Lookup Business Entity | Form Corporation | FAQ

This page was created exclusively to help business representatives use the Nebraska Secretary of State’s website’s business entity search tool. You may also utilize this online feature to obtain access to specific certifications or to learn more about a company’s numerous business filings.

| Official website: | https://sos.nebraska.gov/business-services/corporate-and-business |

| Address: | P.O. Box 94608, Lincoln, NE 68509-4608 |

| Telephone: | 1(402) 471-4079 |

| Fax: | 1(402) 471-3666 |

| E-mail: | sos.corp@nebraska.gov |

Nebraska Business Search Shortcut

Need help forming an LLC in Nebraska? Create an LLC in minutes with ZenBusiness.

How To Lookup An Entity In Nebraska

Nebraska Secretary Of State Business Search By Name

- Navigate to the Nebraska SOS webpage to access the business entity search tool. You’ll see a list when you get there. You have the following options for searching by name: name starts with, name keyword search, the name sounds like, name exact match

- Once you’ve chosen one of the options, you’ll be given the choice to describe the entity’s status as well as the chance to type in the name in question.

- To continue, answer the reCAPTCHA before selecting “Perform Search.”

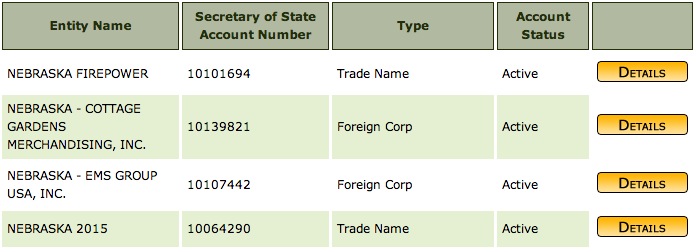

- A list of names will appear, based on the metrics of your search. This list will include information such as the entity’s name, account number, category, and status.

- Click the Details link to learn more.

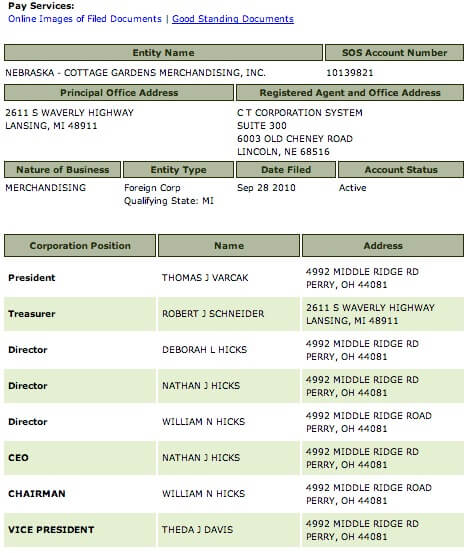

- On the business details page, you’ll find all of the company’s information and filings with the Secretary of State, as well as the option to purchase a Certificate of Good Standing by mail or online.

Nebraska Secretary Of State Business Search By Account Number

A second and more precise option is to do an inquiry using your account number. This search will provide you with quick access to information about your firm. All you have to do is go to this page, choose the account number option, and fill in the required information. Please verify that you are not a robot before proceeding.

If you enter your account number correctly, your business details page should appear which will include all papers filed with the Secretary of State’s office as well as all data currently on file with the Secretary of State’s office. A Certificate of Good Standing will also be available for purchase.

>>MORE: How To Buy A House In Nebraska | New Jersey Secretary of State Business Search | Connecticut Secretary Of State Business Search | North Carolina Secretary Of State Business Search | South Dakota Secretary of State Business Search

Steps To Forming A New Corporation In Nebraska

1. Register a Name

The Secretary of State is in charge of company and trade name registration. If you’re doing business as someone other than yourself, you’ll need to register with the Secretary of State.

The name of your corporation must be distinct from that of other corporate names that are currently on record with the Nebraska Department of Licensing and Regulatory Affairs. By checking the Nebraska business name database, names may be examined for availability.

2. Select a Registered Agent in Nebraska

The state of Nebraska requires every business to have an agent for legal process serving. If a company is sued, this person or business consents to take court documents on the company’s behalf. An entity with a certificate of power to conduct business in Nebraska such as Northwest Registered Agent and GoDaddy, a Nebraska resident, a Nebraska company, or a foreign entity may serve as a registered agent.

3. Articles of incorporation should be filed

The articles must contain the following information: the corporation’s name; its intention; the number of shares it is permitted to issue; the name and address of the agent receiving service of process; the name and address of the resident agent receiving service of process; and the names and addresses of all incorporators.

4. Make bylaws

The by-laws, also known as the operating agreement, are internal agreements that specify how the business and its executives are to be governed. They are not reported to the government. Corporate bylaws are not legally needed for your company, but you should nonetheless adopt them since they define how your company will operate and demonstrate to lenders, creditors, the IRS, and other parties that your company is genuine.

5. Employer Identification Number (EIN)

Employer Identification Numbers, or EINs, are issued by the IRS and serve as a unique identifier for your company. Check with the IRS to discover whether you require an EIN or if you have any issues. For taxation reasons, this identification number serves as the corporation’s Social Security number. Among other things, it enables you to recruit staff and create a company bank account. The IRS website has an online application that you may use to get an EIN. You will require this number for future documents and to file your company’s tax filings, so keep a record of it.

>>MORE: How To Start A Nonprofit In Nebraska | Idaho Secretary Of State Business Search | Washington Secretary of State Business Search | Ohio Secretary Of State Business Search | Arizona Secretary Of State Business Search

6. Register your corporation

If you will have workers, participate in retail sales, rent or lease property, or perform any taxable services, you must register with the Department of Revenue. To register, go to the Department of Revenue’s website and fill out Form 20. Follow the directions on the form. If you have any issues, visit the NDOR’s website’s Frequently Asked Questions section or contact them.

7. Determine the amount of insurance coverage that is required

Unemployment insurance, new hire reporting, contractor registration, and other labor-related programs are all handled by the Department of Labor. Please contact the Department of Labor if you want to hire staff to confirm that you are fully protected.

Frequently asked questions on Nebraska secretary of state business search

Is it possible for a foreign LLC to do business in Nebraska?

All LLCs formed outside of Nebraska must register with the Nebraska Secretary of State to do business in the state. For service of process, foreign LLCs must choose a registered agent who is physically situated in Nebraska. Fill out a Certificate of Authority of Foreign Limited Liability to register. The application can be sent in the mail or submitted online.

Do I have to pay any Nebraska business taxes?

You may be required to register with the Nebraska Department of Revenue in specific circumstances, such as if you have workers or will be selling items and collecting sales tax (DOR). You may register for several taxes on the DOR website.