, different challenges arise for bar owners. A bar is incredibly fast paced with lots of inventory and payments to be made. There is also extra accounting for potential spillages or breakages. There’s the added challenge of predicting these additional costs, but this will get easier as you gain more data. The software can then give you suggestions to improve.

How do I manage my day-to-day bar activities as well as accounting?

Ensure you schedule in your diary to work on accounting and spend some time each week managing your payments and tracking your expenses. Prioritize your inventory and ensure you have enough stock to last you the week or month, as well as enough revenue to pay your suppliers. Bars tend to be busier in the afternoon and evening, so reserve time in your diary in the morning to review your finances.

Should I get an accountant or use accounting software?

There are benefits to both. If you have an accountant, you can take out a lot of the administrative work you need to do each week but, of course, you must pay for this service. There is software available for all sizes of businesses. For those starting, you can start with more straightforward software and learn the basics. Don’t forget the hybrid combination as well! You can have an accountant integrate the software they use with the software you have chosen. Just make sure that you read into the integration capabilities of your software before purchasing.