Lookup Business Entity | Form Corporation | FAQ

Using the Maryland Secretary of State Business Search tool can save you time. It will also offer you various information at various points, during the entity development process. Unlike other states, which outsource entity creation and administration to the secretary of state, Maryland delegated these obligations to the Department of Assessments and Taxation (DAT). You may search their entity database by name or department ID from their website.

| Official Website: | https://egov.maryland.gov/businessexpress/entitysearch |

| Address: | 16 Francis Street – Jeffrey Building, Annapolis, Maryland 21401 |

| Telephone: | 1(410) 974-2486 |

| Fax: | 1(410) 280-5647 |

| mailto:support@sos.state.md.us |

Maryland Business Search Shortcut

Need help forming an LLC in Maryland? Create an LLC in minutes with ZenBusiness.

How To Lookup An Entity In Maryland

Maryland Secretary Of State Business Search By Name

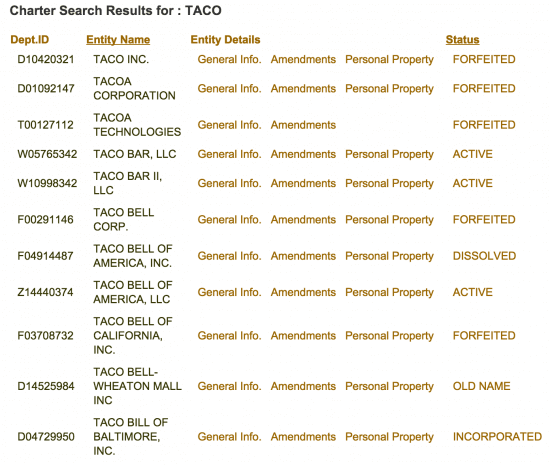

If you want to search for an entity by name, Maryland has set up the systems to make that possible.

- Go to the DAT webpage and click on “Name” from the dropdown menu. The site will take you to the appropriate search page.

- Click Continue after entering the entity name about whom you are looking for information.

- Based on your search parameters, you will be provided with a list of entities. You can pick general information, amendments, or personal property for any particular entity. Then, you’ll be sent to that entity’s specific page on the DAT website.

- You can access information on numerous aspects of the entity’s existence. You can as well request a Certificate of Status from the DAT after you’ve been sent to the entity’s primary information page.

Maryland Secretary Of State Business Search By Department ID

If you know the Maryland entity’s unique department ID, you may find this search strategy to be a more efficient use of your time.

- Go to the DAT webpage and choose “department ID” from the options list to conduct a search based on an entity’s department ID.

- The site will then provide the proper search form for you to use to perform your search. If the department ID of a Maryland entity matches your search entity and its input correctly, your search will only return one result.

- You can pick general information, amendments, or personal property from this page. Then you’ll be sent to the entity’s homepage, where you will find all of the information you want and also seek a Certificate of Status for the entity.

>>MORE: How To Get A Real Estate License In Maryland | What Happens If You Get A Speeding Ticket In Maryland? | Illinois Secretary Of State Business Search | New Jersey Secretary of State Business Search | Connecticut Secretary Of State Business Search

Steps To Forming A New Corporation In Maryland

1. Choose the type of business

New businesses must determine the structure of their business. In the Maryland Department of Assessment and Taxation, the most frequent business formations are; limited liability companies, partnerships, sole proprietorships, and corporations.

2. Choose a name for your business

To find out if a name is available, go to the Maryland Secretary of State’s website and do a name search. The name of your corporation must be distinct from that of other corporate names that are currently on record with the Maryland Department of Licensing and Regulatory Affairs. By submitting an Application for Reservation of Name to the Maryland Department of Licensing and Regulatory Affairs, Bureau of Commercial Services, you can reserve a name for six months.

3. Register your Maryland business

Maryland businesses can be registered on the Department of Assessments and Taxation’s website. The site walks you through the steps of registering a business online. The state of Maryland requires every business to have an agent for legal process serving.

If a company is sued, this person or business consents to take court documents on the company’s behalf. An entity with a certificate of power to conduct business in Maryland such as Northwest Registered Agent and GoDaddy, a Maryland resident, a Maryland company, or a foreign entity may serve as a registered agent.

4. Obtain a business license or permit

Operating an enterprise in Maryland requires the acquisition of permits or licenses. Individual occupational and professional licenses may be required in addition to business licenses for either you or the professionals you hire.

5. Obtain an EIN (Enterprise Identification Number) for your company

New firms must register for a Federal Employer Identification Number (EIN) with the Internal Revenue Service. This is required for the company employee withholding, federal unemployment insurance, and other tax circumstances.

>>MORE: North Carolina Secretary Of State Business Search | South Dakota Secretary of State Business Search | Idaho Secretary Of State Business Search | Washington Secretary of State Business Search | Ohio Secretary Of State Business Search

Frequently Asked Questions On Maryland Secretary Of State Business Search

Is there a personal property tax for businesses in Maryland?

Yes, businesses are required to pay a yearly tax depending on the value of their tangible assets (furniture, equipment, machinery, etc.). The Maryland Department of Assessments and Taxation oversees the valuation process. Counties and municipalities collect taxes based on the property’s location.

What is the best way to find out what licenses I could require?

Do you want to create a construction company, a storage warehouse, or a vending machine company? These are just a handful of the types of enterprises that need a special permit. To find out what licenses and permissions you might need for your firm, go to Maryland’s Business License Database. When corporations, limited liability companies, limited partnerships, and limited liability partnerships are formed, the Maryland Department of Assessments and Taxation registers them for this tax immediately.