RELATED: Writers & Authors Accounting Software | Best Accounting Wholesale Tools | Gym Accounting Tools

Accounting software benefits small business owners by allowing them to monitor accounts payable and receivable, gain a better view of their performance, and plan for tax season. In the world of accounting software, a small business can use out-of-the-box software without comprehensive modifications.

When a company expands, the accounting requirements become more complicated, necessitating using a custom enterprise resource planning (ERP) framework. Choosing the Best Accounting Software for Service Businesses is not an easy task, as there is plenty of software out there.

Accounting software for small companies comes in various flavors, each with its own set of features and price tag. In general, the type of industry and the number of employees are two considerations that can aid a small business owner in selecting suitable accounting software.

You can expect from this article different accounting software companies that we have researched about and can give you the details about that software you can use in your business.

Upfront Software ranking

- Bonsai: (Best Budget-Friendly Accounting Software)

- Xero: (Best accounting program in general)

- QuickBooks: (Most user-friendly program available)

- Wave: (Most cost-effective)

- FreshBooks: (Best invoicing software)

- Zoho Books: (Best automation)

1. Bonsai

One of the best software for accounting on the market is Bonsai. It has many templates that you can use for signing new clients and improving the profitability of your service business. These contracts are made and checked by exceptional attorneys to save you from any legal trouble.

The software is also great for managing projects using workflow tools to enhance company productivity. Scheduling meetings and setting reminders online will save you time and help you focus on other important chores. Updating the clients with the project goals you have achieved is also easy with the customer portal.

People also use Bonsai due to its budget-friendly rates. The starting price of this software is $24 per month, while the maximum you can pay is $79 per month. Remember, Bonsai has different packages to suit the needs of different service businesses.

You can also enjoy access to all templates, unlimited clients, multiple integrations, and more things on each package.

Key Features

- Prepare invoices and payment receipts using the automatic invoicing option

- Schedule meetings online to avoid bookings on call and save time

- Use it with other apps for better efficiency

- Allows you to enjoy five project collaborators to unlimited project collaborators

- Forms and question papers will help you get client information easily

- Get a free trial on every package to make an informed decision

Why do we recommend Bonsai?

Bonsai is an excellent software for those who want to manage their service businesses and ensure orderly books. You can use the customer portal to update clients with project and payment information. Timely payment reminders will also save you from missing a deadline.

The platform is also suitable to use on desktops and other devices. This means you can use the platform anywhere as long as you have a laptop.

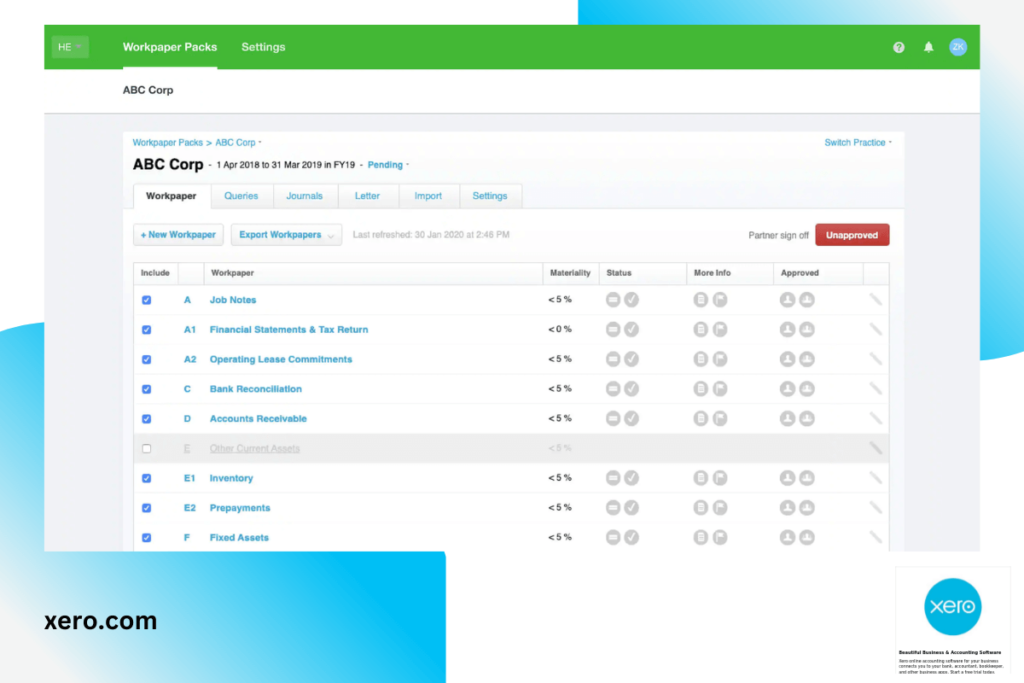

2. Xero

Xero gets high marks for its extensive benefits and low entry price. It sends custom invoices to arrange the books: it consolidates bank transfers, collects receipts for keeping a record and monitor inventory for only $11 a month.

Xero, on the other hand, stands out as a small-business accounting platform in terms of collaboration. Xero’s plans all provide unlimited users, unlike almost any other accounting solution.

Delegating tasks like bank settlement or cost monitoring to another team’s person is included in your price, so you don’t have to pay extra.

On the other hand, Xero’s $11 monthly plan allows you to move in only five bills and submit 20 invoices only per month.

Only the Growing ($32 per month) and Established plans ($62 per month) allow you to submit unlimited invoices and quotes.

Also, the $62 package only includes multi-currency payment assistance, project management, and cost tracking.

The Early plan restricts use to five invoices or quotations, five bills, and the reconciliation of 20 bank transactions each month. This limited plan could be appropriate for a micro-business that conducts a small number of high-ticket transactions each month, such as a consulting or small service provider.

Invoices, bills, and purchases are unlimited in both the Growing and Established plans. The only difference is that the Established plan includes extra features such as (multi-currency, expense control, and project costing). Hubdoc, a bill and receipt capture solution, is included in all three plans.

Key Features

- Any plan includes an unlimited number of users.

- Basic inventory tracking with all its plans in Pro BulletBasic.

- BulletPro BulletIntegration with over 800 third-party apps is easy.

Why do we recommend Xero?

Xero’s web-based option is an excellent choice for Mac users looking for security among the best accounting software for Mac. We recommend Xero because it also does offer you lots of features that will bring the beauty of bookkeeping and accounting to your Mac OS device.

Xero has the best customer support for Mac. It offers you many resources, tools, and articles to keep you at the top of your accounting.

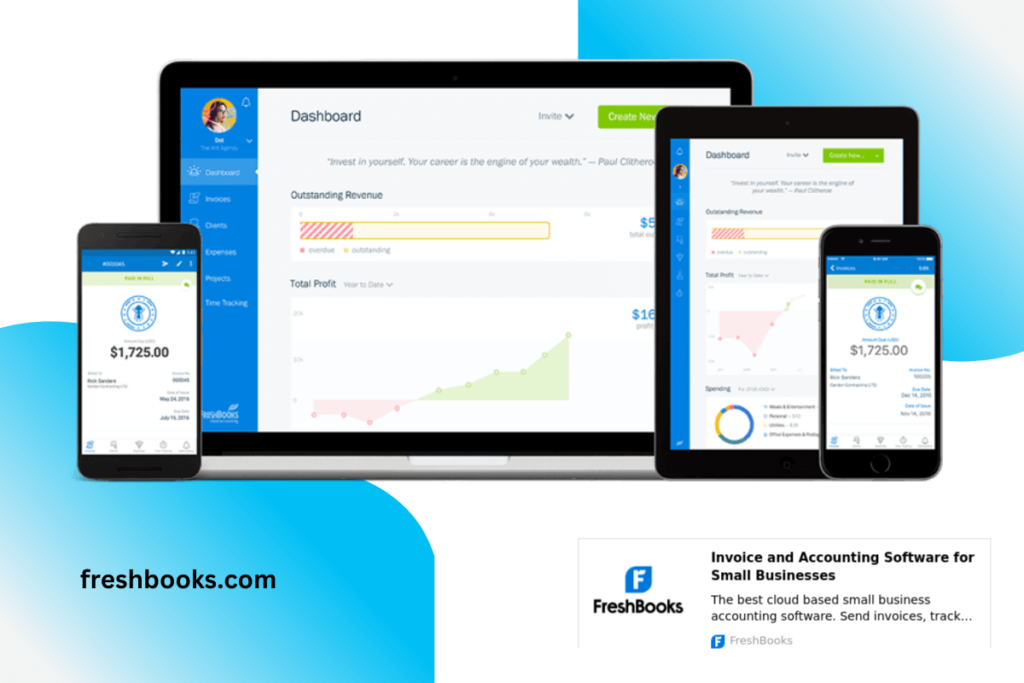

3. FreshBooks

Unlike Xero, each FreshBooks plan allows you to submit an infinite estimation and amount of invoices. Each schedule also includes time-tracking for faster, more reliable client billing, as well as cost tracking to help you stay on track with your budget.

FreshBooks, like Xero, isn’t designed for collaboration. You’ll have to pay an additional $10 a month per account if you wish to include more users in your plan. FreshBooks’ expensive partnership should not be a problem for freelancers and solopreneurs.

However, companies that need additional focus on their finances should consider Xero or a provider like QuickBooks, which has extended users in higher-level plans.

You can bill only a limited number of customers each month but can send unlimited invoices to them as you can have only five clients on the roster.

The number of clients billed each month is the most significant difference between the four plans. Up to five clients can be billed every month on the Lite plan.

The Plus package allows you to bill up to 50 clients a month. The Premium plan will enable you to bill up to 500 clients every month.

The number of clients who can be billed each month is unlimited with the Select package. The accounting program costs an extra $10 per month for several team members. The advanced payment feature costs an additional $20 per month and allows users to charge a credit card in real-time or set up a monthly credit card charge for a customer.

Shopify, Gusto, Stripe, G Suite, and other third-party app integrations are all available.

Key Features

- Any strategy includes expense and time monitoring.

- Starting price for Pro Bullet is $15 per month.

- The Pro BulletProposals, forecasts, and invoices can be customized.

Why do we recommend FreshBooks?

FreshBooks is a fantastic platform for planning projects, submitting projections and plans, and receiving payments from customers. Its invoices can be highly stylized and personalized for a professional look and feel, a unique feature.

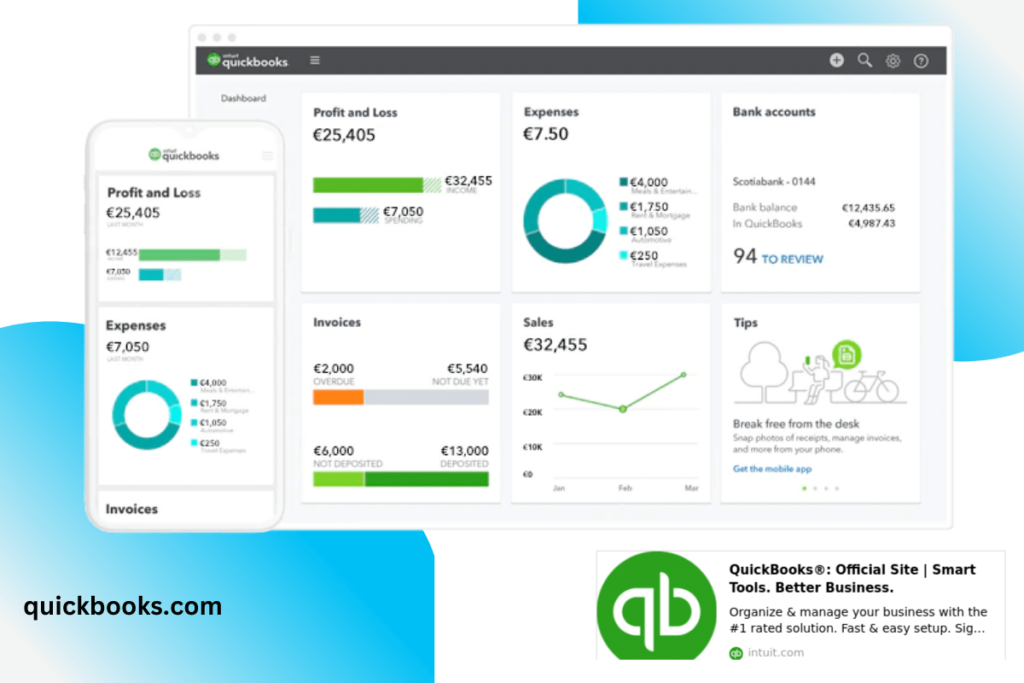

4. QuickBooks

QuickBooks’ company, Intuit, is well-deserving of its fame as a dependable, fax, financial, and accounting software provider. It is a cloud-based accounting software solution that provides standard features like receipt scanning, invoicing, billing, and even the most basic package includes more robust monitoring than many competitors:

- You are tracking your mileage.

- Tracking of sales taxes.

- Automatic categorization of tax deductions.

- Pay monitoring for 1099 contractors.

QuickBooks provides the best mobile accounting software available, in addition to allowing users to monitor more detailed points than many rivals. The app can perform almost all of the program’s functions, and mileage tracking might be a good match for you if you operate on the go. The best reporting features in QuickBooks available at a cost: the lowest price small-business plan starts from $25 per month and limits you to an accountant and one consumer.

The most expensive package, which allows for 25 users, costs $150 a month. You may have a 30-day free trial, but keep in mind that if you do, you’ll miss out 50% off offer on QuickBooks’ for the first three months.

This software’s monthly subscription can be updated as a company expands. The mobile app has several customization options for receiving payments, reviewing reports, capturing a picture of a receipt, and tracking business mileage.

Features

Advanced features such as inventory management, time tracking, additional users, and budgeting are included in each schedule.

- Accounting software providers have the highest-rated mobile app.

- Financial reports that are comprehensive and easy to understand.

- Extensive tracking features are included in the Pro Bullet.

Why do we recommend QuickBooks?

QuickBooks Payroll is a payroll solution that works seamlessly with QuickBooks Online. Simple Start will fulfill all of the needs of most service-based small businesses. Essentials or Plus can have more inventory and customization options for product-based small businesses.

The Advanced subscription is a brand-new offering that includes Fathom-powered financial reporting. Fathom is a high-end online financial report research tool used by many major corporations around the world.

5. Wave

Wave offers a smooth, user-friendly dashboard and a set of features that rival those of its paying rivals for the lovely starting price of $0! Wave Accounting. For example, it offers multi-currency assistance, cost monitoring, double-entry accounting, and unlimited invoicing, something FreshBooks’ cheapest option noticeably lacks.

Key Features

- It is invoicing Accounting and receipt scanning software that is entirely free.

- Affordably priced payroll add-on.

- Multi-business management is a Pro Bullet feature.

Why do we recommend Wave?

If you’re an Amazon vendor and manages a small team of contractors, Wave allows you to run several companies in one account. So, you can keep track of both sets of finances without paying a single dollar.

Wave’s accounting program isn’t suitable for companies with hundreds of employees, even though it has a powerful payroll feature.

Wave only provides one accounting plan, so businesses can’t scale up to projects with more features as they expand. It is best suited to service-based solopreneurs and freelancers due to its lack of inventory monitoring.

6. Zoho Books

Zoho Books makes it simple to automate the most basic bookkeeping task so you may interact more with your company and customers. It allows you to set automatic payment reminders for customers, build recurring expense profiles, and automate inventory tracking, among other things.

Zoho Books costs $9 a month, which is $2 less than Xero. You’ll pay an extra $2 a month for each new account, which is a significant saving over FreshBooks’ $10 per user.

Key Features

- Every strategy includes automated workflows.

- The BulletClient portals for consumer collaboration give their finest.

- Starting price for Pro Bullet is $9 per month.

Why do we recommend Zoho Books?

Zoho Books is one of the enormous Zoho items available. Since the Zoho product is easily integrated with the others, you can use it for accounting, project management, and customer relationship management (CRM) to begin with. Unfortunately, despite being a good accounting tool, Zoho Books has one major flaw: whether you live in California, Texas, or India, Zoho Books does not provide a payroll plan.

It also does not work with third-party payroll providers. Instead, you’ll have to manually change the payroll-related aspects of your books, which detracts significantly from Zoho’s primary benefit of automation.

Conclusion

Transactions can appear in a queue until a business’ bank accounts and credit cards have been synced with the accounting software, and they can be grouped into the groups found on the chart of accounts.

Following the selection of the appropriate category, transactions begin to populate the financial statements of the company.

In seconds, business owners can analyze profitability, compare sales and expenses, check bank and loan balances, and forecast tax liabilities by running a financial report. Having instant access to this financial data empowers company owners to make critical decisions.

The monthly cost of small business accounting software varies from $0 to $150. Basic plans range from $0 to $40 per month and are an excellent place to begin. A small business should categorize revenue and expenditures, submit invoices, and prepare financial reports with a simple plan.

Most software is flexible as a company expands, and the strategy can be easily updated to meet new business needs. Businesses can monitor inventory, create more personalized financial reports, run payroll, and select more invoicing options with more detailed plans.