Lookup Business Entity | Form Corporation | FAQ

Search the Secretary of State website of the state where the corporation is registered for details on any corporation or business entity registered in Vermont. Any Vermont business entity’s filing record and business information can be found through the search.

| Official website: | https://sos.vermont.gov/corporations/ |

| Address: | 128 State Street, Montpelier, VT 05633 1104 |

| Telephone: | 1(802) 828-2386 |

| Fax: | 1(802)828-2853 |

| E-mail: | mailto:corps@sec.state.vt.us |

Vermont Business Search Shortcut

Need help forming an LLC in Vermont? Create an LLC in minutes with ZenBusiness.

Search Vermont SOS by Business Name

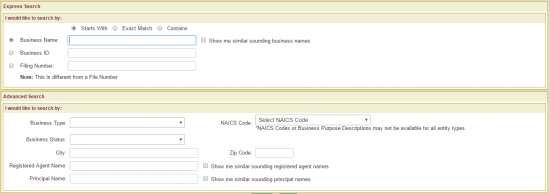

To search by name, go to the Vermont Secretary of State’s Business Search website and type the name you’re looking for into the first search form. You have the option of using Starts With, Exact Match, or Contains. You can also specify that the results include businesses with names that seem similar. When you’re done, click Search.

On a secondary page, a list of names created by the parameters of your search will appear. If you’re looking for the availability of your suggested business name, a lengthy list like the one below will almost certainly imply that you’ll need to choose an alternate name for usage in Vermont. If you’d like to learn more about the company, click on the entity’s name in the left column.

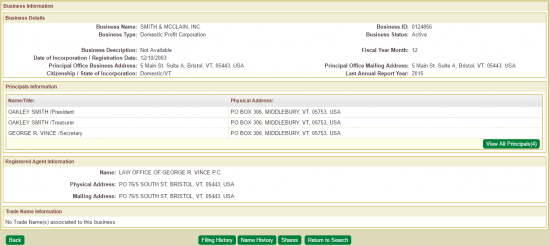

You’ll be able to go through all of the details that have been publicly disclosed about the entity of concern here. By clicking the links at the bottom of the window, you may also study the filing history, name history, and shares.

Vermont Entity Search by Business ID

The advantage of searching by business ID is that you’ll get a single search result. Click “Search” after entering the ID into the relevant area on the webpage.

As previously stated, there should only be one result presented. Click on the entity’s name to see more information about it.

You’ll be able to see all of the information that the Secretary of State has on file for you here.

Search VT SOS by Business Entity Filing Number

Searching by file number should yield a single search result, similar to searching by business ID. The distinction between these two search methods is that the ID refers to a commercial entity, whereas the file number refers to a specific filing made by that entity. Fill in the number in the appropriate field on the web page, then click Search.

You will have access to a certain quantity of information about the business here. For further information, click on the entity’s name in the far left column.

On this last page, you’ll find all of the entity’s business information, including its filing history and name history.

Advanced Business Entity Search in Vermont

The advanced search option on this page allows you to refine your search results by using the following parameters: NAICS code, business status, city, zip code, registered agent name, and principal name

You may use any of the above search tools separately or in combination. The goal is to offer as much information as possible about the entity so that you may spend as little time as possible going through the results. For example, in our advanced search, we utilized the business name, business category, and registered agent name.

We were able to narrow the search results to two because of the quantity of information we provided, allowing us to discover our organization almost instantly. If you find yourself in this situation, simply click on the company’s name for more information.

You’ll be able to check all the public information about the company on this page. Other filings and data can be accessed by clicking on the links provided throughout the page.

>>MORE: Montana Secretary Of State Business Search | Maryland Secretary Of State Business Search | Mississippi Secretary Of State Business Search | Utah Secretary of State Business Search | Hawaii Secretary Of State Business Search

Steps To Forming A New Corporation In Vermont

1. The first step is to decide what kind of business you want to run

New businesses must determine the structure of their business. In the Vermont Department of Assessment and Taxation, the most frequent business formations are; limited liability companies, partnerships, sole proprietorships, and corporations.

2. Name Your Corporation

The name of your corporation must be distinct from that of other corporate names that are currently on record with the Vermont Department of Licensing and Regulatory Affairs. By checking the Vermont business name database, names may be examined for availability. By submitting an Application for Reservation of Name to the Vermont Department of Licensing and Regulatory Affairs, Bureau of Commercial Services, you can reserve a name for six months.

3. Select a Registered Agent in Vermont

The state of Vermont requires every business to have an agent for legal process serving. If a company is sued, this person or business consents to take court documents on the company’s behalf. An entity with a certificate of power to conduct business in Vermont such as Northwest Registered Agent and GoDaddy, a Vermont resident, a Vermont company, or a foreign entity may serve as a registered agent.

4. Depending on the nature of your business, you may be required to open a Vermont Corporate or Business Tax Account

Note that corporate taxes must be paid separately from shareholder profits taxes. Federal and state governments require the proper returns to be filed annually in order to do this.

5. Articles of incorporation should be filed

The articles must contain the following information: the corporation’s name; its intention; the number of shares it is permitted to issue; the name and address of the agent receiving service of process; the name and address of the resident agent receiving service of process; and the names and addresses of all incorporators.

6. Prepare your Vermont corporation’s bylaws

The fundamental guidelines for running your organization are outlined in the bylaws, which are internal corporate documents. They are not reported to the government. Corporate bylaws are not legally needed for your company, but you should nonetheless adopt them since they define how your company will operate and demonstrate to lenders, creditors, the IRS, and other parties that your company is genuine.

7. Obtain an EIN

Obtaining a federal employer identification number (EIN) is required for your business. For taxation reasons, this identification number serves as the corporation’s Social Security number. Among other things, it enables you to recruit staff and create a company bank account. The IRS website has an online application that you may use to get an EIN. You will require this number for future documents and to file your company’s tax filings, so keep a record of it.

>>MORE: Illinois Secretary Of State Business Search | New Jersey Secretary of State Business Search | Connecticut Secretary Of State Business Search | North Carolina Secretary Of State Business Search | South Dakota Secretary of State Business Search

Frequently Asked Questions On Vermont Secretary Of State Business Search

What types of businesses are required to open a Vermont business tax account?

Most businesses must have a Vermont business tax account before they can operate in the state. Exempted organizations must also register to receive their Vermont tax exemption.

How do I register for Vermont state taxes?

You must register your corporation with Vermont’s Online Business Service Center for all relevant taxes, such as withholding and sales tax. Make sure to register for any taxes that apply to your business type individually.

What is the cost of incorporating a business in Vermont?

The filing of Articles of Organization or Articles of Incorporation with the Secretary of State costs $125 in Vermont.