RELATED: Top Restaurant Accounting Systems | Accounting Software Best For Manufacturers | Top Airbnb Accounting Tools

Since distributors serve as a mediator between two parties, distribution businesses require accounting systems that are capable of effectively handling a large number of transactions from both vendors and customers. As a result, accounting software for distributors incorporates additional features and special functionality unique to the distribution industry. To help you choose the best accounting software for your distribution business, we’ve evaluated the scope and key features of various distributor accounting systems and compiled a list of the top 6 distribution software solutions available today.

Upfront Conclusion

The best Distributor accounting software right now is FreshBooks and Quickbooks .

Top 6 Best Distributor Accounting Software Solutions

- FreshBooks – Best Distributor Accounting Software for Ease of Use

- Intuit QuickBooks Online – Best Distributor Accounting Software for App Integrations

- NetSuite ERP – Best Distributor Accounting Software for Experienced Users

- Sage 50cloud – Best Distributor Accounting Software for Windows

- Zoho Books – Best Distributor Accounting Software for Great Value

- Xero – Best Distributor Accounting Software for Small Business Owners

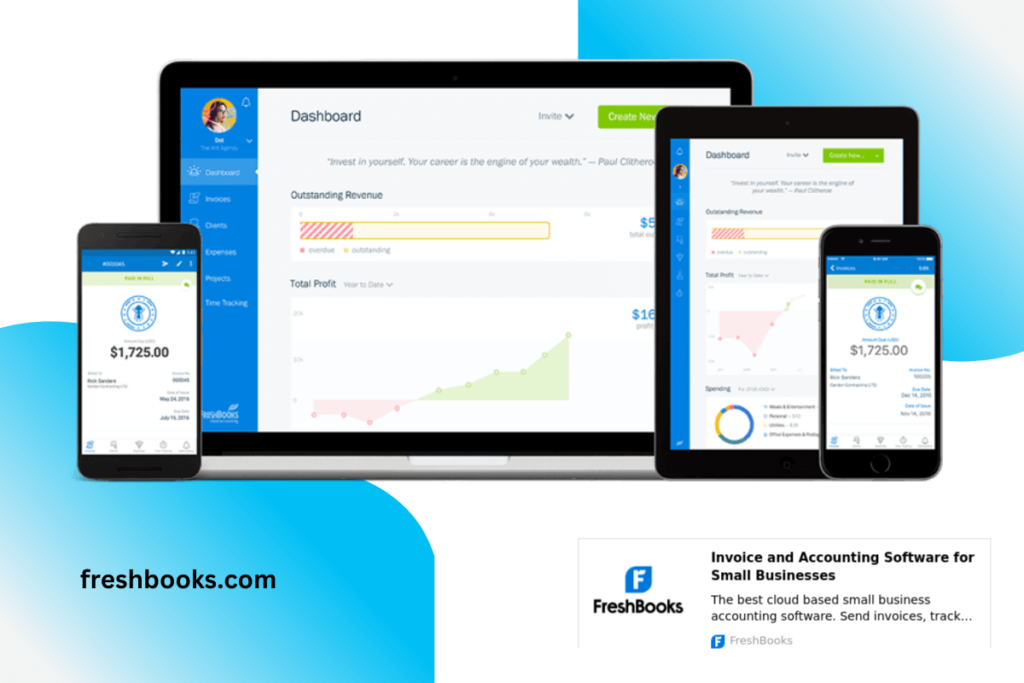

1. FreshBooks – Best Distributor Accounting Software for Ease of Use

PRICING: Plans start at $15/month after a free 30-day risk-free trial

Designed for business owners rather than accountants, FreshBooks allows your distribution company to manage large amounts of cash flow with ease. Create invoices, track expenses, generate expense reports, and easily compile financial data for taxes using a clean and easy-to-navigate interface that simplifies the billing process.

KEY FEATURES:

- Automated online payments for quick and easy invoicing

- Captures and enters expenses automatically

- Mobile app functionality for accounting on-the-go

REASONS TO BUY:

- Intuitive and automated accounting for ease of use

- Well-rated and reliable customer support

- Clean interface for an excellent user experience

REASONS TO AVOID:

- Lacking enterprise-grade capacity

- Invoices not automatically transferred over from other systems

- Bank connections can take time

2. Intuit QuickBooks Online – Best Distributor Accounting Software for Integrations

PRICING: EasyStart plan starts at $11/month with limited features, online demo available

QuickBooks online is a cloud-based accounting software that is both simple to set up and easy to use while allowing shared access to data with employees or your accountant. This online application boasts an extensive selection of powerful and intuitive integrations to simplify the complex needs of your distribution business by syncing data and reducing manual entry for point-of-sale, eCommerce, budgeting and forecasting, and inventory management.

KEY FEATURES:

- 650+ integrations with additional apps and software

- Automated inventory reconciliation, stock control and management

- Fully customizable B2B eCommerce platform

REASONS TO BUY:

- Enhanced onboarding process

- Large selection of customizable reports

- Reduced manual entry due to app integrations and syncing

REASONS TO AVOID:

- Expensive; maintaining and adding features is costly

- Inability to revert to or restore previous versions of your books

- Support focus is on peer-to-peer problem solving in online forums

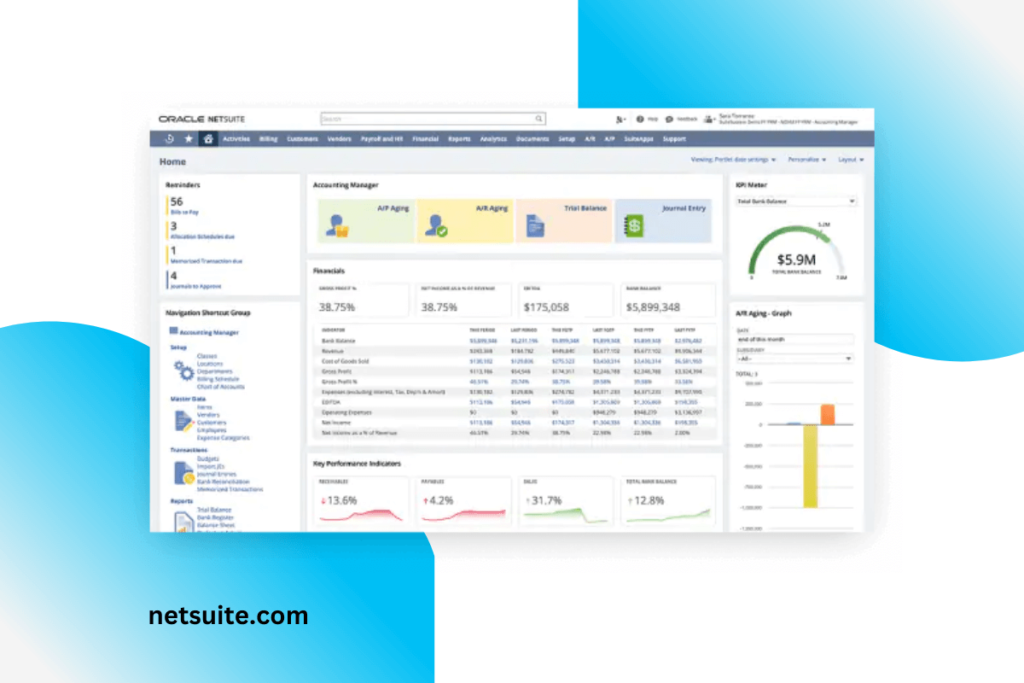

3. NetSuite ERP – Best Distributor Accounting Software for Experienced Users

PRICING: Pricing depends on the size of your business, number of users, and your unique professional goals. Starting prices and available plans available by contacting Oracle directly

NetSuite ERP is an integrated suite of flexible, cloud-based applications used by businesses to streamline enterprise resource planning. NetSuite can help your distribution organization with the automation and efficacy of not only accounting and bookkeeping, but also with other core processes such as production, order processing, inventory management, supply chain and warehouse operations, and real-time financial performance reporting at the local, regional, and headquarter levels.

KEY FEATURES:

- Third-party integrations that extend beyond finance (marketing, sales, HR)

- Unique customizations designed to fit the needs of your business

- Extensive multilingual capabilities to service international companies

REASONS TO BUY:

- Completely scalable, suitable for both small and large enterprises

- Excellent customer relationship management features

- Extensive ERP features that apply to a wide variety of businesses

REASONS TO AVOID:

- Can be a steep learning curve, not newbie-friendly

- Clunky, unappealing interface

- Data presentation can feel dated

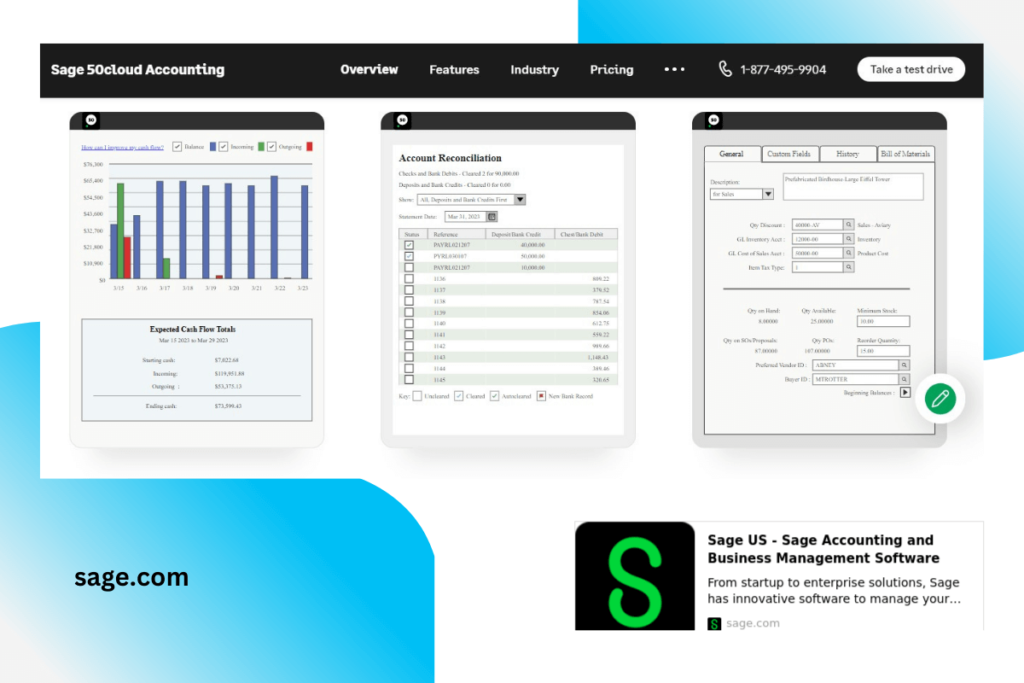

4. Sage 50cloud – Best Distributor Accounting Software for Windows

PRICING: Sage 50cloud Pro tier starts at $48.45/month after a 30-day free trial

Developed by Sage Group, Sage 50 cloud is an accounting software aimed at small business and medium sized businesses, previously called Peachtree. It is primarily a desktop application with high-level dashboards, although it does have several cloud-based add-on features. It is available for Windows operating systems only, and most features require you to use MS-Office 365 Business Premium and OneDrive.

KEY FEATURES:

- Advanced inventory management for distribution industries

- Job and project management for costing and tracking

- Multi-user collaboration through Remote Data Access

REASONS TO BUY:

- Exceptional customizability

- Highly detailed and thorough records and reporting

- Flexible, scalable, and highly secure

REASONS TO AVOID:

- Windows-only and resource-heavy to use

- Mobile app functionality is limited

- Robust and time-consuming setup process

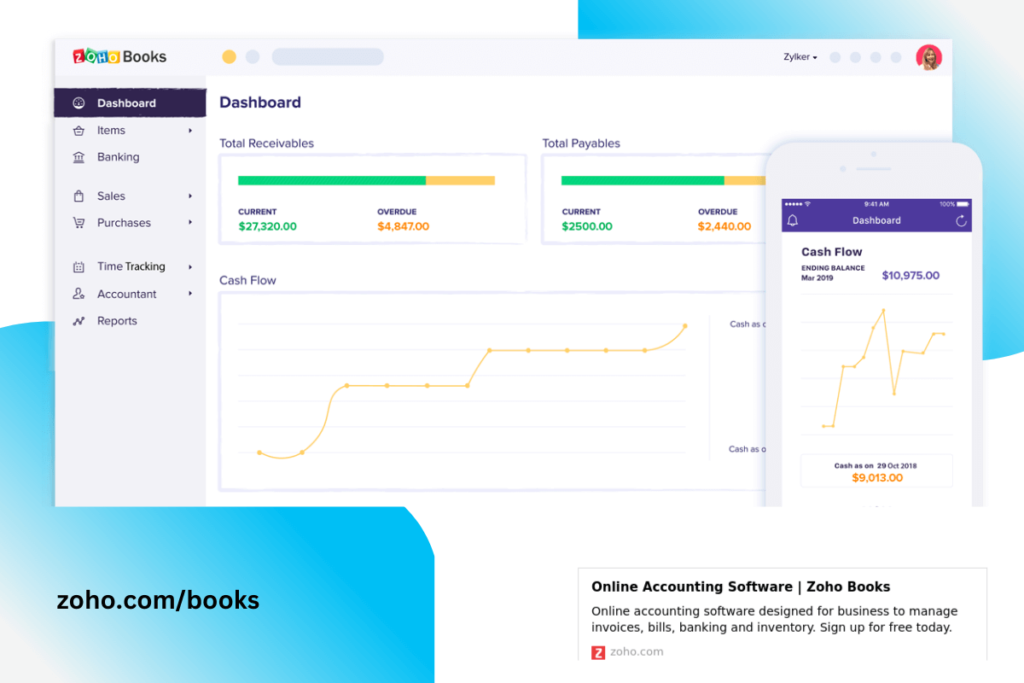

5. Zoho Books – Best Distributor Accounting Software for Great Value

PRICING: Free, limited-feature version available for businesses with annual revenue less than $50,000; Standard plan starts at $10 per month after a 14-day free trial

Zoho Corporation is a cloud-based application developer, and Zoho Books is their accounting program. Zoho Books provides more self-help resources for its users than most competitors, and offers a free version for small businesses with highly affordable monthly plans that offer additional features. Zoho Books recently integrated with SurePayroll to offer internal payroll capabilities. For the distribution industry, Zoho books has dedicated modules for distribution needs that allow you to effectively monitor your distribution network.

KEY FEATURES:

- Payroll integration with SurePayroll

- Authentic and customizable client and vendor portals

- Complete mobile accounting app with widgets

REASONS TO BUY:

- Excellent value and very affordable

- Modern, clean user interface and navigation

- Numerous guidance tools, educational and self-help resources

REASONS TO AVOID:

- Multi-currency feature can be glitchy

- Customer service is slow to respond

- Not all banks currently supported for linking

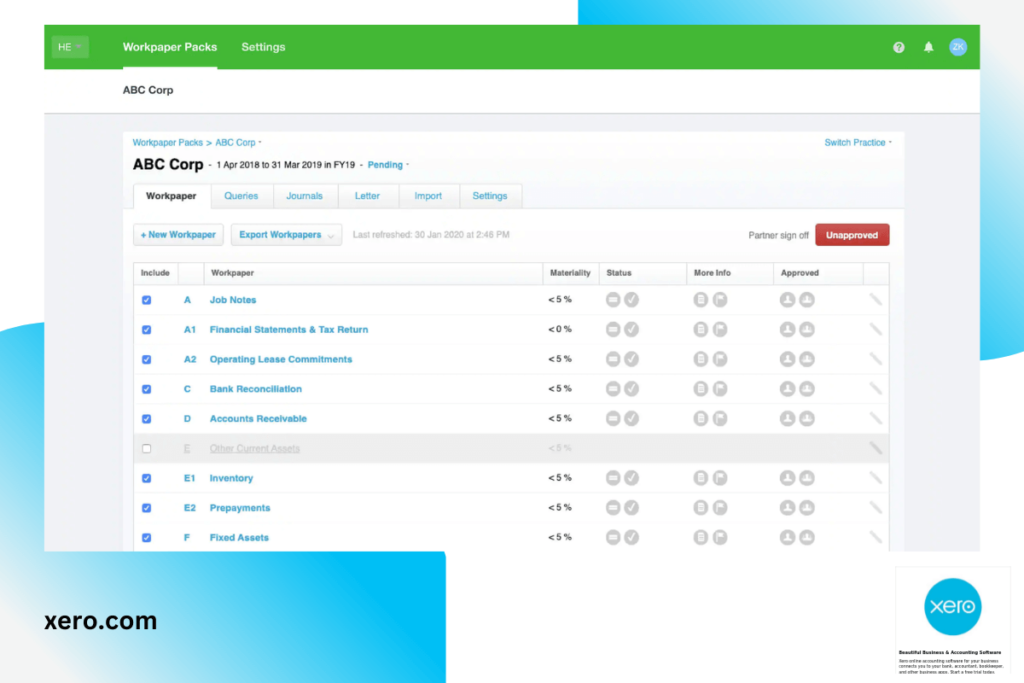

6. Xero – Best Distributor Accounting Software for Small Business Owners

PRICING: Plans start at $12/month after free 30-day trial

Xero is a cloud-based accounting software for small businesses that offers meaningful financial metrics using a unique dashboard display. Xero can be accessed anywhere, anytime, and does not require any advanced IT knowledge or experience, setup, or installation. Xero is a great user-friendly option if you have a smaller distribution business and are looking for transparent and straightforward ways to manage the financial health and well-being of your business.

KEY FEATURES:

- 800+ small-business app integrations

- Suggestive reconciling to match and merge duplicate entries

- Integration with plenty of manufacturing apps to streamline your distribution business

REASONS TO BUY:

- Add unlimited users to your account on any subscription tier

- Full reporting included on all subscription levels

- Small learning curve to use efficiently, includes online courses and webinars to help get you set up

REASONS TO AVOID:

- No live phone support

- Low limits on bills and invoices in the entry-level plan

- API connectivity not as robust as other systems

Frequently Asked Questions

What is the difference between ERP and accounting software?

ERP stands for “Enterprise Resource Planning”. While accounting software and ERP software are often referred to interchangeably, they actually refer to very different business solutions that offer different tools and functionality for a wide variety of business needs. Accounting software generally only provides functionality for accounting, giving you the ability to manage one specific area of your business – finances. Accounting software focuses on accounting-related areas such as accounts receivable and accounts payable, revenue and financial reporting, and bank account reconciliation. ERP software, on the other hand, always includes the same key features of accounting software offers in addition to a full and extensive suite of tools and applications designed to manage the entire supply chain and logistics from start to finish. This includes things like inventory tracking, warehouse management, manufacturing, CRM, project management, eCommerce, HR, and marketing. ERP software offers a comprehensive solution that addresses all aspects of a business. Most distribution businesses will start with an accounting software, and eventually make the decision to integrate and adopt an ERP software solution as their business grows and requires additional functionality.

How is accounting software different for wholesale and distribution?

Distribution brings a higher level of complexity to standard accounting practices, and the industry has unique needs that must be met by accounting software. In order to deal with the high volume of financial transactions that distributors deal with throughout their normal business operations, accounting software must be able to effectively process transactions from both vendors and customers while seamlessly integrating with the systems used by each side. Software that is developed for the distribution industries will assist with complex data entry and reporting tasks that allow you to access important information for better cost control, implementing automatic discount tracking, and preparing compliance reports for government agencies and insurance companies.

Is cloud-based accounting software safe and secure?

Applications that operate within the cloud use highly advanced and sophisticated digital security using encrypted connections that cannot be intercepted by third parties. Cloud accounting software also ensures that you have reliable backups of your data in multiple locations. Additionally, most larger software companies employ full-time security on premise and have strict access controls. Instances of hacking are particularly newsworthy in the press since security breaches are rare and very difficult to achieve as software companies utilize every resource available to safeguard your data within their cloud-based systems. To increase security even further, there are additional precautions you can take when it comes to protecting your data online such as ensuring that your passwords are secure, using multi-factor authentication, and utilizing antivirus and malware software on all of your devices.