Are you the sort of person who wants to help people out with their financial status?

Well, you are in the right place.

Some websites mix a financial counselor and a financial advisor with each other.

They are very similar in a lot of ways, so they get mashed together sometimes.

This guide will dive into what it is to be a financial counselor and most of what you would need to know.

That way, you can make an informed decision on what you are getting into before you go in for that interview.

Financial Counselor information

| Official Job Title | Financial Counselor |

| Average Salary | $42,705 |

| Stress Level | Low-Medium |

| Work/ Life | Medium |

| Job Satisfaction | High |

| Career Advancement | Average |

*Source: Financial Counselor Salary | Salary.com

Financial Counselor Job description

What is a Financial Counselor?

To find out what a financial counselor is, it would be best to learn what they do as it is one of the same.

As a financial counselor, you would be there to help people with their debt, budgeting, and savings, kind of like the Jiminy Cricket of the financial world.

If they have any tax issues that are more than a simple issue, it is solvable by a tax professional that is qualified for that issue.

There are certifications that you would need to be a qualified financial counselor, but that information will come later.

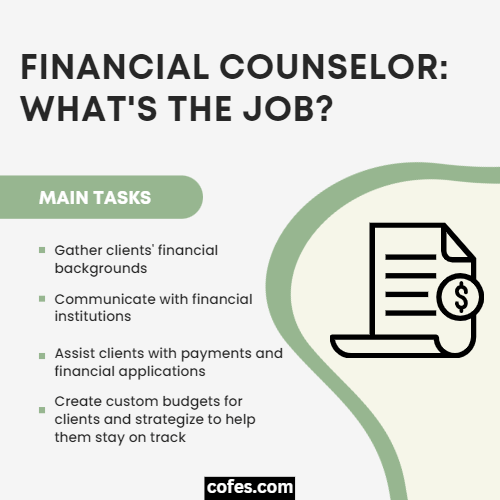

Responsibilities, Duties, & Roles of a Financial Counselor

As a financial counselor, there are responsibilities that you need to be aware of, depending on what field you are in.

You need to gather your client’s financial background, which includes their debt, medical bills, employment, and insurance.

You must be able to communicate and report to the appropriate financial institution about your client’s financial status.

What Does a Financial Counselor Do on a Daily Basis?

You are the mediator between payments needing to be paid and helping them fill out financial applications.

Also, you would need to help them make a budget so they won’t spend over the amount that they would need to pay their bills.

Everyone needs to have a budget, don’t they?

What better way for them to learn to do so than with you as their possible financial counselor?

Financial Counselor Salary

The salary will vary from one financial counselor to another, as some would offer a free consultation for their first visit.

It can also be because of certain skill sets you have and what sector of financial counsel you fall in.

If you have more education in this field, you can make more than the starting salary of someone who has a high school diploma or GED.

- The average salary is about $42,705

- The starting salary is about $38,203

- The senior salary is about $47,724

Find out more salary information on Financial Counselor Salary | Salary.com.

This is helpful for finding out salaries by location or years of experience.

How to become a Financial Counselor

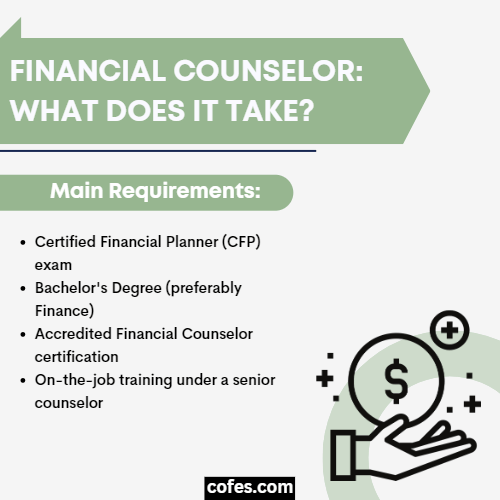

The Entry Level: Certification, Training, & Degree

First, you need to either get or have a bachelor’s degree to take the Certified Financial Planner (CFP) exam.

Rarely is there ever an undergraduate degree program in financial counseling, so you would need to pay close attention to what college you look into to make sure that they have the program you need to take.

Besides the bachelor’s degree, you need to have at least 1000 hours of experience before becoming an Accredited Financial Counselor.

You can find the Accredited Financial Counselor certification at AFC® Certification (afcpe.org).

Other Skill Sets, Requirements & Qualifications

The skills you would need to be a financial counselor are being kind, compassionate, and understanding your clients’ situations without judgment.

You need to be good with numbers and have skills in Microsoft Word and Excel.

One of the requirements is that you keep each client’s case confidential.

The act of telling someone else of the client’s financial situation is a overstep in trust as their financial counselor, and it isn’t professional, nor is it ethical.

How Long Does It Take to Become a Financial Counselor?

It can take more than three years to become a financial counselor.

This depends on all of the education you get while working up to graduating college and getting certified.

Is It Hard to Become a Financial Counselor?

Becoming a financial counselor is not as hard as it is becoming a doctor, nurse, or scientist.

Financial Counselor Career Paths

The Financial Counselor Roadmap

The road to becoming a financial counselor is going to college, doing your 1000 hours of counseling, getting certified, and starting in financial counseling.

Remember not to take on too many clients at one time, as with anything, it could lead to burnout, and imposter syndrome could also take over.

Do your best to grow your financial counseling career, and you could eventually make it where you can hire people in the same field to help you handle the load.

Projections For Growth in Financial Counselor Jobs

According to the U.S. Bureau of Labor Statistics (bls.gov), this profession is projected to grow by 15% through 2031.

In Summary: Is Being a Financial Counselor a good Career?

It’s a good career if you’re looking to help people with their finances and are good with numbers and money.

With a positive growth outlook and high satisfaction ratings, it’s a good field overall.

Working Conditions

Can a Financial Counselor Work Remotely from Home?

It is possible to work remotely from home than it was years back due to the available technology.

Some people would choose to have an office to have an in-person meeting to make it more personable for their clients.

It would be up to what the financial counselor prefers and who they work for.

How Many Hours Does a Financial Counselor Work?

They can work the typical thirty to forty hours a week with overtime if needed.

Can A Financial Counselor Work Part-Time?

As a financial counselor, you can work part-time depending on how many clients you work with and what your employers schedule you for.

If you are self-employed, this will vary on your own schedule.

What Are the Average Vacation Days of a Financial Counselor?

It is up to the employer on how many vacation days a person can have.

So that means it could vary with the workplace.

If you are a self-employed, certified financial counselor, you will get to set your vacation days yourself.

Alternative Careers & Similar Jobs to a Financial Counselor

- Financial Analyst

- Finance Manager

- Budget Analyst

- Accounting Director

- Accounting Manager

- Mortgage Loan Processor

- Business Analyst

- Mental Health Counselor

- Case Manager

Financial Counselor Resume Tips

For your resume, you will want to be as detailed as you possibly can.

List your bachelor’s degree in finance or accounting.

Be sure to list any certifications as well.

You need to be sure and list your skills and abilities that would best fit the job.

Of course, you can also find example resumes online.

Interview Questions

Q1: How patient can you be with how long it could potentially take to gather a client’s financial information?

Why it works: This is so the employer can gauge how well the interviewee can handle the job and their clients.

The clients won’t have everything together at the start, and the financial counselor must be patient due to this fact.

Q2: How do you go about telling your client that they wouldn’t be able to afford certain items?

Why it works: This would tell the employer how well the interviewee handles telling their clients that they can’t afford certain things.

Q3: Can you quickly research the client’s financial background and give them potential estimates on things they would buy, like insurance?

Why it works: This tells the employer that the interviewee can gather the necessary information to provide the best service to the client based on the client’s needs quickly and efficiently.

Jobs Related to Financial Counselors

These jobs are either related or similar to Financial Counselors:

- Financial Advisor

- Financial Analyst

- Financial Examiners

- Oncology Counselor

- Agency Affiliate Counselor

- Senior Licensed Counselor

- Financial Hospital

- Community Counselor

For HR Managers: Tips for Hiring a Financial Counselor

Key Characteristics that a Financial Counselor should have

The key characteristic that a financial counselor should present is kindness, as everyone needs it when going to a financial counselor.

They need to have compassion for the client’s position financially and in general, as not everyone can control their finances perfectly.

They need empathy so they can understand where the client is coming from.

Sometimes people get stressed, and they can overreact unintentionally.

Financial counselors need to be able to get their clients to open up to them.

So that could entail that even if the financial counselor and the clients have different points of view, they shouldn’t judge the client based on anything to do with their financial status.

They need to show integrity to keep their clients trusting them not to spill their confidential information to anyone else but them.

Minimum Level of Education & Experience

You’ll need a bachelor’s degree and 1,000 hours of relevant experience to become an Accredited Financial Counselor.

Resources:

- Financial Counselor Job Description (betterteam.com)

- Certified Financial Counselor Career Info and Requirements (study.com)

- Personal Financial Advisors: Occupational Outlook Handbook:: U.S. Bureau of Labor Statistics (bls.gov)

- AFC® Certification (afcpe.org)

- Financial Counseling: What, Who, When, and Where (financial-library.com)

- Financial Counselor Job Descriptions and Duties (bestsampleresume.com)

- What Does a Financial Counselor Do? – NerdWallet

- Financial Counselor Salary | Salary.com

- Financial Counselor Resume Examples | JobHero