Payroll software is a type of business software that helps organizations manage their payroll processes. Payroll software can automate many of the tasks associated with payroll, including calculating employee pay, tracking employee hours, and managing taxes and other deductions. Payroll software can also help businesses keep track of employee vacation time, sick days, and other types of leave.

Payroll software can make the payroll process more efficient and accurate and can help businesses save time and money. Payroll software can be purchased as a stand-alone application or as part of a larger business software package.

Many payroll software applications are available online, which can make it easier for businesses to get started using the software but choosing the right one for your business can be a challenge. Payroll software should be easy to use and understand, and it should be able to handle the specific needs of your business.

When choosing payroll software, you should consider the size of your business, your budget, and the features that are most important to you. You should also make sure that the software is compatible with your existing accounting software. Payroll software can make a big difference in the efficiency of your payroll process, so it’s important to choose the right one for your business. Here is a list of the best payroll software for one employee in 2022:

Top 6 Best Payroll Software for One Employee

| Brand | Starting price | Best for |

|---|---|---|

| 1. Gusto | $39 – $149/month | Overall |

| 2. Payroll4Free | Free | Free option |

| 3. Rippling | $8/month | Integrations |

| 4. Workful | $30/month | Customer service |

| 5. QuickBooks Payroll | $15 – $190/month | Ease-of-use |

| 6. Paychex Flex | Request quote | Reporting |

1. Gusto – Best overall

PRICING: From $39/month to $149/month.

Gusto is a cloud-based payroll, benefits, and HR platform that helps small businesses manage their people more effectively. Gusto makes it easy to run payroll, offer employee benefits, and stay compliant with the latest employment laws. With Gusto, you can focus on running your business, not managing your HR.

KEY FEATURES:

- Unlimited payrolls

- Pay-as-you-go workers’ compensation plans

- Tax filings and payments

- Next-day deposit

- Employee benefits such as health, retirement savings, and college savings

- Talent management

- Insights and reporting

- Integrations with Zoom, Slack, Xero, and many more

REASONS TO BUY:

- Affordable and high value

- Payroll available in all 50 states

- Basic reports at all tiers

REASONS TO AVOID:

- Dedicated support only available for higher tier plans

- Compliance alerts only available for higher tier plans

2. Payroll4Free – Best free option

PRICING: Free!

Payroll4Free is an online payroll service that helps small businesses manage their payroll and employee data. The service offers a variety of features, including online pay stubs, direct deposit, tax filing, and more. Payroll4Free makes it easy for small businesses to stay compliant with government regulations and save time on payroll administration.

The service is free for businesses with 25 or fewer employees. Payroll4Free is a great option for small businesses that need an affordable, user-friendly payroll solution.

KEY FEATURES:

- Pay employees & contractors

- Tax calculations

- Direct deposits or paper checks

- Vacation time tracking

- Employee portal

- Detailed reporting

- Integration tools

REASONS TO BUY:

- Free to use

- Inexpensive to file taxes

- Pay W-2 or 1099 workers.

REASONS TO AVOID:

- Limited features

- Setup is manual, making it slightly more difficult than other options

>>MORE: Employee Performance Management Software | How To Train Staff On New Software | Free Talent Management Software | Employee Training Software

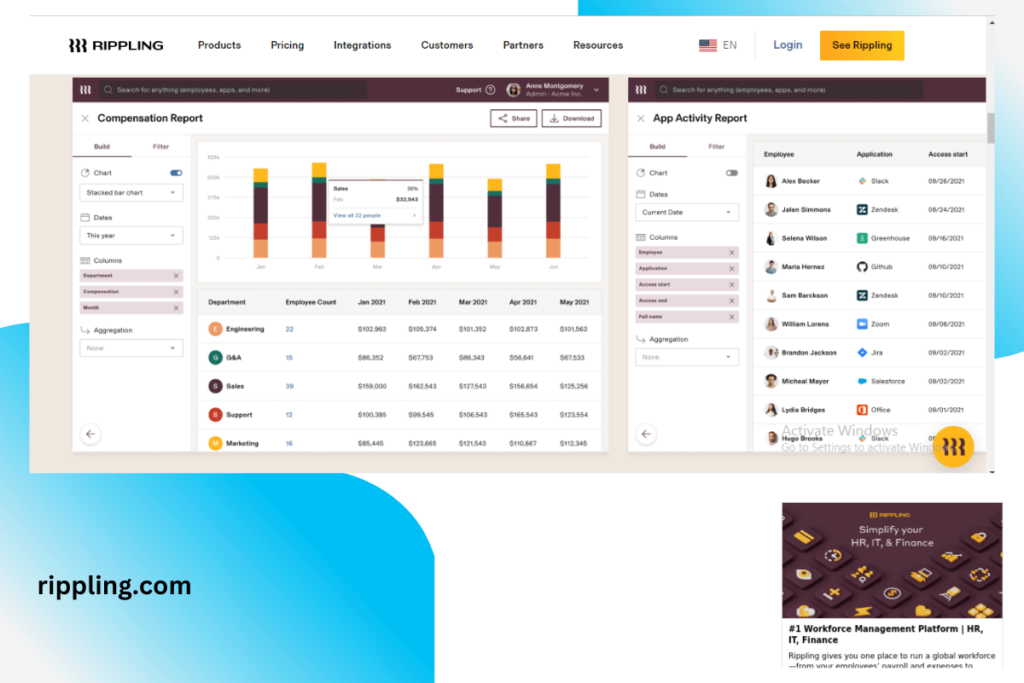

3. Rippling – Best for integrations

PRICING: Starting at $8/month per user.

Rippling is a payroll service that helps businesses manage their employee payroll and benefits. It offers a simple, streamlined way to manage employee compensation and keep track of employee hours worked. Rippling also offers a mobile app that allows employees to view their pay stubs and track their hours worked from anywhere.

Rippling integrates with over 400 popular business applications, including QuickBooks, TSheets, and Google Apps, and offers a large template library of pre-built reports that businesses can use to track their employee compensation data.

Overall, Rippling is a powerful payroll solution that helps businesses manage their employee compensation and benefits in a simple, streamlined way.

KEY FEATURES:

- Automatic compliance, from I-9’s to W-2’s

- Automatic tax-filing

- Pay people across the world

- Track hours worked and PTO

- Library of hundreds of visual and sharable pre-built report templates

- Integrations with over 400 apps, from accounting software like QuickBooks, to time tracking software like TSheets

REASONS TO BUY:

- Affordable for small businesses

- “Run payroll in 90 seconds”

- Pay international employees

- More than 400 app integrations

REASONS TO AVOID:

- Pricing for payroll is not transparent. Must contact them for an accurate price.

4. Workful – Best for customer service

PRICING: 30-day free trial available. $25/month + $5/month per employee.

Workful is a payroll software that allows businesses to streamline their payroll process. It is one of the newest online payroll services on the market, and it’s already gaining a reputation for its exceptional customer service. Workful offers a variety of features that make it easy for businesses to manage their payroll, including online access, direct deposit, and tax filing. Workful also offers a mobile app so businesses can manage their payroll on the go. Workful is a great option for businesses of all sizes.

KEY FEATURES:

- Unlimited payroll runs at multiple pay rates

- Built-in time tracking

- Tax forms and W-2 & 1099 preparation

- Integrates with QuickBooks

- Auto calculates overtime, time accrual, and PTO

- Customized policies

- Employee portal and onboarding

- Employee expense tracking and milage reimbursement

REASONS TO BUY:

- Affordable for small business

- Employee expense tracking

- Geolocation time-clock tracking

- Document storage is available

REASONS TO AVOID:

- Limited reporting features

- Clucky setup

5. QuickBooks Payroll – Best for ease-of-use

PRICING: 30-day free trial available. Plans range from $15/month to $190/month.

QuickBooks Payroll is a cloud-based payroll software that helps businesses manage their payroll process. It offers several features to make the process easier, including online employee self-service, direct deposit, and tax filing. QuickBooks also offers a mobile app so businesses can access their payroll information on the go.

QuickBooks Payroll is the most user-friendly alternative since everything is easy to set up. If you’re already using QuickBooks, it’ll be just as easy for you to navigate. If you run into any problems, there are also numerous tutorials available online.

KEY FEATURES:

- Tax penalty protection (they will pay up to $25k if you make an error and receive a tax penalty)

- Time tracking

- Same-day direct deposit

- Automatic payroll options

- Automated taxes and forms

- Employee benefits such as health, retirement savings, and workers’ compensation

REASONS TO BUY:

- Incredibly easy setup

- Intuitive interface

- QuickBooks integration is seamless

REASONS TO AVOID:

- Time tracking is not available in lower tier plans

>>MORE: HRIS Payroll Systems | Cheap Payroll Software | Construction Payroll Software | Restaurant Payroll Software

6. Paychex Flex – Best for reporting

PRICING: Contact for pricing

Paychex Flex is a comprehensive, cloud-based human capital management (HCM) solution that offers a complete suite of tools to manage your workforce. Paychex Flex includes payroll, time and attendance, benefits, and HR management all in one easy-to-use platform. With Paychex Flex, you can manage your entire workforce from one central location.

KEY FEATURES:

- All-in-one payroll and HR

- Employee benefits including health and retirement

- Time and attendance tracking

- Hiring and onboarding

- HR online library full of resources from training to forms to tools

- Compliance

REASONS TO BUY:

- Easy to use

- Impressive reporting feature

- HR included

- Three months of free payroll processing

REASONS TO AVOID:

- Hidden setup fees

- Hidden end-of-year tax documents fees

- Pricing is not transparent

References:

https://gusto.com/

https://www.payroll4free.com/

https://www.rippling.com/payroll

https://workful.com/

https://quickbooks.intuit.com/payroll/

https://www.paychex.com/