If you’re a business owner, you likely know the grueling hours you have to spend each month dedicated to the payroll process. Perhaps to try and save time, you have hired an accountant or HR personal to get the job done. However, this can be costly, especially in the beginning stages of building your business. Fortunately, technology has advanced enough so that payroll software exists. For a fraction of the cost, payroll software is able to organize employee documents, store bank information, assist you with paying taxes, and more. More importantly, this specialized software is able to get your employees paid automatically with built in calculations, so you don’t have to worry about crunching the numbers. Listed below are some of the best payroll software catering to startups the internet has to offer.

The Top 5 Best Payroll Software for Startups

- Gusto – Best Modern All-In-One

- Zenefits – Best for Most Industries

- Rippling – Best Robust Offering

- Wave – Best Budget Friendly Option

- Square – Best Latest Technology

1. Gusto – Best Modern All-In-One

PRICING: From $39-$149 per month. There is an additional $6-$12 per month per user added. Custom pricing for rapidly growing business is offered when you contact the vendor.

Gusto’s all encompassing software helps companies reach their ultimate goal: saving time. In just 13 minutes or less, your entire company or team can get paid using the power of automation. The platform will automatically file your taxes, store employee documents, and calculate what is owed. Gusto also sweetens the deal by allowing its users to manage employee benefits as well. Calculate and implement PTO, workers’ compensation, break times, and even health benefits all in the same place.

KEY FEATURES:

- Automated, full service payroll system complete with employee form organization, auto-calculations, and break tracking.

- Automated tax filing.

- Includes employee benefits including workers’ compensation.

REASONS TO BUY:

- Document management system.

- Intuitive benefits dashboard.

- Integrates with other apps such as Quickbooks, Xero, Clover, and more.

REASONS TO AVOID:

- Difficult to personalize for some industries.

» MORE: Top Investment Apps to Try If You’re Just Starting Out

2. Zenefits – Best for Most Industries

PRICING: $10-$27 per month per employee. Extra savings apply when you commit annually. An interactive demo trial is available.

Though HR focused with payroll add-ons, Zenefits is hardly lacking. Its biggest selling factor is that it is able to host most industries covered in terms of convenience. Track tips, independent wages, and even show your employees full transparency with what they are earning. Further, tax season is made simple for everyone when the time comes.

KEY FEATURES:

- Implement multiple schedules and pay rates.

- Integrates with HR and Administration for quicker payroll management.

- Employee access feature to manage earnings, individual taxes, and time off requests.

REASONS TO BUY:

- Perfect for numerous different industries like hospitality, freelancers, and more.

- Compliance and benefits tools.

- Simple and straightforward onboarding and tracking.

REASONS TO AVOID:

- Limited access to customer service can be frustrating.

» MORE: Top Startup HR Software (Paid & Free)

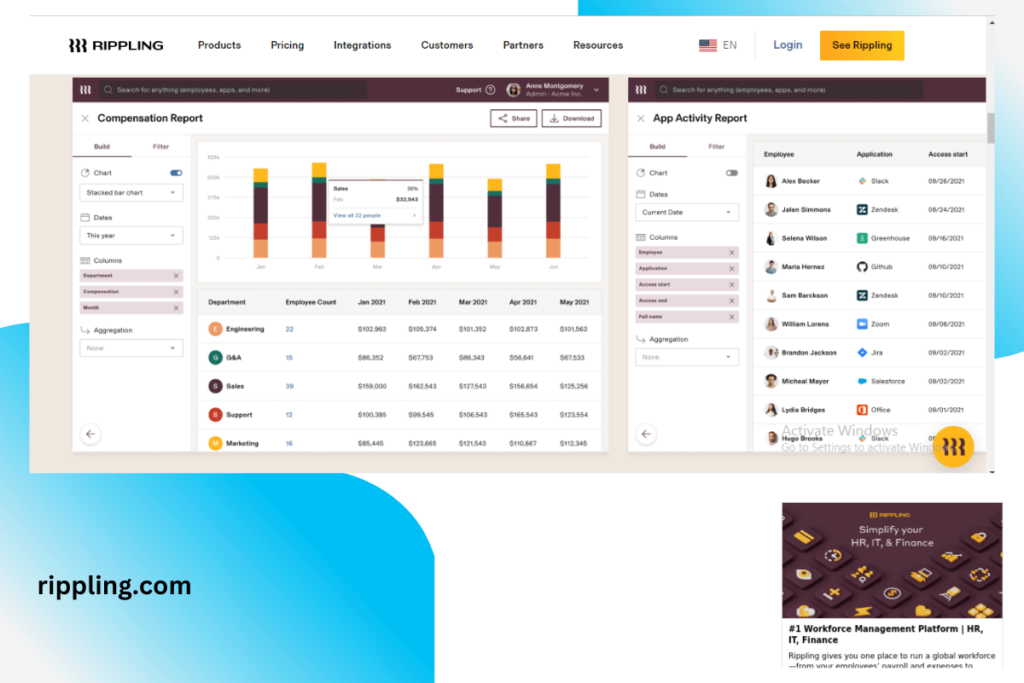

3.Rippling – Best Robust Offering

PRICING: Starts at $8 per user per month. Please contact the vendor directly for a more accurate quote that is tailored to your business needs.

Rippling offers a comprehensive employee management system complete with HR, IT services, and a benefits hub. The platform goes beyond just taking care of employee wages. Manage onboarding and offboarding, project workflow and costs, garnishments, and documentation. You can also integrate and sync with over 400 apps to optimize efficiency, and empower yourself and your employees with mobile access.

KEY FEATURES:

- Global payroll management for remote workers.

- Powerful reporting tools for employee information.

- Time tracking, job costing, and automatic adjustment settings.

REASONS TO BUY:

- Run payroll in 90 seconds or less.

- Integrates with Intact and Netsuite.

REASONS TO AVOID:

- Customer support via phone call is not available. Email support only.

» MORE: Top BI Tools for Startups

4. Wave – Best Budget Friendly Option

PRICING: From $0-$35 per month. There is also a percentage option that runs on a per transaction or payroll run basis. Extra fees per user added apply. A 30-day free trial for the payroll add-on is available.

If you are looking for an effortless and budget friendly way to run payroll, Wave is for you. This affordable option guarantees accuracy and ultimately saves business owners and employees valuable time. Built specifically for small businesses, Wave offers both full and self-service functionality, employee compensation, access to accounting and tax professionals, and thorough integrations. With all of this and more on offer, it is clear you will be set up for success and growth using Wave.

KEY FEATURES:

- Automated payroll receipt entries.

- Direct deposit documentation.

- Option for full-service or self-service pay stubs and tax forms for employees.

REASONS TO BUY:

- Pay employees as well as contractors.

- Built in time tracking software.

- On-site accounting and tax filing professionals.

REASONS TO AVOID:

- Customer service available through chat and email only.

- Full- features are limited.

- No employee benefits add-ons.

» MORE: Top Startup ATS Platforms

5. Square – Best Latest Technology

PRICING: There are various pricing plans, including free ones offered on the website. For payroll services specifically, prices range from $0-$35 per month. There is also custom pricing available for high revenue businesses in which you must contact the vendor for.

Square offers simplified full-service payroll software that is built to work with your business. It is both cloud and internet based, so you can get your employees paid as long as you have a wifi connection. Complete with reasonably priced features and add-ons, you can file both federal and state taxes, and everything you need to pay your team.

KEY FEATURES:

- Flexible with both salary and wage employment types.

- Provides integrated timecards, tax calculators, and new hire operations.

- All accessible dashboard that includes wage and tax information.

REASONS TO BUY:

- Easily manageable for independents.

- Automated tax pay.

- Unlimited payroll runs.

REASONS TO AVOID:

- Ideal for use with other Square compatible products only in order to access full scope of features.

- Limited reporting functionality.

» MORE: Top PayTrace Alternatives & Competitors

Frequently Asked Questions

How Do I Choose Payroll Software For My Startup?

The following are some crucial criteria you can reference in order to choose the best software for your business:

- A robust lineup of automation features.

- An intuitive, easy to look at and navigate interface to stay organized.

- Solid tax execution is crucial. Perhaps loop automation with this feature.

- Remote friendly. In this day and age, more companies are going remote. It is a good thing to have for the future of your company.

- Strong HR functionality, reporting, and accounting integrations.

Of course, some of this criteria might not be relevant for everyone, so pick and choose what you need. It is also advised to speak with your accountant on the matter, as they may have some valuable advice. As you should always do when investing in something new, do your research and get clear on you and your team’s needs.

How Does Payroll Software Work?

Ultimately, payroll software works to save you the time and effort it takes to ensure your employees are paid. Once you and your employees’ bank accounts are inputted into the system, payroll software works to automate the process by directly depositing employee wages into each account. A well performing payroll software should also include tax calculations (and payments), track employee wages and hours worked, and store important documentation (usually for onboarding). Additional features can look like HR integration, which include implementation of employee benefits such as pto, worker’s compensation, healthcare and more.

What Makes Payroll Software Worthwhile?

While in the beginning stages, it is understandable to want to cut costs on software for your business until it becomes more established. However, a matter such as payroll hardly leaves room for error and can be a tedious, time consuming task, depending on how many employees you have. This is why investing in payroll software from the beginning is crucial, because it can help save valuable time and effort. This will undoubtedly free up that time to focus on your company mission and core values, thus growing your business that much quicker.

» MORE: Most Trustworthy & Secure PayPal Alternatives

References and Links

- https://www.brex.com/blog/payroll-software/

- https://www.karllhughes.com/posts/payroll-software-tools

- https://financesonline.com/payroll-software-for-startups/

- https://www.abstractops.com/top-10-payroll-software-for-startups-in-2021

- https://www.business.org/finance/accounting/wave-payroll-review/

- https://www.creditdonkey.com/square-payroll-review.html#pros-cons

- https://kruzeconsulting.com/five_tips_for_startup_financial_health/implement_startup_payroll/

- https://www.usnews.com/360-reviews/business/payroll-software/best-payroll-software-for-small-businesses

- https://www.wpbeginner.com/showcase/best-hr-payroll-software-for-small-businesses/