Upfront Conclusion

The best crypto accounting software right now is Freshbooks and Zoho Books.

Digital currencies have revolutionized the trading world, and cryptocurrency trading has become extremely popular in recent years. Businesses that deal with cryptocurrencies must comply with specific, highly complex, and one-of-a-kind tax and accounting regulations.

A profit or loss must be recorded every time your company spends cryptocurrency. You’ll need specialist software and services to keep track of gains and losses on cryptocurrency investments and document expenses paid for with cryptocurrency.

Trending Accounting Solutions

The best crypto accounting software is the only one that can efficiently handle all the nuances of crypto transactions. If you are looking for top-class crypto accounting software, there is no need to look beyond our list of the best crypto accounting software.

Top 7 Crypto Accounting Software

| Brand | Starting price | Best for |

|---|---|---|

| 1. Freshbooks | $17 – $55 per month | Sole proprietors |

| 2. Zoho Books | $20 – $30 per month | Simplicity and Efficiency |

| 3. Patriot | $10- $200 per month | Manage all businesses |

| 4. OnlineXero | $20 – $40 per month | Different industries |

| 5. SoftLedger | $749 per month | Crypto accounting and financial management |

| 6. Crypto | $60 – $200 per month | Digital assets |

| 7. Cryptoworth | $285 – $910 per year | Crypto businesses |

| 8. ZenLedger | $49 – $999/year | Crypto businesses |

| 9. TokenTax | $35 – $3499/year | Crypto tax calculations |

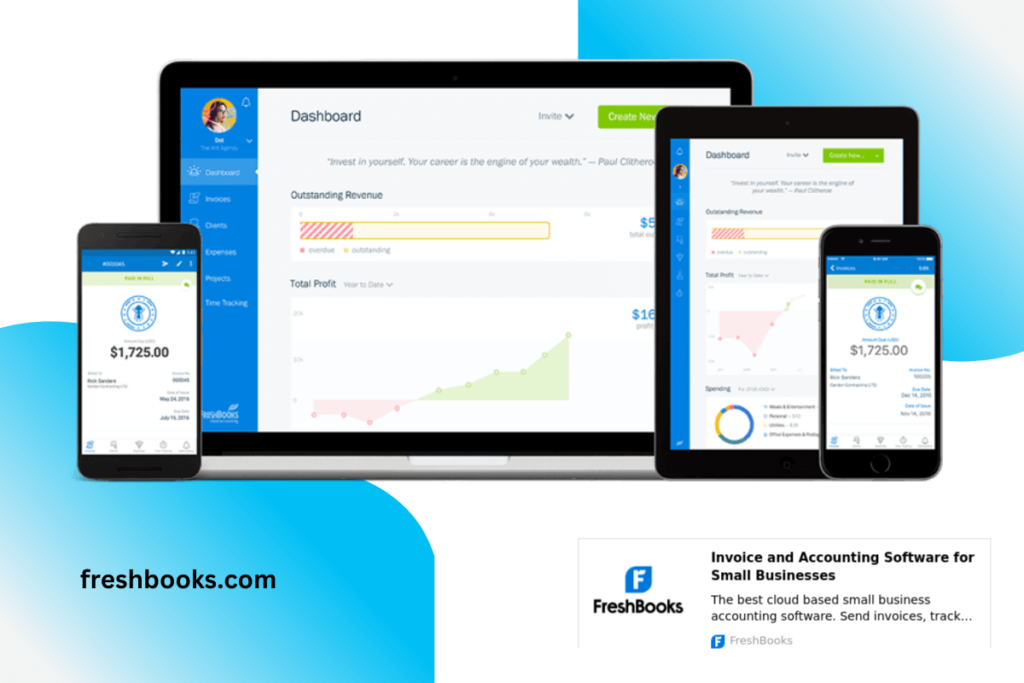

1. Freshbooks – Best & Easy for Crypto Accounting

Freshbooks is a simple, secure, easy-to-use accounting and bookkeeping software for sole proprietors, freelancing, and solo entrepreneurs. You can effortlessly run your small business with Freshbooks accounting software.

It helps organizations deal with their invoices and expenses and facilitates them with automated payments. It provides extra information by classifying tabs and improves profitability with Double-Entry Accounting tools. Its tabs include profit and loss, chart of accounts, balance sheet, sales tax summary, and balance sheet.

Staying organized, keeping track of installment payments due and expenses incurred, sending invoices, and accepting payments are accessible with the software. Freshbooks is one of the best crypto accounting software that is particularly good for businesses and those with only one operator and owner.

Pricing:

Freshbooks offers four different pricing plans with a free trial and a demo. These includes:

- $17.00 per month for Lite (with 5 billable clients)

- $30.00 per month for Plus (the most popular with 50 billable clients)

- $55.00 per month for Premium (with unlimited billable clients)

- Custom pricing plans are also available for businesses with unlimited billable clients and specialized features. (Currently 90% off for 3 months on all 4 plans)

Up to five billable clients can receive unlimited invoices if they choose the Lite plan. If you choose the Plus plan, you will have 50 billable clients and total numbers with the Premium plan.

Highlights and Hidden Gems:

- Instead of clicking on another screen, you can enter the expense directly from the Expenses tab.

- Makes easy to invoice, taking only a few seconds to generate professional invoices.

- Make reports as clear as possible, so you can understand them while providing enough power for accountants.

- The application allows you to keep all your conversations, files, and other pertinent data in one central location, making it easier to manage projects.

Disadvantages and Limitations:

- A little bit expensive if you don’t use all its features.

- Miscategorization of items after import.

- The mobile app is good but has some technical issues.

- Doesn’t have automatic enumeration for all your invoices and expenses.

- Limitations of users and billable clients are one of its most significant disadvantages.

Also Read: Multi-Company Accounting Software

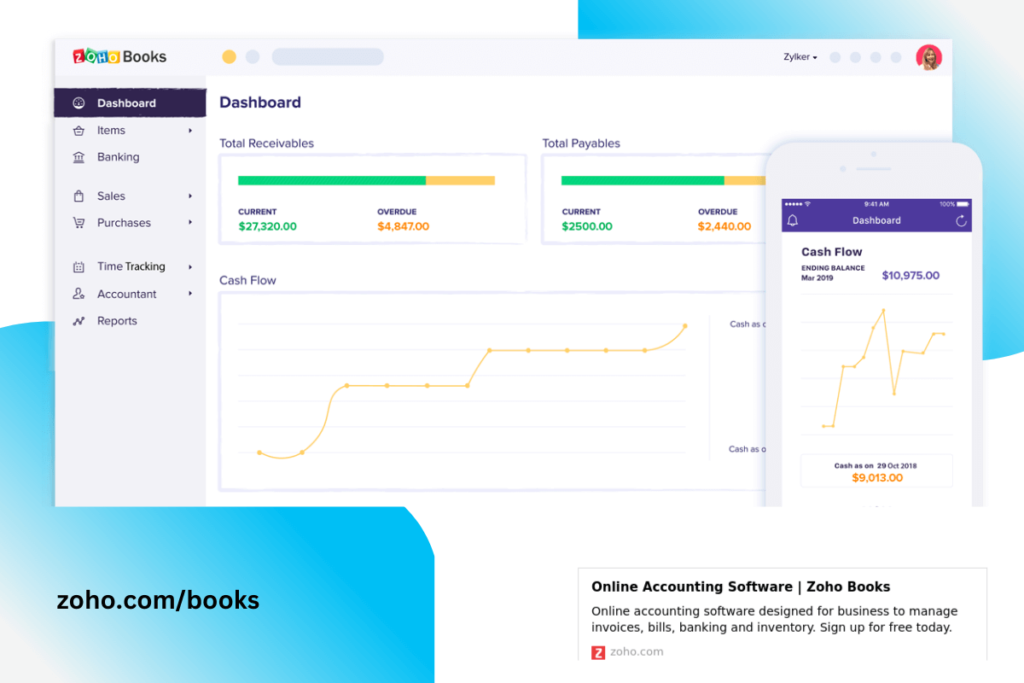

2. Zoho Books – Best for Online Crypto Accounting

Zoho accounting is an innovative online solution that can streamline back-office affairs, automate business plans, and improve secure collaboration between businesses and accountants. All companies, including small and large enterprises, can utilize this software, including marketing and consulting firms.

Zoho is a preferred accounting software with a simple interface and user-friendly mechanism. It helps improve your security by providing end-to-end accounting, easy collaboration, and an integrated platform. Its most acceptable features include estimating invoices, payables reports, inventory, time tracking, and contacts.

All these features make your complex accounting easier and help your organization and small businesses. With this accounting solution, you can manage cash flow, generate one-time or recurring invoices, keep track of inventory, manage purchases, track expenses, automate workflows, and much more.

Pricing:

Zoho accounting has the following pricing plans:

- A free trial is available.

- Standard has $10 per month billed annually or $12 billed monthly.

- Professional has $20 per month billed annually or $24 billed monthly.

- The Premium has $30 per month billed annually or $36 billed monthly.

- The Elite has $100 per month billed annually or $129 billed monthly.

- The Ultimate has $200 per month billed annually or $249 billed monthly.

Also, it does not require any credit card for the trial.

Highlights and Hidden Gems:

- It has top-notch reports.

- It has minimized data loss.

- The stock of retail businesses can be tracked, and smart purchases can be made.

- It enables users to invoice their customers in their currency and offers 11 languages.

- It allows proper integration and preserves data integrity.

- It enables users to manage clients and send an invoice by mail or online; recurring invoices can be automated, payment reminders and thank-you notes can be sent, and payments can be processed through online payment systems.

- It supports the devices such as iPhones, iPad, and Android.

Disadvantages and Limitations:

- Plan restrictions are implemented on users.

- No overall Payroll services are available.

- It has limited integration options available.

- Frustrating payment plans and a limited number of contacts.

- Automatic matching is not good enough.

Also Read: Monero Mining Software

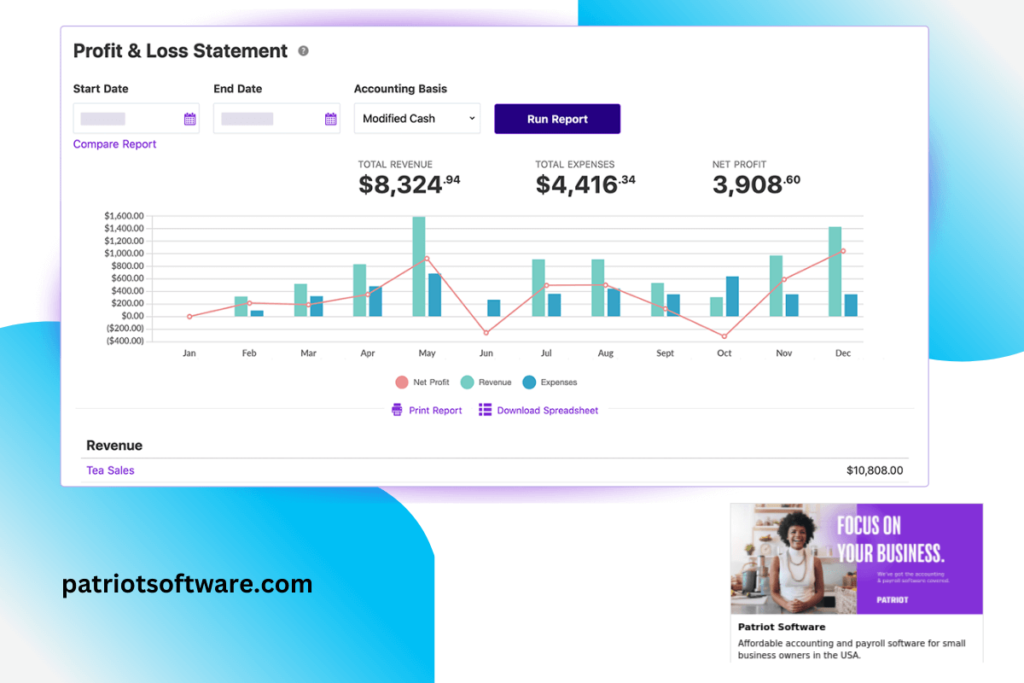

3. Patriot – Best for Small Business Crypto Accounting

Patriot offers accounting software with various tools for handling your crypto data. It has robust capabilities that automate the crypto accounting function of the business for optimal quality and efficiency. It is more accessible and affordable accounting software for small business and companies.

Patriot features are very user-friendly and consist of a simple interface. The reports it generates are simple, and anyone can easily export them. It helps make your accounting more manageable by providing reconciliation, estimates, checking register, profit and loss statements, trial balance, and balance sheets.

To optimize customers’ accounting setup and further speed up the onboarding process, new accounting customers also have the option to use one-click settings, which provides a pre-selected and famous chart of account settings.

Pricing:

Patriot has different accounting pricing plans, including:

- The Basic Accounting plan goes for $20 per month

- Premium Accounting plan goes for $30 per month

It also offers trials for 30 days and demos that are Video-based, self-guided, and personal.

Highlights and Hidden Gems:

- Unlimited Payments to Vendors

- Easiest Payroll administration

- Create and Print Unlimited 1099s and 1096s

- Track Your Expenses, Income, and Money

- Cash-basis and/or Accrual Accounting

- Edit or delete transactions

- Free expert support

Disadvantages and Limitations:

- Delayed response.

- Lack of customizable reports.

- Accounting errors are present.

- Additional fees (somewhat expensive)

- More integrations and detailed instructions should improve.

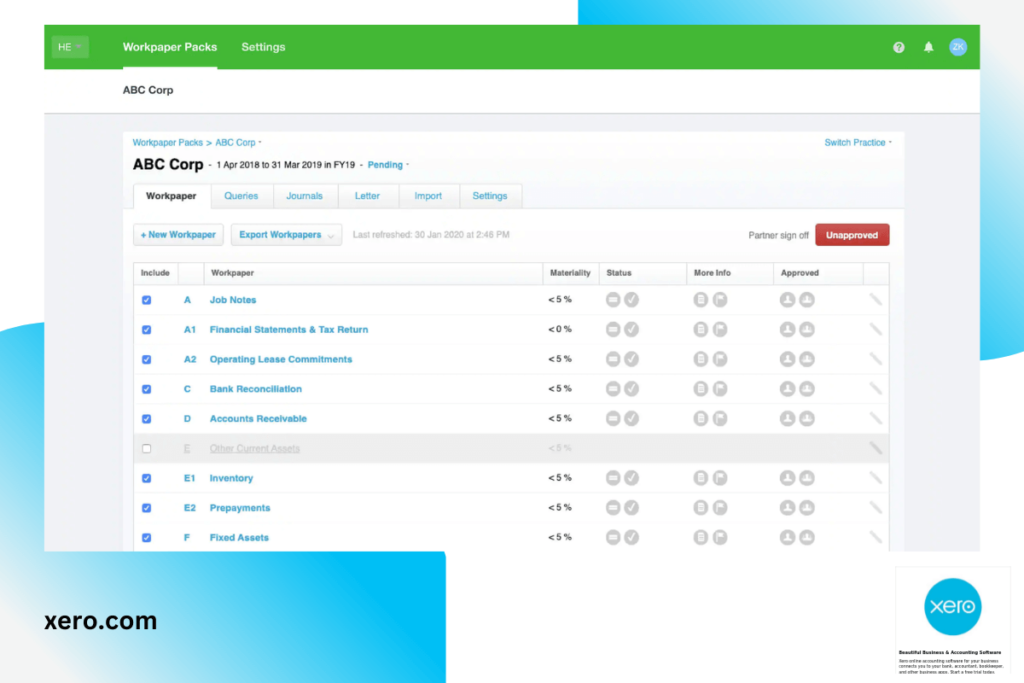

4. Xero – Best for Everyday Crypto Accounting

Xero is another feature-rich, cloud-based, and powerful accounting software that can also be useful for crypto accounting. Its interactive and user-friendly interface is highly captivating for users from different industries. Xero has become popular because it offers remarkable features and makes accounting activities easy.

Xero is the most popular and user-friendly software that helps accountants and bookkeepers to manage their bank connections, pay bills, claim expenses, accept payments, and track projects anytime and anywhere. It makes banking and crypto accounting easier.

However, you need add-ons to integrate crypto accounting in Xero. Again, the Ledgible Accounting tool is the best add-on that integrates well with Xero. Crypto traders happily leave accounting and bookkeeping to Xero and Ledgible Accounting so that they can focus on their business or trading.

Pricing

Xero offers three different pricing plans that cover all accounting essentials. Besides paying Xero’s prices, you also have to pay for add-ons. Xero’s three plans are;

- Offers free trial.

- The Starter plan starts at $25 per month.

- The Standard plan starts at $40 per month.

- The Premium plan starts at $54 per month.

Highlights and Hidden Gems:

- Its mobile application enables its users to handle bookkeeping activities on the go.

- Simple and elegant user-friendly interface.

- Integration, ease of use, and API availability.

- Instantly reconciles with your bank accounts, and you can get bank feeds.

- Generates accurate accounting reports to help you track your finances.

- Ledgible Accounting or any other similar add-on applications give you extra advantages on top of Xero’s features.

Disadvantages and Limitations:

- Disconnection of bank feeds without any reason.

- Sometimes removing/deleting transactions is difficult.

- Constantly changing reports.

- Technical issues and random bugs.

- Duplication of contacts and reports.

Also Read: What is Crypto Staking? | Cheap Accounting Software

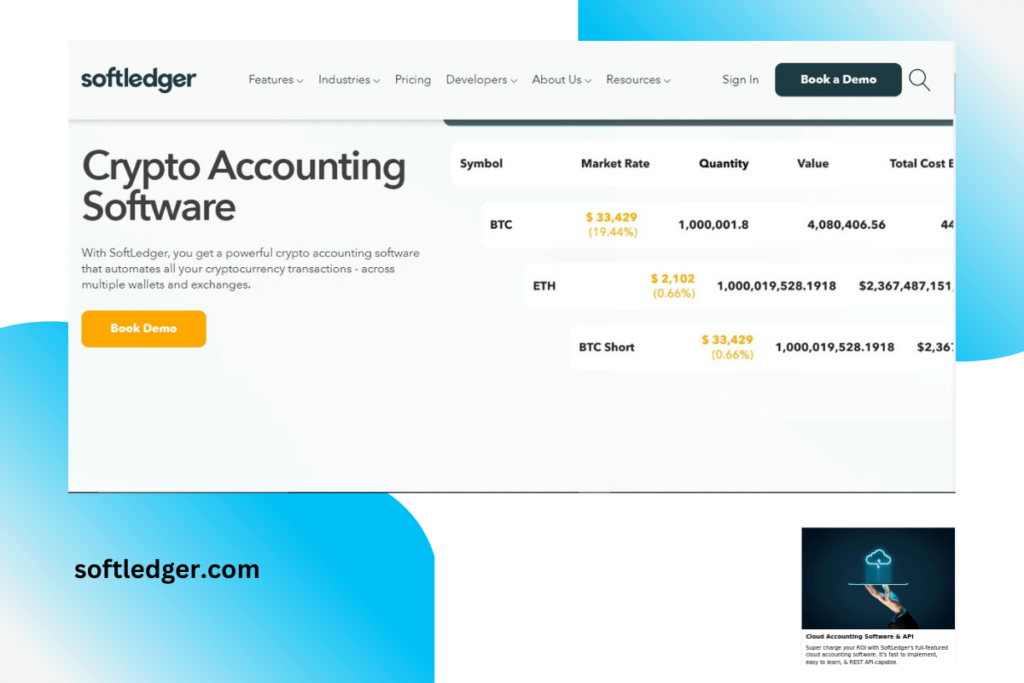

5. SoftLedger – Best for Real-Time Cloud Crypto Accounting

SoftLedger is one of the best crypto accounting software tailor-made for crypto accounting. It is a powerful tool that lets you be on top of your cryptocurrency business’s accounting and financial management.

It is a real-time cloud accounting software that helps you to improve your business and provide the following:

- Features like collecting quicker on accounts receivable.

- Automating your accounts payable.

- Accounting API embedded software.

- Crypto accounting.

- Cash management.

It is a fully connected financial toolkit that is built for speedy operation.

SoftLedger also offers remarkable crypto-specific features that simplify crypto assets accounting simple despite the complexities inherent in this new asset class’s accounting. SoftLedger is such an effective tool that allows perfect tracking of profits and losses that helps you to fulfill the crypto tax and reporting requirements.

Pricing

Softledger offers a free demo and two plans for small businesses and enterprises with custom pricing. These planes are

- SMB: Up to 3 users, 5 entities, and up to 5000 transactions per month.

- Enterprise: With unlimited users, unlimited entities, and integrated payments.

SoftLedger prices are not directly provided; you must contact the vendor for pricing. However, according to some reliable resources, SoftLedger pricing starts at $749 per month.

Highlights and Hidden Gems:

- Efficiently collects profit and loss data required for tax and reporting as it seamlessly integrates with cryptocurrency exchanges.

- It gives you a real-time view of your financial data, automatically tracking realized and unrealized profits and losses, live market rates, etc.

- It can easily track cryptocurrency transactions on a large scale as it supports multiple wallets and exchanges.

- It helps you get professional and powerful custom financial reports to analyze your trading performance.

- It also supports cryptocurrency accounting at scale; you can quickly scale up as your business grows.

Disadvantages and Limitations:

- Requirement of a technical person and developer skills for customization.

- Affordability issue, a bit expensive.

- No mobile app is available.

- Online customer support only.

- Limited Cryptocurrency module to only one currency.

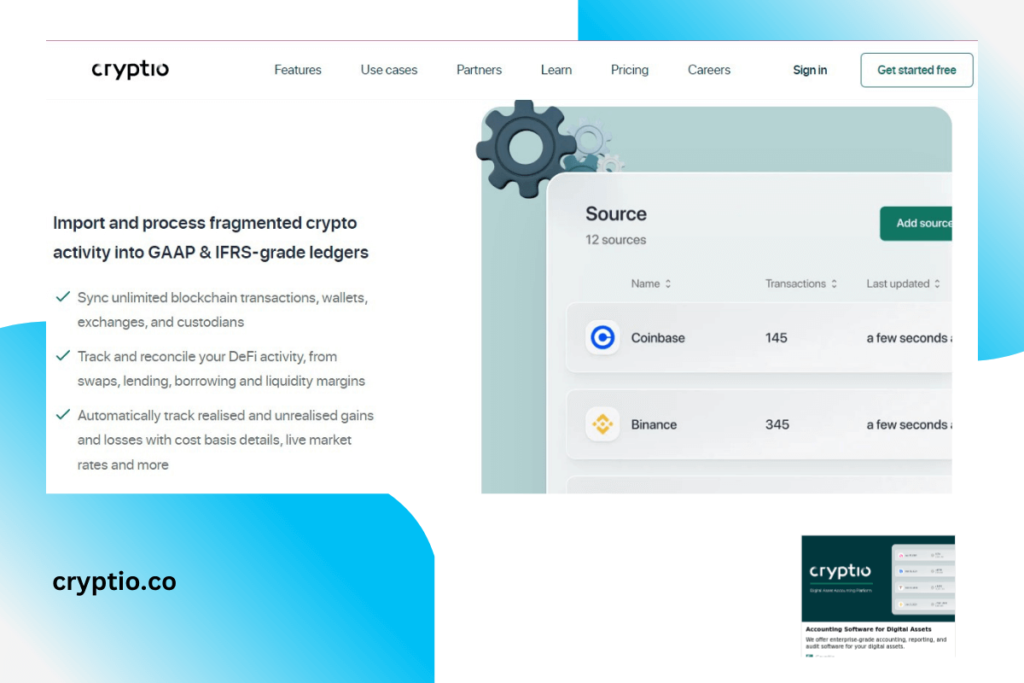

6. Crypto – Best for Accurate Crypto Accounting

Crypto is accounting software for digital assets that is a feature-rich tool to automate crypto accounting and focuses on your business. It optimizes bookkeeping tasks and saves significant time and resources. It has earned the Leader award in regulatory compliance and security certifications.

Crypto has all the power and potential to accurately convert digital asset data into accounting data to stay on top of your cryptocurrency business. Crypto provides you with a safe trading facility in more than one currency. Crypto is considered one of the safest and fastest Crypto exchange platforms.

Its efficiency and effectiveness directly result from its ability to connect to crypto wallets, exchanges, and custody solutions. All those characteristics make Cryptio one of the best crypto accounting software. Its official application is available both on App Store and Google Play Store.

Pricing

Crypto offers four pricing plans;

- The Starter plan starts at $60 per month

- The Pro plan starts at $80 per month

- The Premium starts at $200 per month

- The Enterprise plan (contact vendor for prices)

Highlights and Hidden Gems:

- Allows synchronization with your wallets, custody, and exchanges to track crypto assets precisely and perfectly.

- Presents full transaction history so that you never miss a single transaction.

- It prepares transaction data accounting by organizing transactions, reconciling transactions and invoices, profit & loss calculations, and much more.

- Exports and integrates data to meet all accounting and audit needs.

- It also gives you access to reports such as portfolio performance and capital gains.

Disadvantages and Limitations:

- Possible to delete or lose your virtual money or wallet.

- Technical knowledge and skills are necessary for trading.

- Continuous variations of currencies make users hesitant to use them.

- Under the target of cyber attacks, more protection is necessary.

Also Read: Bitcoin Mining Software |

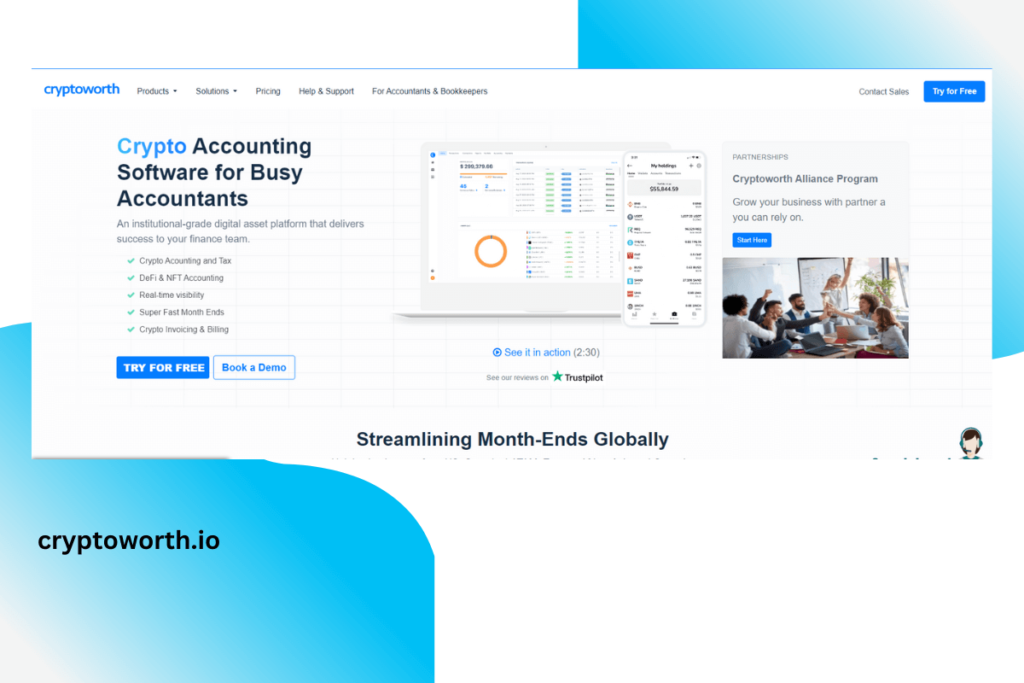

7. Cryptoworth – Best Crypto Accounting for Busy Accountants

Cryptoworth is another remarkable tool for crypto businesses that provide the ultimate crypto tax and accounting solution. It is a user-friendly, systematic, and well-organized tool. Cryptoworth has an all-inclusive dashboard and exhibits a portfolio breakdown of all coins.

It is used chiefly for busy accountants that have to deal with mega amounts. It helps your finance team and provides the following:

- Crypto accounting and tax facilities.

- DeFi and NFT accounting.

- Real-time visibility.

- Crypto invoicing and billing.

It also allows users to thoroughly analyze a transaction and look deeply at it for internal reviews. Cryptoworth’s Cryptocurrency Asset Management Platform (CAP) is also an exceptional tool. It is an intuitive crypto portfolio tracker, tax, and accounting module that connects wallets & exchanges, synchronizes transactions, calculates taxes, and much more.

Pricing

Cryptoworth offers a free plan and five plans;

- Basic: $0 per month.

- Business Tier 1: $285 per month

- Business Tier 2: $555 per month

- Business Tier 3: $910 per month

- Enterprise: Custom pricing

Highlights and Hidden Gems:

- Provides the ultimate solutions to crypto accounting and tax needs such as transaction reconciliation, tracing and analyzing transactions, transaction auditing, cost-based analysis, and much more.

- Offers scalability from individual to enterprise levels so that you don’t have to change software with the needs of growing cryptocurrency businesses.

- Its CAP is an extremely important module that makes your cryptocurrency accounting and taxation processes effortless.

Disadvantages and Limitations:

- Some minor bugs are present.

- More feedback and explanations are still needed.

- More expensive than the others software.

- Different themes of the mobile app make it frustrating.

Also Read: Ethereum Mining Software

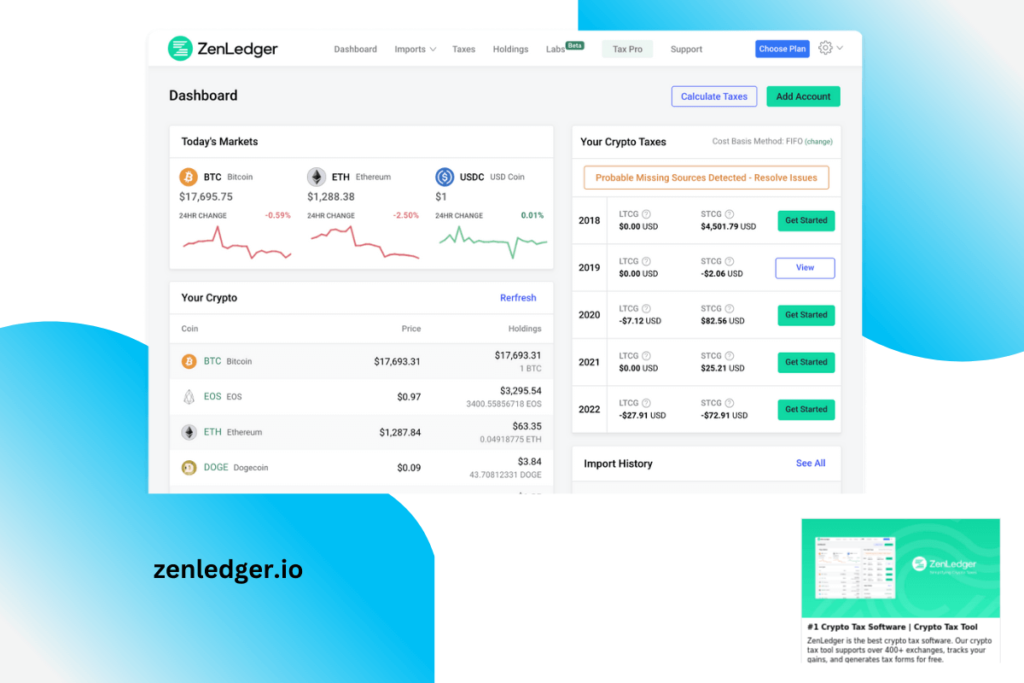

8. ZenLedger – Best for Crypto Accounting & NFT Taxes

ZenLedger is another helpful tool for crypto businesses that is custom-built for crypto tax calculations but also helps in accounting and bookkeeping activities. It helps to track crypto transactions, calculate profits, and avoid overpaying taxes. The most important feature is that DeFi, NFT, and Crypto taxes are done in minutes.

The good thing about ZenLedger is that it is effortless to set up and use. You can perform accounting and tax calculations in three simple steps – importing transactions, reviewing those imported transactions, and downloading your tax forms.

Another factor that makes ZenLedger one of the best crypto accounting software is its support of Defi protocols. In a nutshell, ZenLedger is a reliable tool for cryptocurrency traders and business people to get concise information about crypto trading and tax practices.

Pricing

ZenLedger offers a free plan and four paid plans. It also offers a generous offer of a 1-year refund policy.

- The Starter plan starts at $49 per year

- The Premium plan starts at $149 per year

- The Executive plan starts at $399 per year

- The Platinum plan starts at $999 per year

Highlights and Hidden Gems:

- It is one of the most user-friendly and easy-to-use cryptocurrency accounting and tax software that saves time.

- Supports more than 400 exchanges, including more than 30 Defi protocols. It also supports more wallets, fiat currencies, coin types, and blockchains than any other software.

- Its Tax-loss Harvesting tool lets you save significant money and trade smartly.

- It lets you see all your transactions in a single spreadsheet to simplify the analysis process.

- Offers the highest level of security and encryption through two-factor authentication.

- It also offers exceptional weekly support services via chat, email, or phone.

Disadvantages and Limitations:

- Only high-profile user tiers can avail DeFi support.

- Little bit pricing issue, expensive.

- Tax professional assistance for new users is expensive.

- Localized tax facility is only available in the US.

Also Read: Binance vs Voyager | Investing Software For Startups

9. TokenTax – Best Software for Crypto Accounting and Taxes

TokenTax is another custom-built software for crypto tax calculations that helps in basic accounting and bookkeeping activities. It makes the whole crypto taxation process automated, simple, and effortless.

TokenTax has made crypto taxes calculations very easy. This software allows you to analyze your reports, check documents and transactions, and import data. It helps its users save time, keeps them prepared, and makes them able to make strategic tax decisions with its automatically generated tax forms.

TokenTax lets you connect to exchange, track your transactions and profits, and file a tax return. It also helps you calculate and pay international taxes as well. Besides, TokenTax offers phenomenal customer support, and an expert is always ready to help you.

Pricing

TokenTax offers three pricing plans;

- The Basic plan starts at $65 per year

- The Premium plan starts at $199 per year

- The Pro/VIP plan starts at $3499 per year

Highlights and Hidden Gems:

- Automatically picks transaction data fills Form 8949 and calculates capital gains. You can easily use it in your tax returns.

- It comes with a Tax Harvesting Dashboard to present data on your unrealized gains and losses.

- Its other remarkable modules, such as Margin Trading, Crypto Tax Reports, and Tax Professional Suite, seamlessly simplify your crypto accounting and taxation processes.

- It supports every exchange and automatically imports transaction data.

Disadvantages and Limitations:

- Expensive for new users as well as for regular.

- Services are highly paid.

- Exchange closure can happen at any time.

- Sometimes, data is lost after the closure.

Read More

RELATED: Top Accounting Tools For Entrepreneurs | Best Hotel Business Accounting Tools | Accounting Software Fit For Daycares