Financial service institutions such as banks can manage exposure to various types of financial risks with reliable and efficient risk management software. Banks employ risk management software to conduct in-depth analyses of financial portfolios, credits, deals, and investments. This will help them identify any potential risks, so they can put measures in place to deal with such risks. With the right risk management software, banks can conduct risk analysis, data audit, reporting, risk management, risk monitoring, risk mitigation, and data management.

In this guide, we’ll take a closer look at the best risk management software for banks.

Top 8 Best Risk Management Software for Banks

- LogicManager – Best Risk Management Software for Banks on Risk Assessment

- AI Tracker – Best Risk Management Software for Banks on Risk Reporting

- Reval – Best Risk Management Software for Banks on Risk Mitigation

- FactSet – Best Risk Management Software for Banks on Data Management

- Kyriba – Best Risk Management Software for Banks on Treasury Management

- Riskturn – Best Risk Management Software for Banks on Financial Planning

- D&B Credit – Best Risk Management Software for Banks on Credit Reports

- SmartRisk – Best Risk Management Software for Banks on Financial Advisors

1. LogicManager – Best Risk Management Software for Banks on Risk Assessment

PRICING: To get started you have to request pricing

LogicManager is a financial enterprise risk management software for banks. It prevents banks from experiencing major financial and reputational losses. LogicManager is a comprehensive ERM software that helps banks identify, monitor, and mitigate financial risks. It features a wide range of tools and frameworks to help banks become more reliable and efficient.

KEY FEATURES:

- Data Security

- Disaster Recovery

- Audit Management

- Legal Risk Management

- Documentation Management

- Operational Risk Management

- IT Risk and Incident Management

REASONS TO BUY:

- It allows mobile access

- The extensiveness of the product

- It updates you with alerts and notifications

- It helps with compliance management and compliance tracking

REASONS TO AVOID:

- It is not the most sophisticated risk management platform for banks

» MORE: Top Software for Managing Environmental Risks

2. AI Tracker – Best Risk Management Software for Banks on Risk Reporting

PRICING: Start at $800 per month

AI Tracker is a new robust risk management software specially designed for risk reporting. It allows incident reporting for claims like accidents, medical, insurance, commercial, etc. The platform offers a wide range of product features like claims processing, contract management, fixed asset management, financial risk management, and integrated risk management.

KEY FEATURES:

- Contract Management

- Financial Risk Management

- Integrated Risk Management

- Insurance Claims Management

- Risk Management & Threat Assessment

- Claims Processing & Incident Management

REASONS TO BUY:

- It covers many businesses segments

- It allows report for claims of any type

- Good for workflow automation and analytics

REASONS TO AVOID:

- It takes time to understand how to use the software

» MORE: What Kinds Of Risk Management Are There?

3. Reval – Best Risk Management Software for Banks on Risk Mitigation

PRICING: Free to access

Reval offers treasury and risk management solutions. It helps banks in transforming treasury and risk management in the clouds. Reval helps financial institutions manage cash, liquidity, financial risk, and hedge accounting. It has a team of finance and technology experts that offers value to companies of all sizes. This is the best platform that offers workflow automation solutions to financial institutions, central banks, government agencies, and corporate bodies.

KEY FEATURES:

- Bank Connectivity

- SaaS and Risk Management

- Hedge Accounting and Compliance

- Cash and Liquidity Management

REASONS TO BUY:

- Integrated market data feeds

- Interactive dashboard and custom reporting

- Offers reliable risk solutions to corporates and banks

- Banks can configure their specific solutions

- Seamless connectivity to bank portals and third-party systems

- Banks can deliver superior cash management and liquidity management

- It offers solutions for treasury organizations of various sizes and complexities

REASONS TO AVOID:

- Configuration of treasury and risk management in the cloud requires expertise

» MORE: Single vs. Multi-Tenant, Risks & Benefits of Multi-Tenant (SaaS)

4. FactSet – Best Risk Management Software for Banks on Data Management

PRICING: You can connect for a free trial

FactSet is a risk management software that provides data to power companies’ workflow and analytics to provide insights. It focuses on solving time-management issues affecting financial institutions. With its multi-asset class portfolio analytics, financial advisors can manage data without time-wasting. It also oversees the data distribution of internal and external clients.

KEY FEATURES:

- Risk Analytics

- Quantitative Research

- Performance Measurement

- Advanced Portfolio Analytics

REASONS TO BUY:

- It offers reliable client and portfolio reporting

- It enables support and learning for clients

- Integration with CRM and MS PowerPoint

- Data delivery and data connectivity

REASONS TO AVOID:

- You will need several plugins to obtain projection

» MORE: Top Tools for Vendor Risk Management Software

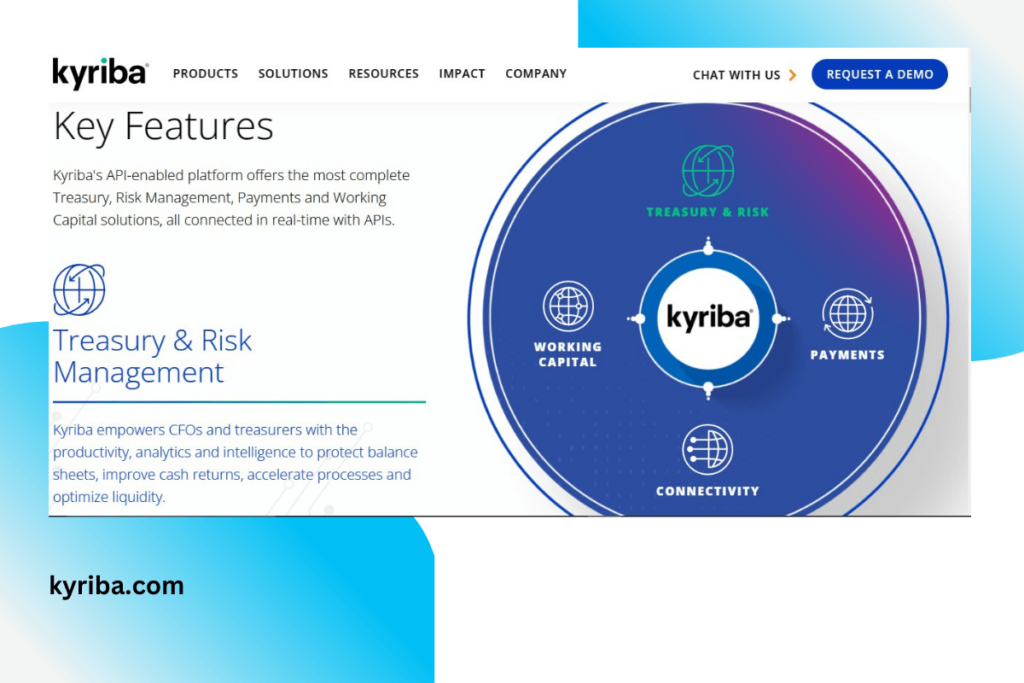

5. Kyriba – Best Risk Management Software for Banks for Treasury Management

PRICING: Request a demo to get started

Kyriba empowers financial institutions to manage risk, liquidity, treasury, payments, capital, etc. It connects banks, trading platforms, and market data providers on an active liquidity network. This is one of the best platforms that offer cloud treasury and financial management solutions.

KEY FEATURES:

- Fraud Detection

- Payments Control

- Supply Chain Finance

- Cash and Liquidity Management

REASONS TO BUY:

- It offers quality cash and risk management

- It is a dynamic system that requires no training

- It offers liquidity allocation between different accounts

REASONS TO AVOID:

- It is not great with currency risk management

» MORE: Top Affiliate Management Software (Most Trustworthy Instruments)

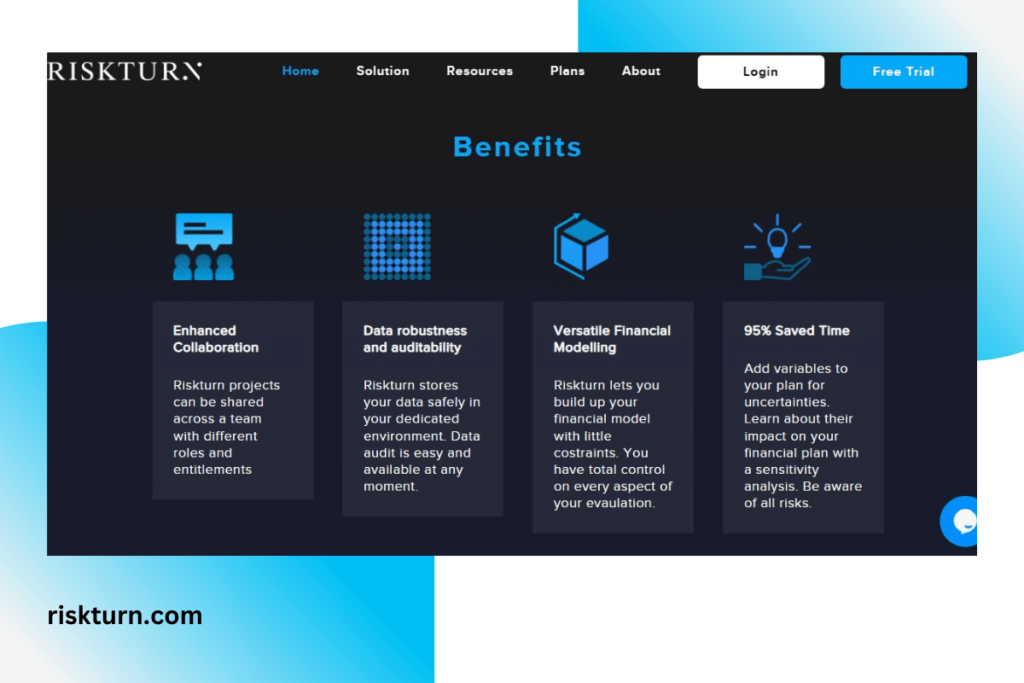

6. Riskturn – Best Risk Management Software for Banks on Financial Planning

PRICING: Start at $95/month (Professional) and Request Pricing for Enterprise Service

Riskturn is a web application designed to shelter banks from financial risks. With its intuitive interface, it helps banks integrate uncertainties and build forecast-based financial planning. Also, it streamlines data-driven cash-flow forecasts and evaluations. This is one of the best enterprise risk management software for structured finance and strategic portfolio planning.

KEY FEATURES:

- Risk Analysis

- Live Chat Support

- Cash Flow Forecast

- Templates Configuration

- Portfolio Management

- Financial Plan Modeling

REASONS TO BUY:

- Monte Carlo Simulations

- It provides APIs for integration

- Enhanced collaboration and versatile financial modeling

- It offers free resources to expand your knowledge of financial forecasts

REASONS TO AVOID:

- It is extremely expensive to run

» MORE: Best Database Management Software (Free & Paid)

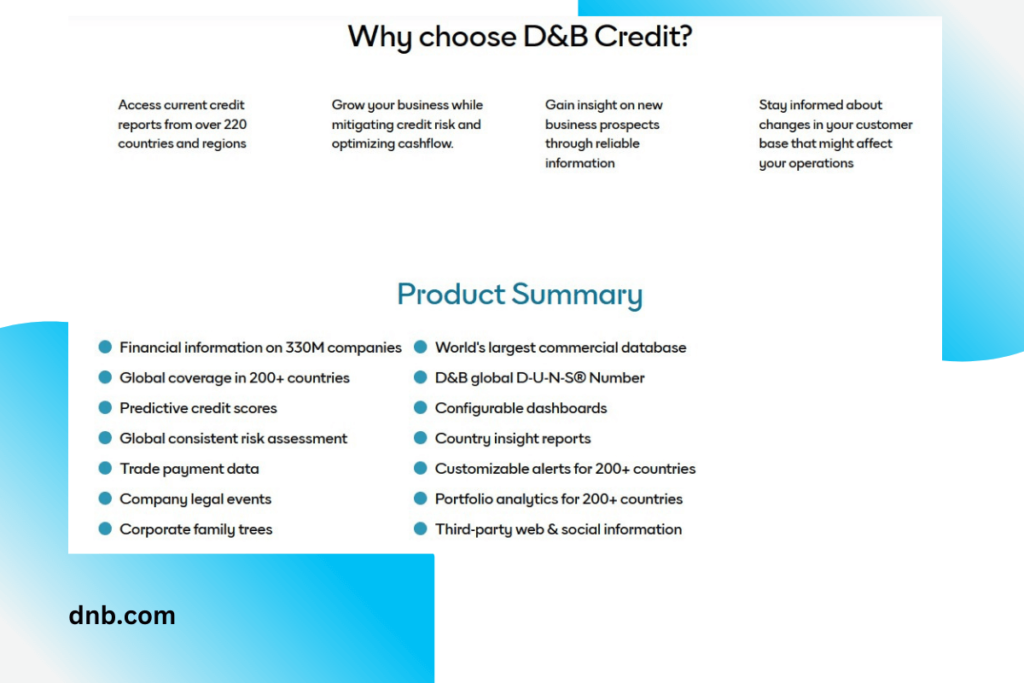

7. D&B Credit – Best Risk Management Software for Banks on Credit Reports

PRICING: It offers a free trial and premium consulting

This platform offers financial analytics through a global credit-to-cash solution. This is useful software for banks because it helps in improving cash flow and operational efficiency. Also, it helps financial institutions mitigate risks. You can easily analyze the strength of companies.

KEY FEATURES:

- Credit Analysis

- Credit Tracking

- Detailed Company Information

REASONS TO BUY:

- The financial risk assessment is top-notch

- It is easy to analyze and understand credit reports

- Ease of use and accuracy in risk management

REASONS TO AVOID:

- Challenge in obtaining smaller business reports

» MORE: Top Workplace Resource Management Software (Pay & Free)

8. SmartRisk – Best Risk Management Software for Banks on Financial Advisors

PRICING: Starts at $49.99/month or $599/year

If there’s one risk management software built for financial advisors, it is SmartRisk. This tool helps in analyzing portfolio risks so clients can make changes. Also, financial advisors use this software to set downside expectations for clients. This will protect clients and prevent them from making costly investment mistakes. It is a great risk management software for banks.

KEY FEATURES:

- Portfolio Comparison

- Concentration Alerts

- Useful Marketing Tools

- Proper Downside Expectations

REASONS TO BUY:

- It motivates clients to make portfolio changes

- Explains risks to clients in a way they can understand

- Access to risk management support, training, and industry expertise

REASONS TO AVOID:

- Designing a portfolio can be challenging

» MORE: Top Software for Field Management in Small Businesses

Reference and Links

- https://www.g2.com/categories/financial-risk-management

- https://www.capterra.com/financial-risk-management-software/

- https://sourceforge.net/software/financial-risk-management/

- https://www.trustradius.com/financial-risk-management

- https://savvycomsoftware.com/best-financial-risk-management-software/#ftoc-heading-7