Lookup Business Entity | Form Corporation | FAQ

There are a variety of reasons why you would need to do a Montana business search. We usually advise anyone who wants to start a new business to check this database for their preferred operational name to make sure it’s available. Whatever your motivation, you will quickly discover that conducting a company search is quite straightforward.

| Official Website: | https://sosmt.gov/business/ |

| Address: | PO BOX 202801, Helena, MT 59620 |

| Telephone: | 1(404) 444-3665 |

| Fax: | 1(406) 495-0464 |

| mailto:www.app.mt.gov/contactus/ |

Montana Business Search Shortcut

Need help forming an LLC in Montana? Create an LLC in minutes with ZenBusiness.

How To Lookup An Entity in Montana

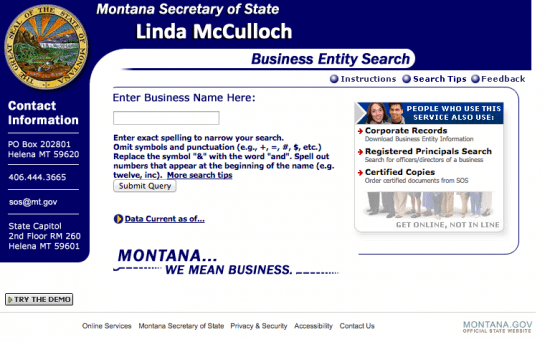

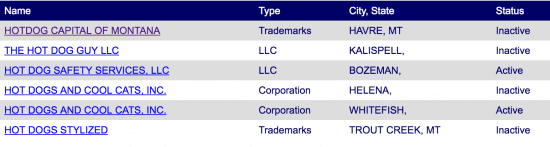

Montana Secretary of State Business Search by Name

- Go to the Montana SOS’s entity search webpage and type the entity name into the space given.

- Based on the given name, your search will produce a list of results.

- Select the entity’s name on the left to be sent to the summary page for that entity.

- On the business summary page, you can get a Certificate of Fact as well as information on principles for a modest cost.

Montana Secretary of State Business Search by filling number

- Enter the entity’s filling number into the provided area on the business entity search webpage.

- The business summary page appears on the following page, from which you may acquire both the Certificate of Fact and information on principles for a nominal cost.

>>MORE: North Carolina Secretary Of State Business Search | South Dakota Secretary of State Business Search | Idaho Secretary Of State Business Search | Washington Secretary of State Business Search | Ohio Secretary Of State Business Search

Steps To Forming A New Corporation In Montana

1. Choose a name for your Montana corporation

Choose a unique name that complies with Montana corporation naming requirements. To find out if a name is available, go to the Montana Secretary of State’s website and do a name search. The name of your corporation must be distinct from that of other corporate names that are currently on record with the Montana Department of Licensing and Regulatory Affairs. By submitting an Application for Reservation of Name to the Montana Department of Licensing and Regulatory Affairs, Bureau of Commercial Services, you can reserve a name for six months.

2. Select a Registered Agent in Montana

Montana businesses can be registered on the Department of Assessments and Taxation’s website. The site walks you through the steps of registering a business online. The state of Montana requires every business to have an agent for legal process serving.

If a company is sued, this person or business consents to take court documents on the company’s behalf. An entity with a certificate of power to conduct business in Montana such as Northwest Registered Agent and GoDaddy, a Montana resident, a Montana company, or a foreign entity may serve as a registered agent.

3. Make bylaws and have them approved

The fundamental guidelines for running your organization are outlined in the bylaws, which are internal corporate documents. They are not reported to the government. Corporate bylaws are not legally needed for your company, but you should nonetheless adopt them since they define how your company will operate and demonstrate to lenders, creditors, the IRS, and other parties that your company is genuine.

4. Hold an organizational meeting to complete the Certificate of Incorporation and sign it

The first corporate directors are chosen by the incorporator and serve on the board up until the inaugural annual shareholder meeting. At the first board meeting, the directors pick corporate officials, choose a corporate bank, establish the corporation’s fiscal year, approve the issuing of shares of stock, and adopt a formal stock certificate form and official seal.

5. Create a share structure and file an Incorporator’s Statement

The number of shares issued should be stated in the company’s annual report. Most firms offer certificates to shareholders stating their shares, even though it is not usually necessary. Stock can be privately or publicly issued. Typically, founders, management, workers, or a small group of investors receive privately issued shares. A public corporation offers some of its equity shares for sale to the general public.

6. Fill out the Montana Certificate of Incorporation form and submit it

The file must contain the following information: the corporation’s name; its intention; the number of shares it is permitted to issue; the name and address of the agent receiving service of process; the name and address of the resident agent receiving service of process; and the names and addresses of all incorporators.

7. Obtain an EIN (Employer Identification Number) for your Montana business

Obtaining a federal employment identification number (EIN) is required for your business. For taxation reasons, this identification number serves as the corporation’s Social Security number. Among other things, it enables you to recruit staff and create a company bank account. The IRS website has an online application that you may use to get an EIN. You will require this number for future documents and to file your company’s tax filings, so keep a record of it.

>>MORE: Illinois Secretary Of State Business Search | Maryland Secretary Of State Business Search | Mississippi Secretary Of State Business Search | Utah Secretary of State Business Search | Hawaii Secretary Of State Business Search

Frequently Asked Questions On Montana Secretary of State Business Search

How Do I Register a Business with the Secretary of State in Montana?

- Visit the Montana Secretary of State’s business website.

- Input your username and password after clicking the login button in the top right corner, then log in with EPass Montana on the left.

- You can create an account on the right-hand side if you need to.

- After logging in with your EPass, you’ll be sent to the online portal, where you may file your business application by selecting Register a Business or Forms from the left-hand menu.

- To register a business structure, select it from the drop-down menu. For your submission to be forwarded for evaluation, follow the instructions and fill in all fields highlighted with a red asterisk, as well as complete payment.

How Do I Reinstate A Business in Montana?

- Visit biz.sosmt.gov to use the online filing portal.

- Log in to the site using your ePass credentials.

- Once you’ve signed in, use the “Search” option in the left-hand menu to look for the business registration.

- When you click on the company name in the results list, a panel will appear on the right side of the page.

- To file each missing annual report, click the “File Annual Report” button, follow the instructions, and pay the $35 fee.

- When you’re done with the yearly reports, go to the “Filing Actions” button and select the “Reinstatement” form.

- Fill out the form, and if necessary, attach your tax certificate to the documents page.

- Submit the submission, together with the appropriate fee, to their office for processing. $30 for a profit corporation, $35 for an LLC, and $10 for a non-profit corporation.

- The filing will be reviewed by their office, and if approved, your registration will be reinstated.

How Can I Withdraw or Terminate a Business Registration in Montana?

- After logging in with your EPass, you’ll be sent to an online portal where you may “search” for the company you want to cancel, withdraw, or terminate.

- To open the record, click on the business name in the search results.

- Select Filing Actions from the right-hand slide-out panel.

- Select Articles of Termination, Cancel an Assumed Business Name, Statement of Withdrawal, and other filing actions from the Filing Actions menu.

- Depending on how the firm is structured, the terminology used here will differ.

- When submitting your documents, fill out the form and pay with a credit or debit card or an e-check.

- The cost of articles of termination is $15.

- If you choose expedited filing, you’ll only have to pay a charge to cancel an assumed business name.

- A tax certificate from the Montana Department of Revenue is required for some filings.

What Exactly Is An “Annual Report”?

Your registration is kept up-to-date by filing an annual report with the Secretary of State’s office, which informs them that you are still in business in Montana. It’s a renewal of your registration information, allowing you to change your business postal address, registered agent, shares (if necessary), and principles of record. It is not an income statement.