Budget Analysts: the Allowance-Givers of the Company

Does reviewing a large budget and having a say in where all the money goes sound fascinating to you?

Well, you might be the perfect fit to be a budget analyst.

These professionals reflect on previous budget strategies, assess future needs and changes, and create new budget outlines for companies big and small.

In this informative article, learn more about what a budget analyst does and what it’s like to be one.

Budget Analyst Job Information

| Official Job Title | Budget Analyst |

| Average Salary | $79,940 |

| Stress Level | Average |

| Work / Life | Slightly Below Average |

| Job Satisfaction | Average |

| Career Advancement | Average |

Budget Analyst Job Description

What Is A Budget Analyst?

Budget Analysts are finance/accounting professionals who help companies (in both the public and the private sectors) plan how they’re going to use their funds.

These staff members asses previous spending activity, monitor ongoing spending, and create new budgets and reports.

These experts advise other staff on how to best utilize the funds available to them.

They field requests from departments on financial needs or budget desires.

These employees also have to assess programs to determine if they are the best use of company funds.

What Does A Budget Analyst Do On A Daily Basis?

From day to day, a budget analyst reviews specific points in the company’s budget, plans for future spending, and determines areas where the company can increase or decrease spending.

They also generate reports about past and future spending and present them to other company staff.

These employees can also function as a financial resource for other team members who have questions about budget issues.

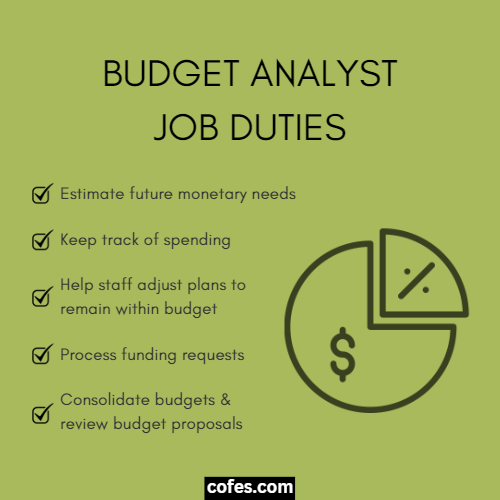

Responsibilities, Duties & Roles Of A Budget Analyst

Budget analysts can be expected to do the following:

- Estimate future monetary needs

- Communicate available funds to different departments

- Keep track of spending and make sure it’s within the budget

- Help other staff to adjust plans to remain within their budget

- Process funding requests

- Present requests to other staff or the public

- Consolidate budgets when appropriate

- Review budget proposals

- Develop future budgets

Budget Analyst Salary

Average Salary

According to the Bureau of Labor Statistics, the average median salary of budget analysts is about $79,940.

Starting Salary

According to the Bureau of Labor Statistics, the lowest-paid 10% of budget analysts are paid about $49,330 each year.

This doesn’t take into mind raises, bonuses, and benefits.

Senior Salary

According to the Bureau of Labor Statistics, the highest-paid 10% of budget analysts are paid about $124,440 each year.

The difference between the lowest-paid 10% and the highest-paid 10% makes it clear that entry-level budget analysts can look forward to regular raises in salary and room for growth.

How To Become A Budget Analyst

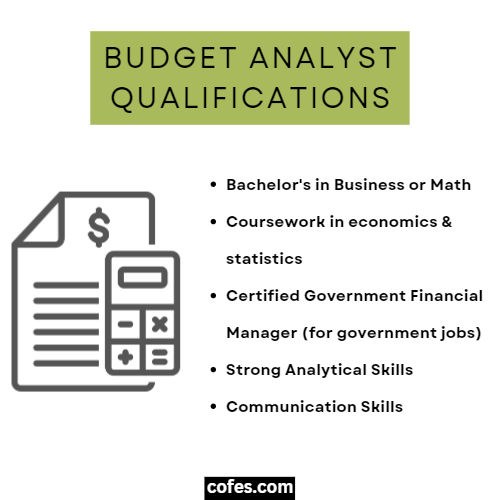

The Entry Level: Certification, Training & Degree

Pretty much every company out there hiring a budget analyst is looking for someone with a Bachelor’s degree in Accounting, Finance, or a related field.

Some employers may even require a Master’s degree or an MBA in Finance and Accounting.

Some employers may allow relevant work experience to take the place of some or all typically-required education, but many require this in addition to the appropriate degrees.

Other Skill Sets, Requirements & Qualifications

If you desire to become a government employee budget analyst, you can pursue the certification of Certified Government Financial Manager (CGFM), which the Association of Government Accountants offers.

Gaining this certification could make you a stronger candidate for government jobs.

Other skills that could help you out in your pursuit of a career as a budget analyst are analytic and critical thinking skills, great communication skills, being extremely detail-oriented, having a deep understanding of math and finance, and adequate writing skills.

How Long Does It Take To Become A Budget Analyst

Depending on the employer’s requirements, you could become a budget analyst in 4-8 years from the day you start undergrad.

If you finish your degree on time, gain a few internships while in school (and maybe even a part-time accounting job), and find an employer who doesn’t require a Master’s or other certifications, you could be a budget analyst in about four years!

However, if you take your time in school, don’t gain any relevant work experience while completing your studies, and find that all potential employers require a Master’s, your career could take up to 8-10 years to kick off.

Is It Hard To Become A Budget Analyst?

Becoming a budget analyst is challenging but not at all impossible!

You must get through undergrad, gain a few relevant entry-level jobs or internships, and potentially get a Master’s degree.

Other than that, you have to apply, interview, and land the gig.

Budget Analyst Career Paths

The Budget Analyst Roadmap

The roadmap to becoming a budget analyst is relatively easy to follow.

First, have a decent interest in numbers and how the finances of a business get allocated.

Second, get your Bachelor’s in Accounting, Finance, or a related field.

Third, get one to three years of industry-related work under your belt.

The smartest way to do so is to land relevant internships or part-time jobs during your time in school!

Third, do some fishing for budget analyst jobs in the location you want to work.

Gain some intel on whether they’ll require you to be a CPA or get a Master’s degree.

If so, go back to school. If not, get out there and get hired!

Projections For Growth In Budget Analyst Jobs

Regarding growth potential for budget analyst jobs, it’s below average.

The industry is growing at an average of only 3% right now, which is slower than most.

When it comes to career growth as a budget analyst, the odds are definitely in your favor.

Considering all the schools that most budget analysts endure, they are often overqualified for their jobs, with the exception of having little work experience.

Spend a few years getting some accounting experience under your belt as a budget analyst, and you’ll be climbing the ladder faster than you think.

In Summary: Is Budget Analyst A Good Career?

Overall, being a budget analyst is a great starting point for a long, successful career in accounting.

Most budget analysts don’t remain budget analysts throughout their entire working life.

The potential to move up is too tempting and too rewarding!

In fact, most opening budget analyst positions are only open because the previous employee moved on up.

Working Conditions

Can A Budget Analyst Work Remotely From Home?

Budget analysts often can work from home.

Whether or not you’re allowed to work from home as a budget analyst depends largely on who you work for.

Some budget analysts are completely remote, and others are required to be in the office.

However, almost 100% of a budget analyst’s job is done on a computer and a phone, so the possibility is there.

How Many Hours Does A Budget Analyst Work?

Budget analysts put in, on average, 40 to 45 hours a week.

That’s pretty normal, and a few extra hours each week is nothing to grip over.

However, at the end of each quarter, the end of each fiscal year, and pretty much any other hard deadlines budget analysts are held to, they can put in as much as 10 to 15 hours of overtime each week, if not more.

Because budget analysts have so many strict deadlines, they can face some grueling hours for weeks.

Not to mention that they can do quite a bit of traveling.

This is why this career ranks below average for work-life balance.

However, a couple of years of putting your nose to the grindstone to be paid back with promotion could be well worth it.

Can A Budget Analyst Work Part-Time?

There are some part-time budget analyst jobs available, but the majority of them are full-time.

It might be hard to find part-time employment as a budget analyst.

If you need the flexibility of part-time work, you may try looking into other accounting positions with more flexible working schedules.

What Are The Average Vacation Days Of A Budget Analyst?

Most budget analysts accrue an average of one day of sick time and one day of annual PTO per month, equalling about four weeks of PTO a year.

Depending on who you work for, this could be more or less.

Since budget analysts can theoretically do their job from anywhere with wifi, many people report not feeling stressed or judged for leaving the office for an appointment or going home at lunch to tend to a sick kid, etc.

Of course, the flexibility varies from employer to employer.

Alternative Careers & Similar Jobs to a Budget Analyst

- Financial Analyst

- Market Research Analyst

- Finance Manager

- Auditor

- Finance Director

- Communications Director

- Accounting Director

- Financial Counselor

- Accounting Manager

Budget Analyst Resume Tips

Here are some tips for making your resume work for you in the job hunt to become a budget analyst:

- Provide a clear list of your hard skills (those that are measurable and teachable), and work your soft skills into your job descriptions;

- Include only your relevant job history and education (that is, leave out the lawn mowing business you started with your buddy in high school);

- Quantify your previous job achievements and skills, when applicable (to find quantifiable data on your resume, ask yourself these questions: how many, how often, and how much?); and

- Don’t skimp out on the education section (list out highly relevant classes you took, and describe what you learned if you have room).

Budget Analyst Interview Questions

Here are some questions you may hear in an interview for a budget analyst position:

Q1: How will you make sure there are no mistakes in your budgets?

Why it works: The interviewer wants to know if you’ll second guess your work in a healthy way.

If something looks too good to be right, will you double-check it?

Will your budget have room for error by including a line item for unexpected costs?

Make sure they know that you are thorough and that you always ask questions when something seems off.

Q2: When given a budget to analyze, what’s your first step?

Why it works: The interviewer wants to know that you’re a self-starter with somewhat of an established method.

They want to know that no one will have to give you a push to get moving with a new project and that you won’t need constant hand-holding.

You can answer one of two ways, pretty much.

- You can assess for unexpected costs first (increased overhead, delivery issues, etc.) to guide your allocation grouping.

- You can compare and contrast the real expenses and the expected expenses.

Jobs Related To Budget Analyst

Here are some jobs similar to being a budget analyst:

- Cost Estimator;

- Actuaries;

- Financial Examiner;

- Insurance Underwriter;

- Accountant;

- Bookkeeper;

- Auditor;

- Economist;

- Tax Examiner/Collector;

- Financial Manager;

- Management Analyst; and

- Financial Analyst.

For HR Managers: Tips For Hiring A Budget Analyst

Key Characteristics To Look For In A Budget Analyst

If you’re an HR professional looking to hire the perfect budget analyst for your company, there are a few skills you want to look for in the right candidate.

Ask questions to see if your interviewee has the following essential skills for a budget analyst:

- Able to use critical thinking in a professional setting;

- Willing to communicate thoroughly and regularly;

- Laser-focused on small details of the tasks at hand;

- Deep understanding of math as it pertains to finance;

- Adequate writing skills for the job; and

- Enthusiasm for innovating in their position.

Minimum Level Of Education & Experience

It is important that the individual in charge of monetary allocation for your company be adequately educated to do so!

It is your company’s best interest to hire someone with at least a Bachelor’s degree in Accounting, Finance, or another related field.

It is even better to find someone who is a CPA and/or has a Master’s degree in Accounting, Finance, or a related field.

Try to find someone with 1 to 3 years of industry experience in addition to their schooling.

Resources:

- https://www.bls.gov/ooh/business-and-financial/budget-analysts.htm#tab-6

- https://www.bls.gov/oes/current/oes132031.htm

- https://www.truity.com/career-profile/budget-analyst

- https://collegegrad.com/careers/budget-analysts#related

- https://interviewpenguin.com/learn-how-to-succeed-in-an-interview-for-a-budget-analyst-job/