Chartered Financial Analysts are finance analyst professionals who specialize in investment strategy and high-level money management.

They are specialized professionals who are CFA Charterholders, a very sought-after certification in the financial business world.

Financial careers like Financial Analysts have gratifying careers, with plenty of opportunities to advance.

Chartered Financial Analyst Information

| Official Job Title | CFA Charterholder |

| Average Salary | $177,000 |

| Stress Level | High |

| Work/Life | Not much balance |

| Job Satisfaction | Average |

| Career Advancement | Above average |

Chartered Financial Analyst Job Description

A Chartered Financial Analyst is a professional certification that an accounting or financial professional can hold, making them more qualified than others in the field.

Once someone passes the required exams, submits references, and proves their work experience, they can apply to be a CFA Charterholder.

Once someone is a CFA Charterholder, financial job opportunities will be waiting for them!

What is a Chartered Financial Analyst?

A Chartered Financial Analyst is a highly-skilled financial professional who specializes in investing and financial markets.

Chartered Financial Analysts earn a CFA Charter that proves their experience in the investment world.

The certification requires a lot of time, work, and experience, so it is always seen as valuable when seen on a resume.

What Does a Chartered Financial Analyst Do daily?

A Chartered Financial Analyst may have different duties depending on their official job title, whether they are a credit analyst, accountant, or a portfolio manager.

Each job will have different duties but share similar tasks.

Chartered Financial Analysts usually work on investment strategies, research and view reports, gather data, manage investor relations, and more.

Responsibilities, Duties & Roles of a Chartered Financial Analyst

As a Chartered Financial Analyst, you would have more responsibilities than other employees since you have proven you have enough experience to handle such duties.

The list of official responsibilities and duties will vary based on your employer, but there are everyday tasks for each position.

Chartered Financial Analysts will be required to complete duties like:

- Collecting financial data

- Analysis

- Evaluating returns and risks on investments

- Creating financial models

- Writing financial reports

- Managing financial portfolios

- Financial account management

- Reporting financial data to executives

Chartered Financial Analyst Salary

Average Salary

The average salary for a Chartered Financial Analyst in the United States is $177,000.

Starting Salary

The average base salary for a Chartered Financial Analyst is $126,000, according to the CFA Institute.

Senior Salary

Since many CFA Charterholders have different financial jobs, salaries can vary.

One of the highest salaries reported from someone holding a CFA certification was $255,000 a year.

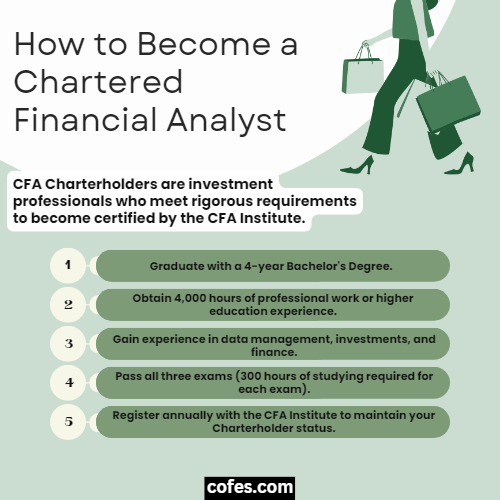

How to Become a Chartered Financial Analyst

Certifications, Training & Degree

To become a certificated Chartered Financial Analyst, you will need a bachelor’s degree or be within 11 months of your graduation date to take the required exams.

The biggest requirement is the 4,000-hour professional work experience requirement that has rules to it.

The 4,000 hours can be a combination of work experience and higher education, and it must be acquired over a minimum of three sequential years, achieved by the date of your Level 1 exam.

If you are using a combination of work experience and higher education, you should make note that the two cannot overlap to be accepted.

Work or internship experiences must be paid experiences to count.

Other Skillsets & Requirements

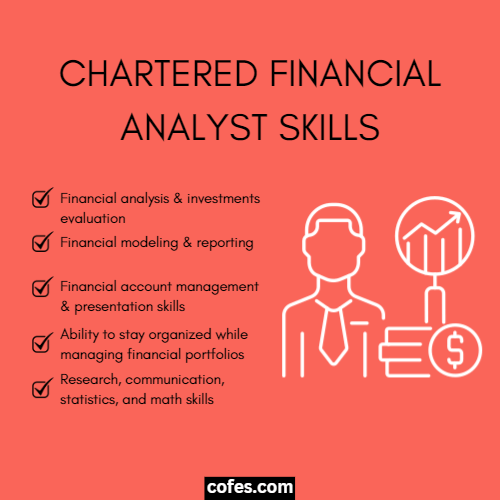

Besides earning the CFA certification, Chartered Financial Analysts will be expected to have experience in data management, investments, and financial knowledge, exceptional communication skills, exceptional research skills, and a great set of mathematical skills.

How Long Does It Take to Become a Chartered Financial Analyst?

Most financial professionals who apply to become CFA Charterholder take about four to five years to complete all of the exams to earn the final certification.

Most successful candidates will spend over 300 hours studying for each exam if they want it!

Is it Hard to Become a Chartered Financial Analyst?

It is a bit difficult to become a CFA Charterholder.

As mentioned before, some people spend approximately 300 hours studying for each exam, and people who study more are more likely to pass the exams.

To give you some perspective on success rates, only 49 percent of Level 1 exam participants in December 2020 passed, according to the CFA Institute.

Chartered Financial Analyst Career Paths

With a CFA certification, financial analysts have an array of options when it comes to jobs.

Many Chartered Financial Analysts choose careers in portfolio management, financial consulting, or account management–some people even decide to work independently.

The great thing about earning your Chartered Financial Analyst certification is that it will open so many opportunities.

The Projection for Growth in Chartered Financial Analyst Jobs

The U.S. Bureau of Labor Statistics projects a six percent growth in financial analyst jobs between 2020 and 2030.

There will most likely always be demands for financial analysts in a world run by money.

So, is a Career as a Chartered Financial Analyst a Good Idea?

Yes!

Financial and business jobs usually pay very well and lead to many opportunities.

Becoming a Chartered Financial Analyst will bring you even more opportunities and money your way if you decide to take on the extra work of becoming a CFA Charterholder.

Working Conditions

Can a Chartered Financial Analyst Work Remotely From Home?

While most Chartered Financial Analysts will probably work in a corporate office setting, it is possible to work from home.

Especially if you plan on becoming self-employed or doing freelance work, you could be working from home!

Being a CFA Charterholder usually means you will hold more responsibilities and more work, so it may be harder to work from home in those situations.

How Many Hours Does a Chartered Financial Analyst Work?

Chartered Financial Analysts work the typical 40-hour work week and, in many cases, will work more than 40 hours.

Can a Chartered Financial Analyst Work Part-Time?

A Chartered Financial Analyst could try very hard to work only part-time, but they will most likely be working a 40-plus hour work week with all of the work they handle.

What are the Average Vacation Days for a Chartered Financial Analyst?

Most Financial Analysts will receive up to 20 days or four weeks of paid vacation time, which is more than most industries.

Another perk of being a CFA Charterholder!

Alternative Careers & Similar Jobs to a Chartered Financial Analyst

- Finance Manager

- Finance Director

- Auditor

- Budget Analyst

- Accounting Director

- Accounting Manager

- Financial Counselor

- Mortgage Loan Processor

- Business Analyst

- Sales Analyst

- Financial Analyst

Chartered Financial Analyst Resume Tips

Financial Analysts should highlight the best skills that are in demand right now.

If you are a Chartered Financial Analyst, this is something to highlight on your resume!

It’s a big achievement that will put your resume at the top of the candidate pile.

Many people who pursue a CFA do not always achieve it, so completing the certification is a big deal.

As always, make sure your resume has relevant work experience and concise descriptions of what you did in each position.

Chartered Financial Analyst Interview Questions

Q1: How do you determine which investment opportunities will be best for a financial plan?

Why It Works: A Chartered Financial Analyst specializes in investment finances, so if an employer sees that you are knowledgeable about investing, you could have a better chance of landing the job.

Q2: How do you deal with high-stress situations?

Why It Works: Many financial jobs are high-stress, and employers will have high expectations for someone who holds a CFA certification.

Q3: How do you stay current with financial market trends?

Why It Works: Chartered Financial Analysts will be expected to know the latest market trends and investing trends since it is their specialty.

Employers want to know if you are as current as they need you to be.

Q4: How do you approach working on large projects with large amounts of data?

Why It Works: Being a Chartered Financial Analyst most likely means you will be working with lots of numbers and lots of money–being able to work with large amounts of data is essential!

Q5: What is your process when creating financial analysis reports?

Why It Works: Employers will want to know how you create financial reports and how well you can create them.

An experienced Financial Analyst should be able to easily answer this question.

Jobs Related to Chartered Financial Analyst

Are you looking for jobs you can apply to with a CFA certification? Do you want to know which jobs CFAs usually hold?

Related jobs include:

- Corporate Financial Analyst

- Risk Analyst or Manager

- Account Manager

- Credit Analyst

- Financial Relations Manager

- Portfolio Manager

- Financial Consultant

HR Manager: Tips for Hiring a Chartered Financial Analyst

Key Characteristics to Look for in a Chartered Financial Analyst

A Chartered Financial Analyst that wants to work for a company should be highly skilled in research, analysis, communication, and math.

During an interview, ask questions related to these skill sets and ask for examples based on answers.

Minimum Level of Experience & Education

Since a Chartered Financial Analyst certification takes four to five years to complete, most people who fall into this category will have a good chunk of work experience already under their belt.

A highly specialized and skilled financial professional should hold at least a bachelor’s degree in business or finance with several years of experience.

Many candidates will most likely hold an MBA.