Becoming a homeowner in recent times comes with the massive possibility of accruing debts.

Unless you are a wealthy citizen or hit the jackpot, you would likely not pay all cash for your first home.

Mortgaging to finance home payments is common, especially in the U.S.

It’s important that homebuyers get everything spot on, and this is why the duty of a mortgage loan processor cannot be understated.

Mortgage Loan Processor Information Table

| Official Job Title | Mortgage Loan Processor |

| Average Salary | $69,213 |

| Stress Level | Average |

| Work/ Life | High |

| Job Satisfaction | Average |

| Career Advancement | Average |

Mortgage Loan Processor Job Description

Who Is a Mortgage Loan Processor?

A mortgage loan processor is tasked with preparing all necessary documents to apply for a mortgage loan.

This helps the underwriter quickly locate documents, making the lending process smoother.

The loan processor also helps to ensure that the loan approval stays within lending guidelines.

Mortgage loan processors make it easier for homebuyers to spread out mortgage payments to suit their lifestyles.

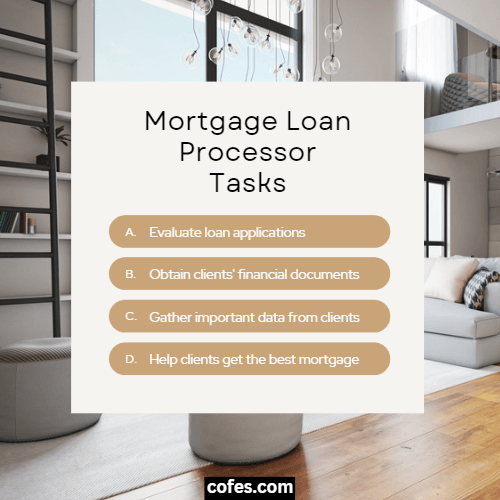

Responsibilities, Duties, and Roles of a Mortgage Loan Processor?

The services of a loan processor are needed to smoothen the process, lifting the burden from your neck.

They arrange your documents and analyze your credit report to determine the right loan for you based on your creditworthiness.

They are always in contact with the underwriter to keep everything in check, and they always ensure that you are meeting up with deadlines.

What Does a Mortgage Loan Processor Do on a Daily Basis?

Technology has replaced many jobs; however, an automated system cannot adequately replace the human touch of a mortgage loan processor.

The mortgage loan processor handles all paperwork, verifies all information, and requests additional information (if the documents aren’t adequate).

They also work with insurance companies and escrows.

In all, they take out the stress from the loan application process and make it easy to finance a home purchase.

Mortgage Loan Processor Salary

According to Glassdoor, these are the average salaries of mortgage loan processors.

Average Salary

The Average Salary of a Mortgage Loan processor is around $69,213.

Starting Salary

The starting salary for lower levels is usually around $63,352.

Senior Salary

And the Senior salary is usually around $87,071.

How To Become A Mortgage Loan Processor

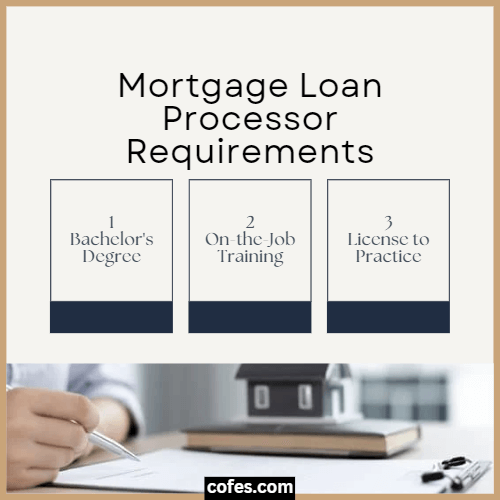

The Entry Level: Certification, Training & Degree

According to Zippia, most loan processors (50.4%) have a Bachelor’s degree, and 4% have a Master’s degree.

Generally, the minimum requirement to work in this category is a high school diploma or a GED.

However, most employers are willing to employ someone with an Associate’s or a Bachelor’s degree in related fields, especially accounting, business administration, or real estate management.

Other Skill Sets, Requirements & Qualifications

After getting a degree, it is also essential to have certifications from specific discipline-related courses and programs.

These programs cover detailed topics in loan processing, such as counseling, approval, underwriting, appraisal, and other loan processor duties.

Certifications can be obtained from courses and programs in several institutions.

However, it is vital to get an official certificate from the National Association of Mortgage Processors (NAMP).

Three levels of certifications can be obtained from the NAMP

- The Certified Purple Processor (CPP): Loan processors earn this certification badge after completing at least twelve hours of basic and advanced loan processing.

- Certified Master Loan Processor (CMLP): Loan processors earn the CMLP badge after completing 24 hours of training in basic loan processing, advanced loan processing, underwriting basics, processing FHA loans, and processing VA loans.

- The Certified Ambassador Loan Processor (CALP): Loan processors earn the CALP badge after completing 18 hours of training in addition to the CMLP certification. This additional training includes the FHAs rehab program, analysis of tax returns, and fraud detection and prevention.

To get a certification at any level, participants must pass background checks and clear examinations with a minimum grade of 85 percent.

How Long Does It Take to Become a Mortgage Loan Processor?

After you satisfy the basic education requirements, it takes only 42 hours of training to become an adequately certified Loan processor.

Is It Hard to Become a Mortgage Loan Processor?

Given the information above, we can conclude that it’s not difficult to become a loan processor.

Mortgage Loan Processor Career Paths

The Mortgage Loan Processor Roadmap

The roadmap of the mortgage loan processor is quite straightforward.

- Get a high school or college degree

- Gain work experience in accounting, business admin, sales, customer service, or other related fields

- Train yourself with the requirements of being a loan processor

- Obtain a license

- Get a certification badge

Projections For Growth in Mortgage Loan Processing Jobs

You may not begin your career as a mortgage loan processor.

Instead, you could start out as a customer service representative, a low-level loan officer, or a low-level underwriter.

As a mortgage loan processor, you can become a Senior Loan Officer or a Senior Underwriter.

You can also go further to becoming the Underwriting Manager or the Office Manager of Human Resources.

In Summary: Is Mortgage Loan Processing A Good Career?

In summary, it is a promising career, easily practicable, and it provides accessible expansion routes.

Moreover, even after progressing, it is possible to combine roles and work partly as a Loan processor.

Working Conditions

Can a Mortgage Loan Processor Work Remotely from Home?

As a Mortgage loan processor, you have the liberty of very flexible working conditions.

You can work remotely from home as long as you can remain in contact with people to contact for loan processing.

Of course, computer literacy is required, whether you intend to work from home or not.

How Many Hours Does a Mortgage Loan Processor Work?

You should expect to work for about 40 hours a week, and in some cases, it could be slightly higher.

Can a Mortgage Loan Processor Work Part-Time?

Mortgage loan processors typically work full-time from Monday to Friday.

However, some employers offer the job on a part-time work basis.

If you work remotely, you could spend some of your productive hours on other jobs, provided you aren’t overloaded with your primary job as a mortgage loan processor.

What Are the Average Vacation Days of a Mortgage Loan Processor?

Some loan processors work on weekends, although that is uncommon.

Depending on your company, you are entitled to all your usual employee benefits like the general company holidays, sick leave, annual leave, and some other time off.

However, all these are firm-specific. If you were applying to any firm as a mortgage loan processor, it would be best to check out their employee policy first.

Alternative Careers & Similar Jobs to a Mortgage Loan Processor

- Sales Engineer

- Sales Analyst

- Product Manager

- Business Development Manager

- Account Representative

- Merchandise Associate

- Marketing Consultant

- Paralegal

- Surveyor

- HR Generalist

- Finance Manager

- Financial Counselor

- Finance Director

Mortgage Loan Processor Resume Tips

As a loan processor, your reputation grows with your experience; you learn on the job.

So, your resume must contain the following items to show your level of expertise and how well you can handle the job requirements.

- Outline your most recent jobs and experience anti-chronologically.

- Mention the job title, the company you worked for, how long you worked for, and other employment information.

- After doing this, you should list out your roles and responsibilities at your job and your remarkable achievements when carrying out your duties.

- Mention your skills, especially the ones in the job description.

- As a general rule of thumb, it is essential to mention all skills you possess relevant to the job; however, it is more appropriate to start with the specific skills mentioned in the job description.

- Give details of your education, including college, high school, and other short-term programs and degrees that were important in shaping your professional life.

- It is also essential to mention your certifications and the relevant badges you hold, as this will give you some prestige.

- Format your resume excellently.

- Make all information clear, concise, easy to read, and easy to access, even from a glance.

- Use keywords smartly.

- Identify the most important keywords and search terms employers use for their job openings.

- Smartly arrange these in your resume, especially if you intend to upload to job-search websites like indeed, Glassdoor, ZipRecruiter, and others.

Mortgage Loan Processor Interview Questions

Why do you want to work at our organization?

Why it works: It helps the recruiter to determine if the candidate is a good fit for the organization in terms of values and core beliefs.

Have you ever been in a challenging situation? How did you go about it?

Why it works: It helps to identify the problem-solving ability of the candidate.

Where do you see yourself in the next three years?

Why it works: It helps to determine the vision and aspirations of the candidate for the short term.

Why do you consider yourself a perfect fit for this role?

Why it works: It helps to determine if candidates can justify their skills and link them to the job requirements.

Have you ever faced an upset client? How did you handle the situation?

Why it works: It helps to understand the candidate’s customer relation level.

Jobs Related To Mortgage Loan Processing

According to indeed, the most closely related careers to that of a mortgage loan processor are

- A loan officer, or

- An underwriter.

For the HR Manager: Tips for Hiring a Mortgage Loan Processor

Key Characteristics to Look for In a Mortgage Loan Processor

When hiring a mortgage loan processor, it is crucial to ensure that you are looking for a person who pays attention to details.

This is because the role is tasked with making sure that all documents regarding the loan process are complete and correct.

The loan processor must intricately view all records (which are usually bulky), make necessary corrections, or email the concerned parties to make corrections.

The mortgage loan processor is the point where all errors are reviewed, so paying attention to detail will help spot all errors while avoiding more mistakes.

Time management and calculation skills are also critical as they are special requirements of the job.

There are bulky documents to review in very little time, and some cannot be done without impeccable math ability.

Minimum Level of Education and Experience

A diploma isn’t bad, but for more knowledge, it’s preferable to request a minimum of a Bachelor’s degree in accounting, business administration, or related disciplines.