Everybody knows that non-profits have a different business, including providing humanitarian help to the needy and insecure, engaging in activities and projects beneficial to the public, etc. But very few know that Non-profits have to do many tasks to maintain the non-profits status, get funds, manage funds, etc.

However, suppose you are about to set up a non-profit. In that case, declare your organization a non-profit, and you just registered as a non-profit using the right accounting software is one of the very few ways you could use to help you gain these tasks and processes non-profits have to do.

While there is so much accounting software out there, you would want accounting software designed for non-profits to help them through accurate non-profit accounting and bookkeeping, tax reporting, etc. That will make your work easier, compliant government regulations, and show accountability to your donors and sponsors.

To help you identify the best accounting software for Non-profits, we have made this amazing list. Let’s take a look!

Best Accounting Software for Non-profits Ranking

- Fastfund – best overall accounting software for Non-profits.

- Aplos – top church accounting software.

- Quickbooks non-profit – best for raising funds

- Non-profit plus – top scalability option for younger non-profits.

- Blackbaud – best accounting software for transparency and accountability.

- MIP fund -best easy-to-use interface.

1. Fastfund

Fastfund is a cloud-based trust accounting solution for a non-profit that fully integrates with accounts receivable, account receivable, etc., and excellent customer support to give you hassle-free non-profit finance management.

Research has shown us that this overall best accounting software for Non-profits is the best option you can get in the market to have your finances, bookkeeping, fund management all made easy. In hindsight, Fastfund is best for non-profit experts who have been in your shoes before!

Pricing

- Fast funs pricing starts at $42 per month for the fast fund accounting plan.

- Fastfund raising: $20 per month

- Fastfund payroll: $66 per month.

- Fastfund doesn’t offer a free trial, but you can schedule a demo done with fast fund’s won data set.

We recommend that you go for Fastfund’s accounting plan because it is best to solve non-profits’ basic bookkeeping functionalities.

Features

- Fast fund automates reversing and recurring entries for you.

- Enables duplication of search and merge

- Provides system security for you

- You can simply customize big chart accounts.

- It gives you automatic find balancing.

- Enables you to easily import or export data.

- It is compliant with FASB financial statement standards and IRS Form 990.

- Provides bank reconciliation and audit trail.

- Tracks expenses your Non-profits make to source transactions.

Why Do We Recommend FastFund?

We recommend fast fund because it is the best all-in-one accounting software for Non-profits, starting from its features in non-profits management, accounting, fundraising, and payroll management. It also covers you right from non-profits financial statements and balance sheets to blogs and free resources for your greater experience.

What more? It was designed by non-profit software experts, covering all you can think of as a non-profit.

MORE: Top Blockchain Accounting Software

2. Aplos

Aplos is the runner-up to Fastfund in our research of the best accounting software for Non-profits. It is cloud-based accounting software with its roots in California. It’s been simplifying donor management, fund accounting, tax preparation, and reporting for churches and non-profits for some years now.

Aplos magic box of features includes donor tracking, tax reporting guidance, and reporting membership tracking, and it is also compatible with both phones and PCs.

Pricing

- Aplos offers you two pricing plans; the full suite plan and the advanced accounting plan.

- Aplos’ entry price is $49 per month for the full suite plan.

- Advanced Accounting plan: $179 per month

- It offers a 15-day free trial.

For Non-profits and Churches, we recommend that entry plan because it has the basic features and integrations which Non-profits would need for the proper fund manager and accountability.

Features

- With Aplos, you can easily track funds, such as grants, event donations, etc.

- It makes it simple for you get create reports that compare your budget for each fund.

- Enables easy Campaign, project, and department reporting

- You can create a custom chart of accounts for your church or non-profit.

- Simple identification of your tax-exempt income.

- Curate membership data as well as sponsorship invoices.

- Facilitates fundraising projects using tags.

Why Do We Recommend Aplos?

Aplos is very popular among Non-profits, especially Churches. CPA, who is also a pastor, developed the software. This means that this accounting software for you covered with anything with church or ministerial accounting besides the developer has been in your shoes. This is the reason why we recommend it. It also has so many features that will help you through church accounting, fundraising, and membership management.

» MORE: Which QuickBooks Version Is The Best For Nonprofits?

3. QuickBooks Non-profit

Ultra-famous accounting software also has a specifically made package for non-profits called QuickBooks Non-profits. This cloud-based simplifies everything from Membership Management to fund accounting that includes fund tracking, income, and expenses and lets you get access to a larger number of donors, vendors, and gives you access to free tools and resources for your Non-profit.

Pricing

- QuickBooks Non-profit has two packages.

- Quickbooks for Non-profits advanced plan which starts at $150 but $75 for the first three months

- QuickBooks enterprise online Non-profit that includes;

- Silver plan: $892 per year.

- Gold plan: $993 per year.

- Platinum plan: 1017 per year.

- It also offers you a 30-day free trial.

We recommend you but the non-profit enterprise Silver plan as it includes all the features you will need for your Non-profit and is good in case your organization grows to be larger.

Features

- It offers you Integration with so many apps and software that would help optimize your non-profit accounting, such as Donorpath, Kindful, Neoncrm, etc.

- It makes your fundraising easy.

- Will boost your fundraising campaign by bringing your non-profit to more channels.

- It helps to maintain a good IRS form 990 for your non-profit.

- It automates and creates any type of report you need.

- It helps you keep track of invoices, donations, bookkeeping, and all accounting you may need.

- QuickBooks non-profit lets you easily keep track of income and expenses on projects your non-profit incurs.

- Excellent non-profit accounting, bank reconciliation, and non-profit balance sheets

- It keeps track of times, non-profit projects, and membership as well as sponsors.

Why Do We Recommend QuickBooks Non-profit?

We recommend QuickBooks non-profit because of its excellence in raising profits for non-profits and churches. It has always been a popular accounting software. Still, its integration with Kindful and other fundraising apps has made it one of the top accounting software for raising and managing funds for non-profits over the years.

So, if you want to raise funds for your non-profit, QuickBooks non-profit might be your right stop.

>>More: Best Hairdresser Accounting Software | Best Medical Accounting Software | Best Accounting Software For Woodworkers | Best Accounting Software For Partnerships

4. Non-profit plus

This is cloud-based accounting software geared towards non-profits; it is specifically engineered to give non-profit accounting and management solutions such as remote collaborations, rapid integrations, encumbrance accounting, grant management, etc. It runs on the Acumatica system and is widely known for its wide range of features which has earned its place in our list of the best accounting software for non-profits.

Pricing

Non-profit plus pricing depends on the features you want on your service, and to get a price, you have to ask for a quote.

It does not offer a free trial, but you can ask for a demo.

Features

- It offers a scalable non-profit ERP

- It gives you better controls of overall fund management processes

- Gets you access to restricted funds.

- Non-profit plus facilitates better management of funds received and funds given.

- Automatic tracking is reporting of donations and donors.

- You can easily track the fixed assets of your non-profit and automatically calculate depreciation.

- It captures expenses as they occur.

- Automatically analyze your non-profit’s data and shows your results on your dashboard in real-time.

- You can also simply create custom charts and interface for yourself and other users.

Why Do We Recommend Non-profit Plus?

We recommend you non-profit plus because of its scalability feature. It lets you easily increase your plan and functionalities needed as your non-profit grows. While having so many features, including encumbrance accounting and rapid integrations, this scalability feature is why it is loved and used by a large number of non-profit organizations.

» MORE: How To Start A Non-Profit In Wyoming (Step-By-Step Guide)

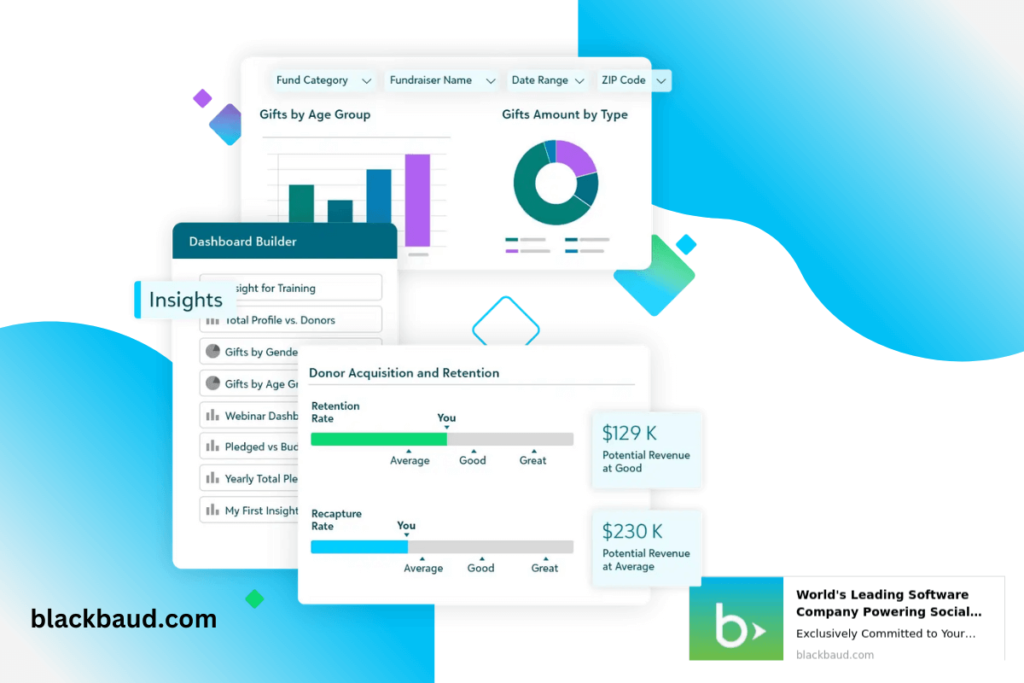

5. Blackbaud

Blackbaud’s financial edge is another well-known accounting software among the best accounting software for non-profits. Its main focus is on how to optimize transparency and accountability among non-profits. It engages in allocating, tracking, and reporting how non-profit and charity organizations’ funds gets utilized.

Generally, this Cloud-based accounting software helps you through fundraising, fund management, donation tracking, membership tracking, etc.

Pricing

Its pricing starts at $0.01 per year. So cheap right? Well, you can call to get a quote. However, it does not offer a free trial.

Features

- It lets you track and report transactions by their net class to FASB compliant.

- It makes it possible for you to capture program and Grant information that is specific to your non-profits.

- It makes it possible for you to create actionable data that your non-profit can use to make actionable and rational decisions.

- Tracks your grants by type, status, amount, details of donors, etc., and shows transparency to legal systems.

- It includes working capital and expense management.

- Automatically manage your cash flow, account receivable, and accounts receivable.

- It helps you eliminate time, duplicate data entry, and resource consumption.

- Improve donor transparency and gives you customizable templates.

Why Do We Recommend Blackbaud?

We recommend Blackbaud as one of the best accounting software for your non-profit because of the transparency and accountability feature it offers. There is also a wide range of features that it gives you, plus Integrations and add-ons that optimize the user experience you will get from it.

What’s more? If you are looking for very cheap accounting software for non-profits, you should go with Blackbaud’s financial edge. The next is almost free.

» MORE: Best Non-Profit Team Collaboration Software

6. MIP Fund

MIP funds is another leading accounting software. It is one of the best accounting software for non-profits and government organizations; it has one of the best user-friendly interface and navigation systems for Non-profits in the accounting software market. According to our research, its main aim is to remove the complexities involved in funds tracking, non-profit funds management, etc.

It is also well known among non-profits for the wealth of resources it offers and its flexibility and scalability features.

Pricing

MIP fund prices depends on the features you want. You can call in to request a quote. It does not offer a free trial, but you can call in to request a demo.

Features

- MIP fund accounting software makes for easier financial growth with an accurate accounting system.

- It Lets you track all donations, how they are allocated and used.

- It scales with your non-profit as it grows.

- You can easily create charts if accounts as it suits your needs.

- Easily manage finances and growth with advanced fund accounting software.

- You can choose between cloud accounting of on-premises accounting software.

- Includes custom reporting that takes charge of fund and tax-exempt compliant reporting.

Why Do We Recommend the MIP Fund?

MIP fund accounting software is popular for so many reasons among non-profits, but we recommend it for its easy-to-use, user-friendly interface.

This feature makes it one of the important tools for younger non-profits to have, and while it includes other non-profits fund management, fundraising, MIP fund offers by-feature pricing, which is a great thing for small new non-profits.

Last Tip

Common knowledge lets every individual know that even non-profits have to do some tax-exempt accounting, fund accounting, etc. That can be time-consuming and take some resources out of your organization’s limited resources. To do this set of functionalities and in-keep line with government regulations and reporting and be accountable to their donors and sponsors, non-profits have to have the best accounting software at their services.

Hence, in this posted we have listed out the best accounting software for Non-profits starting from the top and overall best – Fastfund to Aplos, QuickBooks non-profits, non-profit plus, Blackbaud MIP fund.

While most of these top best accounting software have specific plans and prices, others do not, and you have to call for the quote of their price by feature system.

However, our last tip to you for your non-profit is that you should make sure that whatever accounting software you choose out of these top best options, that you choose the right option that you make sure that it does make your work easy, faster, user friendly and is to settle tax-exempt reporting effortless.

This will protect you from regulation issues and help you to be truly accountable and fair to workers, members, and donors.

» MORE: Top Nonprofit Website Builder

Read More

- Best Accounting Software For Human Services Organizations

- Best Landlord Accounting Software

- Best Accounting Software For Graphic Designers

- Best Accounting Software For Notaries

RELATED: Accounting Software Best For Mini Businesses | Accounting Apps Best For Gas Stations | Top Online-Store Accounting Tools