Lookup Business Entity | Form Corporation | FAQ

The Business Division of the Pennsylvania Secretary of State can do a Pennsylvania Secretary of State Business Search. The Secretary of State for Pennsylvania’s Business Division is in charge of managing and establishing the registration for every business entity registered in the state. By doing a Pennsylvania business search with the Secretary of State, you may search for an existing company entity or see if the business name you want is available in Pennsylvania.

All businesses functioning in the state are included in the registry. Limited companies, limited liability partnerships, corporations, and limited partnerships are all examples of this. The Secretary of State in Pennsylvania also develops new policies for businesses and companies.

| Official Website: | http://www.dos.state.pa.us/corps |

| Address: | 401 North Street, Room 206, Harrisburg, PA 17120 |

| Phone: | 1(717)787-1057 Toll Free 1(888) 659-9962 |

| E-Mail: | RA-CORPS@pa.gov |

| Fax | (717) 705-0927 or (717) 783-2244 |

Pennsylvania Business Search Shortcut

Need help forming an LLC in Pennsylvania? Create an LLC in minutes with ZenBusiness.

How to Lookup an Entity in Pennsylvania

Pennsylvania Secretary of State Business Search by Business Name

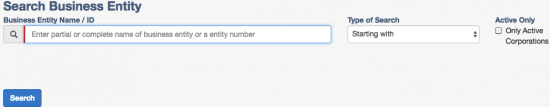

- On the search tab of the Pennsylvania Department of State website, look for business groups that have registered with the Pennsylvania SOS.

- Begin by putting the business entity’s name into the search box. The search is conducted under the premise that the search criteria begin with.

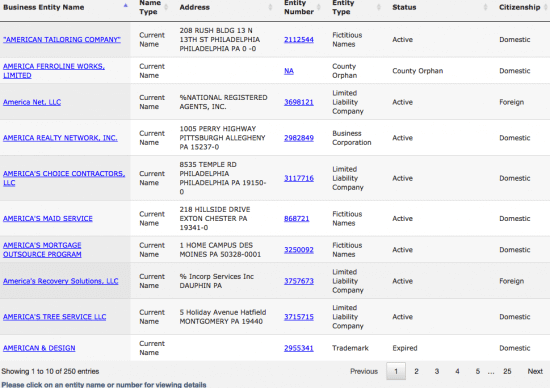

- Select the option to search. A list of entities will appear on the results page, along with their entity number, category, and status.

- To understand more about an entity, simply click on its name. The following is a list of few accessible information: Name of the entity, Entity Number, Business Type, Status, Entity Creation Date, Effective Date, Principal Business Address, Officer/Board of Directors/Member Information, Registered Agent

Pennsylvania Secretary of State Business Search by ID Number

- Look up a business entity ID number using the search feature on the page. Selecting just active businesses or utilizing the kind of search drop-down option might help you narrow down your results.

- You’ll get a list of all the Pennsylvania entities which include the search keyword on the next page.

- Click on the business entity name or the entity number to get more information about that company.

- You’ll find a lot of important business information regarding the PA corporation you’re looking at right here. At this point, you have the opportunity to purchase additional certified papers.

>>MORE: Oklahoma Secretary Of State Business Search | Georgia Secretary Of State Business Search | Arizona Secretary Of State Business Search | Idaho Secretary Of State Business Search | Alaska Secretary of State Business Search

Steps to Form your New Corporation in Pennsylvania

1. Name your corporation

The name of your corporation must include the terms “Incorporated,” “Corporation,” “Company,” or “Limited,” or a short version of one of those phrases. The name of your corporation must be distinct from that of other corporate names that are currently on record with the Pennsylvania Department of Licensing and Regulatory Affairs.

By checking the Pennsylvania business name database, names may be examined for availability. By submitting an Application for Reservation of Name to the Pennsylvania Department of Licensing and Regulatory Affairs, Bureau of Commercial Services, you can reserve a name for six months.

2. Select a Registered Agent in Pennsylvania

The state of Pennsylvania requires every business to have an agent for legal process serving. If a company is sued, this person or business consents to take court documents on the company’s behalf. An entity with a certificate of power to conduct business in Pennsylvania such as Northwest Registered Agent and GoDaddy, a Pennsylvania resident, a Pennsylvania company, or a foreign entity may serve as a registered agent.

3. Create and approve bylaws for the corporation

The fundamental guidelines for running your organization are outlined in the bylaws, which are internal corporate documents. They are not reported to the government. Corporate bylaws are not legally needed for your company, but you should nonetheless adopt them since they define how your company will operate and demonstrate to lenders, creditors, the IRS, and other parties that your company is genuine.

4. Initial Directors should be appointed

The first corporate directors are chosen by the incorporator and serve on the board up until the inaugural annual shareholder meeting. At the first board meeting, the directors pick corporate officials, choose a corporate bank, establish the corporation’s fiscal year, approve the issuing of shares of stock, and adopt a formal stock certificate form and official seal.

5. Decide on a share strategy and structure

The number of shares issued should be stated in the company’s annual report. Most firms offer certificates to shareholders stating their shares, even though it is not usually necessary. Stock can be privately or publicly issued. Typically, founders, management, workers, or a small group of investors receive privately issued shares. A public corporation offers some of its equity shares for sale to the general public.

6. Incorporate in Pennsylvania by filing Articles of Incorporation

The articles must contain the following information: the corporation’s name; its intention; the number of shares it is permitted to issue; the name and address of the agent receiving service of process; the name and address of the resident agent receiving service of process; and the names and addresses of all incorporators.

7. Obtain a Federal Employer Identification Number (EIN) for your Pennsylvania corporation

Obtaining a federal employer identification number (EIN) is required for your business. For taxation reasons, this identification number serves as the corporation’s Social Security number. Among other things, it enables you to recruit staff and create a company bank account. The IRS website has an online application that you may use to get an EIN. You will require this number for future documents and to file your company’s tax filings, so keep a record of it.

>>MORE: Hawaii Secretary Of State Business Search | North Carolina Secretary Of State Business Search | Rhode Island Secretary Of State Business Search | Nevada Secretary Of State Business Search | Nebraska Secretary Of State Business Search

Frequently Asked Questions on Pennsylvania Secretary of State Business Search

Why are there so many firms that are registered in Pennsylvania?

Any corporation conducting business or expecting to do business anywhere in the United States, particularly if the firm will have any activities in Pennsylvania, should incorporate in Pennsylvania. This is true regardless of whether the company is publicly traded.

In Pennsylvania, where can I get tax information?

Contact the Department of Revenue’s new Taxpayer Services Center at (717) 787-1064 for Pennsylvania tax information. The Internal Revenue Service may be reached at (800) 829-1040 for federal tax information.

Is there a need for registered agents in Pennsylvania?

No. According to their information, the company has a registered office address. Service of Process may be sent to the entity’s registered address as listed in our records. A Pennsylvania judge may order the Secretary of the Commonwealth to accept service. The court order, along with the complaint, is sent certified mail, to the Department of State, return receipt requested. The statutory cost for each defendant to be served is $70.

How can I come up with a unique business name?

The first step in naming your firm is to figure out what type of business structure you’ll utilize. After that, you’ll come up with at least four potential names. Once you have a list of names, compare them to business standards, name availability, and state regulations.

Is it necessary to write “LLC” after my business name?

Most states will require you to use LLC after your new business’s name if you choose to use a limited liability company structure. You can also use the term “limited liability company” in its entirety. If you’re marketing your business, you usually don’t need to add “LLC” to the end of the name.