Lookup Business Entity | Form Corporation | FAQ

As a business owner, affiliate, or curious consumer, you may be required to conduct a simple business search in a variety of situations. If done correctly, the Minnesota Secretary of State’s Business Search will give all publicly accessible information about a specific entity.

| Official Website: | https://www.sos.state.mn.us/business-liens/business-help/how-to-search-business-filings/ |

| Address: | Retirement Systems of Minnesota Building, 60 Empire Drive, Suite 100, St Paul, MN 55103 Map |

| Telephone: | 1(877)551-6767 |

| Fax: | 1(651)297-7067 |

| mailto:business.services@state.mn.us |

Minnesota Business Search Shortcut

Need help forming an LLC in Minnesota? Create an LLC in minutes with ZenBusiness.

How To Lookup An Entity In Minnesota

When searching the Minnesota company database, you have two options: search by name or search by filing number.

Minnesota Secretary of State Business Search by Name

- Go to the Minnesota SOS business search page to begin your search. Select the “Business name” option.

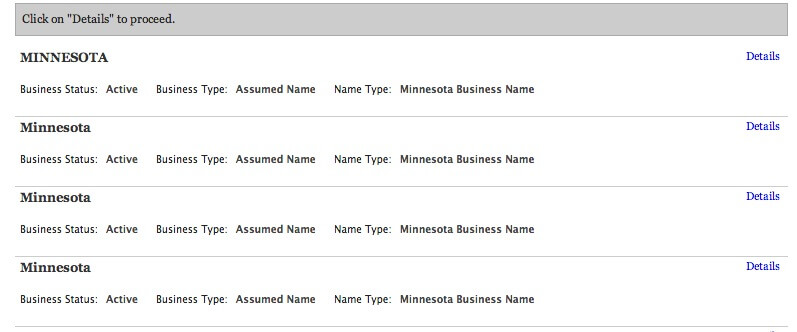

- Click Search after entering your preferred search name into the search field. Based on the supplied search keywords, the database will create a list of results.

- To get to the information page for a given entity, click the Details link to the right of it.

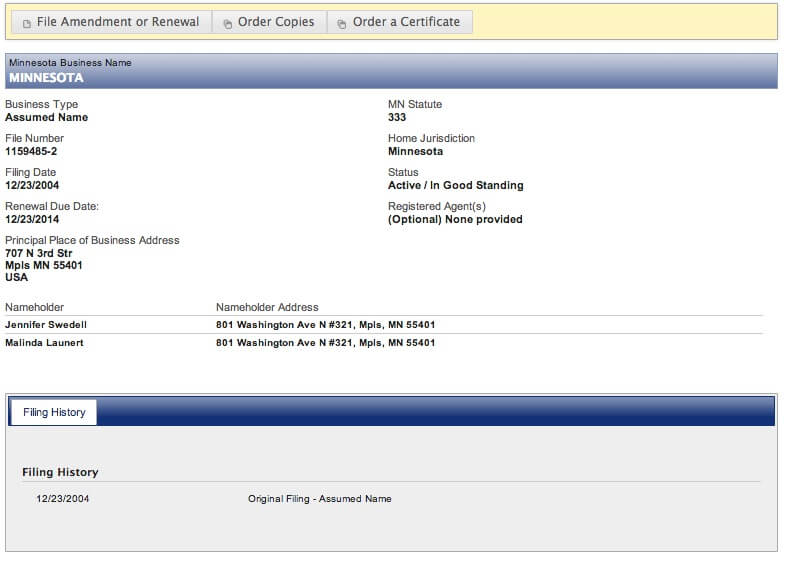

- You’ll now be on the information page for the business you’ve chosen. This page contains all public information about the entity, as well as links to its filing history and Certificate of Good Standing.

Minnesota Secretary of State Business Search by File Number

- Go to the business database search and click the File Number option above the search box to search by file number.

- To proceed, type the file number into the search window and click Search.

- You will be directed to the entity’s information page right away. This page contains all publicly available information about your entity. Additionally, you will be able to obtain a filing history as well as a Certificate of Good Standing for your business.

>>MORE: Tennessee Secretary Of State Business Search | Wyoming Secretary Of State Business Search | Missouri Secretary of State Business Search | Wisconsin Secretary Of State Business Search | New Jersey Secretary of State Business Search

Steps To Forming A New Corporation In Minnesota

The manner in which you incorporate a company in Minnesota is governed by state law, and the procedure is rather simple.

1. Name the Corporation

A corporation’s name is required by state law to fulfill the following:

- must be written in English.

- The phrases “corporation,” “incorporated,” “limited,” “business,” “professional association,” or “chartered” should all be included (or abbreviations).

- must not include any words or phrases that suggest the corporation is engaged in a business that isn’t lawful.

- be distinct from existing corporate names, reserved names, assumed names, trademarks, and servicemarks registered with the Secretary of State.

To see if your selected name is available, look it up in the Secretary of State’s company database.

2. Select a registered agent

The state of Minnesota requires every business to have an agent for legal process serving. If a company is sued, this person or business consents to take court documents on the company’s behalf. An entity with a certificate of power to conduct business in Minnesota such as Northwest Registered Agent and GoDaddy, a Minnesota resident, a Minnesota company, or a foreign entity may serve as a registered agent.

3. Number of authorized shares of stock

Any number of shares of stock can be authorized by a corporation. The total number of shares allowed is all that is required in the articles of incorporation. The number of shares issued should be stated in the company’s annual report. Most firms offer certificates to shareholders stating their shares, even though it is not usually necessary. Stock can be privately or publicly issued. Typically, founders, management, workers, or a small group of investors receive privately issued shares. A public corporation offers some of its equity shares for sale to the general public.

4. File Article of Incorporation

Incorporators’ names, addresses, and signatures: Each of the incorporators’ names, complete postal addresses, and zip codes must be listed in the articles. A minimum of one incorporator is required. An incorporator should be at least 18 years of age and sign the articles of incorporation.

5. Obtain the Required Business Permits or Licenses

Take time to investigate any necessary permissions or licenses to maintain your new firm on the legal straight and narrow. Depending on the type of company services you offer, the county or city where your firm is situated, and if you employ people, different permissions and licenses may be required.

6. Apply for an EIN and look over the tax requirements

Obtaining a federal employer identification number (EIN) is required for your business. For taxation reasons, this identification number serves as the corporation’s Social Security number. Among other things, it enables you to recruit staff and create a company bank account. The IRS website has an online application that you may use to get an EIN. You will require this number for future documents and to file your company’s tax filings, so keep a record of it.

7. Registration is required annually

Minnesota corporations are required to register an annual corporate registration with the Secretary of State, who will send them a reminder to do so.

8. A Report on Business Activities

Every company doing business in Minnesota is required to file an annual business activity report with the Minnesota Department of Revenue.

>>MORE: Washington Secretary of State Business Search | Pennsylvania Secretary of State Business Search | Texas Secretary Of State Business Search | Michigan Secretary of State Business Search | Oregon Secretary of State Business Search

Frequently Asked Questions On Minnesota Secretary of State Business Search

Who is eligible to serve as a registered agent?

An individual, a corporate organization, or a professional registered agent service can serve as your registered agent. A registered agent is required to:

be at least 18 years old, have a physical address in the state where business is done, and always be present (in person) during regular business hours.

What is an S corporation?

An S corporation (S corp) is a for-profit corporation that pays taxes as a pass-through organization. This implies that S corporations do not have to pay federal income taxes on their profits. Instead, the profits of the firm “pass through” to the S corp’s owners, commonly known as shareholders. The stockholders then pay income tax and declare their portion of the earnings as salary on their personal tax returns, which are subsequently taxed.