RELATED: Accounting eBay Vendors Tools | Accounting Tools Best For Accountants | Top Tax Preparation Platforms

Running a restaurant can be very tedious if you don’t have proper planning and accounting software for keeping an eye on your business’s financial health and tax compliance. There are so many things to keep an eye on including getting the right staff to work with; ensuring quality service and positive customers’ feedback, and making sure you’re not running at loss, among others. All of these require good accounting software to have a clear and true insight into the financial health of your business. A robust accounting solution will go a long way in helping keep a tab on your expenses and revenue.

As important as having accounting software is, you can easily go off the rail if you don’t choose the right one. Because the restaurant industry has its own peculiar business needs, you need to be careful while selecting an accounting software to use. In this article, we’re going to unveil to you our best accounting software for restaurants. Let’s go…

Upfront Conclusion

The best accounting software for restaurants right now is ZipBooks and QuickBooks Online.

What Does Restaurant Expenses Category Look Like?

Restaurants like other types of businesses have two basic categories of expenses. These are fixed costs and variable costs.

Fixed Costs – These are expenses that are not likely to change and have pre-determined values. Examples of fixed costs include salaries, rent, insurance premiums, mortgages, loan payments, property taxes, etc. These types of expenses don’t vary with an increase or decrease in the number (amount) of goods sold or services rendered by a business.

Variable Costs – These are expenses that vary with the number of goods sold or services provided by an organization. Examples of variable costs are food, beverage, utilities, hourly wages, gas, oil, etc. All these costs are simply referred to as the cost of goods sold and they are all variable costs.

Why Accounting For Restaurants Is Different?

Accounting Method

While many people may want to believe accounting for restaurants is the same as other business industries there are some slight differences. Although restaurants can choose between cash and accrual accounting there are some restrictions and financial benchmarks to consider here. If we were to consider the view of Chron.com, you can choose between the two accounting methods only if your annual revenue is less than $1 million. And where your annual revenue is more than $1 million, you are under obligation to use the accrual accounting method.

What is cash and accrual accounting?

Cash accounting is an accounting method in which transactions or activities are recognized and recorded when cash is received. It means no credit sales are allowed and you can’t have accounts receivable. This is the most common method adopted by many restaurants since foods sold or services provided are paid for immediately. The only drawback this method has is that it fails to show the true financial position of your business.

Accrual accounting recognizes and records transactions when goods are sold or when services are rendered. It doesn’t matter whether the goods or services have been paid for immediately or not. This accounting method allows for accounts receivable and payable balances. This method is accurate as it shows the true picture of how expenses are incurred to generate the revenue realized. In other words, accrual accounting matches expenses with the income generated for the same period. This is known as the matching concept in accounting.

Accounting Period

Another area of disparity between restaurant accounting and accounting for other industries is in the aspect of the accounting period used. While other industries may find monthly accounting periods useful for them, it’ll be more useful for restaurants to have a four-week accounting period. This is so as days seem to have an effect on restaurants’ business or sales. Fridays and Saturdays are usually the peak periods for restaurants since these days are always the busiest days.

Benefits of Accounting Software Restaurant Accounting

There so many benefits of accounting software for restaurant businesses that one can’t even exhaust. The following are the fundamental benefits of accounting software for restaurant business:

- It ensures automated and accurate data entry and eliminates the stress and repetitiveness of having to enter data manually which tend to be a hectic thing to do.

- It saves both time and cost of manual bookkeeping.

- It aids in the audit process

- It aids in accurate and timely retrieval of operational and financial data.

- It provides the basis for setting competitive prices for goods and services.

- It streamlines account balances (bank and POS transactions) reconciliations.

What To Look For In Restaurant Accounting Software

Dashboards – Ugly and confused dashboards can be hard to use especially if it is not well-organized and designed for you to easily locate what you’re looking for in time. A friendly interface, on the other hand, will make it more enticing and easy for you to interact with and get things done quickly and easily. So you must give a priority to this factor when you’re set to choose software for your restaurant.

Point of Sales System – POS system is useful for keeping track of your small business cash flow, food inventory, and sales. It is also useful for ensuring proper bookkeeping as well as appropriate tax collection. With Point of Sales, you can rest assured your customers are not being under-charged or over-charged. Advanced accounting software offer the feature as a part of their built-in functionalities or allows for integration with third-party POS software.

Payroll – Good accounting software should let you manage your payroll effortlessly. Most advanced accounting software offers this feature with other capabilities that let you track tips received by your staff so you can reconcile before you start to process your payroll.

Integration – You don’t want to buy software that would be difficult or impossible to integrate with other apps. You should consider the ease of integration when selecting your accounting software. Ask yourself whether it allows you to integrate into your existing app or not.

Tax Filling – Accurate tax filling is something you don’t want to joke with if you’re running a profit-oriented business. While this can be very difficult for you to do if you don’t have an accounting background, fortunately, good accounting software will simplify this for you and ensure you stay compliant with tax laws.

Best Accounting Software For Restaurants

1. ZipBooks

ZipBooks is a free restaurant accounting solution that helps you track your cash flow in an easy and efficient manner. While you’re busy preparing delicious meals to satisfy your customers and paying to the core restaurant activities, ZipBooks will help you with your business bookkeeping so you don’t miss a record of how money is flowing in and out of your business.

More interestingly, you don’t have to be an accountant to use the software for your business as it’s a DIY (Do-It-Yourself) tool. Some of the features ZipBooks offers include payroll, tax preparation, time tracking, sophisticated financial reporting, personalized invoice and emails, and more.

Additionally, ZipBooks offers mobile accounting and cloud-based software, which makes it easy for you to access your financial data anywhere and manage your accounts on the go.

What We Like About ZipBooks

- Mobile app for easy access to data and for managing account anywhere

- Effective time tracking capability with a single click

- Robust tagging that lets you tag a transaction and effect actions based on your tagging.

- Smart collaboration capability for effective team management

Pricing

ZipBooks’s Starter plan is free for you to get started and it gives you access to only a few features. As for their paid plans, they have the Smarter plan, the Sophisticated plan, and the Accountant plan. The Smarter plan starts at $15.00 per month, while the Sophisticated plan costs $35.00 per month, and the Accountant plan is available on request.

2. QuickBooks Online

QuickBooks Online is cloud-based accounting software designed to simplify your restaurant accounting, manage and improve your cash flow management. Understanding the workloads involved in the restaurant business, this accounting solution has designed with simplicity and convenience in mind in that it comes with exciting features like cost management, accurate and insightful reports, real-time bookkeeping support, automated billing and invoicing, and more. The good thing about this software is that it supports synchronizing with other apps like QuickBooks, Square, etc.

What We Like About QuickBooks Online

- Smart income and expense tracking capability

- Real-time reports

- Robust cash flow management

- Time and inventory tracking

- Multiple users capability

- Live chat with bookkeeping experts to help you review your books, reports, etc.

Pricing

There are two pricing options for you to get started with QuickBooks Online and these include the Plus and the Advanced plan. You can check out the pricing for each of these plans on their official website here.

3. TouchBistro

TouchBistro is one software that is specially designed for restaurant accounting with a robust and feature-rich Point of Sales system. It is an iPad-based Point of Sales system jam-packed with lots of exciting features meant to help you increase your revenue, improve your customer satisfaction, eliminate staff errors and streamline your workflows for more productivity.

What We Like About TouchBistro

- Ease of use

- High flexibility and intuitiveness

- Smart reports

Pricing

Although TouchBistro offers flexible pricing plans that reflect individual restaurant’s needs, you can get started with $69.00 per month.

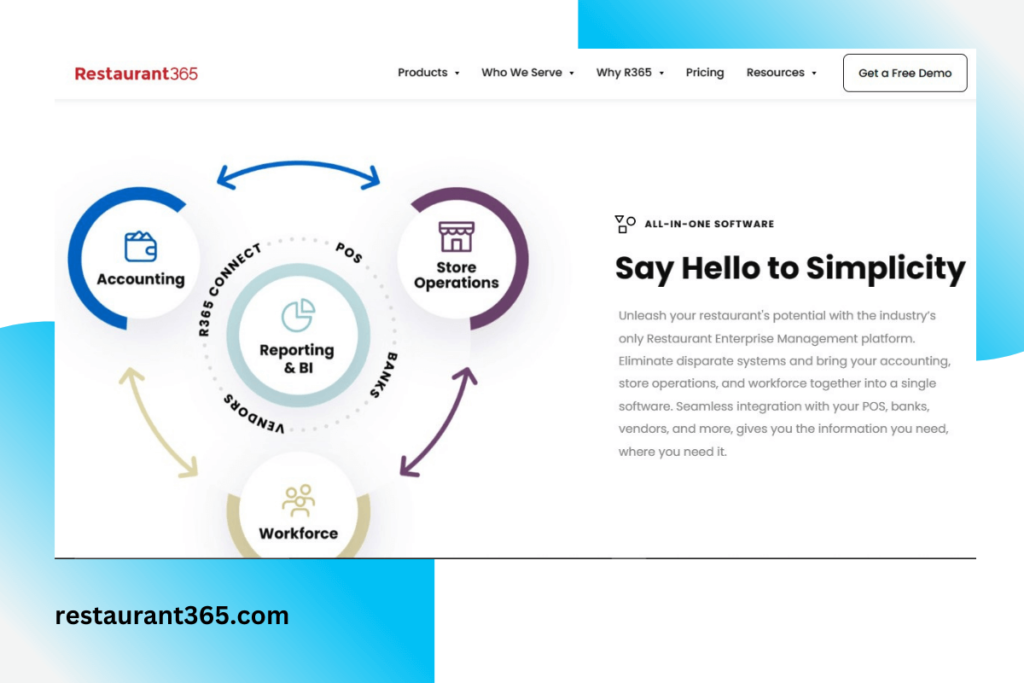

4. Restaurant365

Restaurant365 is a web-based restaurant accounting and management solution with fantastic built-in features for payroll, inventory, human resource management, reporting and scheduling, among others. Most interestingly, you can seamlessly connect the software with your vendors, bank, and POS.

What We Like About Restaurant365

- Fast and easy billing and invoicing

- Seamless integration with POS, bank and vendors.

- Centralized data for easy accessibility to team members

Pricing

To get started with using Restaurant365, visit their official website here for best pricing plan for your business.

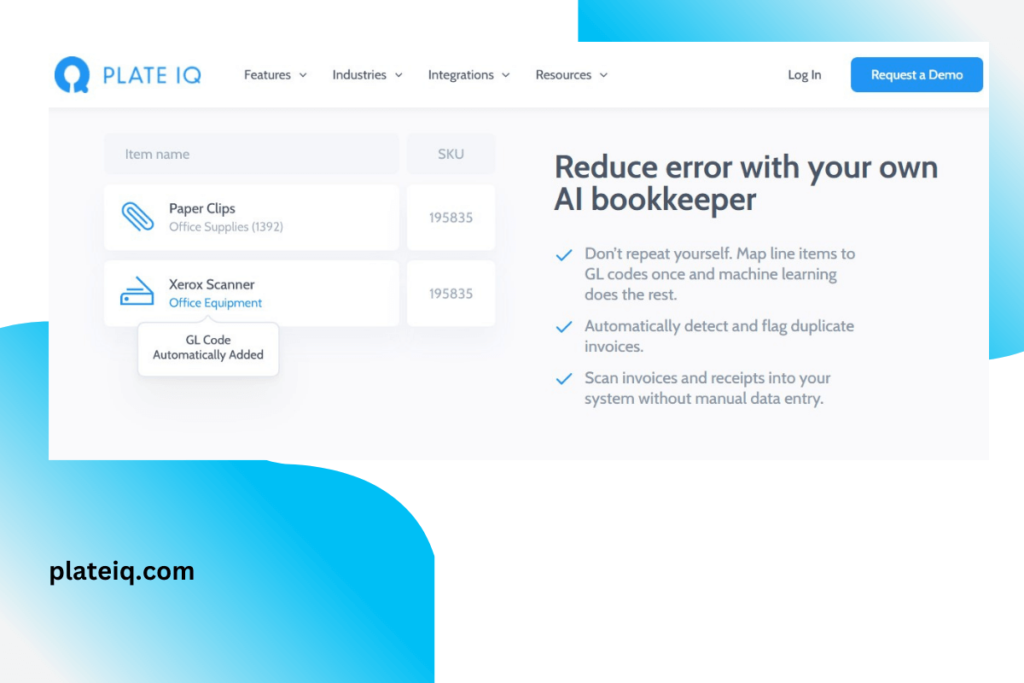

5. Plate IQ

This is one of the best accounting solutions for restaurants and other hospitality-specific businesses to manage their accounts payable. With Plate IQ, you can not only manage your accounts payable, but you can also take the advantage of the automated invoicing feature of the tool to process the invoice and automate payment. One of the most interesting things about Plate IQ is its seamless integration with other apps like Sage, Microsoft Dynamics, Compeat, QuickBooks, Restaurants365, etc. This makes it easy for you to continue using your existing app with Plate IQ.

What We Like About Plate IQ

- Automated invoice processing and payment schedule

- Smart Accounts payable management and automation

- Easy to use with user-friendly interface

- Seamless integration with third-party apps

- Excellent customer support

- Easy to setup

Pricing

As of the time of writing this review, PlateIQ hasn’t provided any pricing for the product. I would recommend you contact their sales for custom quotes that will reflect your needs.

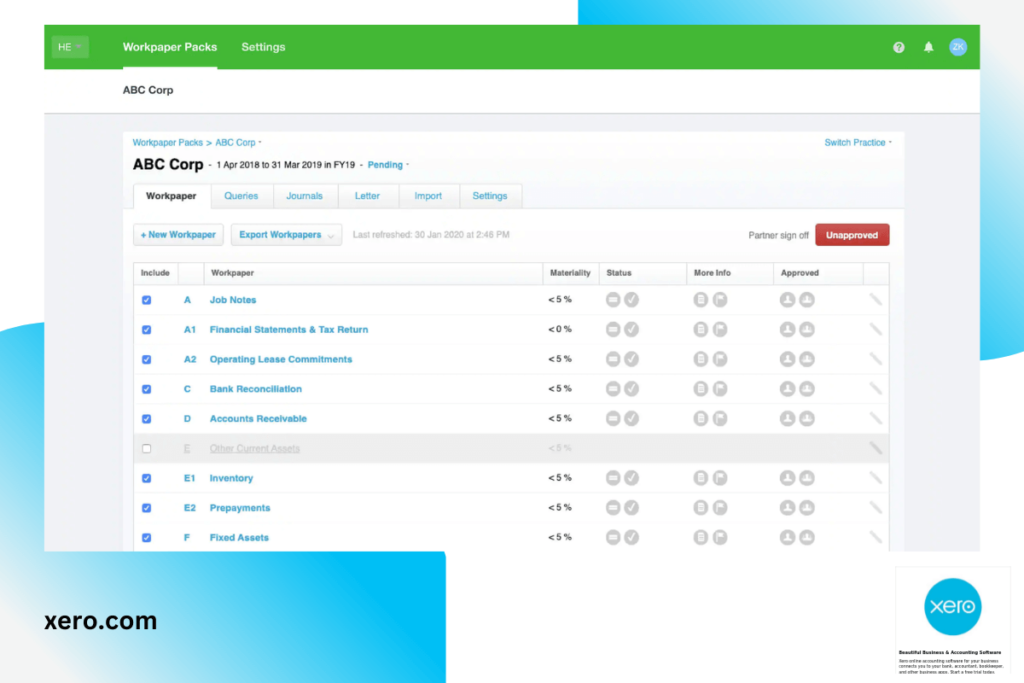

6. Xero

Xero is accounting software designed for cottage businesses and accounting professionals. It’s an accounting solution for bookkeepers, accountants, and small business owners. Some of the the features of Xero for users include bill tracking, secured bank connections, seamless payment receipt, projects tracking, multi-currency accounting, etc.

What We Like About Xero

- Mobile app for Apple and Android so you can access the app on the go.

- Ease of use

- Customizable invoicing

- Excellent online security for your information

Pricing

Xero offers three pricing plans with different budgets in mind. The Early plan starts at $11.00 per month, while the Growing plan costs $32.00 per month, and the Established plan goes for $62.00 per month.

Wrapping Up On Best Accounting Software For Restaurants

There are so many factors to take into consideration when choosing accounting software for your restaurant business. Depending on your specific needs, you need to consider things such as price, integration compatibility, ease of use, etc. Also, one of the most important reasons you need software is so you can automate your operations, so you should consider automation as one of the key factors for choosing accounting software. Fortunately, these are what we considered in compiling our lists above and you shouldn’t go wrong above.