Upfront Conclusion

The best accounting software for airbnb right now is FreshBooks and Zoho Books.

Deciding how to run and manage your Airbnb business is already a big job for you, and you wouldn’t need more, especially if you are solo. However, as Airbnb has grown to 40 million users and more than $17.99 billion gross booking value, you must prepare for severe accounting and bookkeeping.

Accounting is one part of your business you can’t leave behind or manage. Like most small businesses, you might not hire a professional accountant, so what do you do?

You can subscribe to accounting software to help you run your accounting processes from invoicing, billing, payments, expenses, tax, financial reports, taking orders, tracking your finance, and even reconciling you and your bank.

Trending Accounting Solutions

Still, there are lots and lots of accounting software for Airbnb to choose from, so how do you choose the best accounting software that will suit your business?

In this post, we have tried to help you make your decisions by outlining the best accounting software for Airbnb hosts that will help you run your accounting and finance without hassles and help grow your business. Here they are!

Top 6 Best Accounting Software for Airbnb

| Brand | Starting price | Best for |

|---|---|---|

| 1. Freshbooks | $17 – $55 per month | Customer support |

| 2. Zoho Books | $10- $200 per month | Unlimited invoices |

| 3. Patriot | $20 – $30 per month | Timely payment |

| 4. Topnotepad | $34.72 – $62.5 per year | Airbnb hosts |

| 5. Instabooks | Free | Ease of use |

| 6. Xero | $20 – $40 per month | User-friendliness |

| 7. Wave | Free | Business Finance |

1. Freshbooks – Best Accounting Software for Customer Support

Freshbooks is cloud-based accounting software for small and medium-sized businesses, especially service providers, small business owners, entrepreneurs, and freelancers. It is a simple, intuitive, powerful accounting software accessible across all your devices, whether PC or mobile.

Moreover, FreshBooks offers unique invoicing features such as customizable invoice formats, recurring invoices, etc. It lets you do accounting activities ranging from simple to complicated activities. Besides invoicing and income/expense bookkeeping, you can reconcile your bank account, create numerous reports, manage projects, and manage and track time.

Its user interface makes it so easy that you don’t have to do much besides inputting your data; Freshbooks does the rest for you.

Pricing:

Freshbooks comes in various pricing plans for you to choose from; these include the following –

- Lite plan: $17.00 per month (5 billable clients)

- Plus plan: $30.00 per month (the most popular and offers 50 billable clients)

- Premium plan: $55.00 per month (unlimited billable clients)

- Custom pricing plans are also available for businesses with unlimited billable clients and specialized features.

The website currently has a 90% off for three months on all four plans. The select plan is for large businesses, and the pricing is customized. For each of the plans, you have some add-ons. We will recommend that Airbnb hosts go for the lite plan.

Highlights and Hidden Gems:

- It accepts credit card payments.

- Freshbooks tracks your expenses 25% faster.

- Freshbooks facilitates your online payments.

- It quickly generates your financial reports for you.

- It also helps create, send and manage your invoices faster.

- Freshbooks offers you great user-friendliness and customer integration.

- The software works on the double-entry system, so you are ensured of your accounting process.

- Freshbooks lets you send your invoice in whatever currency or language you want.

Disadvantages and Limitations:

- Lack of automatic enumeration.

- Limitations of users and billable clients.

- Miscategorization of items after import.

- System crashing and loss of information occur.

- The mobile app is not suitable due to technical issues.

- It’s expensive if you don’t use all its features.

Why Do We Recommend Freshbooks as One of the Best Accounting Software for Airbnb?

Freshbooks offer feature-rich services, whether on PC or Android. The software is worth its name from the fastness, security, integration, reports, invoicing, tax preparation, and payment log. Freshbooks offers excellent customer support as top-rated accounting software for individuals and small businesses. We strongly recommend Freshbooks to small companies such as Airbnb.

Also Read: Cheap Accounting Software

2. Zoho Books – Best Accounting Software For Unlimited Invoices

This is top-rated accounting software for Airbnb hosts as it offers unlimited invoices. Small businesses to large enterprises can benefit from this software. It can also be used by marketing and IT consulting firms. You can manage business expenses and cash outflows with Zoho software, tracking commitments for buyers, services, clients, etc.

With Zoho software, you can manage your business expenses and cash outflows and track commitment and invoices for buyers, services, and clients. Marketing and consulting firms, as well as small and large businesses, can benefit from this software. All these features make your complex accounting easier and help your organization and small businesses.

Pricing:

Zoho offers you the following basic pricing plans:

- A free trial is available.

- Standard plan: $10 per month billed annually or $12 billed monthly.

- Professional plan: $20 per month billed annually or $24 billed monthly.

- The Premium plan: $30 per month billed annually or $36 billed monthly.

- The Elite plan: $100 per month billed annually or $129 billed monthly.

- The Ultimate plan: $200 per month billed annually or $249 billed monthly.

Highlights and Hidden Gems:

- No credit/debit card is needed for the payment.

- You can issue invoices in 11 different languages to customers and their currencies.

- Provides accurate accounting reports so that you can keep track of your finances.

- The stock of retail businesses can be tracked, and intelligent purchases can be made.

- It enables users to invoice their customers in their currency and offers 11 languages.

- It allows proper integration and preserves data integrity.

- Reconciliation of credit cards and multiple bank accounts is possible.

- This software can use on all iOS, Android, and Windows devices.

Disadvantages and Limitations:

- It has limited integration options available.

- Plan restrictions are implemented on users.

- No overall Payroll services are available.

- Automatic matching needs to be better.

- Frustrating payment plans and a limited number of contacts.

- Technical knowledge and experience are required.

Why do we recommend Zoho as one of the best Accounting software for Airbnb?

Zoho is intelligent online accounting software that’s easy to use for small and large businesses alike. Data entry becomes faster, allowing you to focus on other business-related projects while saving time. Due to its ease of use, we recommend it as Airbnb accounting software.

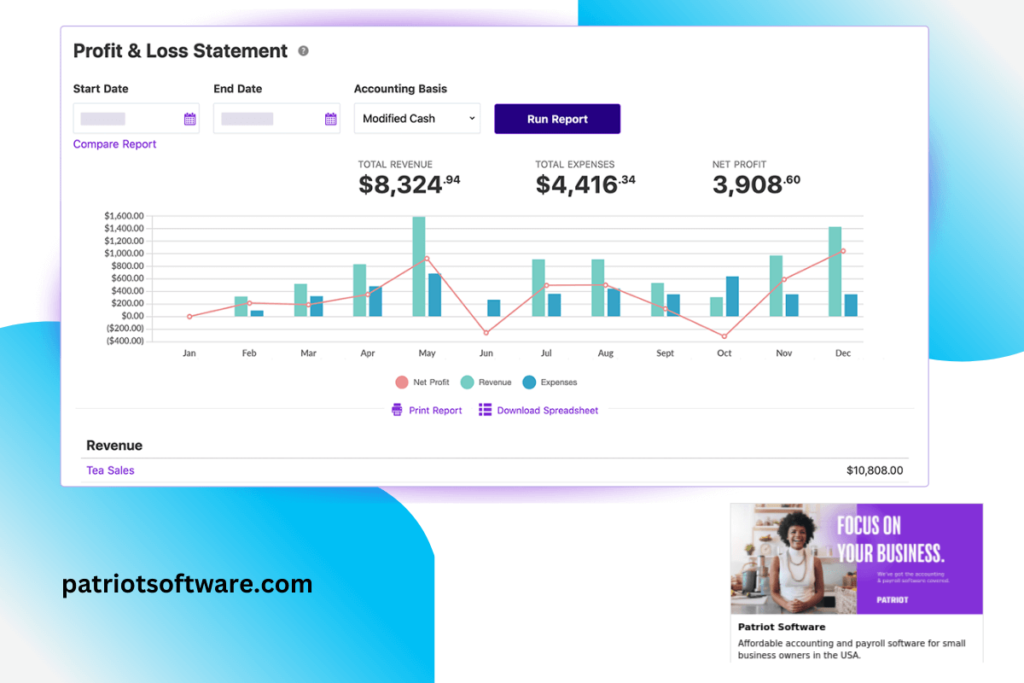

3. Patriot– Overall Best Accounting Software

Patriot is a type of software that allows you to manage and automate Airbnb accounting. Patriot services facilitate timely payment via online banking, pay cards, or business-generated checks. The software has powerful features that streamline Airbnb accounting functions for maximum quality and effectiveness.

To optimize customers’ accounting setup and further speed up the onboarding process, new accounting customers also have the option to use one-click settings, which provides a pre-selected and famous chart of account settings. The reports it generates are simple, and anyone can easily export them. It helps make your accounting more manageable and accessible.

Pricing:

Patriot Accounting offers two different pricing plans.

- Offers trials for 30 days and demos. (Video-based, self-guided, and personal)

- The basic accounting plan charges $20 per month.

- The premium accounting plan charges $30 per month.

Highlights and Hidden Gems:

- Unlimited Payments to Vendors

- Create and Print Unlimited 1099s and 1096s

- Track Your Expenses, Income, and Money

- Accept Credit Card Payments

- Automatically Import Bank Transactions

- Free Expert Support

- Edit or delete transactions

Disadvantages and Limitations:

- Confusing interface

- Delayed customer support.

- Lack of customizable reports.

- Accounting errors and bugs are present.

- Additional fees (probably expensive)

- More integrations and detailed instructions should improve.

Why Do We Recommend Patriot as One of the Best Accounting Software for Airbnb?

With Patriot Accounting, users can create several accounts, such as expense and income accounts, to handle various types of transactions, such as money deposited or withdrawn, outgoing money, payroll operations, receiving cash from product sales, and more. It also helps with customer invoicing and vendor payment by allowing users to add, delete or edit information related to them. Due to this, we recommend it as Airbnb accounting software.

Also Read: Free Small Business Accounting Software

4 TOPNOTEPAD – Top Accounting Software with the Best Value for Your Money

This is excellent accounting software built explicitly for Airbnb hosts; it’s a straightforward tool for Airbnb hosts to control their businesses and finances completely. If you don’t want to rack your brains and worry about your finances, use TopNotepad accounting software. Whatever you need to be done on your books, you will find on Topnotepad.

TopNotepad is the simplest E-invoicing and accounting software that provides information and tracks your products, clients, patients, estimates, invoices, refunds, reports, and delivery notes. Feature-rich software makes your accounting more accessible and values your money. In addition to this feature, it is a top-rated affordable, secure, and cloud-based software.

Pricing:

Topnotepad comes in three pricing plans, the free plan, the pond plan, and the lake plan.

- It starts with a free trial, and then you have to pay.

- The Pond plan is $34.72 per year.

- The Lake plan is $62.5 per year.

The recommended plan for an Airbnb host is the pond plan, which gives you unlimited space and is also budget intensive.

Highlights and Hidden Gems:

- TopNotepad facilitates online payments integrating with trusted payment platforms.

- It tracks your expenses, so you don’t have to worry about where your money goes.

- It also automates your accounting processes.

- Topnotepad provides crafted reports for you.

- It possesses a dashboard that offers you a clear view of your business position.

- It enables you to estimate, create and send invoices in just one click.

- With Topnotepad, you get a simple user interface.

- Topnotepad allows you to add attachments and import or upload leads.

Disadvantages and Limitations:

- Data conversion is complicated.

- Average customer support.

- Lack of option of sharing screen to experts.

- It’s a complex interface and needs to be clarified.

- A learning curve and technical knowledge are necessary.

- Some integrations, such as tax calculations, need to be improved.

Why Do We Recommend TOPNOTEPAD as One of the Best Accounting Software for Airbnb?

TopNotepad is cloud-based and secure accounting software, meaning you can work on your books from anywhere without worrying about its security.

With its user-friendliness, simplicity, value for money, ease of use, customer support, and affordability, we highly recommend Airbnb hosts looking for the best accounting software to run and manage their businesses.

Also Read: Accounting Software For Partnerships | Personal Accounting Software

5. Instabooks – Ideal Accounting Software for Ease of Use

Instabooks is a small business accounting software best for new businesses. With Instabooks, you don’t need any accounting knowledge to run and use the software. It automates your accounting cycle steps and lets you record daily accounting transactions in real time using simple voice commands, presenting accounts visually and appealingly.

With Instabooks, you can skip tax time, and small businesses can use tax calculators, tracker apps, tax invoices, receipts, expenses, and templates for quotes. Its tax accounting services and ease of use have made it popular among US small organizations and companies. It is brilliant software that makes business sense and improves your accounting.

Pricing:

Instabooks accounting software has three plans: the Launch, Growth, and Success Plan. They are all free for you only for one month, and you’ll also get $20 as a reward. The prices are

- Thirty days trials for all packages.

- Launch plan: $20 per month.

- Growth plan: $40 per month.

- Success plan: $60 per month.

Highlights and Hidden Gems:

- Instabooks help you keep track of your expenses.

- It facilitates your bank reconciliation.

- With Instabooks, you don’t need to worry about tax; it calculates your sales tax automatically.

- It automates your accounts payable and receivable.

- Have a bird-eye view of your business performance with Instabooks.

- Instabooks create reliable financial reports for you to make your decisions.

- It serves as a document manager to store your financial files securely.

- Instabooks offer you a fast payment system.

- Your bills get managed as Instabooks automates its check and payments.

Disadvantages and Limitations:

- Technical knowledge is required to get benefits.

- Bugs are present while generating the posts.

- Delayed customer support and response.

- Templates are challenging to edit and understand.

- Limited integration options are available.

Why Do We Recommend Instabooks as One of the Best Accounting Software for Airbnb?

Instabooks is easy-to-use online accounting software for small businesses. Its free sign-up and simple usage are an excellent enticement for you, as you will no longer worry about the software’s cost. We recommend it as the best accounting software with ease for Airbnb hosts.

Also Read: Craft Business Accounting Software | Accounting Software For Bloggers

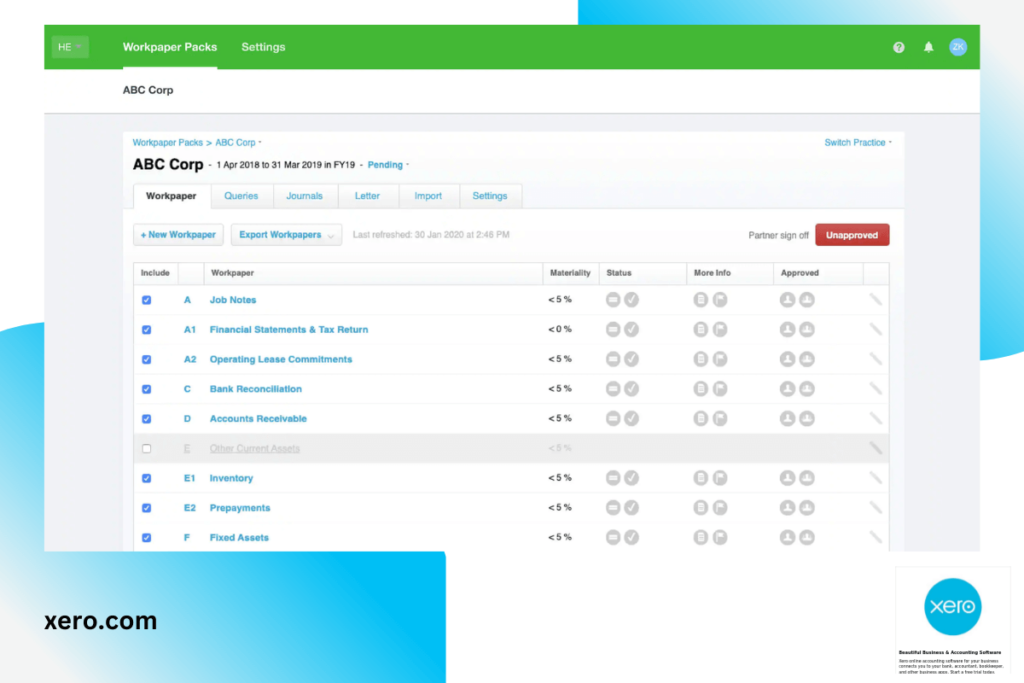

6. Xero – Best Accounting Software for User Friendliness

Xero is highly recommended for Airbnb business hosts. It is a straightforward accounting software for individuals and entrepreneurs who don’t need complex accounting processes to manage their businesses. It is user-oriented and allows you to customize it according to your needs and preferences. Xero offers you the ability to sync across all platforms.

Its interactive and user-friendly interface is highly captivating for users from different industries. Xero has become popular because it offers remarkable features and makes accounting activities easy. It is the most popular and user-friendly software that helps accountants and bookkeepers to manage their bank connections, pay bills, claim expenses, accept payments, and track projects anytime and anywhere.

Pricing:

Xero offers three different pricing plans that cover all accounting essentials. Besides paying Xero’s prices, you also have to pay for add-ons. Xero’s three plans are;

- Offers free trial.

- The Starter plan: $25 per month.

- The Standard plan: is $40 per month.

- The Premium plan starts at $54 per month.

Xero also offers you a one-month free trial. Each of the plans comes with a different add-on. We strongly recommend the standard plan for Airbnb hosts.

Highlights and Hidden Gems:

- With Xero, you get the privilege of multiple-currency accounting.

- Xero offers you online capture and storage of financial data and information.

- It grants you real-time tracking of income and expenses.

- You have customized contacts and a smart-lists database.

- You will have no issues and worry about your bank reconciliations and connections as Xero automates everything.

- It grants you access to online payment solutions for faster processes.

- Your taxes are calculated automatically by Xero.

- Xero tracks your orders in real-time.

- Accurate accounting reports are generated and presented by Xero.

Disadvantages and Limitations:

- Disconnection of bank feeds without any reason.

- Sometimes removing/deleting transactions is difficult.

- Expensive and duplication of contacts and reports.

- Constantly changing reports.

- Technical issues and random bugs.

- Duplication of contacts and reports.

Why Do We Recommend Xero as One of the Best Accounting Software for Airbnb?

Xero will make your financial process simplified and easily understandable. The fast data entry process it offers helps you save time and focus on other projects you need to run your business. Being cloud-based, you can work with it wherever you are, whether on the go or at your office. Its user-friendliness makes us recommend it as one of the best accounting software for Airbnb.

Also Read: Accounting Software For Investors | Accounting Software for Startups

7. Wave – Great Accounting Software for Cost Effectiveness

When you need software specifically for entrepreneurs and small businesses comprising everything you need to run your business finance, Wave Accounting is your answer. You can refer to it as your business’s accounting and bookkeeping solution.

Wave Accounting is a simplified software that truly helps you understand and process your transactions whether you are an accounting professional or not. You can also avail yourself of superb features like payroll processing and scanning receipts through Wave mobile application. Wave Accounting also allows you to reconcile bank accounts and record old expenses you failed to record by uploading old bank statements.

Pricing:

Wave Accounting is accounting software for day traders that is free. It is among the best accounting software for day traders because it is free and has remarkable features.

Invoicing, Banking, and Accounting are 100% free, while you have to pay for the following features.

- Payroll: $40 per month

- Payments: 2.9% + $0.60 per transaction and 3.4% + $0.60 per AMEX transaction.

- Advisors: Bookkeeping support costs $149 monthly and $379 monthly for accounting and payroll coaching.

Wave Accounting allows you to scale up by presenting numerous collaborators if you want an expert to handle your accounts, manage payroll and payroll taxes, run more than one business from a single Wave account, and much more.

Highlights and Hidden Gems:

- Wave Accounting offers you the solution of handling your finances without any cost.

- It enables you to carry out your payments online automatically.

- With the software, you can automatically generate and process invoices quickly and when needed.

- Wave provides you with lots of invoicing templates to choose from.

- It is easily understandable with a clear and simple user interface.

- Get your financial reports generated in no time with Wave.

- Your investments also get tracked by Wave.

Disadvantages and Limitations:

- Lack and delayed proper customer service.

- Management of accounts is frustrating.

- Slow payment speed needs significant improvement.

- Whenever updates come, it changes the entire interface.

- Charges per transaction are expensive.

Why Do We Recommend Wave as One of the Best Accounting Software for Airbnb?

Wave Accounting is the best if you are wary of the cost of running and maintaining your accounting software, as it is made open for any business to use for free. The software is built for small businesses with 1 – 9 employees. It offers you the freedom of all the basics needed. For its cost-effectiveness, we strongly recommend Wave as the go-to accounting software for Airbnb hosts.

Last Tip

The Airbnb host, like every other business, whether large or small, needs to know how its income and expenses occur and the factors in play. You can only survive in the business with accurate accounting and management, which you would get with the help of good accounting software. Therefore, you must adapt and use accounting software to help you. Yes, that’s true!

As an Airbnb host, you would need accounting software that can precisely fit in with the business, and choosing the right software can be strenuous and time-consuming, not to mention the damages if you make the wrong choice.

We have listed the best accounting software for the Airbnb business, which includes Quickbooks, Freshbooks, Zoho Books, Instabooks, Topnotepad, and Wave. This unique accounting software for Airbnb hosts is ranked from the value for money, customer support, ease of use, user-friendliness, overall best, and cost-effectiveness.

In choosing from this software, considering its features and offers, remember to consider your budget, personal needs, and required service before making your choices.

Before you choose, ensure that you adopt accounting software that offers flexibility, ease, and support and enables you to grow your business.

Read More

- Airbnb Competitors & Alternatives

- Vrbo Competitors & Alternatives

- Accounting Software For Law Firms

- Can Accounting Software Help Reduce Costs?

RELATED: Top Accounting Software For Big Companies | Best Accounting Service Company Tools | Amazon FBASellers Accounting Tools