According to popular perception, an influential finance director lays a solid foundation for the company’s future growth.

Additionally, you must have excellent communication skills if you plan on rising to the position of Finance Director (FD).

The finance director uses their financial skills to help the company and its stakeholders succeed financially, regardless of whether they are the organization’s most senior finance professional or the finance head of a division, subsidiary, or region.

In addition to overseeing the organization’s financial processes and controls, finance directors serve an important function in training, coaching, and counseling their other directors on financial concerns, especially for those who aren’t math whizzes.

Finance Director Information

| OFFICIAL JOB TITLE | FINANCE DIRECTOR/MANAGER |

| AVERAGE SALARY | $189,613 |

| STRESS LEVEL | AVERAGE |

| WORK/LIFE | LOW |

| JOB SATISFACTION | HIGH |

| CAREER ADVANCEMENT | HIGH |

Finance Director Job Description

What is a Finance Director?

The financial state of their firm is the responsibility of finance directors, who are part of the senior management team.

You’ll be in charge of overseeing operations and setting out a financial strategy for the company’s long-term profitability.

They must be adaptable and talented to meet a constantly changing set of conditions to accomplish the position.

What Does A Finance Director Do On A Daily Basis?

Maintaining accounting personnel and overseeing internal controls are only a few of the everyday tasks of a finance director.

Others include executing fund-raising initiatives, interacting with investors to establish a financial plan, monitoring spending, and keeping an eye on cash flow.

Responsibilities, Duties & Roles Of A Finance Director

- Managing the financial planning and strategy of the organization.

- Performing financial analysis and generating reports on that performance.

- Supervising the audit and tax activities of the company.

- Accounting policies development and implementation.

- Creating detailed budgets and projections.

- Staff development in the accounting department.

- Examining the spending plans of various government agencies.

- Identifying, evaluating, managing, and reducing the impact of potential risks.

- Studying and interpreting intricate financial data.

- Taking care of the controls on the inside.

Finance Director Salary

Average Salary

In the United States, the national average compensation for a Finance Director is $189,613 per year.

Starting Salary

In the United States, a finance director’s beginning compensation or starting salary is $118,518 per year, possibly increasing.

Senior Salary

The senior salary of a finance director is $231,000 per year.

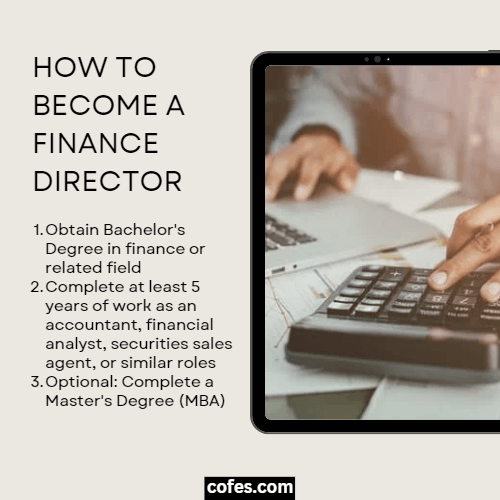

How To Become A Finance Director

The Entry Level: Certification, Training & Degree

Certifications:

To demonstrate their abilities and credentials to current and future employers, directors of finance may enroll in one of the numerous certification programs.

These programs can help them learn new skills and grow in their careers.

- Association of Chartered Certified Accountants (ACCA)

- Chartered Institute of Management Accountants (CIMA)

- Institute of Chartered Accountants in Ireland (ICAI)

- Institute of Chartered Accountants of Scotland (ICAS)

Training:

A minimum of five years of experience in a managerial job in finance is generally required for directors of finances.

Many people have worked as financial analysts or as certified public accountants.

Degree:

The minimum educational requirement for directors of finance is an undergraduate degree in accounting, finance, or a closely related subject.

Candidates with an MBA or similar masters-level degree with a focus on finance or economics are frequently preferred by employers.

Accounting, economic concepts, international economics, money and banking, business administration, and international relations are covered in the relevant curriculum.

As part of their onboarding, finance directors frequently get additional business training as part of their job duties.

They may improve their management and leadership abilities while also learning the systems and technology they’ll need in the future.

Other Skill Sets, Requirements & Qualifications

The finance director is a senior position.

It is required to accumulate substantial relevant expertise during your ascent up the corporate ladder.

The following are the most crucial abilities that will assist you in landing the job you want:

- A good understanding of the commercial and corporate environment

- Exceptional interpersonal abilities

- Exceptional mathematical abilities

- IT abilities that are second to none

- A mind that is analytical and inquisitive

- Excellent problem-solving abilities

- Management abilities that are above average

- Excellent prioritization

- The capacity to make rapid yet sound judgments is essential.

How long does it take to become a Finance Director?

Directors of finance typically require at least five years of experience in a financial management position.

A lot of people have worked as accountants or financial analysts.

As part of their onboarding for their new position, finance directors frequently receive additional company training.

They can learn the relevant systems and technology while also honing their management and leadership skills.

Is it Hard To Become A Finance Director?

Being a finance director may be hard because credibility and efficiency are expected from a finance director to make sure that the company’s finance is well taken care of.

Finance Director Career Paths

The Finance Director Roadmap

Today’s finance director is a business leader with a broad skill set.

So, what are the specific skill sets that separate a competent performer from an exceptional one?

- Excellent Ability to Convey Ideas

- Modern-day finance directors must be upbeat and look for growth prospects while carefully weighing the risks and rewards.

- Given the uncertain economic outlook, they recommend market opportunities and long-term investments.

- Money-Minded

- Resilience, integrity, honesty, qualifications, and years of hard work are necessary to be a successful finance director.

- They must have a laser-like focus on cash flow.

- Considering how vital the accounting department is for corporate growth, an outstanding finance director will consider not only working capital and returns but also how to alter an organization’s operations to improve its cash flow.

- Strong Business Acumen

- An outstanding finance director will give high priority to commercialism and strategic understanding.

- Entrepreneurial abilities are developed early in a person’s career by seizing opportunities and tackling complex tasks.

- The best place to learn about business is in a company, which necessitates curiosity and initiative.

- Even today’s top finance directors have faced difficulties outside their comfort zone and have succeeded despite making blunders along the road.

- Network Savvy

- It’s critical to create relationships with coworkers inside and outside the organization, including the CEO, board members, and managers.

- Leadership & Risk-Taking Ability

- Finance directors must provide the proverbial “light at the end of the tunnel” by leading the company through difficult times.

- Instead of being known as someone who is overly cautious and continually says “no,” they must seize opportunities when they arise.

- While planning for expansion, they must also ensure the accounting fundamentals are met.

- The leader of a high-quality team must have a thorough awareness of the business, its customers, and markets, be good with numbers, and interpret relevant data for others.

Projections For Growth In Finance Director jobs

Compared to other occupations, the employment of financial managers is expected to increase faster than average at a rate of 17% between 2021 and 2031.

Financial managers will have an estimated 123,100 new job opportunities through 2031.

There will be numerous opportunities to replace workers who change professions or leave the workforce for various reasons.

Is Finance Director A Good Career?

Anyone interested in generating financial reports, managing investments, and devising strategies to help their companies achieve their long-term financial goals would enjoy this career.

Working Conditions

Can A Finance Director Work Remotely From Home?

Several roles in the finance field allow for some degree of flexibility, including those of financial directors, advisors, and planners.

Flexible work arrangements are available in many forms.

Still, remote financial positions, which allow professionals to work from home, are prevalent.

How Many Hours Does A Finance Director Work?

Banks, investment firms, and insurance companies all employ financial directors.

While most financial directors work 40 hours or more a week, a few work even longer.

Can A Finance Director Work Part-Time?

The responsibilities of a part-time Financial Director are pretty similar to those of a full-time Financial Director.

You must surround yourself as a part-time Financial Director with the necessary people and systems to execute your job.

Then, develop a financial plan that aligns with the firm’s broader business strategy to establish a successful formula.

A part-time Financial Director must have a thorough understanding of the day-to-day operational areas critical to every business, such as working capital management, margin improvement, controls, and system and reporting quality.

However, their role is more of an oversight than a “hands-on” interaction.

What Are The Average Vacation Days for a Finance Director?

Creating a sensible and equitable vacation policy is a challenge for many business owners, especially new ones.

When deciding on a standard vacation policy, consider the number of vacation days offered by companies all around the country.

Vacationers typically take 15 to 20 days off at the busiest times of the year.

Alternative Careers & Similar Jobs to a Finance Director

- Financial Analyst

- Market Research Analyst

- Business Development Manager

- Auditor

- Finance Manager

- Branch Manager

- Business Development Manager

- Communications Director

- Budget Analyst

- Accounting Director

- Accounting Manager

- Financial Counselor

Finance Director Resume Tips

- Set accounting and finance objectives that are in line with the mission and vision of the firm.

- Prepare yearly financial reports, yearly audits, and audits of specific projects.

- Execute payroll transfer and payment disbursement operations to remote offices and field sites.

- Consistently follow company and state policies when doing financial transactions.

- Perform an analysis of the financial accounting and control systems and recommend improvements.

- Ensure that all project financial reports are prepared and distributed regularly.

Finance Director Interview Questions

Q1. When it comes to financial industry trends, how do you stay abreast of them?

Pay attention to whether or not a potential hire is a subscriber to several financial magazines.

Candidates’ research skills and willingness to refresh their financial knowledge should also be demonstrated.

Q2. In your experience, what are the most difficult aspects of working with a budget of any size?

Look for applicants who have a history of successfully managing budgets.

Candidates should also highlight their ability to take on difficult situations and solve them creatively.

Q3. To be successful with financial planning and budgeting, what are the most important factors?

Look for applicants who can demonstrate the capacity to prioritize tasks supporting the company’s long-term objectives.

Q4. What financial performance measures do you employ when evaluating an organization?

Look for people that have a keen eye for detail and can think critically.

Also, seek those that assess performance using precise measures.

Job-Related To Finance Director

- Accountants and Auditors

- Budget Analysts

- Chief Executives

- Financial Analysts

- Financial Examiners

- Insurance Sales Agents

- Personal Financial Advisors

- Purchasing Managers

Tips For Hiring A Finance Director

Here are some pointers to make the process go more smoothly and help you pick the best person for the job.

Key Characteristics To Look For In A Finance Director

1. Determine the responsibilities of the position.

First, determine what you need from a finance director by doing an internal assessment.

Determine the current and future tasks required for the position.

So, you know what to look for in potential candidates and know what you anticipate from them.

Be as explicit as possible in your job description.

2. Recruit the right people for the job by creating an effective job advertisement.

Following completing your ideal job description, you can begin constructing your finance director employment advertisements or postings, as appropriate.

Ads for senior posts should include specific language and a specific format.

These articles reflect your company’s and brand’s personality.

If you want to seek the attention of the best candidates, you need to make an outstanding job advertisement.

3. Carefully examine every resume that you receive.

One of the most time-consuming and difficult chores you’ll face is sorting through a large number of resumes to find qualified candidates.

However, it will be much faster if you know what to look for during the screening process.

4. Prepare for the interview by coming up with thoughtful interview questions in advance.

To get the most out of your interview, focus on the most qualified and desired individuals and ask relevant questions about their experience and qualifications.

Identify the technical talents and core values of potential employees by asking probing questions.

Prepare questions that will give you a sense of their management or leadership style, as well as their approach to solving problems.

5. Look into the backgrounds of the people you’ve shortlisted for the job.

Because this individual will be in charge of making important financial decisions, you must ensure that they are trustworthy and honest before hiring them.

Hire a third-party organization to perform a complete background check on your applicants with their permission.

Before hiring them, you should ask about the provider’s civil and criminal past, professional licenses and affiliations, educational degrees, employment, and credit history.

They should offer this information to you.