Lookup Business Entity | Form Corporation | FAQ

The Connecticut Secretary of State’s Business Search record includes complete information on firms that have been incorporated in the state. The Connecticut Secretary of State’s Business Search website allows users to search for a business entity and read the business information of any business on record with the Secretary of State.

| Official Website: | https://service.ct.gov/business/s/online business search? language=en_US |

| Address: | Commercial Recording Division PO Box 150470 Hartford, CT 06115-0470 |

| Telephone: | (860) 509-6032 |

| E-mail: | mailto:crd@ct.gov |

| Working Hours: | 8:30 – 4:00, Monday to Friday |

Connecticut Business Search Shortcut

Need help forming an LLC in Connecticut? Create an LLC in minutes with ZenBusiness.

How To Lookup An Entity In Connecticut

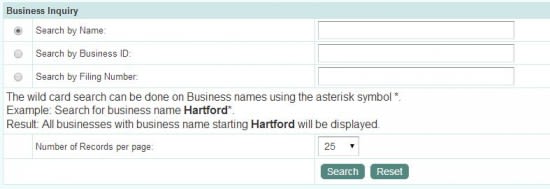

Connecticut Secretary Of State Business Search By Name

- Find the area that requests the name of the business for which you’d want information on the Secretary of State’s government website.

- Input the name you’re searching for into the space and click “Search.”

- The business name, location, filing number, and status of each applicable entity will be shown in a list.

- You’ll be able to see the business information as well as the agent overview once you’ve discovered and clicked on your choice.

- There are three options accessible on the bottom right-hand side of the page: you may see the filing history, the name history, and the entity’s shares.

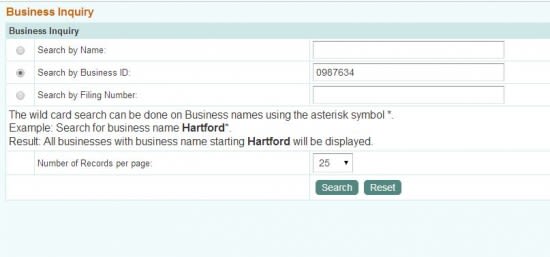

Connecticut Secretary Of State Business Search By Business ID

- Enter the Business Identification number of the business you’d like to enquire about in the second supplied space on the business search web page.

- On the second page, you’ll see the business’s address, name, status, and ID if the business ID has been entered correctly.

- To explore the business information of the entity of interest, click on its name.

Connecticut Secretary Of State Business Search By Filing Number

- You can conduct a business search on the Secretary of State’s website by providing the filing number in the necessary field. You will be able to narrow down your search to only one company.

- Find more information about the company by simply clicking on its name, in addition to the address, ID, and status.

>>MORE: Kentucky Secretary Of State Business Search | South Carolina Secretary Of State Business Search | Delaware Secretary Of State Business Search | Montana Secretary Of State Business Search | Alabama Secretary Of State Business Search

Steps To Forming A New Corporation In Connecticut

1. Select a Business Structure

New businesses must determine the structure of their business. In the Connecticut Department of Assessment and Taxation, the most frequent business formations are; limited liability companies, partnerships, sole proprietorships, and corporations.

2. Make sure the name you want is available

The name of your corporation must be distinct from that of other corporate names that are currently on record with the Connecticut Department of Licensing and Regulatory Affairs. By checking the Connecticut business name database, names may be examined for availability.

3. Assign a Registered Agent

Every corporation in Connecticut is required to have a registered agent. If the Secretary of State or another government agency needs to contact your company, a registered agent serves as the point of contact. An entity with a certificate of power to conduct business in Connecticut such as Northwest Registered Agent and GoDaddy, a Connecticut resident, a Connecticut company, or a foreign entity may serve as a registered agent.

4. Incorporate in Connecticut by filing Articles of Incorporation

The articles must contain the following information: the corporation’s name; its intention; the number of shares it is permitted to issue; the name and address of the agent receiving service of process; the name and address of the resident agent receiving service of process; and the names and addresses of all incorporators.

5. Create bylaws and keep corporate records

The fundamental guidelines for running your organization are outlined in the bylaws, which are internal corporate documents. They are not reported to the government. Corporate bylaws are not legally needed for your company, but you should nonetheless adopt them since they define how your company will operate and demonstrate to lenders, creditors, the IRS, and other parties that your company is genuine.

6. Initial directors should be appointed

The management of the corporation is done by the board of directors. A company’s first board of directors is frequently chosen by the incorporators. Following that, the board is picked by the shareholders every year. A director or shareholder may be an incorporator. A Connecticut corporation can really be founded by one individual, who can also hold all of the titles that go along with it. The three titles, however, are connected to various corporate functions.

7. Organize an organizational meeting

At the first board meeting, the directors pick corporate officials, choose a corporate bank, establish the corporation’s fiscal year, approve the issuing of shares of stock, and adopt a formal stock certificate form and official seal.

8. Make Stock Certificates Available

The number of shares issued should be stated in the company’s annual report. Most firms offer certificates to shareholders stating their shares, even though it is not usually necessary. Stock can be privately or publicly issued. Typically, founders, management, workers, or a small group of investors receive privately issued shares. A public corporation offers some of its equity shares for sale to the general public.

9. Apply for a Federal Employer Identification Number (FEIN)

Obtaining a federal employer identification number (EIN) is required for your business. For taxation reasons, this identification number serves as the corporation’s Social Security number. Among other things, it enables you to recruit staff and create a company bank account. The IRS website has an online application that you may use to get an EIN. You will require this number for future documents and to file your company’s tax filings, so keep a record of it.

10. Get Business Permits and Licenses

Take time to investigate any necessary permissions or licenses to maintain your new firm on the legal straight and narrow. Depending on the type of company services you offer, the county or city where your firm is situated, and if you employ people, different permissions and licenses may be required.

>>MORE: Michigan Secretary of State Business Search | Oregon Secretary of State Business Search | California Secretary of State Business Search | Massachusetts Secretary Of State Business Search | Mississippi Secretary Of State Business Search

Frequently Asked Questions On Connecticut Secretary Of State Business Search

In Connecticut, how can you reserve a business name?

A company can reserve a business name for up to 120 days. A $60 deposit is required to reserve a name.

Is it necessary to submit an annual report in Connecticut?

In Connecticut, unless a waiver is filed by mail, annual report company filing is required online.

Is it necessary to have a registered agent in Connecticut to register a business?

Yes. A registered agent is someone responsible for receiving formal documents on behalf of your LLC, LLP, or company. Individuals can serve as registered agents as long as they have a physical address in the same state.

Where can I learn more about business licensing in Connecticut?

The Connecticut Department of Revenue has information about business licenses on its website.

Why do I need an EIN for my Connecticut corporation?

For federal tax filings, businesses must get an EIN from the IRS. When opening a bank account, obtaining a loan, or filing for local business permits and licenses, you may be asked for your EIN.

How can I get my Connecticut corporation a bank account?

A copy of the Connecticut corporation’s Articles of Incorporation, the corporation’s bylaws, and the corporation’s EIN are required to create a corporate bank account in Connecticut. You may also wish to introduce a corporate resolution to create a bank account if your bylaws don’t grant the right to do so. The individual going to the bank would be declared eligible to open a bank account in the name of the corporation in the resolution.