RELATED: Best Accounting Distributor Tools | Accounting Hotel Business Software | Best Accounting Logistic Software

Accountants have the tough job of playing with numbers 24/7 and giving a business all the accounting services like preparing balance sheets, accounting for expenses, payroll, etc. And here, one of their most sought-after tools is excellent accounting software.

Accountants have usually specialized in the domain of accounting. So they don’t need to opt for software that is simple and easy to understand only. They do not necessarily need to purchase software that offers only basic features.

Accountants are very familiar with all the aspects of bookkeeping. And as they are professionals, they need more advanced tools to meet the needs of growing businesses. Their topmost priority is usually software that offers the most features and functionality, which will benefit their client the most.

To do your job well as an accountant, CPA, or bookkeeper, you’ll need a few resources. Good accounting software is one of the essential tools. With so many choices, how does an accountant decide which software to purchase? Regrettably, there isn’t a single right response. After all, what appeals to one accountant may not work for the next. Even so, you can narrow down your options by eliminating software that is obsolete, overpriced, or otherwise fails to meet your needs.

Upfront Conclusion

The best accounting software for accountants right now is Oracle’s NetSuite and Striven.

Why do Accountants Use Accounting Software?

You might be wondering what the need for Accounting Software is if accountants are highly skilled at their job. Well, accounting software offers a lot of convenience for its users.

#1 Keeps track of finances

An accounting server is a category of a computer program that allows you to keep track of an accountant’s client’s finances. The complexity of such systems will vary greatly, with some designed for nothing more than basic bookkeeping and others designed to handle the entire financial comings and goings of large corporations.

#2 Saves resources

Accounting software allows businesses and accountants to use their accounting departments’ resources better while also reducing costly accounting and reporting errors.

#3 Improves precision

Accounting software aids accountants in that it provides improved precision by reducing or removing human measurement errors. Doing a lot of mathematical calculations by hand is a big part of manual bookkeeping. Early in the process, an incorrect estimate may have a significant effect on the final balance.

#4 Automation

Accounting software helps accountants to process their accounts faster than they could if they did it manually. Part of this speed improvement is due to computers, which can process data even faster than the human brain.

Accounting software enables businesses to improve productivity by automating processes. The advantages of accounting software’s speed and reliability are often accompanied by lower overall costs. Because an accounting program helps each participant of the accounts department accomplish more in less time, a smaller group might be required.

#5 Reliable

Accounting software enables companies to provide timely and reliable financial statements to all members of their employees. Many accounting software packages offer reporting modules that allow users to develop this type of report by simply filling out forms or pressing a button. Creating such a report manually, on the other hand, will take a long time.

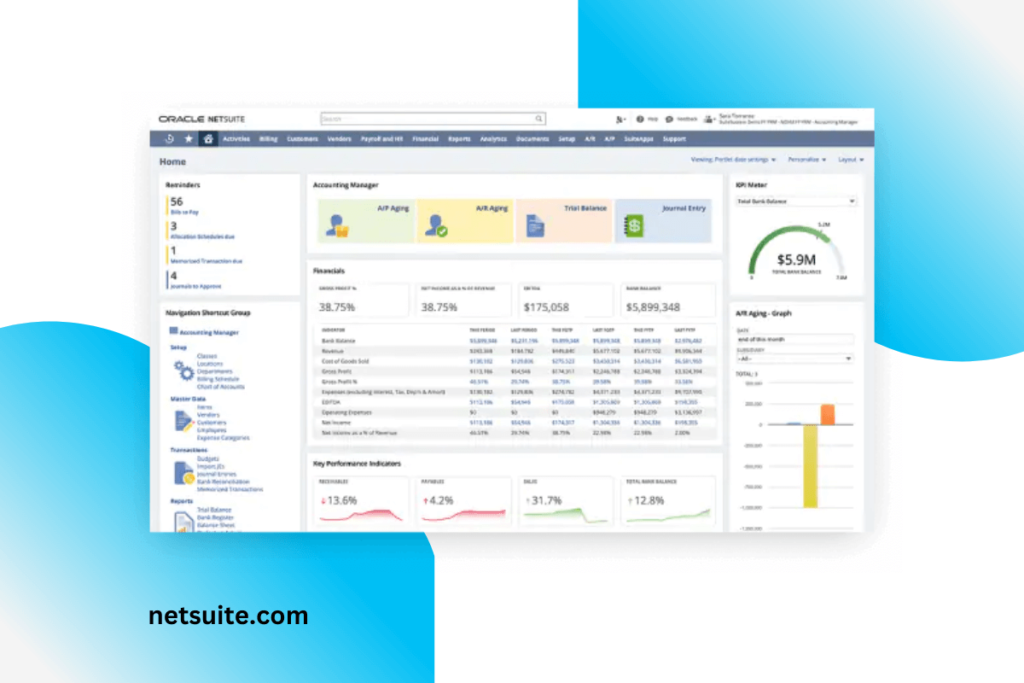

1. Oracle’s NetSuite

NetSuite is a business-oriented software package that executes cloud enterprise resource planning (ERP) and customer relationship management (CRM) tasks. Accounting, procurement, supply chain, and order management are only a few of the core financial business processes management that NetSuite ERP manages in the cloud. NetSuite is really the only on-demand CRM that provides a complete 360-degree view of the market.

This accounting software is the best accounting software for accountants because it offers very advanced features. It is not ideal for small businesses, but professional accountants can run it smoothly and make excellent use of the features and functions it has to offer.

Mobile compatibility

Not only is it fantastic and detailed software, but it also offers you immense convenience. You need not turn on your computer every time you want to glimpse the company’s financial performance in the discussion. NetSuite allows you to access financial data through a web browser or a mobile device. So you can access it from anywhere.

Automatic updates

The device is updated automatically and offers a variety of customization options. The software upgrades on its own from time to time, so it constantly gets all-new features and variations the company decides to add.

Cloud-based

NetSuite is a cloud-based application that can be accessed via a variety of web browsers. So make sure you have a stable internet connection if you’re using oracle suite.

Data Security

Data can be exported to IIF or CSV files. NetSuite’s data center, as well as the suite’s built-in security controls, ensure data security. Don’t ever worry about your data getting into the wrong hands and potential losses due to that.

No unnecessary costs

There is no hardware or big upfront licensing charge. NetSuite also doesn’t have any hardware or software maintenance costs and no complicated setups for this service.

Unification

NetSuite is a centralized international business platform designed to help you manage operations across various countries, currencies, languages, and divisions in real-time. From the point of sale and order management to marketing, merchandising, inventory, financials, and help, you can Unify any aspect of your online shop.

Features

It’s a horizontal plan that caters to a wide variety of industries. Companies’ back-office, procurement, and operation processes can all be integrated with NetSuite Financials.

Some of the features included in NetSuite’s package are:

- Financial accounting.

- Financial reporting and analytics.

- Payment processing.

- Order and billing management.

- Supply chain management.

- Inventory management.

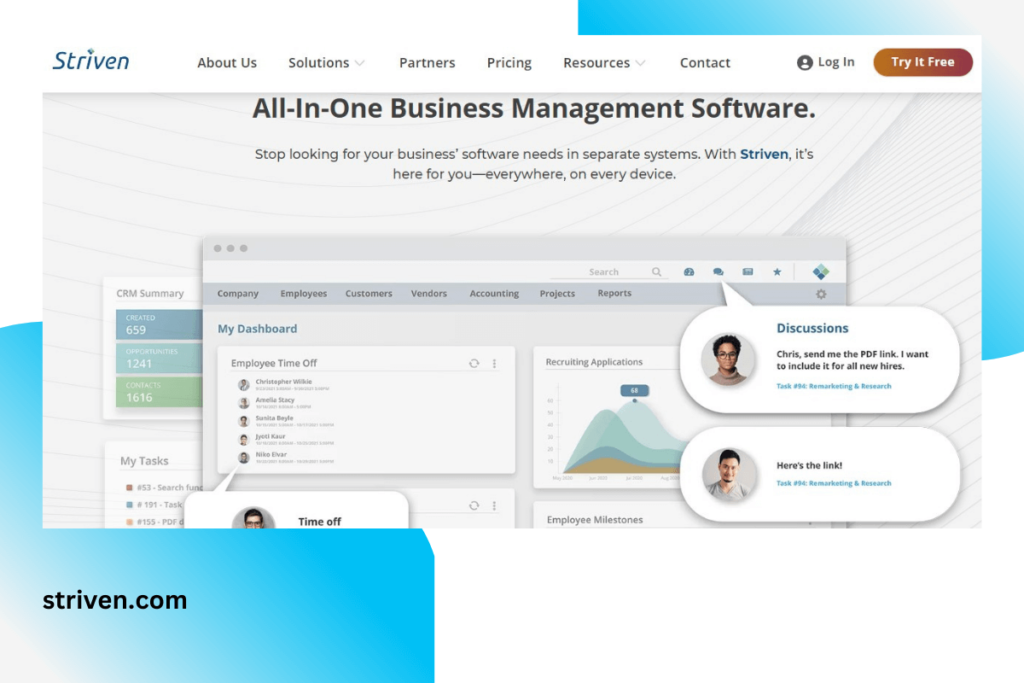

2. Striven

Striven is a cloud-based enterprise resource planning (ERP) system that can be used by companies of all sizes in a variety of industries. Google, Microsoft, Authorize.Net, Yodlee, and ShipStation are all supported by Striven.

Access and Updates

Striven can be accessed from any location and on any computer. It updates itself, so there is no downtime in terms of efficiency. Striven offers coverage on a per-user, per-month basis, including phone, live chat, email, and online helpdesk ticketing support. Striven developed a strong, unified device that links and enhances core business processes based on their experience assisting businesses to succeed.

Automation and streamlining of processes

Striven helps improve processes that save time, resources and allow a company to develop and improve the flow of knowledge through divisions and job functions.

Businesses may use Striven to simplify key operations and increase employee efficiency. When all the critical enterprise management processes like accounting and project management work together, the overall efficiency Is increased, and the team obtains synergy.

Perhaps this is why this software is the best accounting software for accountants.

Reasonable Price

Striven has all of the tools you’d want from a top-tier ERP device, but it’s priced reasonably. You’d think that such advanced tools designed for accountants would be pricey, but Striven proves you wrong!

Customer Support

Striven’s software advisors and service technicians are quick to react and quickly fix any issues you may have to get back to doing what you do best.

Features

Some of the features Striven has to offer are:

- Accounting.

- Inventory control.

- Human resources.

- Customer relationship management (CRM).

- Project management.

- Calendar integration.

- A company portal.

- Internal newsfeed with social media integration.

- Versatile input tools.

- Dashboard customization.

- Personalized reporting.

- A resource navigator.

- Surveying.

- Land service management,

- Business Analytics and much more!

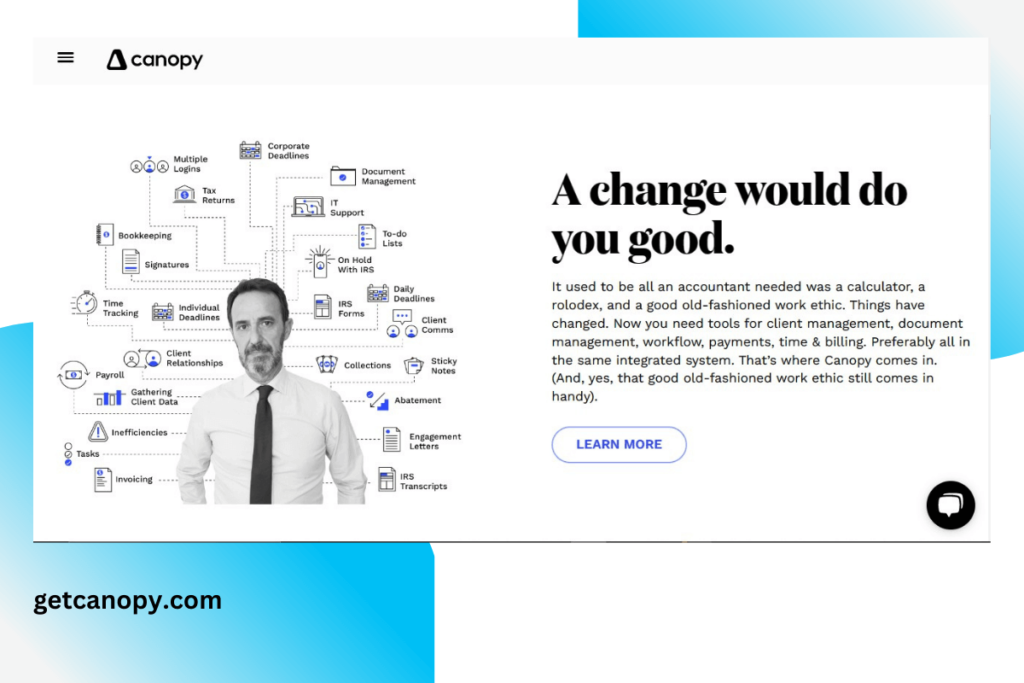

3. Canopy

Canopy is management software and tax resolution platform that runs on the cloud. It includes a practice management system that lets users automate client onboarding, control protected file sharing, and keep track of client communications.

Accounting companies, tax consultants, tax lawyers, and licensed agents may use it as a platform. It offers an integrated suite of tools that can help improve productivity while also providing a connected customer experience. Clients can safely share files, complete case to-do lists, e-sign papers, access invoices, and make payments using Canopy’s mobile app.

Pricing

Accountants can benefit from Canopy greatly because it is suitable for mid-size accounting firms. They can get this robust practice management solution that allows them to handle their team, workload, and clients all from one location. Canopy’s monthly pricing starts at $89.00 per feature. A free trial is available from Canopy.

Tax Resolution

Canopy’s tax resolution section assists you in getting clients back on the rails with the IRS by notices, transcripts, collections, and other methods.

Pricing And Customer Support

The cost is based on an annual subscription. Phone support, an online knowledge base, and video tutorials are all available.

Features

Some of the features Canopy has to offer are as follows:

- Client requests.

- Digital signatures.

- Recurring payments automation.

- A bird’s eye view of the company’s progress.

- Customized templates.

- Document reviews.

- Transcripts retrieval.

- Notices.

- Tax resolution.

- Automated workflows.

- Accounting features.

- Data management features.

- Security.

- Penalty Abatement.

- Audit log and permissioning.

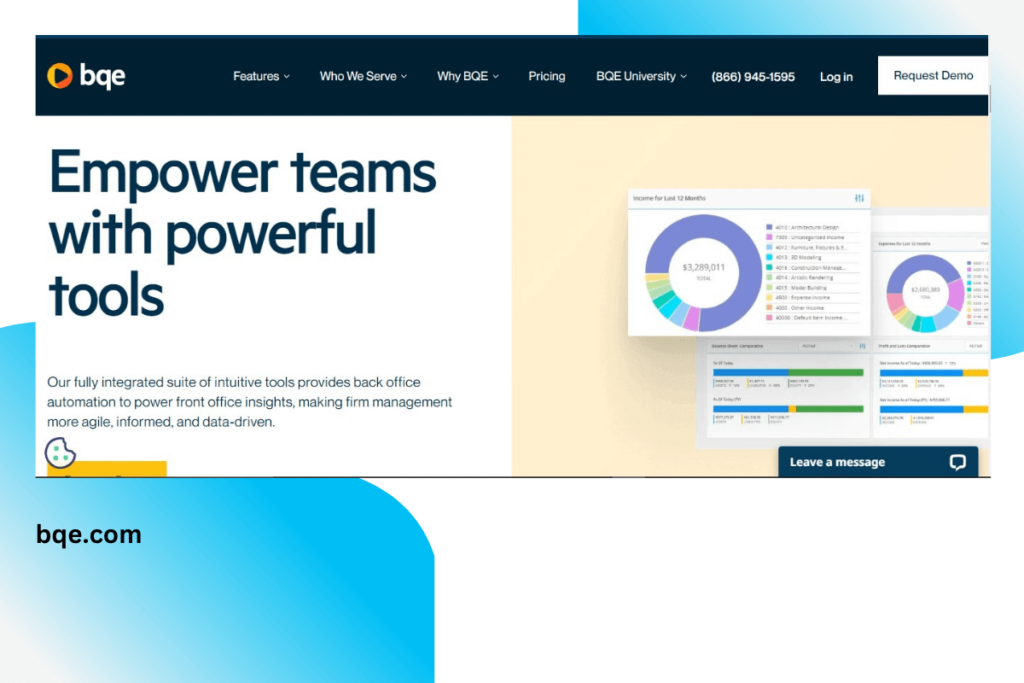

4. BQE Core Suite

BQE Core Legal is a cloud-based legal accounting, time monitoring, and billing and invoicing system. It can help several law firms with their activities, including litigation, corporate, family, tax, immigration, and more.

Thus BQE core suite is one of the best accounting software for accountants. With the multitude of fantastic features and specialized accountant-oriented features, CPAs from all over the world love using this accounting platform!

Small to mid-sized legal firms looking for a time monitoring solution with built-in accounting and CRM functions will benefit from the system.

Mobile compatibility

You don’t necessarily have to get your computer running every time you want to use the BQE Core suit. BQE Core can be acessed from any browser or smartphone, and there are native applications for iPhone and Android devices that are perfectly usable. Over 200 customizable report formats are included to generate various invoice forms, including percent full, retainer, recurring, fixed, hourly, phased, joint, and more.

Automation

CORE makes it simple to keep track of all expenditures and receipts and connect them to projects for accounting and billing. CORE is very adaptable and fast and very easy to use. You will be able to keep track of time because CORE offers monthly, regular, bi-weekly time cards.

It also comes with timers that can be paused and played at any time during the day. It only takes two minutes per day.

Integration

BQE Core has accredited associations with QuickBooks Online, MYOB AccountRight Live (Australia), Dropbox, Google Drive, and Amazon Web Services and provides integration with various third-party accounting tools.

Features

Some of the valuable features BQE Core Suite has to offer are:

- Track Time and Expenses

- Over 150 built-in Invoice templates

- Vendors management.

- Employee management.

- Project management.

- Client management.

- Billing, Accounts Receivable, and Payments

- Accounts Payable

- Over 400 built-in Report templates

- Credit card transaction import

- Revenue forecasting

5. AccuFund Accounting Suite

AccuFund is an online accounting platform tailored to the nonprofit sector. AccuFund’s Accounting suite, which is integrated into just one, assists nonprofit organizations and government entities in reporting revenue sources, costs, and operations for internal control as well as external enforcement and auditing.

In light of its fantastic accounting tools and functions, it’s definitely one of the best accounting software for accountants.

Report Creator

Accountants can easily create financial meeting agendas using AccuFund’s built-in report creator, which helps them identify accounts and modify account structures. Each company may generate and customize its own marks, receipts, checks, and invoices using the built-in form designer.

Versatile

The solution can also be used to support organizations from a few to hundreds of users and is accessible in both on-premise and hosted deployment models. Nonprofits and government organizations searching for a comprehensive accounting solution with various reporting capabilities should consider this solution.

Features

The core features offered by AccuFund accounting software include:

- General ledger.

- Customizable dashboards,

- Bill-tracking and payments.

- Bank reconciliations.

- Cash receipts management.

- There are also several add on modules offered by the AccuFund Accounting Suite, such as:

- Accounts receivables.

- Inventory management.

- Tracking and depreciation of assets.

- Position control.

- Grants management.

- Travel management.

- Loan tracking.

- Allocation management.

- Payroll suite.

- Budget development.

- Client accounting.

- Program management.

- Client invoicing.

Accountants certainly have more advanced needs than smaller software can offer. The above are the five best accounting software for accountants that can help them automate and optimize their workflows and achieve better results.