Upfront Conclusion

The best day trading tax software right now is FreshBooks and Zoho Books.

Day trading is a complex endeavor that demands a crystal clear strategy and discipline. Day traders have to remain sharp and vigilant as things happen so fast in day trading. They must remember many things and try to observe so many aspects simultaneously keenly.

Accounting software is among those helping tools that can transform the trading business. This software is cloud-based and helps day traders work smarter and faster. Accounting software help in several ways, such as tracking income/expenses, creating and sending invoices, time tracking, and much more.

Trending Accounting Solutions

So, if you are a day trader looking to simplify your accounting and bookkeeping activities simple and easy, then accounting software is the best option for you.

However, finding the perfect accounting software for day trading is difficult, as you need a tool you are comfortable with. To simplify this task, we will share a list of the best accounting software for day traders in this post.

Top 6 Accounting Software for Day Traders

| Brand | Starting price | Best for |

|---|---|---|

| 1. FreshBooks | $17 – $55 per month | Cloud-based accounting |

| 2. Zoho Books | $10- $200 per month | Sharing accounting responsibilities |

| 3. Sage | €12 – €27 per month | Simplicity |

| 4. Xero | $25 – $55 per month | Really complicated accounting |

| 5. Wave Accounting | Free | Tight budgets |

| 6. Sage | $20 | Fast payment |

| 7. Reckon | $12 – $63 per month | Everything that day traders need |

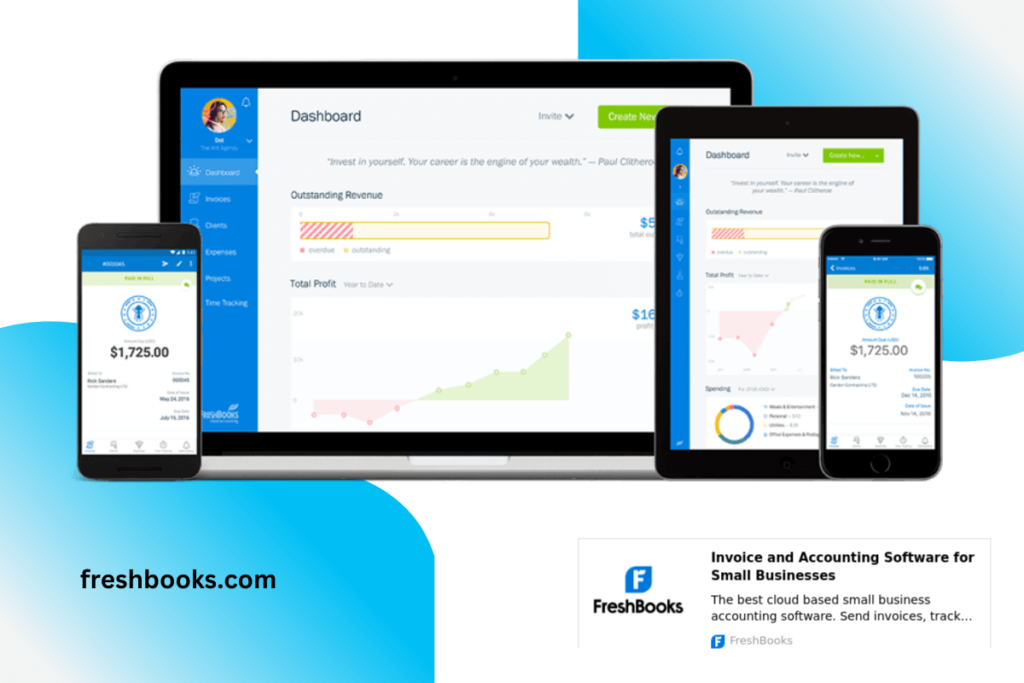

1. FreshBooks – Best for Cloud-based Trading

FreshBooks is a cloud-based accounting software that makes day traders focus only on their trading and carefully look after their accounting needs. It has all the strengths to earn its place in the list of the best accounting software for day traders.

FreshBooks is among the most user-friendly accounting tools available, making it the best option for day traders or sole traders with little knowledge of accountancy and financial management. Moreover, FreshBooks offers unique invoicing features such as customizable invoice formats, recurring invoices, etc.

It lets you do accounting activities ranging from simple to complicated activities. Besides invoicing and income/expense bookkeeping, you can reconcile your bank account, create numerous reports, manage projects, manage and track time, avail automatic payment and fees reminder, and various other remarkable features.

Pricing

FreshBooks offers four pricing plans to help day traders manage their finances.

- Lite: $17.00 per month (5 billable clients)

- Plus: $30.00 per month (the most popular and offers 50 billable clients)

- Premium: $55.00 per month (unlimited billable clients)

- Custom pricing plans are also available for businesses with unlimited billable clients and specialized features. (Currently 90% off for 3 months on all 4 plans)

All four plans come with different features. You can start with the Lite plan at the very outset of your day trading profession and scale up to other plans with more advanced features when you expand your day trading. FreshBooks is among the best accounting software for day traders because of its remarkable features and flexible pricing plans.

Highlights and Hidden Gems:

- It enables you to generate professional invoices and makes invoicing easy, taking only a second.

- Organize your income and expenses effortlessly and help you prepare for tax time.

- It also empowers you to manage projects by keeping your conversations, files, and other relevant data in one place. You can also synchronize your team and projects on schedule.

- It brings automatic depositors and eliminates the chase of clients for checks.

- Ensures to make reports as simple as possible to be more understandable for you while quite powerful for accountants for professional use.

- Its iOS and Android apps empower you to remain in contact with your clients from anywhere, anytime.

- Integrates with other 100+ apps and enables you to streamline your business, connect with your customers, and run your business better.

Disadvantages and Limitations:

- Miscategorization of items after import.

- The mobile app is good but has some technical bugs present.

- A little bit expensive and confusing if you don’t use all its features.

- System crashing and loss of information occur.

- Doesn’t have automatic enumeration for all your invoices and expenses.

- Limitations of users and billable clients are one of its most significant disadvantages.

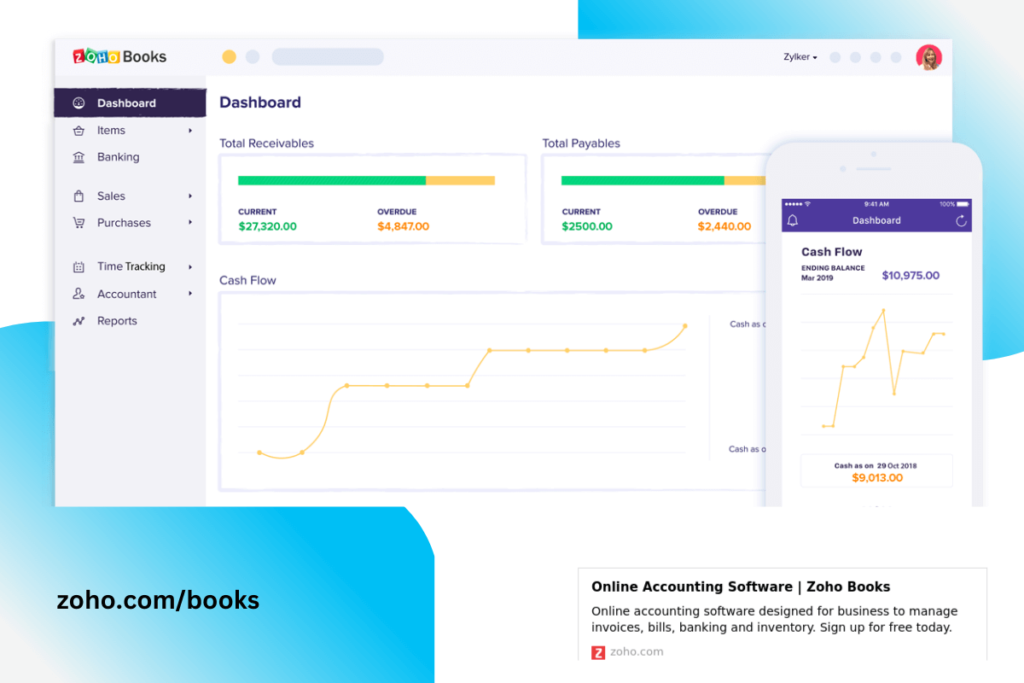

2. Zoho Books – Best for Online Crypto Trading

Zoho Books is the best online software for day traders that offers users to share accounting responsibilities with anyone in the field. This cloud-based accounting software helps you manage your accounting and accountancy tasks, such as payroll, payment, record control, invoicing, etc.

All these features make your complex accounting easier and help your organization and small businesses. With this accounting solution, you can manage cash flow, generate one-time or recurring invoices, keep track of inventory, manage purchases, track expenses, automate workflows, and much more.

With Zoho software, you can manage your business expenses and cash outflows and track commitment and invoices for buyers, services, and clients. Marketing and consulting firms, as well as small and large businesses, can benefit from this software.

Pricing:

It offers a pricing model-free and also offers a subscription. The following pricing plans are offered by Zoho accounting:

- A free trial is available.

- Standard: $10 per month billed annually or $12 billed monthly.

- Professional: $20 per month billed annually or $24 billed monthly.

- The Premium: $30 per month billed annually or $36 billed monthly.

- The Elite: $100 per month billed annually or $129 billed monthly.

- The Ultimate: $200 per month billed annually or $249 billed monthly.

Highlights and Hidden Gems:

- Tracks your finances by providing accurate accounting reports.

- Multi-bank accounts and credit card reconciliation are possible.

- This software is compatible with iOS, Android, and Windows devices.

- Customers can be invoiced in their currency, and 11 languages are available.

- It enables users to manage clients and send an invoice by mail or online; recurring invoices can be automated, payment reminders and thank-you notes can be sent, and payments can be processed through online payment systems.

- By easily sharing your financial books with your accountant, you can get professional help with accounting.

- Zoho accounting software has the facilities to other apps such as Zoho CRM, Zoho Inventory, Zoho sign, etc.

Disadvantages and Limitations:

- No overall Payroll services are available.

- Automatic matching is not good enough.

- It has limited integration options available.

- Plan restrictions are implemented on users.

- Frustrating payment plans and a limited number of contacts.

3. Sage – Best for Multi-purpose Day Trading

Sage is a powerful accounting program for day trading with various financial tools and flexible customization possibilities. Businesses may track their revenue, costs, and sales with this tax software in one place. Sage is a platform that provides accounting tools and advice from experts to anyone, anytime.

Sage is a multi-purpose program that accountants and bookkeepers can use for small businesses, construction and real estate, and medium businesses. Sage business clouds include accounting, finance, and payroll that assist organizations in improving their trading and business.

Common bookkeeping mistakes are also avoided with the use of Sage. It works closely with HMRC to guarantee that the tax return software complies with the most recent laws, including Making Tax Digital.

Pricing

Sage accounting offers a free trial, and its pricing plan includes the following:

- Sage accounting start plan is $10 per month.

- The most popular Sage accounting plan is $7.50 per month. (You can avail of 70% off for 6 months.)

Highlights and Hidden Gems:

Sage’s primary features are as follows:

- Manage sales invoices

- Automatic bank reconciliation

- Protect your business from tax audits

- Calculate and create VAT Returns

- Maintain digital tax records

- Run advanced reports

- Forecast cash flow

- Manage inventory

Sage assists with cash flow management, administrative removal, and preparation of tax submissions. It is a feature-rich and adaptable accounting program for day trading tax management.

Disadvantages and Limitations:

- Time-consuming and difficult to understand.

- Complicated and confusing features.

- Journal entry shows a lack of efficiency.

- Staff training is mandatory to use Sage properly.

- Lack of proper documentation and customer support.

- A technical and Sage expert is needed to set up initially.

Also Read: Crypto Accounting Software

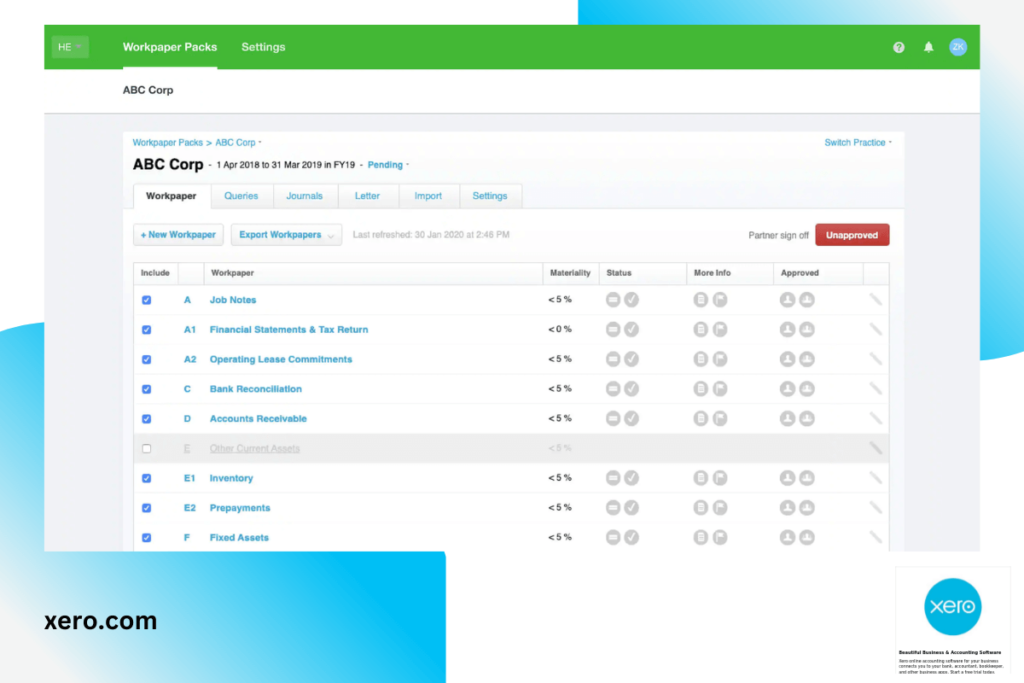

4. Xero – Best for Everyday Trading Tax

Xero has 2.7 million users worldwide and is among the top accounting software currently available. It is also among the best accounting software for day traders as it simplifies finances and makes a complicated accounting process easy.

Xero helps accountants and bookkeepers to manage their bank connections, pay bills, claim expenses, accept payments, and track projects anytime and anywhere. It makes banking and crypto accounting easier. Crypto traders happily leave accounting and bookkeeping to Xero and Ledgible Accounting so that they can focus on their business or trading.

Xero is user-friendly and cloud-based accounting software that lets you control and streamline your basic accounting and bookkeeping requirements, such as payroll, inventory management, invoicing, etc. The good thing is that it offers various features and pricing plans that suit several small businesses, including the day trading business.

Pricing

Xero offers three different pricing plans that cover all accounting essentials. Its three plans are;

- Offers free trial.

- The Starter plan starts at $25 per month.

- The Standard plan starts at $40 per month.

- The Premium plan starts at $54 per month.

The Starter plan is the best for professional day traders at the early stages of their trading profession. They can easily upgrade to other plans when their trading begins to grow. Xero is the best accounting software for day traders because it makes complex accounting tasks extremely easy, supports them during early stages, and offers affordable pricing plans.

Highlights and Hidden Gems:

- Its mobile application enables its users to handle bookkeeping activities on the go. So, it allows access to your data and its tools from anywhere, anytime.

- It helps you track and timely pay bills and presents a clear picture of accounts payable and cash flow.

- Instantly reconciles with your bank accounts, and you can get bank feeds.

- It empowers you to track projects and their timeframe, costs, and profitability.

- Generates accurate accounting reports to help you track your finances.

Disadvantages and Limitations:

- Constantly changing reports.

- Technical issues and random bugs.

- Lack of delivery notes and packing slips.

- Lack of built-in Debator Chasing function.

- Disconnection of bank feeds without any reason.

- Expensive and duplication of contacts and reports.

- Sometimes removing/deleting transactions is difficult.

Also Read: Tax Preparation Software | Does QuickBooks Do Corporate Tax?

5. Wave Accounting – Best Accounting software for Traders

Wave Accounting is another of the best accounting software for day traders, especially when they have tight budgets at the start of their day trading journey. It is an award-winning accounting software yet absolutely free. You can get almost all features you need for business accounting for free.

With its user-friendly dashboard, organizations can access invoicing, banking, trading, payments, payroll, and accounting, and it also provides expert consultations. Wave allows you to do more advanced accounting activities such as recording income/expense, tracking, sending invoices, etc.

You can also avail yourself of superb features like payroll processing and scanning receipts through Wave mobile application. Wave Accounting also allows you to reconcile bank accounts and record old expenses you failed to record by uploading old bank statements.

Pricing

Wave Accounting is accounting software for day traders that is absolutely free. It is among the best accounting software for day traders because it is free and has remarkable features.

Invoicing, Banking, and Accounting are 100% free, while you have to pay for the following features.

- Payroll: $40 per month

- Payments: 2.9% + $0.60 per transaction and 3.4% + $0.60 per AMEX transaction.

- Advisors: Bookkeeping support costs $149 monthly and $379 monthly for accounting and payroll coaching.

Wave Accounting allows you to scale up by presenting numerous collaborators if you want an expert to handle your accounts, manage payroll and payroll taxes, run more than one business from a single Wave account, and much more.

Overall, Wave Accounting is the best option for day traders and sole traders to handle their accounting requirements without spending a penny on software that charges a lot monthly.

Highlights and Hidden Gems:

- Handles your accounting requirements effortlessly, easily, more efficiently, and effectively.

- It enables you to create and send professional invoices within seconds.

- It empowers you to scan receipts from anywhere, anytime, through Wave mobile app.

- It allows you to track total income/expenses and get paid quickly.

- It also makes your accounting efforts competent and highly professional by offering to add various collaborators, accountants, and partners.

- It also has the potential to generate professional reports that clearly display due bills and invoices, profit and loss reports, cash flow reports, etc.

- It allows you to reconcile multiple bank accounts and credit cards.

Disadvantages and Limitations:

- Lack of proper customer service

- Management of accounts is a little bit difficult.

- Slow payment speed, needs significant improvement.

- Whenever updates come, it changes the entire function.

- Major bookkeepers are hesitant to use it, only small business owners used it.

Also Read: Accounting Software For Etsy Sellers

6. Sage – Best for Trading and Bookkeeping

Sage is another one of the best accounting software for day traders through which they can take control of their finances. It is a cloud-based, automated, and intuitive tool that lets you get paid faster.

Sage is a multi-purpose program that accountants and bookkeepers can use for small businesses, construction and real estate, and medium businesses. Sage business clouds include accounting, finance, and payroll that assist organizations in improving their trading and business.

Sage offers robust accounting and bookkeeping features that allow you to take complete control over your financing processes and also lets you spend more time improving your day trading skills and your business. The plus point of Sage is that it offers a free 35-day trial to calmly assess its usability for your day trading financing needs and requirements.

Pricing

Sage offers a free 35-day trial and one plan starting at $20 per month with many features that are more than enough for day traders during the early stages of their trading. You can also select “Additional Add-ons” for additional fees, such as $7 monthly for “Direct bank feed.”

Highlights and Hidden Gems:

- Allows you to create invoices directly from quotes, track your receivables, and accept payments.

- It helps you avoid manual processing, importing, and bank reconciliations as it automatically updates books once you connect Sage accounting software with your bank account.

- Its payroll module makes your payroll easy and processes it more accurately, quickly, and efficiently.

- Prepares financial reports like balance sheets and profit and loss statements that enable you to continuously assess your business’s financial status.

Disadvantages and Limitations:

- Complicated and confusing features.

- Journal entry shows a lack of efficiency.

- Staff training is mandatory to use Sage properly.

- Lack of proper documentation and customer support.

- A technical and Sage expert is needed to set up initially.

Also Read: Free Small Business Accounting Software

7. Reckon – Best for Small Business Trading

Reckon is another economical and best accounting software for day traders. It offers everything that day traders need for their bookkeeping and accounting needs, especially when they have a small business or have just started one. Reckon is like a mini account in your pocket anytime, anywhere.

It is the most popular platform for small organizations and accountants. Its products include accounting, payroll, and invoicing, while on smartphones, it has both payroll and invoices apps. It is the best easy-to-use online business accounting software making it more accessible.

Reckon is also a cloud-based and feature-rich accounting software that makes your accounting activities, such as tracking income/expense, invoicing, organizing for tax payments, etc., extremely easy.

Pricing

Reckon offers the most affordable prices as compared to its competitors. It offers four pricing plans;

- The Basics plan starts at $12 per month

- The Essentials plan starts at $33 per month

- The most popular Essentials + Payroll plan starts at $45 per month

- The Premium plan starts at $63 per month

Reckon truly offers pricing plans that its competitors cannot match. Although more expensive plans come with extra and more advanced features, the Basics and Essentials plans can be enough for day traders at the start of their profession.

They can later upgrade to better plans when the accounting needs of their day trading require them to get advanced features. Reckon is on the list of the best accounting software for day traders because of its fabulous features, customer support, and clever pricing plans.

Highlights and Hidden Gems:

- It allows you to observe your income, expenses, and cash flows with the help of timely reports and a customizable dashboard.

- Generates professional invoices. You can send unlimited invoices and get paid quickly.

- Categories unlimited transactions and helps you monitor the money coming in and out of your day trading business.

- Its marvellous budget tool helps you reserve resources and plan future trading activities.

Disadvantages and Limitations:

- Few integrations can be seen.

- Lack of fixed assets management.

- The overall system is outdated compared to others.

- Accounting expert or technical knowledge is required.

- Problems in the bill payment section that needs to be improved.

Also Read: Accounting & Payroll Software For Small Business

Read More

RELATED: Top Interior Designer Accounting Tools | Best Windows Accounting Plugins | Accounting Software Best For Desktops