| Brand | Starting price | Best for |

|---|---|---|

| 1. Freshbooks | $17 – $55 per month | Fast, Sole proprietors, & Cloud based accounting |

| 2. Zoho Books | $10 – $200 per month | Data Tracking |

| 3. Patriot Payroll | $17 – $37 per month | Ease of use |

| 4. Sure Payroll | $19.99 – 29.99 per month | Customer Support and Service |

| 5. Square Payroll | $5 – $35 per month | Employees and Contractors |

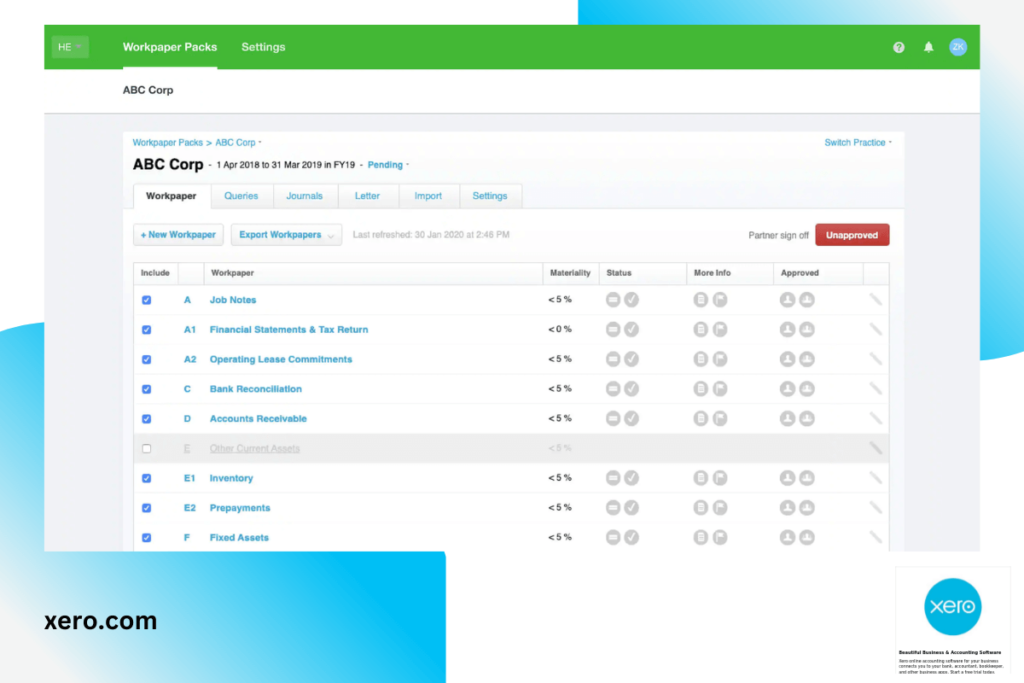

| 6. Xero | $29 – $110 per month | Small Businesses |

| 7. Wave | $20 – $40 per month | Management of Invoices, Accounts, and Cash flow |

Many businesses outsource administrative tasks such as payroll, executive salaries, attendance management, tax filing, general liability, and entitlements.

Outsourcing is expensive, and it could be difficult for small companies to outsource their administrative tasks because of a low budget. Management accounting is one of the first web services you should acquire when starting a business.

The best management accounting software allows your company to grow with a reasonably happy employee by reducing organizational headaches that frequently disturb payroll teams. Choosing the right payroll service for your corporation reduces administrative headaches but also assists your industry in scaling with a relatively pleased working population.

In this article, you will determine how to select the best accounting & payroll software for your small businesses.

Best Payroll Software for Small Businesses

In the market, numerous payroll software solutions are available. However, finding out which software suits your company can be overwhelming. To help you, we navigate your options and develop a list of famous payroll software. Have a look!

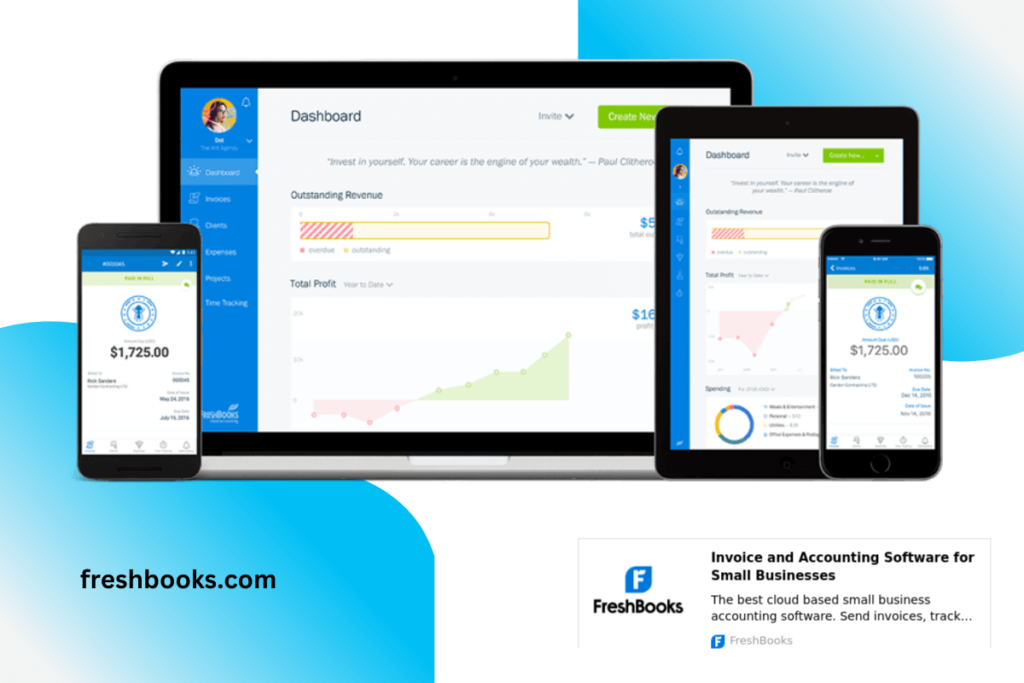

1. Freshbooks Payroll – Best for Fast & Easy Payroll

One of the best Payroll software is Freshbooks. You are maintaining your business’ finances, keeping track of what you owe and what you have spent, sending invoices, and accepting payments. Customer invoices can be generated easily and emailed or printed out. A smaller business, or a company with only one owner and operator, is especially well suited to FreshBooks.

Gusto is a simple, secure, easy-to-use accounting and bookkeeping software for sole proprietors, freelancing, and solo entrepreneurs. Its specialty includes automatic payroll tax filling and is an easy-to-use payroll solution integrated with Freshbooks. You can effortlessly run your small business with Freshbooks accounting software.

It helps organizations deal with their payroll tax filing, invoices, and expenses and facilitates them with automated payments. It provides extra information by classifying tabs and improves profitability with Double-Entry Accounting tools.

Pricing:

The pricing of Freshbooks is very straightforward. It offers four pricing plans that are the following:

- Lite: 17 USD per month.

- Plus: 30 USD per month.

- Premium: 55 USD per month.

- Select contact sales and custom prices.

Custom pricing plans are also available for businesses with unlimited billable clients and specialized features. (Currently 90% off for three months on all four plans)

Highlights and Hidden Gems:

- Freelancers, solopreneurs, and small business owners would benefit greatly from FreshBooks’ accounting and invoicing capabilities.

- Several payment methods are supported, including credit and debit card payments, ACH transfers, Stripe, and PayPal.

- Instead of clicking on another screen, you can enter the expense directly from the Expenses tab.

- The application allows you to keep all your conversations, files, and other pertinent data in one central location, making it easier to manage projects.

- Makes easy to invoice, taking only a few seconds to generate professional invoices.

- Using Gusto Payments, you can also easily track payrolls.

- FreshBooks is a better choice for small businesses when a single person manages an account.

Disadvantages and Limitations:

- Limitations of users and billable clients.

- A little bit expensive if you don’t use all its features.

- Lack of in-depth reports and limited reporting choices.

- The mobile app is good but has some technical issues.

- Doesn’t has an integrated inventory management system.

- Lack of automatic enumeration for all your invoices and expenses.

Bottom Line:

If you need to send invoices and take payments as part of your business, FreshBooks is the perfect fit. FreshBooks has a user-friendly interface that makes navigation easy. You can start with the basics and send your first invoice quickly if you want a simple solution to organize your business accounting.

Also Read: 6 Best Free Payroll Software

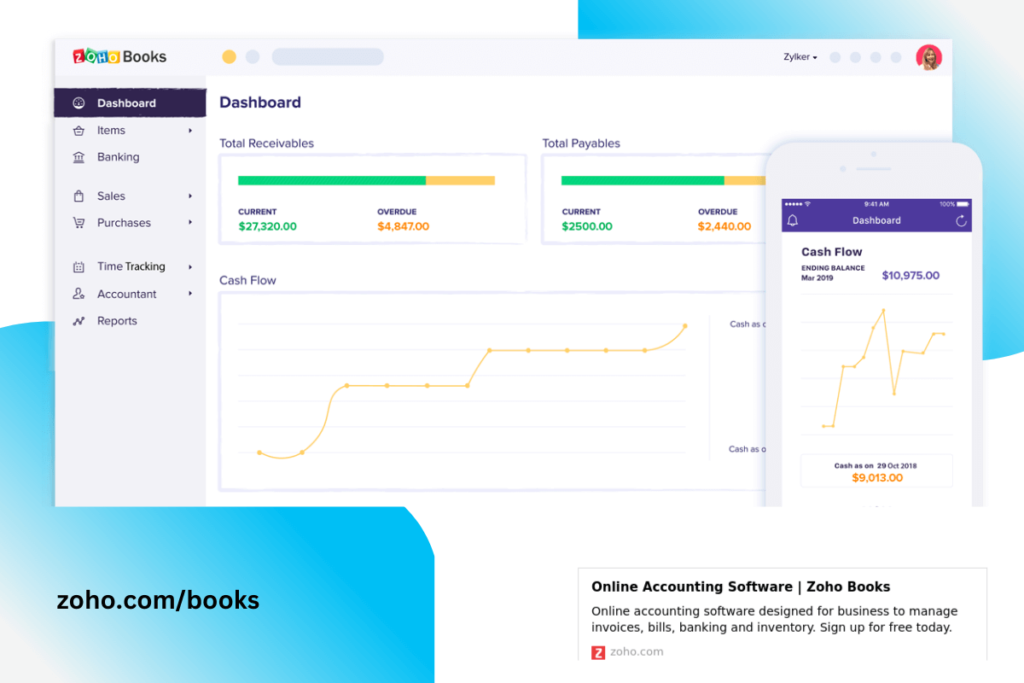

2. Zoho Payroll – Best & Stree-free Payroll for Small Business

As it supports unlimited invoices, this accounting software for payroll is one of the best. It can be used by small businesses as well as large enterprises. Marketing and consulting companies can also utilize it. You can track buyer, service, and client commitments using Zoho software and manage business expenses and cash outflows.

Zoho payroll allows organizations to check employees’ summaries, pay runs, taxes, forms filling, benefits, reports, and contact support. It is fully integrated with Zoho books and provides pre-integrated accounting that maintains records of your payroll expenses.

Zoho accounting is an innovative online solution that can streamline back-office affairs, automate business plans, and improve secure collaboration between businesses and accountants.

Pricing:

Zoho offers a free plan. Here are the basic plans provided by Zoho:

- Standard: $10 per month billed annually or $12 billed monthly.

- Professional: $20 per month billed annually or $24 billed monthly.

- The Premium: $30 per month billed annually or $36 billed monthly.

- The Elite: $100 per month billed annually or $129 billed monthly.

- The Ultimate: $200 per month billed annually or $249 billed monthly.

Highlights and Hidden Gems:

- It has top-notch reports.

- It has minimized data loss.

- Retail businesses can track their stock and make smart purchases.

- Besides offering 11 languages to users, it allows them to invoice their clients in their currency.

- You can manage your clients and send them invoices by mail or online, and you can also automate recurring invoices and send payment reminders online.

- It is compatible with iPhone, iPad, and Android devices.

Disadvantages and Limitations:

- Premium consulting and integration services are plan limited.

- Non-existent support and weak documentation.

- It is considered non-reliable for bank links.

- Plan restrictions are implemented on users.

- Sudden closure of certain admin/owner accounts.

Bottom Line:

Accounting tasks can be shared or delegated to anyone using Zoho accounting software; however, each employee can have different permissions. Your accountant or financial advisor can easily access your books to assist you with accounting. Zoho offers high security online, so it’s the best accounting software.

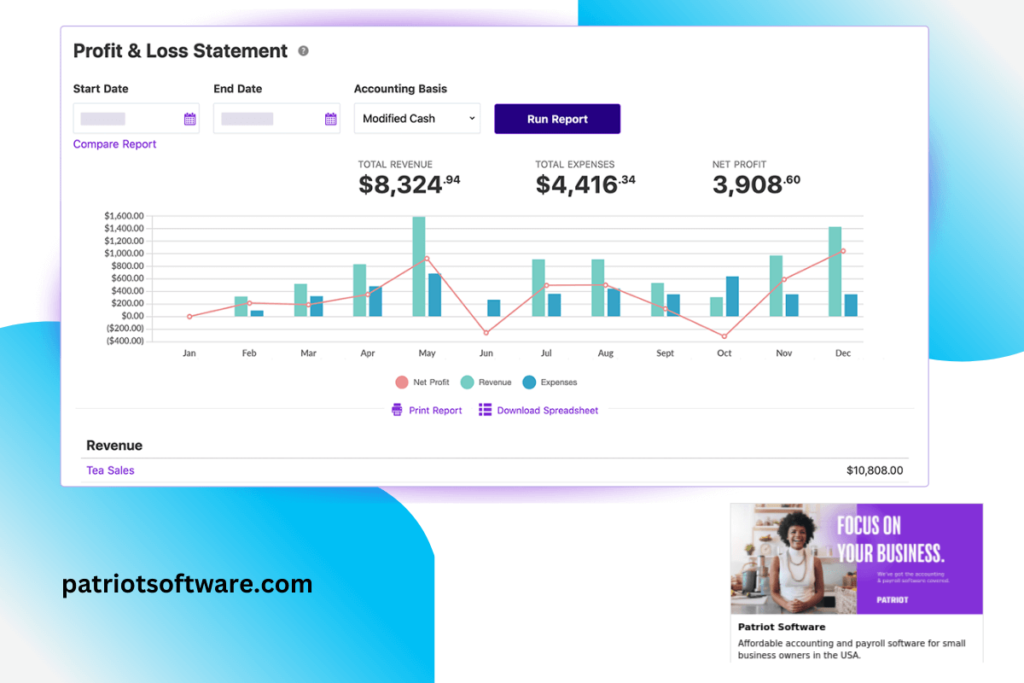

3. Patriot Payroll – Best Value for Money Payroll Software

Patriot Payroll software allows you to manage and automate your payroll process effectively. The setup process is very simple and fast. According to the company, running Payroll takes the typical small-business user around three minutes.

Patriot Payroll is best known for its best value for money. Its Payroll is robust, affordable, free, and easy setup, offering support. Its full-service plan, the more expensive of the two options, includes tax filings and deposits, making it an excellent alternative for small businesses with up to 100 employees.

Patriot offers accounting software with various tools for handling your crypto data. It has robust capabilities that automate the crypto accounting function of the business for optimal quality and efficiency. The average user runs Payroll in 3 minutes.

Pricing:

Patriot Payroll offers two packages with a variety of features.

- Basic Payroll: $17 per month + $4 per employee/contractor

- Full-Service Payroll: $37 per month + $4 per employee/contractor

Highlights and Hidden Gems:

- Paid time-off policies.

- Employee dashboard.

- Free and easy onboarding setup.

- Free integration with workers’ compensation insurance.

- Integrates with Patriot’s accounting software or other software.

- Import time-tracking data from Patriot Time and Attendance software.

Disadvantages and Limitations:

- Lack of customizable reports.

- Accounting errors are present.

- Payroll tax filing reports show errors.

- Expensive as it charges an additional fee.

- Technical knowledge is mandatory for benefits.

- Plan-limited features are one of the biggest disadvantages.

Bottom Line:

Patriot Payroll is an excellent option for a small business looking for a straightforward payroll solution. Patriot’s full-service package is one of the least expensive choices to consider if you want to keep prices down.

Also Read: What Is A Payroll System, And How Does It Work?

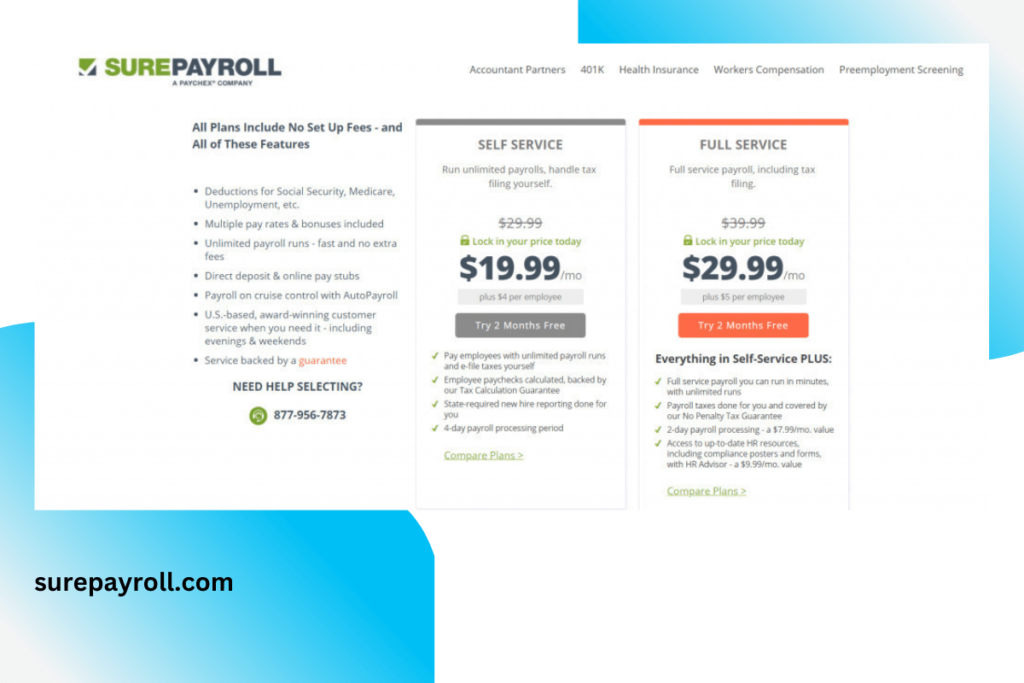

4. Sure Payroll – Best for Fundamental Payroll System

Sure Payroll is a successful alternative in this price range for small businesses that require an entire payroll system but do not have a huge number of extra functionalities. Sure Payroll’s main goal is to provide simplified payroll options to smaller businesses at a reasonable cost, and it achieves that goal admirably.

Sure Payroll includes:

- A practical HR toolkit.

- Customized tax assistance.

- Availability to a group of compliance experts to ensure that your organization complies with local legislative requirements.

Pricing:

Sure Payroll has flat pricing depending upon self-service and full service, according to the Sure Payroll team. These services are:

- Offers a one-month free trial.

- Self-service: $19.99 per month + $4 per employee.

- Full service: $29.99 per month + $5 per employee.

- Customer service charges $4.99 per Payroll processed, $4.99 + $3 per employee per month, local tax filling, $9.99 per month, and tax filling in multiple states for $9.99 per month.

Even though they do not publicly announce their expenses, you will need to ask for a quotation from their online webpage to get accurate pricing for your company.

Highlights and Hidden Gems:

- Easy to use with a simple interface.

- Users can approach Payroll with a single click.

- Sure Payroll provides many functionalities that small companies should expect from an online invoicing service, such as direct deposit and payroll assistance for any employee, as well as some unique features that set it apart from the competition.

- It is accessible as software and an Android application for integrating accounting systems.

- Sure, Payroll integrates with an attendance management system, eliminating the need to enter payment details sequentially.

Disadvantages and Limitations:

- Customer service is the worst.

- Annoying security feature.

- Re-routed for every inquiry.

- Lack of ability to void incorrect payroll cheques.

- Support and technology need to be improved.

- After leaving, you don’t have access to anything.

Bottom Line:

Sure Payroll should be considered if you are searching for a low-cost, simple, and intuitive payroll program. It’s simple and was created with small businesses in mind, both in terms of price and function.

5. Square Payroll – Best and Simplified Payroll Software

Square Payroll offers a function for managing employees, including regular staff, hourly staff, and contractors. This running feature enables the companies to pay their employees and contractors based on their working hours over a defined pay period and data automatically extracted from the Square Point of Sale app.

Square Payroll has simplified the payroll features. Now, you can get full-service Payroll, tax filling, and other benefits all in one place, anytime, anywhere. It also automatically calculates paid hours off, working hours, and total work costs for each employee. You can set up a Payroll that works with your business and allows you to track time seamlessly.

Pricing:

The pricing of Square Payroll is very simple. You can either pay employees and contractors, or contractors can only be settled. If you only hire business people for a contract, you won’t have to pay any early-monthly fees –you only have to pay $5 for each contractor per month.

- Pay employees and contractors: $35 per month + $5 per person paid.

- Pay contractors only: $5 per month per person.

There is no other plan for pricing, and the trial is free only until you start paying your employees.

Highlights and Hidden Gems:

- Computerized on-time payment payroll.

- Flat pricing for Payroll is available.

- Payment options for direct deposit or check.

- Timecard, tips, and commission integrations.

- Machined Payments and filings from the State Agency.

- Offers the dashboard for updating employees’ details, bank account information, and tax deductions.

Disadvantages and Limitations:

- Hold times for the live support.

- Lack of flexibility, tough to set up.

- Time-sensitive issues are difficult to handle.

- Lack of ability to schedule same-day payments.

- Flat pricing can be expensive for a large team.

Bottom Line:

Square has many exceptional qualities and services and will keep you updated regardless of the situation. You have several ways to contact them and an outstanding forum for quick answers to questions.

Also Read: Accounting Software For Insurance Agencies

6. Xero Payroll – Best & Powerful Payroll Software

Xero Payroll is one of the best payroll software because it makes things easier for small businesses. Xero connects SMBs with its loyal supporters and makes their financial situation instantly visible to business owners. It has powerful payroll software integrated with Xero online.

Xero Payroll administers your tasks, updates your accounts automatically, and creates HMRC submissions. It is described as a software containing all the toolkits you want in the best payroll software. It allows you to pay staff, report payroll details to the ATO, and make automated tax calculations.

Pricing:

The price of Xero begins at $14.50 per month. No free version of this accounting software is available. For Xero Payroll, the company provides four monthly subscription levels.

- Free trial of 30 days.

- Starter: Usually $29 but now $14.50 monthly for the first three months.

- Standard: Usually $59 but now $29.50 monthly for the first three months.

- Premium: Usually $76, but now $38 monthly for the first three months.

- Ultimate: Usually $110, but now $55 monthly for the first three months.

Highlights and Hidden Gems:

- One of its key aspects is the personalized dashboard, which gives you an idea of your economic state.

- You can run dozens of reports simultaneously with Xero.

- The software in Xero’s Premium Plan lets you get paid in 160 currencies.

- With logos and details, you can personalize your invoices in Xero.

- Xero is the best accounting software with high online security.

- Single-touched payroll sorted that simplifies compliance and reporting.

- Automated online payroll that calculates taxes and views payslips.

Disadvantages and Limitations:

- Constantly changing reports.

- Technical issues and random bugs.

- Expensive as compared to others.

- Duplication of contacts and reports.

- Payroll tax calculations show incorrect figures.

- Automatic integration management needs to be improved.

Also Read: 9 Best Payroll Software For Accountants

7. Wave Payroll – Best for Payroll that Pays Off

Wave Payroll is also among the best affordable software for small businesses. You can use the system to measure revenues and costs, organize your finances with bank statements and check receipts, and build successful invoices. Wave-integrated payroll makes managing payroll smart and effortless.

Wave Payroll offers you to run payroll in minutes, pay employees and contractors, make automated payroll journal entries, make tax payments and fillings, direct deposit, and self-service pay stubs and tax forms. This program is designed to work with smartphones and tablets to allow users to easily upload receipts, accept customer payments from any location, and generate product financial statements.

Pricing:

Wave Payroll pricing is different from the other Wave accounting software. Payroll pricing is listed below:

- It offers a 30-day free trial to its users.

- Tax service states: $40 per month + $6 per active employee + $6 per independent contractor paid

- Self service states: $20 per month + $6 per active employee + $6 per independent contractor paid

Highlights and Hidden Gems:

- Wave Payroll helps to manage all of your accounts in a single location.

- Wave also enables you to manage all of your invoices professionally.

- You can also order and control your business costs with the Wave software.

- The dashboard is one of our preferred Wave design elements.

- Another thing we like about Wave is the client portal.

- Wave also enables you to ensure that all of your books are balanced.

- Wave provides a chart of accounts that can be customized.

Disadvantages and Limitations:

- Pricing issue, expensive depending upon the states’ users.

- A subscription is required after a 30-day free trial.

- Only US and Canadian languages are available on the websites.

- It is not suitable for multi-entities companies.

- Lack of proper customer service

- Management of accounts is a little bit difficult.

- Slow payment speed needs significant improvement.

Bottom Line

Wave Payroll’s outstanding customer experience and thoughtful feature selection make it an excellent choice for sole proprietors and freelancers needing a dependable accounting system. We also like how this software allows you to do much more than manage your payroll. You can keep track of your expenses, manage your accounts, generate invoices, and more. Wave Payroll is suitable for small businesses with fewer than 15 employees, which requires simple payroll.

Also Read: HR & Payroll Software

Final Thoughts

A good payroll system is a worthwhile investment necessary for every small businessman. It reduces the operational burden on your staff, erases barriers to compliance, and creates consistency on which your employees can rely.

Rather than wasting time on managing tasks, invest in digital solutions such as payroll software to remove manual labor. It will not only help you manage all of your documentation, but it will also save you time that you can use to plan and expand your business. Though selecting payroll software distinct from your accounting system may be more difficult in the short run, it may save you time and money in the long run.

If possible, request a free trial and ask the vendor to explain the post-processing fees in detail so you don’t have to regret your decision later and can get the most out of your business management software. QuickBooks is the best payroll software for smaller companies, in our opinion. It is affordable, supports many integrations that can be used to increase its utility, and does not charge for each use. Self-employed individuals can use Wave accounting software for free.